Forex trading, also known as foreign exchange or FX trading, is a decentralized global market where all the world’s currencies are traded. It’s the largest and most liquid market in the world, with a daily trading volume exceeding 6 trillion dollars. Amidst this vast financial ecosystem, ECN Forex Brokers have emerged as a highly sought-after category of financial intermediaries.

ECN stands for Electronic Communication Network, a computerized system that facilitates direct trading between market participants without the need for intermediaries. ECN Brokers connect traders with other participants in the Forex market – including banks, hedge funds, and even other individual traders. As a result, ECN Brokers offer a unique set of advantages, including increased transparency, faster execution times, and lower costs, making them an attractive choice for seasoned Forex traders.

Comparing ECN Forex Brokers to other Types of Brokers

In the Forex market, brokers serve as intermediaries facilitating the trading process. Here is how ECN Brokers differ from other types:

Dealing Desk (DD) Brokers:

DD Brokers, also known as market makers, create an internal market for their clients by taking the opposite side of their trades. They control the prices at which orders are filled, which can lead to potential conflicts of interest.

Non-Dealing Desk (NDD) Brokers:

NDD Brokers provide traders with direct access to the interbank market. They do not take the opposite side of the client’s trades and make money through spreads and commissions.

Straight Through Processing (STP) Brokers:

STP Brokers send client orders directly to the market without passing through a dealing desk. However, they may increase the spread to make a profit.

ECN Brokers:

ECN Brokers offer a transparent trading environment by providing a direct market access trading system. They connect traders with each other and other market participants like banks and financial institutions. ECN Brokers charge a commission per transaction instead of making money through spreads, which ensures there’s no conflict of interest.

Features of ECN Forex Brokers

ECN Forex Brokers offer several unique features:

- They provide a transparent, direct market access trading environment.

- They display real-time order book information, including the market’s depth and liquidity.

- ECN Brokers don’t trade against their clients, reducing potential conflicts of interest.

- They offer variable spreads, which can be lower during high-volume periods.

How to Spot Fake ECN Forex Brokers

Fake or ‘pseudo’ ECN Forex Brokers may display the following signs:

- They offer fixed spreads, which is uncharacteristic of the variable spreads found in true ECN models.

- They may prohibit strategies like scalping, which genuine ECN Brokers usually allow.

- They might restrict your trades during news events, something a real ECN Broker won’t do.

- Fake ECN Brokers may fail to provide an authentic Depth of Market (DOM) information.

How to Choose ECN Forex Brokers

When choosing an ECN Forex Broker, consider the following:

- Check if the broker is regulated by an authoritative financial body.

- Consider their commissions and fees structure.

- Look for brokers offering low spreads.

- Evaluate their trading platform and technology.

- Examine the broker’s customer support and service quality.

Best ECN Forex Brokers

The following are some of the top ECN Forex Brokers in the market:

#1. RoboForex

What is RoboForex?

RoboForex is a globally recognized online broker providing a broad range of trading services, including Forex, Stocks, Indices, ETFs, Commodities, and Cryptocurrencies. Established in 2009, it has built a reputation for its advanced trading platforms, offering MetaTrader 4, MetaTrader 5, cTrader and its own proprietary R Trader. RoboForex also provides a wide variety of account types, including ECN accounts, that cater to traders of all experience levels. It is regulated by the International Financial Services Commission (IFSC) of Belize.

Advantages and Disadvantages of Trading with RoboForex

Commissions and Fees

RoboForex charges a commission on its ECN accounts. The standard commission is $20 per million USD traded.

#2. Exness

What is Exness?

Exness is a leading online Forex and CFD broker that was established in 2008. Renowned for its transparency and reliability, Exness offers a variety of account types, including ECN, and provides access to a wide range of financial markets. Its commitment to providing high-quality customer service and strong regulatory oversight have earned it a place among the top Forex brokers worldwide. Exness is regulated by the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

Advantages and Disadvantages of Trading with Exness

Commissions and Fees

Exness charges a commission on its ECN accounts, starting from $25 per million USD traded.

#3. Alpari

What is Alpari?

Founded in 1998, Alpari is one of the oldest and most respected names in the online trading industry. Alpari provides a broad spectrum of financial products, including Forex, Spot Metals, CFDs on commodities, indices, and stocks. It offers various account types, including ECN, for both novice and experienced traders. Alpari is well-known for its robust trading platforms, MetaTrader 4 and MetaTrader 5, and innovative trading solutions like copy trading and PAMM accounts. Alpari is regulated by the Financial Services Commission of Mauritius.

Advantages and Disadvantages of Trading with Alpari

Commissions and Fees

Alpari charges a commission from $16 per million USD traded on its ECN accounts.

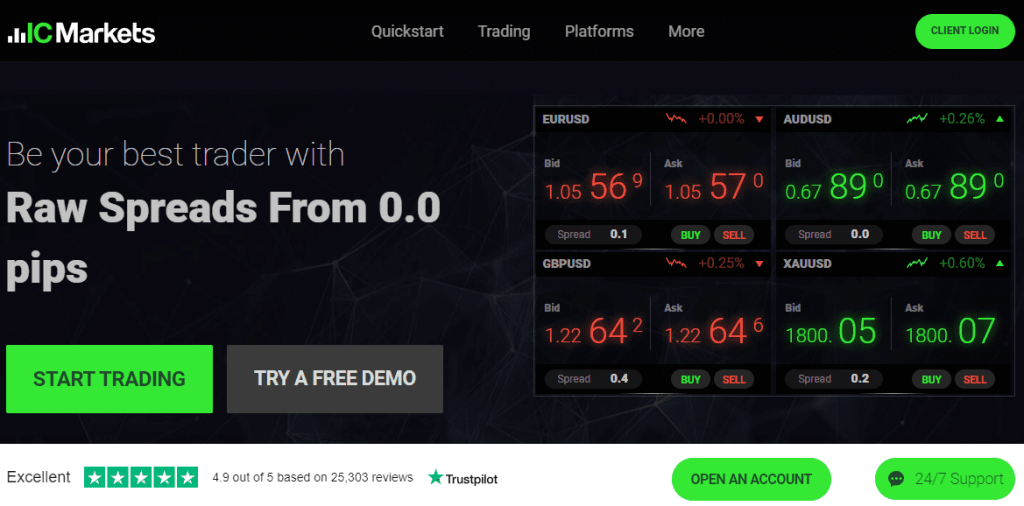

#4. IC Markets

What is IC Markets?

IC Markets is a leading Australian ECN broker known for providing a true ECN trading environment. Since its establishment in 2007, IC Markets has been offering low-latency trading with deep liquidity and tight spreads, making it an excellent choice for scalpers and day traders. IC Markets provides a vast range of trading instruments across Forex, CFDs, Bonds, Indices, Commodities, Stocks and Cryptocurrencies. It offers both MetaTrader and cTrader platforms. IC Markets is regulated by the Australian Securities and Investments Commission (ASIC).

Advantages and Disadvantages of Trading with IC Markets

Commissions and Fees

IC Markets charges a commission of $7 per lot round turn on its Raw Spread (ECN) accounts.

#5. LiteForex

What is LiteForex?

LiteForex is a Cyprus-based ECN broker, established in 2005, offering a wide array of trading instruments including Forex, Stocks, Indices, Commodities and Cryptocurrencies. With a focus on making trading accessible to all, LiteForex has a relatively low minimum deposit requirement and provides a variety of account types, including ECN. LiteForex is also known for its social trading features that allow novice traders to copy the trades of experienced traders. LiteForex is regulated by the Cyprus Securities and Exchange Commission (CySEC).

Advantages and Disadvantages of Trading with LiteForex

Commissions and Fees

LiteForex charges a variable commission starting from $5 per lot on its ECN accounts.

Conclusion

Choosing the right ECN Forex broker can significantly enhance your trading experience by providing you with greater transparency, more competitive pricing, and faster execution. This guide has aimed to provide you with an understanding of what ECN brokers are, how they differentiate from other types of brokers, how to spot a fake ECN broker, and how to select a genuine one. Moreover, we introduced some of the industry’s top ECN brokers – RoboForex, Exness, Alpari, IC Markets, and LiteForex, each with its unique offerings and advantages.

Remember, while the choice of a broker is crucial, it’s equally important to understand your trading style, risk tolerance, and investment goals. Always do your due diligence and consider your unique needs and preferences when choosing an ECN Forex broker.

FAQs

Why choose an ECN Forex Broker?

ECN Brokers provide a transparent, conflict-free trading environment with faster execution and potentially lower spreads.

Are ECN Brokers safe?

As long as the ECN Broker is regulated by a reputable financial authority, they are generally safe for trading.

Can I start with a small deposit with an ECN Broker?

Yes, some ECN Brokers allow you to start trading with a small deposit. However, it varies from broker to broker.

What does ‘spread’ mean in Forex trading?

Spread is the difference between the bid and the ask price of a currency pair in Forex trading.

What’s the difference between ECN and standard account?

ECN accounts provide direct access to the Forex market with more transparency, while standard accounts are typically managed through brokers who may mark up spreads for profit.