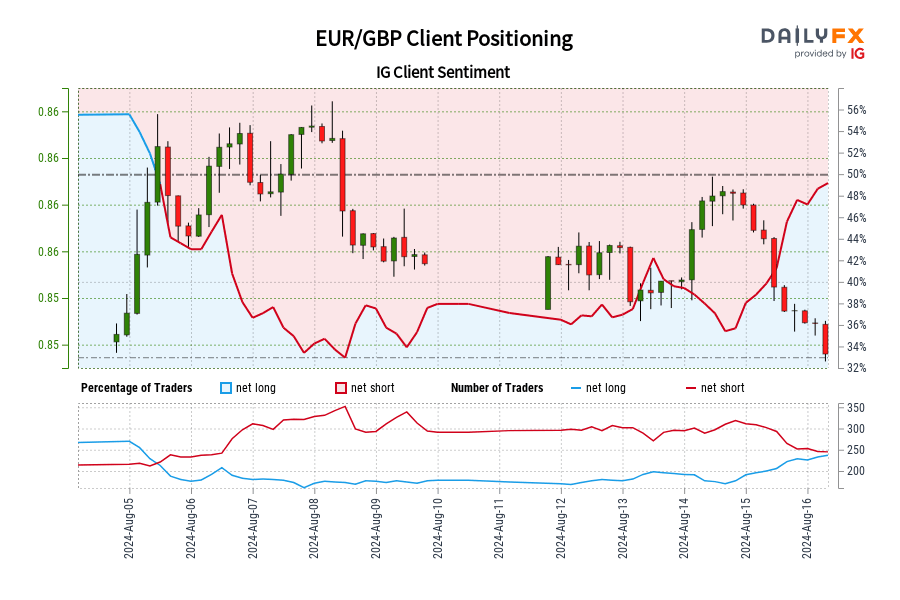

Retail trader data reveals that 50.94% of traders are currently net-long on EUR/GBP, with a long-to-short ratio of 1.04 to 1. This marks the first time traders have been net-long since August 5, when EUR/GBP was trading near 0.86. Since that date, the pair has declined by 0.69%. Notably, the number of traders holding net-long positions has increased by 18.93% since yesterday and by 40.80% over the past week. Conversely, the number of net-short traders has decreased by 19.45% since yesterday and by 30.38% compared to last week.

Analysts often adopt a contrarian stance to crowd sentiment, which means the fact that traders are net-long suggests that EUR/GBP prices may continue to decline.

Data indicates that traders are net-long on EUR/GBP for the first time since early August, when the pair traded near 0.86. With traders more net-long compared to yesterday and last week, the current sentiment and recent shifts reinforce a stronger EUR/GBP-bearish contrarian outlook.