Current Trading Sentiment for EUR/GBP

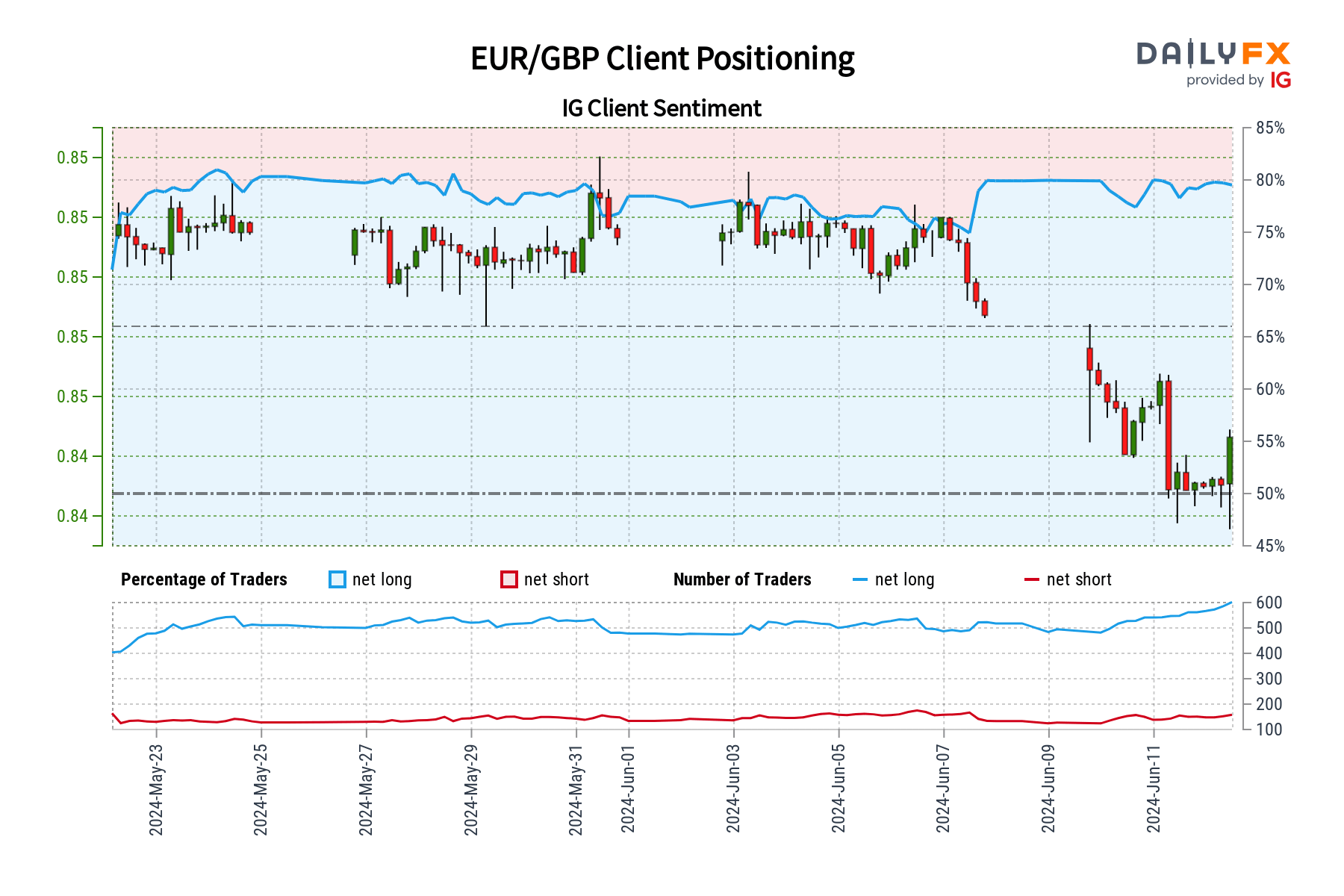

Retail trader data indicates that 81.43% of traders are net-long on EUR/GBP, with the long-to-short ratio at 4.39 to 1. This level of net-long positions has not been seen since May 24, when the EUR/GBP was trading near 0.85.

The proportion of traders net-long has increased by 3.39% since yesterday and 12.21% from last week, while the net-short positions have decreased by 8.33% since yesterday and 16.46% from last week.

Contrary to the prevailing market sentiment, our analysis adopts a contrarian perspective. The high net-long positioning suggests that EUR/GBP prices might face downward pressure.

Given the increase in net-long positions both from yesterday and last week, coupled with the overall sentiment trends, we hold a stronger bearish contrarian outlook for EUR/GBP.

This analysis points to potential declines in the near future, considering the heightened long interest among traders.