Errante Review

In the dynamic world of Forex trading, selecting the right Forex broker is paramount to achieving financial success. A reliable broker acts as a gateway to global financial markets, offering access to a wide range of currencies and trading instruments. The importance of choosing the right Forex broker cannot be overstated; it directly impacts your trading experience, affecting everything from the execution of trades to the security of your funds.

Errante, an international broker established in 2019 and regulated by the Cyprus Securities and Exchange Commission since March 2020, positions itself as a formidable contender in the Forex market. This detailed review aims to scrutinize Errante, highlighting its unique selling propositions alongside any potential drawbacks. We delve into various aspects such as account options, deposit and withdrawal processes, commission structures, and more, to offer a comprehensive overview.

Our approach combines expert analysis with real trader experiences, ensuring a balanced perspective. By furnishing you with crucial details about Errante, we strive to empower you with the knowledge needed to make an informed decision about whether this broker aligns with your trading objectives. Discover what sets Errante apart in the competitive Forex brokerage landscape.

What is Errante?

Errante stands as an online broker with registration in both Cyprus and the Seychelles. It caters to traders looking to engage in the most frequently traded assets, utilizing popular platforms like MT4 and MT5. What sets Errante apart is its global client base, serving traders from various countries, albeit with notable exceptions like the USA, Canada, and a few others due to regulatory restrictions.

This broker offers a diverse range of account types and features three retail platforms: the widely recognized MetaTrader 4 and MetaTrader 5, along with cTrader. An attractive aspect of Errante is its competitive fees, particularly noticeable in share CFDs and some indices, which can significantly impact a trader’s bottom line.

What truly differentiates Errante in the Forex trading space is its enhanced copy trading feature and the provision of engaging educational webinars. These offerings, coupled with its suitability for day traders and those interested in automated trading, underscore Errante’s commitment to catering to a broad spectrum of trading needs and preferences.

Benefits of Trading with Errante

Trading with Errante has provided me with a clear perspective on its benefits, which notably enhance the trading experience. The broker’s regulation by CySEC offers a significant layer of security, assuring me that my investments are under the supervision of a reputable financial authority. This peace of mind is crucial in the volatile world of Forex and CFD trading.

The availability of multiple trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, allowed me to choose the environment that best suited my trading style and strategies. This flexibility ensured that whether I was focusing on technical analysis or automated trading, I had the right tools at my disposal.

Additionally, Errante’s diverse account types catered to my specific needs, whether I was looking for low spreads or unique features like ECN access. The ability to choose an account that aligned with my trading volume and preferences significantly enhanced my trading efficiency and potential profitability.

Lastly, the option to trade cryptocurrencies through Errante’s FSA-regulated division expanded my trading portfolio and offered new opportunities in the dynamic crypto market. This addition was particularly beneficial, given the growing interest and market movements within the cryptocurrency space.

Errante Regulation and Safety

Errante operates under the umbrella of the Errante Group, which is composed of two main entities. This distinction is crucial for traders to understand the regulatory environment and the safety mechanisms in place. Notely Trading Ltd, catering to European clients, falls under the jurisdiction of the Cyprus Securities and Exchange Commission (CySEC). This regulation ensures that all client investments from the EU are safeguarded up to €20,000 by the Investors Compensation Fund, highlighting the importance of choosing a broker that offers such financial protection.

Outside of Europe, Errante Securities (Seychelles) Ltd serves international traders and is regulated by the Seychelles Financial Services Authority (FSA). The public availability of Errante’s financial performance adds an extra layer of transparency, offering peace of mind to traders about the broker’s stability and reliability. Furthermore, the regulatory framework does not impose restrictions on the use of electronic payment systems for depositing and withdrawing funds, ensuring convenience and accessibility for traders globally.

Understanding these regulatory and safety measures is essential after trading with Errante. It provides traders with the confidence that their investments are protected to a certain degree and that the broker operates within the bounds of recognized financial authorities. This knowledge is pivotal in making an informed decision about engaging with Errante for trading activities.

Errante Pros and Cons

Pros

- CySEC regulation ensures safety

- Offers MetaTrader and cTrader platforms

- Enables copy and automated trading

- Provides educational webinars

- Wide selection of currency pairs

- Offers flexible leverage

- Various account options available

Cons

- Fewer trading instruments offered

- Research tools are scarce

- CopyTrade feature not available in the EU

- Lacks cent accounts

Errante Customer Reviews

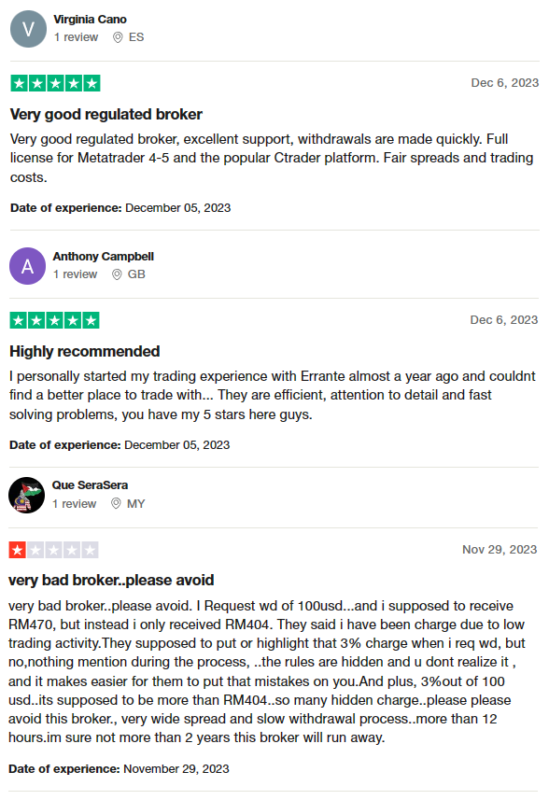

Customer reviews of Errante Broker present a mixed picture, revealing both satisfaction and dissatisfaction among its users. On one hand, several customers praise the broker for being well-regulated, offering excellent support, and facilitating quick withdrawals. They commend the availability of full licenses for popular platforms like MetaTrader 4-5 and cTrader, along with fair spreads and trading costs. These positive reviews highlight Errante’s efficiency, attention to detail, and quick problem-solving abilities, earning high marks from satisfied traders.

Conversely, some reviews paint a less favorable view, criticizing the broker for hidden charges and slow withdrawal processes. One particular grievance mentions an unexpected 3% charge on withdrawals due to low trading activity, which was not clearly communicated beforehand. This reviewer also points out discrepancies in the exchange rate applied, suggesting hidden fees that significantly reduce the withdrawal amount. These criticisms underscore the importance of transparency and fast service, areas where Errante appears to fall short according to some users.

Errante Spreads, Fees, and Commissions

When I traded with Errante, I noticed their trading commissions primarily take the form of spreads. The spreads vary across different account types. In a Standard account, spreads start at 1.8 pips, which is fairly reasonable for casual traders. For those with Premium accounts, the spread tightens to 1 pip, offering more cost-effective trading conditions. The VIP accounts enjoy even lower spreads, starting at 0.8 pips, ideal for high-volume traders seeking the best rates.

For traders opting for Tailor Made accounts, spreads can go as low as 0 pips, but here’s the catch – there’s a commission per lot traded. This commission isn’t a flat rate; it varies depending on your country and your trading volume, making it a bit unpredictable but potentially very competitive for heavy traders.

Withdrawal fees also caught my attention. Errante charges a 1% fee for withdrawals to e-wallets, and for cryptocurrencies, the fee is either $1, $2, or $5, depending on various factors. While bank fees might apply for some transactions, it’s noteworthy that Errante absorbs the fees for depositing funds, which is a nice perk.

However, if your account becomes inactive for 12 months, a $5 or €5 fee kicks in, which is something to keep in mind if you plan to take a break from trading. Also, for positions held overnight, there’s a swap commission, which is fairly standard in the industry, except for swap-free (Islamic) accounts, which can be opened upon request and are exempt from these charges.

Account Types

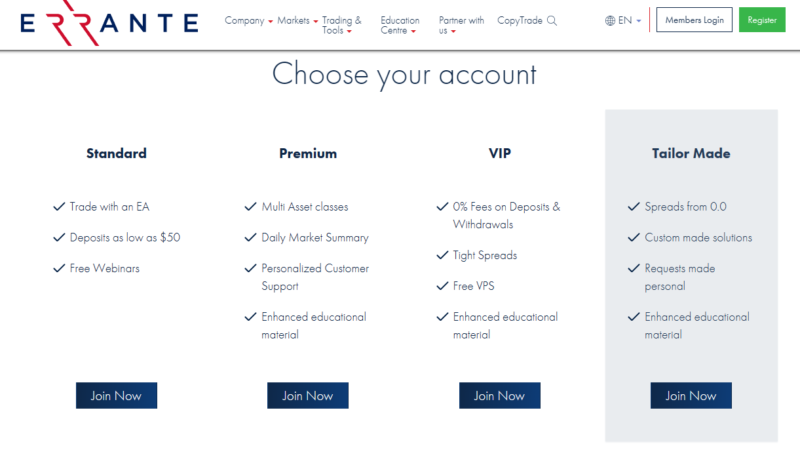

When I delved into Errante to consider my options for Forex trading, I discovered that they offer a variety of account types to suit different trader needs and investment levels. Here’s a concise breakdown:

Standard Account

- Spreads start at 1.8 pips.

- Minimum deposit: €50.

- No commission per lot, making it accessible and straightforward for beginners or those trading smaller volumes.

Premium Account

- Minimum spread value of 1 pip.

- Minimum deposit: €100.

- Offers trading without additional commissions, catering to traders looking for better spreads without extra fees.

VIP Account

- Spreads are even tighter, starting at 0.8 pips.

- Minimum deposit: €5,000.

- No other transaction fees charged, designed for more serious traders with a larger capital base seeking the best trading conditions.

Tailor Made Account (ECN Account)

- Spreads from as low as 0 pips.

- Commission per lot is charged, specific to this account type.

- Minimum deposit: €15,000.

- Tailored for high-volume traders and professionals who prefer direct market access and the tightest spreads.

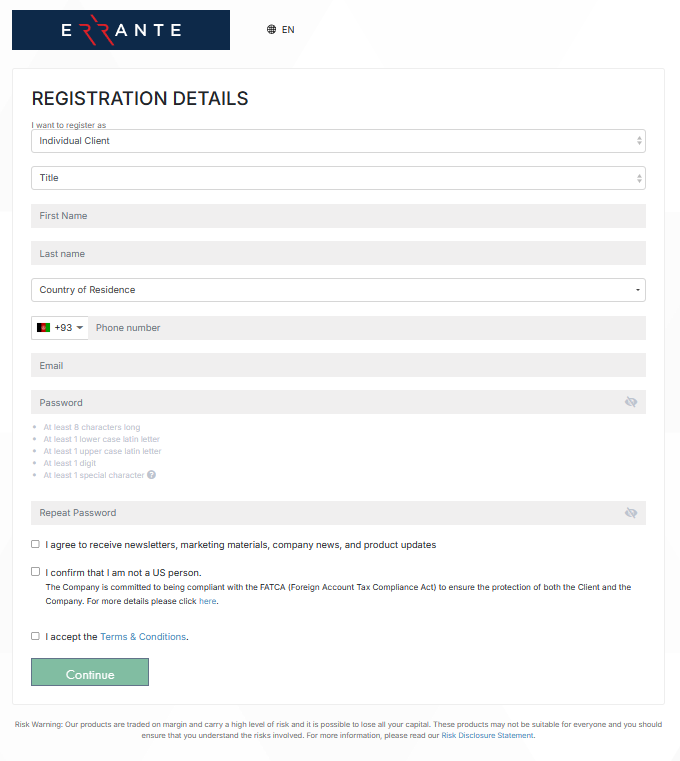

How to Open Your Account

- Start by clicking Register or Join Now to begin the process of opening an account with Errante.

- Fill out the form with your personal details, including your last name, first name, phone number, and email.

- Indicate your country of residence and set a password for accessing your account.

- Look for an email from Errante containing a PIN code, which is sent for the authorization of new accounts.

- Input the PIN code into the designated field in the registration form as instructed.

- Use your email address and newly created password to log into your Errante account.

- Complete any additional steps as instructed by Errante to finalize the setup of your account.

- Provide the necessary documents to verify your identity and address as requested by Errante, completing the verification process.

Errante Trading Platforms

Based on my experience, Errante provides traders with access to three of the most popular trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform caters to different trading preferences and styles, ensuring that every trader finds a comfortable and efficient environment for their trading activities.

MetaTrader 4 is widely recognized for its user-friendly interface and powerful analytical tools, making it a favorite among beginners and experienced traders alike. It offers advanced charting capabilities, numerous technical indicators, and supports automated trading systems known as Expert Advisors (EAs).

MetaTrader 5 builds on the strengths of MT4, providing more advanced tools and enhanced features for comprehensive market analysis, trading, and automation. It supports more order types, has an improved strategy tester for EAs, and offers access to a wider range of markets, including stocks and commodities.

cTrader, on the other hand, is known for its sleek design and advanced trading capabilities, especially appealing to traders looking for depth of market visibility and advanced order types. It’s particularly favored by those interested in ECN trading due to its sophisticated interface and faster order execution.

What Can You Trade on Errante

During my time trading with Errante, I explored a diverse range of trading instruments that the broker offers. This variety ensures traders can engage in a broad spectrum of markets, enhancing the trading experience.

Forex trading with Errante gives access to major, minor, and exotic currency pairs, allowing for a wide array of strategies, from high volatility trades to stable investments. The availability of such a wide forex selection caters to traders of all levels, from beginners to seasoned veterans.

Shares trading offers the opportunity to invest in some of the world’s leading companies. This access enables traders to take positions based on the performance of these companies, providing a way to diversify trading strategies beyond forex.

In addition to forex and shares, Errante allows trading in metals and energy, including precious metals like gold and silver, and energy commodities such as oil and gas. These markets can be particularly attractive during periods of economic uncertainty or volatility in other markets.

Commodities and indices trading further broadens the possibilities, offering exposure to markets that can provide a hedge against inflation or currency risk. Trading indices allows for speculation on the overall movement of market sectors or the economy without having to select individual stocks.

Lastly, cryptocurrencies are available for trading through Errante’s FSA-regulated division, catering to those looking to delve into the dynamic and fast-paced crypto market. This addition highlights Errante’s commitment to providing access to a comprehensive range of financial instruments.

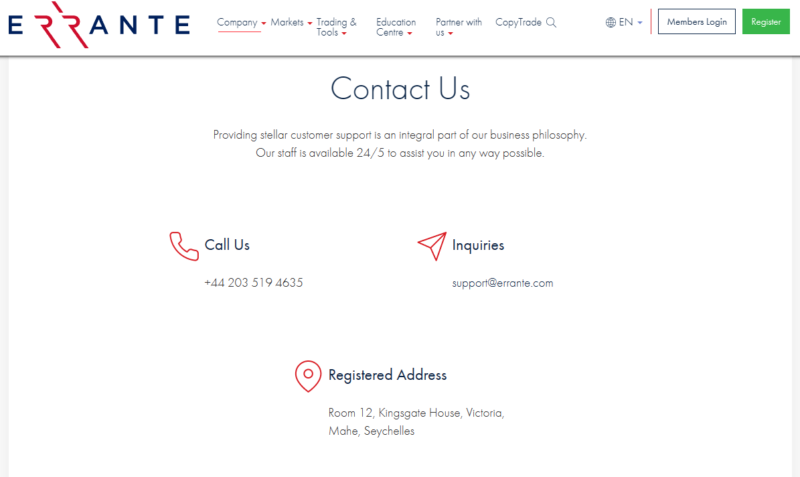

Errante Customer Support

Based on my experience, Errante offers a comprehensive customer support system that is both accessible and user-friendly. Their support team can be reached through multiple channels, ensuring that traders have several options for assistance.

I found that calling the numbers listed in the contact section provides a direct and immediate way to speak with a representative, which is particularly useful for urgent issues. Additionally, sending an email to the company is a straightforward method for less time-sensitive queries, allowing for a detailed explanation of any problems or questions.

LiveChat is another efficient option Errante offers, ideal for getting quick answers while multitasking on trading activities. The contact form available on their website is a convenient way to reach out without opening your email client, streamlining the process of sending inquiries or feedback.

Furthermore, Errante enables clients to create a ticket directly from their user accounts, providing a detailed description of any issue they encounter. This feature is particularly helpful for tracking the progress of your query and ensures that all relevant information is clearly communicated to the support team.

Advantages and Disadvantages of Errante Customer Support

Withdrawal Options and Fees

In my experience with Errante, I found their withdrawal options to be quite flexible, accommodating a wide range of preferences. You can withdraw funds to a bank account, credit or debit card, Skrill, or Neteller. For traders outside the EU, there’s the additional option to withdraw in cryptocurrencies through services like SticPay, Perfect Money, Advcash, and various local e-wallets.

The minimum withdrawal amount varies depending on the method: €100 or $100 for bank transfers, €20 or $20 for cards and e-wallets, and $50 (for XRP, USDT-TRC20) or $100 (for USDT-ERC20, BTC, ETH) for cryptocurrencies. This structure ensures that traders can manage their funds efficiently, based on their specific needs.

Withdrawal requests at Errante are processed Monday through Friday, from 9:00 to 18:00 (GMT+2). The speed of fund crediting is impressive, with cards, e-wallets, and crypto wallets seeing funds within 1 business day, and bank accounts within 2-4 days. This promptness is crucial for traders needing quick access to their funds.

However, there’s a catch for those withdrawing more than 80% of their deposit within 48 hours without trading at least two lots: Errante withholds 5% of the requested amount. After 48 hours, this fee drops to 3%. This policy is something to keep in mind, especially for traders making large deposits and withdrawals within a short timeframe.

Errante Vs Other Brokers

#1. Errante vs AvaTrade

Errante and AvaTrade both position themselves as reputable brokers in the Forex and CFD trading sphere, yet they cater to different trader needs through their unique offerings. AvaTrade, established in 2006, boasts a substantial global presence with a large client base and a wide range of financial instruments. Its commitment to regulation and licensing across various jurisdictions provides a robust trust factor. On the other hand, Errante, a newer entrant, focuses on offering competitive spreads and personalized account options, including ECN accounts for direct market access.

Verdict: AvaTrade might be better for traders looking for a more established broker with a broader range of instruments and a strong regulatory framework. Its extensive experience and global footprint offer confidence, especially to traders prioritizing safety and a wide array of trading options.

#2. Errante vs RoboForex

RoboForex and Errante offer distinctive advantages based on their trading conditions and technological offerings. RoboForex shines with its extensive range of trading options, boasting over 12,000 instruments across eight asset classes and a variety of trading platforms, including MetaTrader, cTrader, and RTrader. It’s tailored for traders who seek variety in trading platforms and instruments, alongside innovative contest projects. Errante, while offering a competitive range of platforms and instruments, places a strong emphasis on flexible account types and trading conditions, such as low spreads and various withdrawal options.

Verdict: RoboForex is potentially the better choice for traders who value a wide selection of trading instruments and platforms, alongside innovative features like contest projects. Its broad range of options can cater to nearly any trader’s preferences and strategies.

#3. Errante vs Exness

Comparing Errante with Exness reveals a contrast in their target markets and strengths. Exness is known for its high trading volume and offers a remarkable feature of unlimited leverage, appealing to traders looking to maximize their trading potential on small deposits. It provides a broad spectrum of CFDs across more than 120 currency pairs, metals, energies, and cryptocurrencies, catering to a diverse trading audience. Errante focuses on providing tailored trading experiences through its range of account types and competitive spreads, aiming to meet the specific needs of its clients.

Verdict: Exness stands out for traders who prioritize high leverage and a vast array of trading instruments, including a strong emphasis on forex. Its ability to facilitate high volumes and offer beneficial working conditions makes it a compelling option for those looking to trade a wide range of assets with competitive conditions.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: Errante Review

n conclusion, Errante emerges as a solid choice for traders seeking a flexible and user-friendly trading environment. With its range of account types, from Standard to Tailor Made ECN accounts, Errante caters to a diverse clientele, offering competitive spreads and various platforms including MetaTrader 4, MetaTrader 5, and cTrader. This diversity ensures that both new and experienced traders can find an account that fits their trading style and requirements.

However, potential clients should weigh the limited range of trading instruments and research tools, which may impact traders looking for broad market access and in-depth analysis capabilities. Furthermore, the absence of weekend support and limited customer service hours could be a drawback for traders who require round-the-clock assistance.

Errante does stand out for its regulatory compliance, providing a layer of security to its clients through CySEC regulation and adherence to international standards. Yet, traders should remain mindful of withdrawal fees and the conditions attached to withdrawing funds, especially when dealing with large sums or frequent withdrawals.

Also Read: Fibo Group Review 2024 – Expert Trader Insights

Errante Review: FAQs

Is Errante regulated?

Yes, Errante is regulated by the Cyprus Securities and Exchange Commission (CySEC), providing a layer of security and trustworthiness to its operations.

What trading platforms does Errante offer?

Errante offers the MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader platforms, catering to a range of trading preferences and strategies.

Can I trade cryptocurrencies with Errante?

Yes, traders residing outside of the EU can trade cryptocurrencies through Errante’s FSA-regulated division, offering access to popular crypto assets.

OPEN AN ACCOUNT NOW WITH ERRANTE AND GET YOUR BONUS