Engulfing Candle is a candlestick pattern in technical analysis that is used to identify a potential trend reversal. It occurs when a larger candle “engulfs” the smaller candle that came before it. The body of the following candle completely covers or “engulfs” the first candle’s body. There are two kinds of Engulfing Candles – Bullish Engulfing Candles and Bearish Engulfing Candles.

This pattern is considered a key element in technical analysis because it can indicate a significant shift in market sentiment. Traders and analysts use this pattern to identify potential trend reversals and make trading decisions.

Engulfing Candles can provide valuable insights into market movements and help traders make more informed decisions when combined with other technical indicators and analysis.

Also Read: How To Trade the Hanging Man Candlestick Pattern

Contents

- Bullish Engulfing Pattern

- How to Identify and Interpret Bullish Engulfing Candlesticks

- Bearish Engulfing Pattern

- How to Identify and Interpret Bearish Engulfing Candlestick patterns

- Pros And Cons of Engulfing Candlestick pattern

- Engulfing Candle Pattern Trading Strategies

- Bottom Line

- FAQs

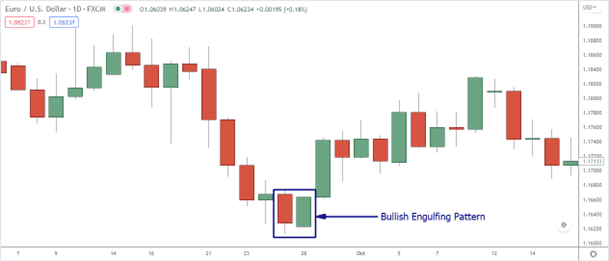

Bullish Engulfing Pattern

A bullish engulfing candle is a two-candlestick pattern formed when a larger bullish candlestick follows a small bearish candlestick. The bullish candle completely engulfs the bearish candle, opening below the previous candle’s low and closing above the previous candle’s high.

This pattern is considered a bullish reversal pattern, which may indicate a potential reversal of a previous downtrend. The pattern suggests that the buying pressure has overwhelmed the selling pressure, and the bulls are in control of the market.

Traders often use bullish engulfing candles to signal to enter long positions or add to existing ones. Technical indicators and analyses can confirm the validity or strength of the pattern before making any trading decisions. Additionally, the pattern can be more significant when it occurs after a prolonged downtrend rather than in a sideways or consolidating market.

How to Identify and Interpret Bullish Engulfing Candlesticks

To identify a bullish engulfing pattern, you need to look for two consecutive candlesticks on a price chart.

Here are the steps to identify and interpret a bullish engulfing candlestick pattern:

- Look for a small bearish candlestick: The first candlestick in the pattern should be a small bearish candlestick with a small real body. This candlestick indicates that the bears are in control of the market.

- Look for a large bullish candlestick: The second candlestick should be a large bullish engulfing pattern with a long real body that completely engulfs the first candlestick. This candlestick indicates that the bulls have taken control of the market.

- Confirm the pattern: Other technical indicators and analysis should confirm the bullish engulfing pattern to determine whether it is a strong reversal signal.

- Interpret the pattern: The bullish engulfing pattern is a bullish reversal pattern that indicates a trend reversal from a downtrend to an uptrend. The larger the engulfing candlestick, the more significant the pattern is considered to be.

- Consider the volume: Higher volume on the engulfing pattern can further confirm the strength of the pattern.

The bullish engulfing pattern is a strong bullish trend signal that can indicate a potential trend reversal.

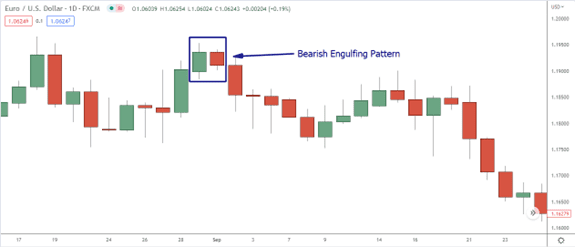

Bearish Engulfing Pattern

A bearish engulfing pattern is a two-candlestick pattern that is formed when a larger bearish candlestick follows a small bullish candlestick. The bearish candle completely engulfs the previous bullish candle, opening above the high of the previous candle and closing below the low of the previous candle.

The pattern suggests that the selling pressure has overwhelmed the buying pressure, and the bears are in control of the market. As a result, the pattern is considered to be a bearish trend reversal pattern that may indicate a potential trend reversal from an uptrend to a downtrend.

How to Identify and Interpret Bearish Engulfing Candlestick patterns

To identify and interpret bearish engulfing patterns, follow these steps:

- Look for a small bullish candlestick: The first candlestick in the pattern should be a small bullish engulfing pattern with a small real body. This candlestick indicates that the bulls are in control of the market.

- Look for a large bearish candlestick: The second candlestick should have a long real body that completely engulfs the first candlestick. This candlestick indicates that the bears have taken control of the market.

- Confirm the pattern: Other technical indicators and analysis should confirm the bearish engulfing pattern to determine whether it is a strong reversal signal.

- Interpret the pattern: The bearish engulfing pattern is a bearish reversal pattern that indicates a potential trend reversal from an upward trend to a downtrend. The larger the engulfing candlestick, the more significant the pattern is considered to be.

- Consider the volume: Higher volume on the engulfing pattern can further confirm the strength of the pattern.

While the bearish engulfing pattern occurs, a strong bearish signal that can indicate a potential trend reversal.

Pros And Cons of Engulfing Candlestick pattern

Pros of Engulfing Candlestick patterns

- Provides a clear and easy-to-identify visual signal for traders.

- Can be used in combination with other technical indicators and analysis to confirm signals and improve trading decisions.

- The Bullish Engulfing Pattern is a strong bullish signal that can indicate a potential trend reversal or a continuation of an uptrend.

Cons of Engulfing Candlestick patterns

- The pattern can be subjective and open to interpretation, leading to false signals if not analyzed carefully.

- The pattern may not always be reliable on its own and should be used in combination with other technical indicators and analyses for better accuracy.

- Engulfing patterns can occur frequently, leading to potential confusion and overtrading if not used properly.

Although Engulfing Candle patterns have pros and cons, they can be a valuable tool in technical analysis when combined with other indicators and analysis.

Engulfing Candle Pattern Trading Strategies

Engulfing candles can be used as part of a trading strategy to identify potential trend reversals in the market. Here are some trading strategies that traders often use with engulfing candles:

- Engulfing candle as a reversal signal: Traders looking for a bullish or bearish engulfing candle on a chart as a signal to enter a long or short position, respectively. This strategy assumes that the engulfing candle is a strong reversal signal and that the market will likely reverse its trend.

- Combining with other indicators: Traders can also use engulfing candles in combination with other technical indicators, such as moving averages, trend lines, or oscillators, to confirm the reversal signal. For example, if a bullish engulfing candle appears near a support level, it may be a stronger signal to enter a long position.

- Engulfing patterns in a trend: Traders can also use engulfing candles to identify potential pullbacks in a trend. For example, in an uptrend, a bearish engulfing candle may signal a temporary pullback before the uptrend resumes.

- Engulfing candles as a confirmation: Engulfing candles can also be used to confirm other technical analysis signals. For example, if a breakout occurs on a chart and is followed by a bullish engulfing candle, it may be a stronger signal that the breakout is valid.

Overall, traders can use engulfing candles as a standalone signal or in combination with other technical indicators to make trading decisions.

Bottom Line

Engulfing Candle is an important candlestick pattern in technical analysis that provides traders with valuable insights into market movements. The Bullish Engulfing Candle, in particular, is a solid bullish signal that can indicate a potential trend reversal or a continuation of an uptrend.

Traders can use this pattern to identify trading opportunities and make more informed decisions. By understanding and being able to identify Engulfing Candles, traders can improve their technical analysis skills and improve their chances of success in the markets.

FAQs

What is an Engulfing Candle?

An Engulfing Candle is a two-candlestick pattern in technical analysis, where a larger candle engulfs the previous candle, indicating a potential trend reversal.

Is Engulfing Candle Bullish or Bearish?

The Engulfing Candle can be either bearish or bullish, depending on the market bias. A Bullish Engulfing Candle indicates a potential trend reversal to the upside, while a Bearish Engulfing Candle points to a potential trend reversal to the downside.

What is the Success Rate of Engulfing Pattern?

The bearish enclosed candlestick is a widely-used candlestick. This is extremely effective in bearish reversed behavior and performs 79% in all instances (5 out of 100 types with an overall score of 1).