Eightcap Review

If you’re searching for a reliable broker to support your success in the stock market, Eightcap is worth considering. This brokerage firm has gained popularity among traders worldwide due to its focus on openness, client satisfaction, and the provision of cutting-edge trading strategies and tools.

One notable aspect that sets Eightcap apart from other brokers is its sophisticated trading platform, which offers a variety of tools and features to assist traders in making informed decisions. The platform is designed to be user-friendly and intuitive, catering to traders of all experience levels, including beginners.

In addition to its advanced trading platform, Eightcap provides traders with a range of educational resources and market analysis tools. These resources aim to keep traders informed about the latest market trends and news, equipping them to make well-informed trading decisions. Moreover, Eightcap offers different account types to accommodate the specific needs of traders.

However, what truly distinguishes Eightcap is its commitment to delivering excellent customer service. The company boasts a team of skilled professionals who are available round-the-clock to address any inquiries or problems that traders may encounter. This level of support can be particularly helpful for new traders who are navigating the market for the first time.

Eightcap is a broker to take into account if you’re seeking one who provides cutting-edge trading tools, reasonable fees, and dependable customer service. Using Eightcap, you can trade with assurance and advance your trading career.

What is Eightcap?

A global internet broker named Eightcap was established in 2009 and operates from its headquarters in Melbourne, Australia, with additional offices in Shanghai and London. The company was founded to provide traders with access to international financial markets while prioritizing transparency and customer care.

Since its establishment, Eightcap has experienced rapid growth and earned a strong reputation as a reliable broker. The firm offers traders access to a diverse range of advanced trading tools, resources, and services, including FX, indices, commodities, and cryptocurrencies.

To ensure regulatory compliance and enhance trader security, Eightcap is supervised by the Financial Conduct Authority (FCA) in the United Kingdom and the Australian Securities and Investments Commission (ASIC) in Australia. These regulatory bodies impose strict financial regulations that further safeguard traders’ interests.

Eightcap utilizes a proprietary trading platform called MetaTrader 4 (MT4), known for its user-friendly interface, advanced charting capabilities, and an extensive collection of technical indicators.

Advantages and Disadvantages of Trading with Eightcap?

Benefits of Trading with Eightcap

There are several noteworthy benefits to trading with Eightcap that traders may take advantage of. First off, the business provides simple and adaptable methods for making deposits and withdrawals. For their transactions, traders have the option of using bank transfers, debit/credit cards, or even cryptocurrencies. This offers a selection of practical choices to accommodate various demands and preferences.

The limited spreads that are offered on both Raw and Standard accounts at Eightcap are an additional benefit of trading with them. Since they have an immediate effect on trading expenses, narrow spreads are crucial. When spreads are competitive, traders may be able to increase their earnings and cut costs, improving their entire trading experience.

Numerous trading systems, such as the well-liked MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the user-friendly WebTrader platform, are accessible through Eightcap. These platforms give traders access to sophisticated trading tools, comprehensive charting features, and a variety of technical indicators, enabling them to easily execute trades and make well-informed trading decisions.

Eightcap provides more than 1,000 Contracts for Difference (CFDs) in numerous marketplaces, with a broad range of assets. Due to the wide variety of CFDs available, investors can diversify their portfolios and investigate various trading opportunities. Eightcap offers a wide variety to suit various trading interests, whether it is in forex, indices, commodities, or cryptocurrencies.

Additionally, Eightcap provides significant currency pairs with high leverage up to 1:500. By leveraging their trading positions, traders might potentially increase their prospective earnings. The use of leverage should be done carefully, and traders should employ risk management techniques, as increased leverage also increases risk.

Eightcap Pros and Cons

Pros

- Eightcap boasts several notable pros that make it an attractive choice for traders. Firstly, the platform offers low forex fees, which can significantly impact trading costs. Low fees allow traders to keep more of their profits and maximize their returns. By minimizing transaction costs, Eightcap ensures that traders can focus on their trading strategies and goals without being burdened by excessive fees.

- Another advantage of trading with Eightcap is its seamless and quick account opening process. The platform strives to make the onboarding experience as smooth as possible for traders. The account opening procedure is user-friendly and streamlined, allowing traders to start trading efficiently. This ensures that traders can quickly access the markets and seize trading opportunities without unnecessary delays.

- Additionally, Eightcap offers free deposit and withdrawal services, which further adds to its appeal. Traders can conveniently deposit funds into their trading accounts without incurring any additional charges. Likewise, when it comes to withdrawing funds, traders can enjoy the freedom of transferring their profits or funds back to their chosen payment method without any withdrawal fees. This transparency and cost-efficiency contribute to a positive trading experience with Eightcap.

Cons

- While Eightcap offers several advantages, there are also some cons to consider. One of the drawbacks is the slim product selection. Compared to other brokers, Eightcap’s range of available financial products may be limited. This can be a disadvantage for traders who prefer a diverse portfolio and want access to a wide range of markets and instruments.

- Another con is the limited research and educational tools provided by Eightcap. While the platform may offer basic market analysis and economic news updates, the depth and breadth of research materials and educational resources may be lacking. Traders who rely heavily on in-depth market analysis and comprehensive educational materials may find this limitation restrictive in terms of expanding their knowledge and improving their trading skills.

- Additionally, one notable con is the absence of investor protection. While Eightcap may have regulatory oversight, it’s important to note that there may be no specific investor protection schemes in place. This means that in the event of financial difficulties or insolvency, traders may not be entitled to compensation or protection for their investments. This lack of investor protection can be a concern for traders seeking additional security and peace of mind.

Eightcap Customer Reviews

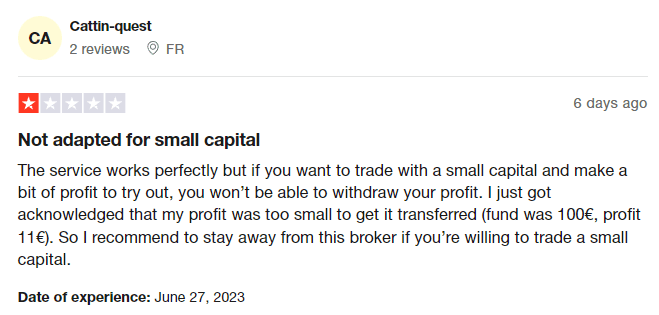

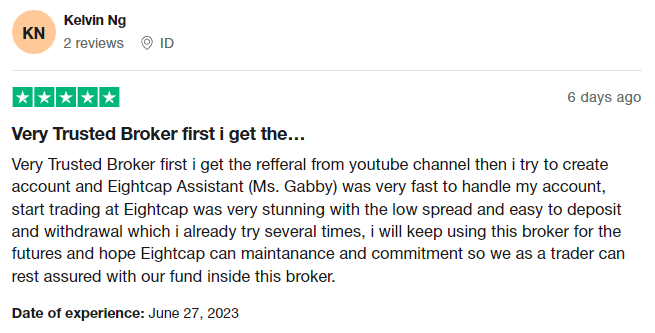

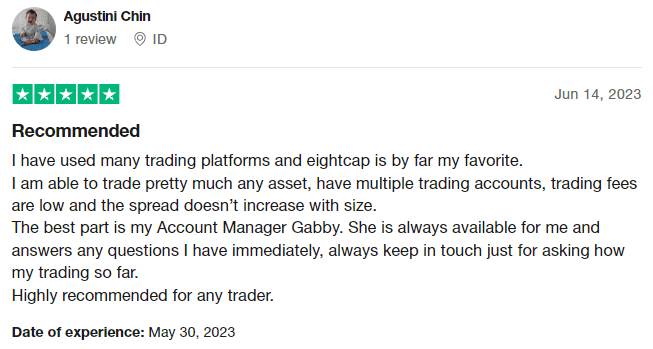

Customer reviews on Eightcap are mixed. One customer warns that withdrawing small profits can be challenging and advises against trading with small capital. Another customer expresses trust in the broker, highlighting the low spreads, easy deposit and withdrawal process, and fast assistance. A third customer considers Eightcap their favorite trading platform, praising its asset variety, low fees, consistent spreads, and responsive Account Manager. Overall, there are concerns about withdrawing small profits, but many customers appreciate Eightcap’s services, including its range of assets, low fees, and helpful customer support.

Eightcap Spreads, Fees, and Commissions

Eightcap is known for its competitive and transparent pricing structure, offering traders low spreads and commissions. The specific fees and commissions charged by Eightcap depend on the chosen account type and the instrument being traded.

Forex traders can select between the Standard and Raw account types. The Standard account has no commission fees and offers spreads starting from 1 pip. On the other hand, the Raw account charges a commission fee of $3.5 per side and provides spreads starting from as low as 0.0 pips.

For trading indices, commodities, and cryptocurrencies, Eightcap exclusively offers the Raw account type. The commission fees and spreads vary depending on the specific instrument being traded. For instance, the commission fee for trading the S&P 500 CFD is $3 per side, while spreads begin at 0.3 pips.

It is important to note that Eightcap does not impose any deposit or withdrawal fees. However, clients should be aware that they may incur fees from their payment providers, such as bank wire transfer fees.

Account Types

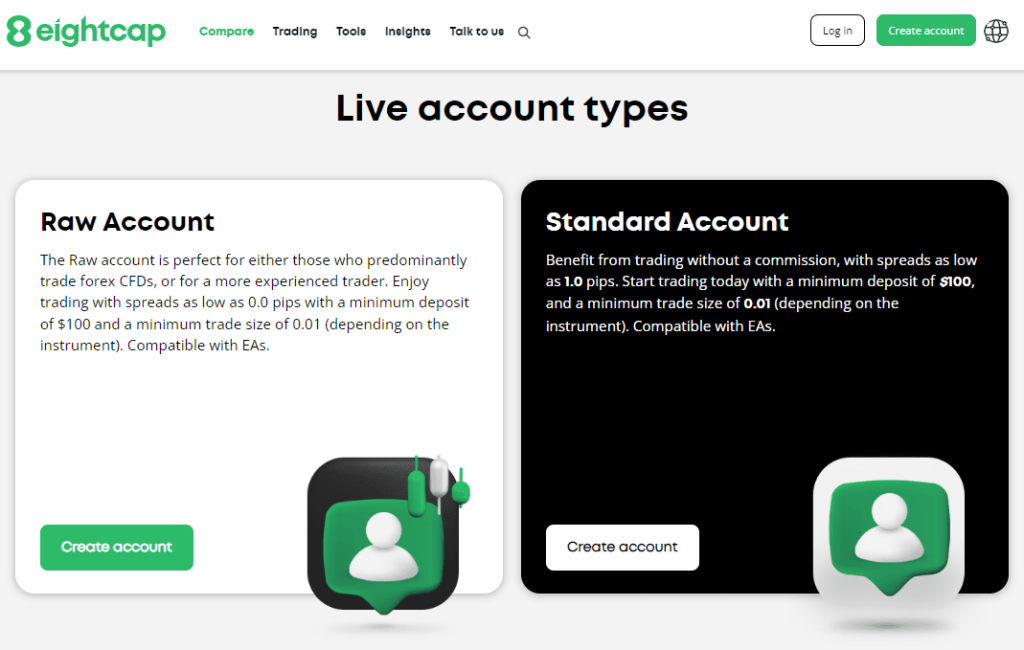

Eightcap provides traders with two primary types of live trading accounts to choose from:

Raw Account

Designed for traders who prefer direct market access and tight spreads. This account offers raw spreads sourced from top liquidity providers without additional markups. It is suitable for traders who value fast execution and are comfortable with a commission-based fee structure.

Standard Account

A commission-free account that offers competitive spreads. It is suitable for traders who prefer a straightforward fee structure without separate commissions per trade. The Standard Account provides access to a wide range of tradable instruments, including forex, indices, commodities, and cryptocurrencies.

How to Open Your Account

Eightcap provides traders worldwide with access to the global capital markets. They offer a variety of trading services, including forex, indices, commodities, and cryptocurrencies. Traders can utilize Eightcap’s user-friendly MetaTrader 4 (MT4) platform, as well as TradingView and MT5, across web trader, desktop, and mobile devices. To start your journey with Eightcap and open an Eightcap account, follow these simple steps:

Create an account

Register for an Eightcap account by completing the registration form and validating your account.

Fund the account

After validation, fund your account using various payment options and consider the minimum deposit requirement.

Choose a trading platform

Select between MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platforms for desktop or mobile. Alternatively, use the web trader platform or mobile app.

Start trading

Access a range of financial instruments through the chosen trading platform. Execute trades manually or utilize automated trading strategies.

Monitor and evaluate trades

Keep track of trades and analyze performance using the trading platform’s tools, such as charts, indicators, and news feeds.

Withdraw funds

Use the trading platform to initiate fund withdrawals by following the provided instructions.

What Can You Trade on Eightcap

Eightcap users have the opportunity to trade a variety of financial instruments via Contracts for Difference (CFDs) on the MT4 or MT5 trading platform. Here are the key trading options available:

Forex

Participate in the world’s largest financial market by trading currency pairs. Forex trading offers high liquidity and the potential for profit due to frequent price fluctuations. Eightcap provides access to over 40+ major and minor currency pairs.

Indices

Trade on indices that measure the performance of a group of stocks. These indices can reflect the overall market performance within a country or track specific sectors. Eightcap offers trading on eight of the largest global stock indices.

Commodities

Engage in the buying and selling of raw materials, such as precious metals and oil, through futures contracts. Explore opportunities to trade commodities like Crude Oil, Gold, and Silver with Eightcap.

Shares

Speculate on the price movements of Australia’s largest stocks without owning the underlying shares. Share CFDs allow you to trade on the performance of individual companies. Companies may offer shares to investors through Initial Public Offerings (IPOs), providing opportunities for capital growth and potential returns.

Eightcap Customer Support

Eightcap prioritizes exceptional customer support to cater to Eightcap users’ needs and ensure a positive experience. The support team is readily available and responsive, committed to delivering prompt and valuable assistance. Traders can conveniently access live chat support on the Eightcap website, enabling real-time communication for immediate help.

For more in-depth inquiries and guidance, email support is accessible, and personalized assistance is provided through phone support. Additionally, the website features an extensive FAQ section, covering common queries and concerns.

To facilitate self-help and learning, Eightcap offers a knowledge base comprising informative articles, guides, and tutorials. Engaging with users on social media platforms, Eightcap maintains an active presence, providing updates and promptly addressing inquiries.

Advantages and Disadvantages of Eightcap Customer Support

Security for Investors

Withdrawal Options and Fees

When it comes to withdrawing funds from your Eightcap trading account, you have several options available:

Bank Wire Transfer

You can initiate a withdrawal via bank wire transfer, allowing you to transfer funds directly from your Eightcap trading account to your bank account. This method provides a secure and reliable way to access your funds.

Credit/Debit Cards

If you have previously made a deposit using a credit or debit card, you may also have the option to withdraw funds back to the same card. The availability of this method is subject to the policies of your card issuer.

E-wallets

Eightcap supports withdrawals to popular e-wallets, providing a convenient and fast way to receive your funds. E-wallets offer flexibility and ease of use for managing your financial transactions.

It’s important to keep in mind that the availability of specific deposit and withdrawal methods may vary depending on your location and the regulations in your country.

Eightcap does not also charge any internal fees for deposits or withdrawals from the trading account. However, it’s essential to note that while Eightcap does not impose any fees, the payment provider that the trader uses may have its own transaction fees or international processing fees that the trader should be aware of.

Eightcap Vs Other Brokers

#1. Eightcap vs AvaTrade

Eightcap is a global online broker that offers access to a wide range of financial instruments, including forex, indices, commodities, and cryptocurrencies. They provide traders with the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, along with competitive spreads and low commission fees. Eightcap is regulated by ASIC, ensuring a level of trust and security for its clients. However, there may be limited availability in terms of customer support and language options.

On the other hand, AvaTrade is also a global broker that offers trading services in various financial markets. They provide traders with a choice of trading platforms, including AvaTradeGO, MT4, and MT5, along with a wide range of trading tools and educational resources. AvaTrade is regulated by multiple authorities, including ASIC, ensuring a high level of regulation and client protection. They also offer a variety of account types to suit different trading needs. However, some traders may find that AvaTrade charges higher spreads and fees compared to Eightcap.

In terms of the verdict on which broker is better, it ultimately depends on individual preferences and trading requirements. Eightcap may be a better choice for traders looking for competitive spreads and low commission fees, as well as a focus on the MetaTrader platforms. AvaTrade, on the other hand, may be preferred by traders who value a wider range of account options and a comprehensive selection of trading tools and resources.

#2. Eightcap vs RoboForex

Eightcap is a global broker that provides access to various financial markets, including forex, indices, commodities, and cryptocurrencies. They offer the MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced charting tools. Eightcap is regulated by ASIC, ensuring a level of trust and security for traders. However, their customer support and language options may have limitations.

Roboforex, on the other hand, is a global broker offering a wide range of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies. They provide traders with multiple trading platforms, including MT4 and MT5, as well as their proprietary platform. RoboForex is regulated by several authorities, such as CySEC and IFSC, offering regulatory oversight for client protection. They also offer various account types and trading conditions to suit different trading styles.

In terms of the verdict on which broker is better, it depends on individual preferences and trading priorities. Eightcap may be a better choice for traders who value the simplicity and reliability of the MT4 platform, along with competitive spreads and low commissions. RoboForex, on the other hand, may appeal to traders looking for a broader range of trading instruments, multiple platform options, and more flexible account types.

#3. Eightcap vs Exness

Eightcap is a global broker that offers access to various financial markets, including forex, indices, commodities, and cryptocurrencies. They provide the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced charting tools. Eightcap is regulated by ASIC, which adds credibility and ensures a certain level of safety for traders. They offer competitive spreads and low commissions, making them appealing to cost-conscious traders.

Exness, on the other hand, is also a global broker that provides access to a wide range of trading instruments, including forex, metals, energies, indices, and cryptocurrencies. They offer both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, giving traders flexibility in their trading choices. Exness is regulated by reputable authorities, such as CySEC and FCA, which offers regulatory protection for traders. They are known for their tight spreads and fast execution.

When it comes to determining which broker is better, it ultimately depends on individual preferences and trading priorities. Both Eightcap and Exness have their strengths and advantages. Eightcap may be preferred by traders who value simplicity, competitive pricing, and the familiarity of the MT4 platform. Exness, on the other hand, may appeal to traders seeking a broader range of instruments, including more diverse cryptocurrencies, and tighter spreads.

Conclusion: Eightcap Review

According to the mentioned characteristics and offerings in this Eightcap review, Eightcap is a suitable choice for both novice and experienced traders who want to access global financial markets. It caters to traders of all skill levels with its user-friendly platform, diverse range of trading products, and competitive fees. Additionally, its commitment to regulation, customer service, and transparency provides an added layer of protection and support for traders.

While there are some drawbacks like the absence of a custom trading platform and limited educational resources, Eightcap presents an enticing overall package. When compared to competitors like RoboForex and AvaTrade, Eightcap stands out as a strong contender in the online brokerage market.

Ultimately, the decision to choose Eightcap as a trading platform depends on individual preferences and needs. However, given its solid reputation, affordable fees, and focus on customer service and transparency, Eightcap is definitely a platform worth considering for traders and investors.

Eightcap Review: FAQs

Is Eightcap a legitimate broker?

Yes, Eightcap is a legitimate broker. It is a reputable online brokerage firm that operates globally, providing access to the international financial markets.

Can I trust Eightcap with my funds?

Yes, you can trust Eightcap with your funds. The company is committed to transparency, regulation, and customer protection. It is regulated by reputable financial authorities and follows strict compliance measures to ensure the security of client funds.

Is Eightcap regulated and compliant with financial authorities?

Yes, Eightcap is regulated and compliant with financial authorities. It is regulated by two reputable financial regulatory bodies, including the Australian Securities and Investments Commission (ASIC). This regulatory oversight ensures that Eightcap operates in accordance with strict financial standards and guidelines.