Equiti Review

Equiti is a global brokerage known for its accessible trading options and regulated services. Offering a range of assets, including forex, commodities, and indices, Equiti aims to cater to different trading styles. It provides competitive spreads and multiple account types to meet the needs of both beginner and experienced traders.

The broker supports MetaTrader 4 and MetaTrader 5, popular platforms known for their reliability and user-friendly interfaces. Equiti also offers its own proprietary platform, giving traders more flexibility. Each platform is accessible on desktop, web, and mobile, allowing trading from virtually any device.

Equiti places a strong emphasis on regulation and security by adhering to financial authorities across multiple regions. This regulation ensures transparent operations and helps protect client funds. The broker also includes customer support and educational resources, helping users stay informed and make better trading decisions.

For traders looking for reliable options with robust regulatory backing, Equiti’s platform offerings and accessible account types make it a competitive choice in the market.

What is Equiti?

Equiti is an international brokerage providing access to trading in various financial markets, including forex, commodities, indices, and cryptocurrencies. It aims to cater to traders of all levels by offering multiple account types, competitive spreads, and reliable trading platforms.

Equiti is known for its focus on security and regulation, operating under the oversight of reputable financial authorities. This regulatory backing, along with user-friendly platforms like MetaTrader 4, MetaTrader 5, and its proprietary platform, makes Equiti a trusted option for those looking to trade across global markets with confidence.

Equiti Regulation and Safety

Equiti prioritizes regulation and safety to provide a secure trading environment for its clients. It operates under the supervision of several reputable financial authorities across regions like Jordan Securities Commission (JSC), EGM Futures DMCC, regulated and licensed by UAE’s Security and Commodities Authority and Equiti Capital, regulated by the Financial Conduct Authority (FCA) with Equiti UK ensuring compliance with industry standards. This regulatory structure promotes transparency and helps protect clients’ funds from potential risks.

To enhance security, Equiti implements advanced data encryption and segregates client funds from operational accounts. These measures add an extra layer of protection, helping traders feel confident about their assets and information. Equiti’s strong commitment to regulation and security makes it a trustworthy choice for traders focused on safe trading conditions.

Equiti Pros and Cons

Pros

- Competitive spreads

- Multiple platforms

- Regulated

- 24/5 support

Cons

- Occasional delays

- Limited crypto

- High swap fees

- Peak-hour wait times

Benefits of Trading with Equiti

Trading with Equiti comes with several key benefits designed to cater to a wide range of traders. One major advantage is its competitive spreads, which help traders keep costs low, especially for high-frequency trading. This cost efficiency appeals to both new and experienced traders looking to maximize returns.

Equiti also offers multiple trading platforms, including MetaTrader 4, MetaTrader 5, and its proprietary platform, providing flexibility and familiar tools for effective trading. This versatility allows traders to choose the platform that best fits their style and preferences.

Additionally, Equiti provides robust educational resources and market analysis to support informed trading decisions. These tools are beneficial for traders looking to enhance their skills and stay updated on market trends, making Equiti a solid choice for those who value both cost efficiency and continuous learning.

Equiti Customer Reviews

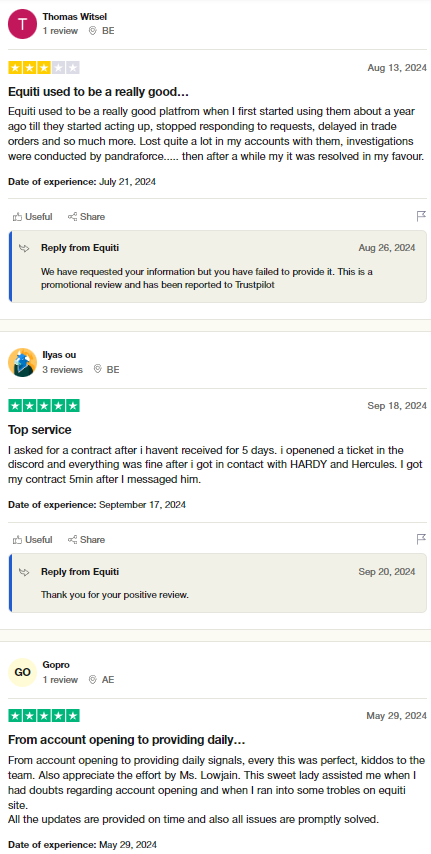

Customer reviews of Equiti often highlight its user-friendly platform options and solid regulatory backing. Many traders appreciate the broker’s competitive spreads and the variety of account types available, which cater to different trading strategies and experience levels. These features make Equiti appealing for both novice and seasoned traders.

Some users have noted responsive customer support, praising the team’s knowledge and helpfulness in addressing issues. However, there are occasional mentions of delays during high-traffic periods or with certain withdrawal methods, though Equiti has taken steps to address these concerns.

Overall, Equiti has a strong reputation for its secure trading environment, diverse platform options, and supportive customer service, making it a favored choice among traders seeking reliability and accessibility.

Equiti Spreads, Fees, and Commissions

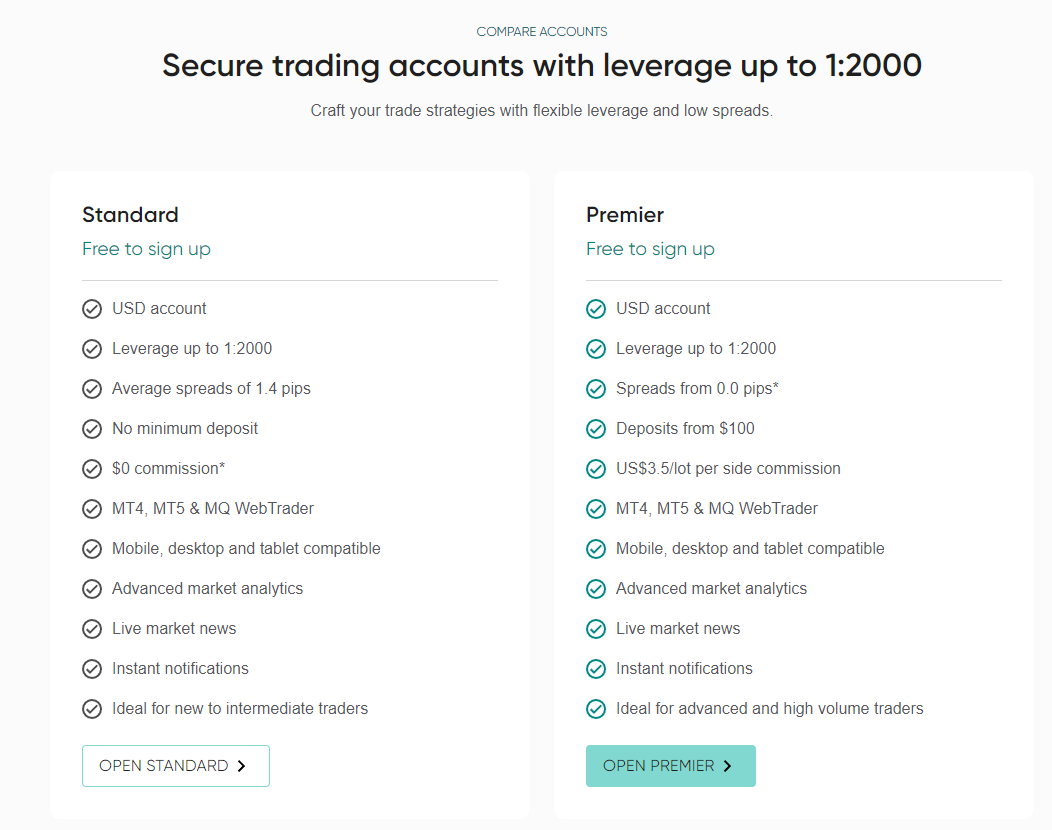

Equiti offers competitive spreads that vary depending on the account type and market conditions. The broker’s spreads are generally tight, which is beneficial for traders looking to keep transaction costs low. For example, some accounts offer spreads as low as 0.0 pips on major forex pairs, appealing to high-frequency traders.

In terms of fees, Equiti maintains a transparent pricing structure. Certain account types come with no commission and slightly higher spreads, while others with lower spreads may involve a commission per trade. This setup allows traders to select an account that best fits their trading style, whether they prefer spread-based costs or a commission structure.

Equiti also applies swap fees on overnight positions, which is standard in the industry. These fees vary based on the asset and position held. By offering a range of spreads, fees, and commissions, Equiti allows traders to optimize their costs according to their specific strategies and preferences.

Account Types

Equiti offers a variety of trading account types tailored to meet the needs of traders with different experience levels and strategies. Each account type provides unique features that suit both beginners and more advanced traders. Here’s an overview of the available account options on Equiti.

Standard Account

The Standard Account is ideal for new traders or those looking for a straightforward trading experience. It offers competitive spreads and no commissions, making it cost-effective and simple to use. This account type is compatible with both MetaTrader 4 and MetaTrader 5, providing access to essential trading tools.

Premier Account

Equiti’s Premier Account is designed for experienced traders who require tighter spreads and access to higher leverage. It operates on a commission-based structure to accommodate more sophisticated trading strategies. This account type supports MetaTrader platforms and provides an optimized environment for professional-level trading.

Demo Account

The Demo Account is available for practice and skill development without the use of real money. It’s ideal for beginners or experienced traders testing strategies, offering a risk-free environment with access to the same tools and features as live accounts on MetaTrader.

All instruments can be traded on both of the two account types that the broker offers, which is an Executive account and a Premiere account, respectively. Although both of these account types are referred to as “Market execution ECN” accounts.

How to Open Your Account

Opening a trading account with Equiti is a simple, user-friendly process. Follow these steps to get started:

Step 1: Visit the Equiti Website

Start by visiting the official Equiti website and selecting the “Open Account” button on the homepage. This will lead you to the registration page to begin your account setup.

Step 2: Fill Out the Registration Form

Enter your personal information, such as name, email, phone number, and country of residence. Choose your preferred account type that aligns with your trading experience and objectives.

Step 3: Verify Your Identity

To comply with regulatory requirements, Equiti will ask you to verify your identity. Upload a government-issued ID, like a passport or driver’s license, along with a recent document showing your address, such as a utility bill or bank statement.

Step 4: Fund Your Account

Once your identity is verified, you can deposit funds using one of the payment methods supported by Equiti. This allows you to begin trading immediately upon confirmation of the deposit.

Step 5: Start Trading

With your account funded, you can access your selected trading platform, either MetaTrader 4, MetaTrader 5, or Equiti’s proprietary platform. You’re now ready to start trading and explore the various markets available.

Equiti Trading Platforms

Equiti provides access to multiple trading platforms, offering flexibility for traders at all levels. The broker supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both known for their user-friendly interfaces, comprehensive charting tools, and fast execution speeds. These platforms are popular choices for traders due to their reliability and wide range of analytical tools, ideal for both forex and CFD trading.

Additionally, Equiti offers its proprietary trading platform, designed with features that cater to more specific trading needs. This platform provides a customizable interface and includes tools for market analysis, making it a versatile choice for traders seeking a tailored trading experience.

All platforms are available on desktop, web, and mobile, ensuring that traders can access their accounts and manage positions from anywhere. Equiti’s range of platforms makes it convenient for traders to choose an option that aligns with their trading style and accessibility needs.

What Can You Trade on Equiti

Equiti provides a diverse range of trading instruments, enabling traders to build well-rounded portfolios. From forex to commodities, Equiti’s asset offerings are designed to suit various trading strategies. Here’s a breakdown of what you can trade on Equiti.

Forex

Equiti offers a wide selection of major, minor, and exotic currency pairs for forex trading. This market is highly liquid, with round-the-clock trading, making it ideal for both new and experienced traders looking to capitalize on currency movements.

Commodities

With commodities trading, Equiti provides access to gold, silver, oil, and natural gas. These assets allow traders to hedge against inflation or diversify their portfolios with tangible resources, which can be more stable during economic uncertainty.

Indices

Equiti offers trading on major global indices like the S&P 500, FTSE 100, and NASDAQ. Indices trading allows traders to speculate on the performance of a group of stocks, providing insight into the broader market trends without focusing on individual companies.

Cryptocurrencies

Equiti includes popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, catering to those interested in digital assets. Cryptocurrency trading is often marked by high volatility, appealing to traders looking for opportunities outside traditional markets.

Equiti Customer Support

Equiti provides 24/5 customer support, accessible via multiple channels, including live chat, email, and phone. This availability ensures that traders can get help with account issues, technical assistance, or general inquiries during market hours. The support team is generally known for its responsiveness and knowledge, with many users noting quick resolutions to their questions.

In addition to direct support, Equiti offers a detailed FAQ section and educational resources on its website, allowing users to troubleshoot common issues independently. While most customers report positive interactions, some feedback highlights occasional delays during peak hours, which Equiti continually works to improve. Overall, Equiti’s customer support is regarded as reliable, aiming to provide an efficient experience for traders.

Advantages and Disadvantages of Equiti Customer Support

Withdrawal Options and Fees

Equiti offers several withdrawal options to provide flexibility and convenience for its clients. Fees and processing times may vary depending on the chosen method. Here’s an overview of the available withdrawal options and their fees.

Bank Transfer

Bank transfers are secure but may have higher fees and a processing time of up to 5 business days. This option is reliable for larger withdrawals, although it may not be the fastest.

Credit/Debit Cards

Equiti supports credit and debit card withdrawals, which typically have lower fees and take 1-3 business days to process. This option is convenient for quick access to funds.

E-Wallets

E-wallets like Skrill and Neteller offer faster withdrawals, with processing times ranging from instant to 24 hours. These options often have minimal fees, making them popular among traders seeking faster transactions.

Cryptocurrency

Equiti also allows withdrawals via cryptocurrencies like Bitcoin, providing a digital option for users. Processing times are generally quick, although network fees may apply, depending on the blockchain’s current activity.

Equiti Vs Other Brokers

#1. Equiti vs AvaTrade

Equiti and AvaTrade both cater to forex and CFD traders, yet they differ in platform options and trading conditions. Equiti offers MetaTrader 4, MetaTrader 5, and its proprietary platform, focusing on simplicity and a user-friendly experience across forex, commodities, and indices. AvaTrade, however, provides a wider range of trading platforms, including MetaTrader, AvaTradeGO, and WebTrader, as well as unique tools like AvaProtect, which allows traders to minimize losses. AvaTrade is also known for its extensive educational resources and broader regulatory presence across regions, giving it an edge in global reach. Equiti, on the other hand, focuses on straightforward pricing with competitive spreads and a focus on regulatory compliance.

Verdict: AvaTrade is well-suited for traders looking for a variety of platforms and added risk management features like AvaProtect. Equiti is ideal for those preferring high transparency, competitive spreads, and a straightforward trading experience across key financial markets.

#2. Equiti vs RoboForex

Equiti and RoboForex both offer forex and CFD trading, but they cater to slightly different trading styles and preferences. Equiti provides MetaTrader 4, MetaTrader 5, and its proprietary platform, aiming for a straightforward experience with competitive spreads and a focus on regulation. RoboForex, on the other hand, offers a wider selection of platforms, including cTrader and its proprietary R Trader, alongside MetaTrader. Additionally, RoboForex provides bonus programs, cashback offers, and social trading options through CopyFX, appealing to traders seeking incentives and community trading features. Equiti’s strength lies in its transparent pricing and regulated environment, while RoboForex stands out for its diverse tools and promotional offerings.

Verdict: RoboForex is ideal for traders interested in social trading, bonuses, and platform variety. Equiti, by contrast, suits those who value regulatory backing, transparent fees, and a simplified, no-frills trading experience.

#3. Equiti vs Exness

Equiti and Exness both offer robust options for forex and CFD traders, but they cater to different needs in terms of leverage and transparency. Equiti provides MetaTrader 4, MetaTrader 5, and a proprietary platform, with an emphasis on competitive spreads and regulatory compliance. Exness, however, offers unlimited leverage on some accounts, which appeals to high-risk traders, and supports both MT4 and MT5 alongside a seamless account management app. Exness also has a strong reputation for transparency, frequently publishing financial reports and offering extensive market analytics. Equiti stands out for its simple, secure trading setup, while Exness attracts those looking for maximum leverage and detailed financial transparency.

Verdict: Exness is suited for traders who prioritize high leverage and want access to detailed financial reporting. Equiti is a better fit for those seeking competitive spreads, a strong regulatory framework, and a straightforward trading environment.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Equiti Review

Equiti is a solid choice for traders seeking a secure and flexible trading environment backed by reputable regulatory oversight. With a wide range of assets, competitive spreads, and a choice of platforms, including MetaTrader 4, MetaTrader 5, and a proprietary option, Equiti caters to both beginner and advanced traders. The broker’s commitment to transparency and customer support makes it a trustworthy option for those valuing reliability.

While some users have noted occasional delays, especially during high-traffic times, Equiti’s consistent efforts to improve its service and maintain a transparent pricing structure keep it competitive. Overall, Equiti stands out for its user-friendly approach, cost-effective options, and dedication to safe trading, making it a dependable broker for a variety of trading needs.

This review provides a technical analysis about the Equiti brokerage, trading accounts, does the minimum deposit fits on every traders trading skills and standards, and more trading knowledge. UK’s financial conduct authority is under this broker so the online trading and institutional brokerage services is pretty legit. Traders whether web or mobile trading can trade precious metals, forex, crypto, and more.

Equiti Review: FAQs

What assets can I trade with Equiti?

Equiti offers trading across forex, commodities, indices, and cryptocurrencies, giving traders a range of options to diversify their portfolios.

Is Equiti regulated?

Yes, Equiti is regulated by reputable financial authorities across different regions, ensuring a secure and transparent trading environment for its clients.

What trading platforms does Equiti support?

Equiti provides access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its own proprietary platform, all available on desktop, web, and mobile.

OPEN AN ACCOUNT NOW WITH EQUITI AND GET YOUR BONUS