Position in Rating | Overall Rating | Trading Terminals |

237th  | 2.0 Overall Rating |

EC Markets Review

Selecting the right forex broker is important because of a broker’s direct impact on trading success. A good broker ensures secure transactions, competitive pricing, and reliable support, while a poor choice could mean slow trade execution, hidden costs, or, in extreme cases, compromised funds.

EC Markets is a forex broker for traders wanting transparency, efficiency, and advanced technology. This broker offers competitive spreads, quick trade execution, and a platform that is easy to use.

Differentiating EC Markets is the concern of client security and compliance with regulatory requirements. An excellent tool for succeeding in either way, EC Markets provides everything a trader needs to succeed in the forex world.

This review will do a deep-dive into EC Markets and highlight its strength and weaknesses. The aim is to provide you with useful information about the broker, mainly regarding types of accounts, deposit and withdrawal procedures, commissions, and the like.

By bringing together expert analysis with real trader experiences, this review provides you with a level-headed picture to give you valuable insight into whether or not EC Markets is the right choice based on your trading needs.

What is EC Markets?

EC Markets is a globally regulated broker offering financial trading solutions, including forex, CFDs, commodities, and indices. Notably authorized by reputable financial authorities including the Seychelles FSA, UK FCA, Australian ASIC, and others, EC Markets has created a secure and transparent trading environment. The company provides trading services for traders across the globe but excludes certain regions like the UK, EU, and USA through platforms like MetaTrader 4 for seamless trading experience.

The company takes risk management very seriously, citing in-depth educational sources for traders to better understand financial markets. EC Markets supports advanced trading tools such as Trading Central indicators, enabling users to analyze market trends very effectively. Their multi-jurisdictional compliance highlights their commitment to providing reliable services for traders at all levels.

EC Markets Regulation and Safety

EC Markets operates under strict regulatory oversight to ensure the safety and security of its clients. The company is licensed and regulated by several trusted authorities, including the Seychelles Financial Services Authority (FSA), the Financial Conduct Authority (FCA) in the United Kingdom, and the Mauritius Financial Services Commission (FSC). Additional licenses are held from regulatory bodies in Australia (ASIC), New Zealand (FMA), and South Africa (FSCA). These licenses justify the company’s standing compliance with a regulatory and committed international financial standard along with the transparency of its activities.

Client funds are secured by allocation in secure banks, with further protection from operational risks. EC Markets holds strong risk management policies and provides legal documents related to the Client Service Agreement and Risk Disclosure, which provide the clients a substantial insight while making any trade. Along with this, measures strengthen the company’s core principles of providing clients with a secure and trustworthy trading environment.

EC Markets Pros and Cons

Pros

- Global regulation

- Diverse instruments

- Flexible leverage

- Secure funds

Cons

- Limited availability

- High risk

- No proprietary platform

- Complex documentation

Benefits of Trading with EC Markets

Regulated and Trusted

EC Markets, is supervised by various authority bodies that guarantee the secured and transparent environment in which trading is operated. The broker is compliant with international standards and regulations, and this instills confidence in traders that the broker responsibly manages their funds responsibly.

Variety of Instruments

In terms of market, EC Markets provides trading instruments, including Forex, Commodities, Indices, and CFDs. This variety allows traders to operate in different markets and form many trading approaches.

High Leverage

EC Markets offers leverage up to 500:1, which gives even a small trader access to tremendous amounts of capital and hence a chance of earning decent profit. High leverage with highly developed risk management systems can use this broker to meet the needs of both advanced and novice traders.

Secure Client Funds

Traders’ funds will be held in segregated accounts with trusted financial institutions. This keeps clients’ fund highly protected in segregated accounts. EC Markets industry best practices to protect funds against operational risks.

Education and Support

EC Markets offers education in the form of trading guides and market analysis to help traders improve their trading skills. Besides this, customer support will respond to any inquiries relating to trading or accounts.

Reliable Trading Platforms

Traders can access MetaTrader 4 (MT4), the most reliable trading platform employing a user-friendly interface and superior tools. This platform has been the most preferred option for forex and CFD trading it offers real-time data, an option of custom charts, and automated trading

These benefits make EC Markets a strong option for traders looking for a secure, flexible, and well-regulated trading platform.

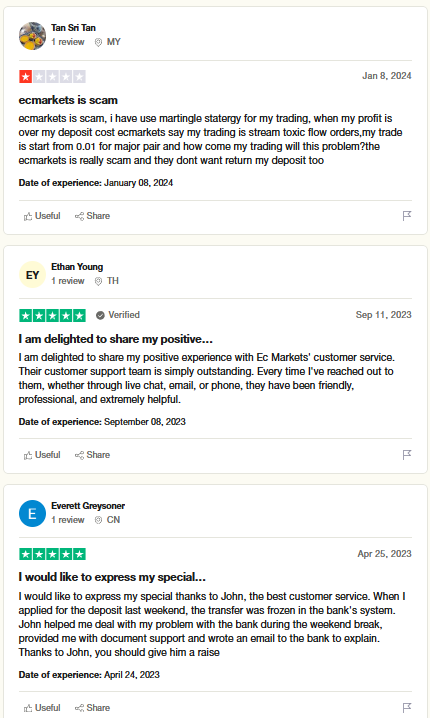

EC Markets Customer Reviews

EC Markets has received mixed reviews from its customers. Some users have expressed dissatisfaction, citing issues like trading losses and concerns about deposit returns. For example, one customer mentioned challenges with the martingale strategy and unreturned funds.

On the other hand, many customers praise EC Markets for its excellent customer service. Users highlight the professionalism, quick response times, and helpful support provided through multiple channels, including chat and email. A few reviews emphasize special assistance during banking issues, demonstrating the company’s commitment to resolving client problems.

EC Markets seems to meet the demands of a customer supportive service while there is room for improvement concerning trading strategies and financial transparency. It will be a great idea for new clients to weigh both positive and negative comments before settling on this service provider.

EC Markets Spreads, Fees, and Commissions

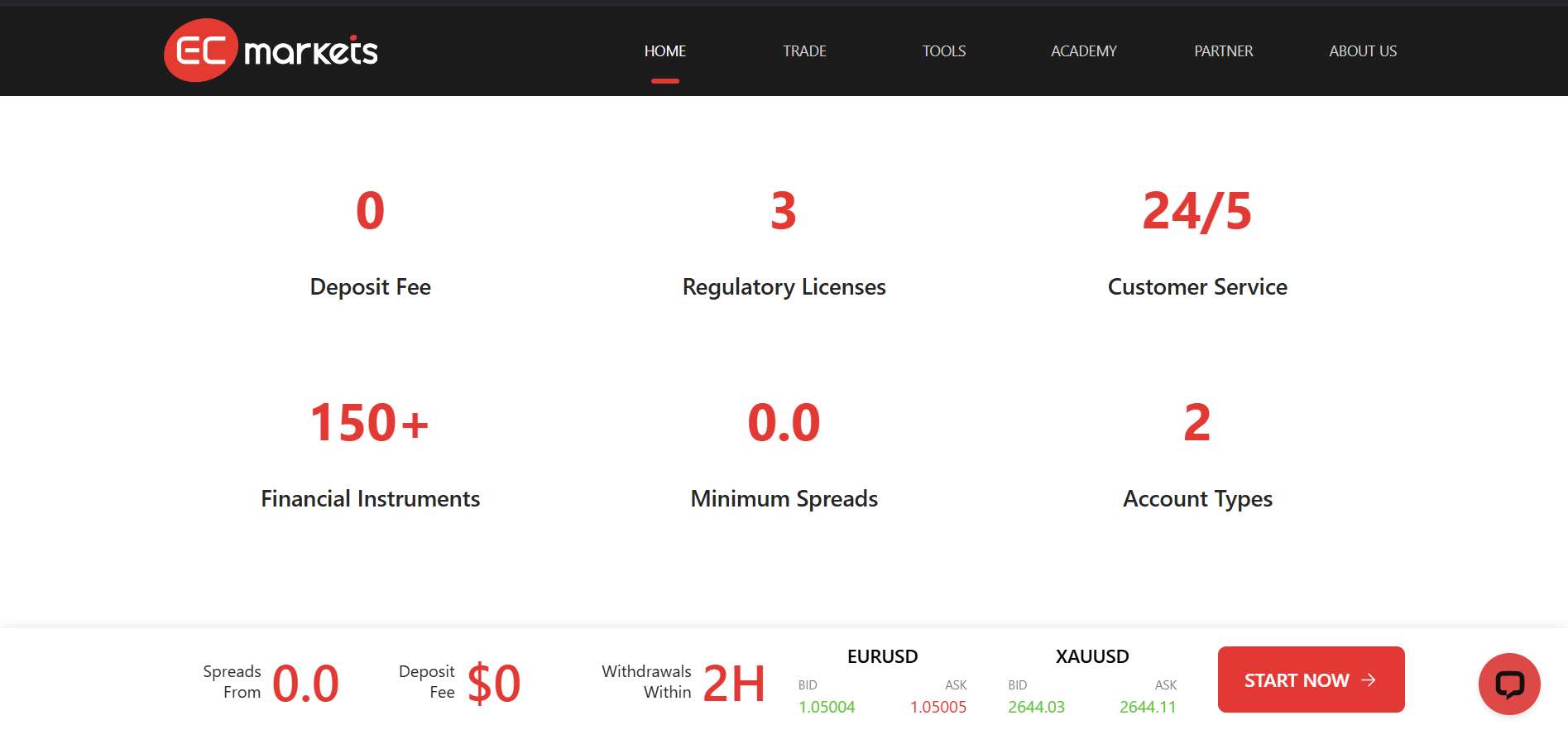

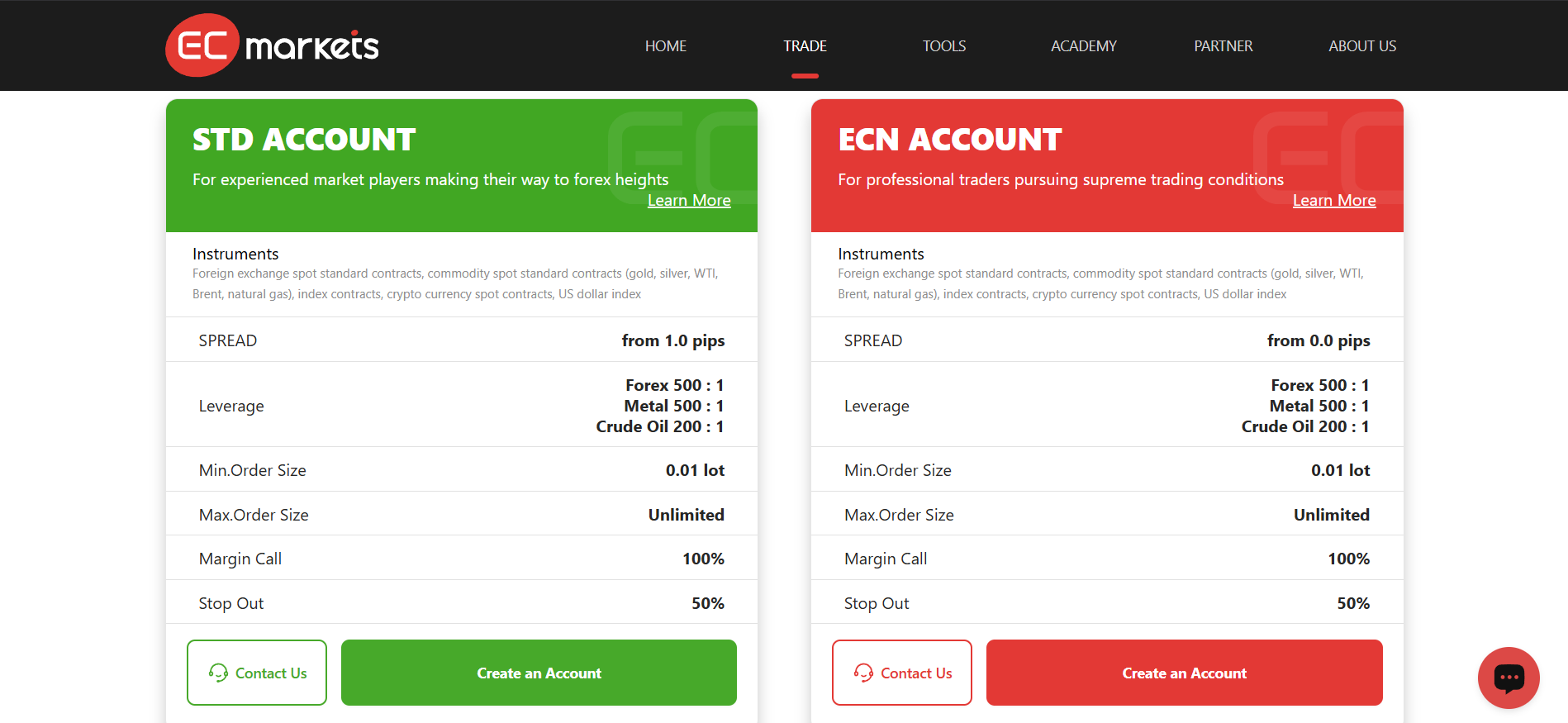

Traders with all levels of experience will benefit from EC Markets competitive pricing strategy. It has a Standard (STD) Account starting with spreads from 1.0 pips, ideal for experienced traders who demand constant access to the market. In contrast, the ECN Account is for professional traders with spreads starting from 0.0 pips that deliver premium trading experience. Both accounts offer a minimum order size of 0.01 lots and leverage up to 500:1 for forex and metals, providing flexibility in global markets.

The platform is committed to transparent pricing without hidden fees. EC Markets declares no deposit fees and offers ultra-fast execution speeds, with orders typically filled in under 2 milliseconds. The platform currently has over 150 financial instruments available for trade on forex, metals, crude oil, and index trading efficiently and at minimal cost.

Account Types

EC Markets provides two accounts tailored for different trading needs: STD Account and ECN Account. Both grant access to global financial markets under competitive trading conditions.

STD Account

This account would be ideal for beginners, with no commissions and spreads from 1.6 pips. The maximum leverage is as high as 500:1, catering to the needs of traders preferring a simple trading process. The STD Account supports trading forex, metals, and indices with fluent integration via MetaTrader 4.

ECN Account

The ECN Account serves professional traders who look for low spreads combined with execution speed. Spreads start at 0.0 pips and have a slight commission of $5 per lot per side. With the ECN account, traders have direct access to the market with deep liquidity. Advanced trading strategies are permitted with a maximum leverage of 500:1.

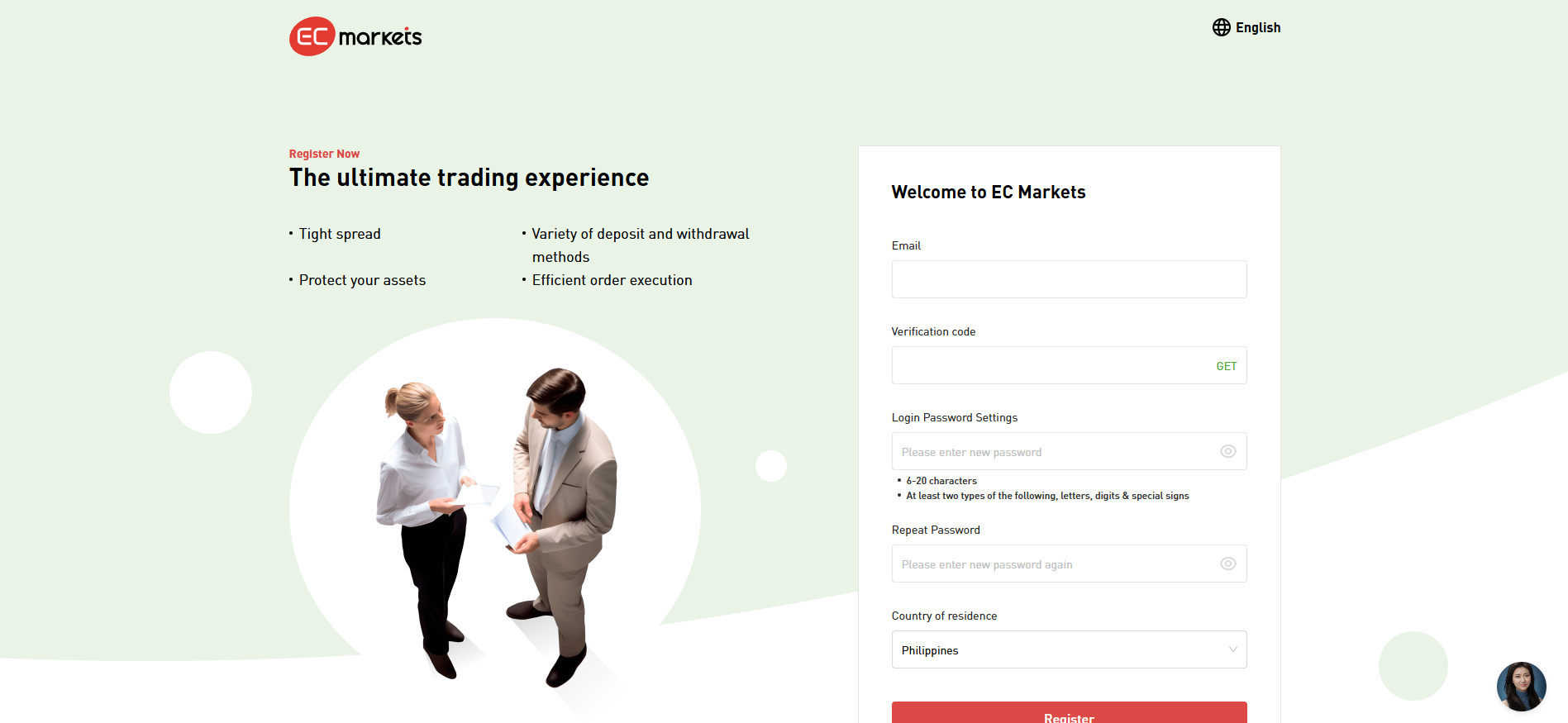

How to Open Your Account

The process of getting an EC Markets Account is simple in itself, taking but a few steps. Therefore, follow this short guide to get you going:

Step 1: Click on “Start Trading”

First, go to the EC Markets website and click on the “Start Trading” button at the top-right corner of the homepage as was pictured above. This leads you to the registration form.

Step 2: Fill Out the Registration Form

Enter your email and ask for the verification code. Create a secure password in accordance with the guidelines provided (6-20 characters, with letters, numbers, and special symbols). Choose your country of residence from the drop-down menu.

Step 3: Verify and Submit

Enter the verification code that was sent to your email, verify your details, then click the “Register” button to create your account.

Once your account is prepared, you can log in to EC Markets, fund your account, and start trading.

EC Markets Trading Platforms

The platforms offered by EC Markets include MT4, allowing both new and professional traders flexibility. The different types of trading assets supported include Forex, precious metals, indices, and commodities. Traders can have access from any iOS, Android, or desktop device anytime, anywhere.

MT4, which is widely known to have an easy-to-use interface, provides comprehensive charting tools, automated trading, and expert advisors. It’s great for traders who need flexibility in their customizable experience.

Both of these platforms are integrated with Trading Central’s technical analysis tools, including the Adaptive Divergence Convergence (ADC) indicators and candlestick pattern recognition. These enable traders to make the right decisions based on real-time market data. EC Markets offers a cost-efficient and secure trading environment with tight spreads, zero deposit fees, and fast withdrawals.

What Can You Trade on EC Markets

EC Markets offer a diverse range of trading options over several classes of assets. Traders can diversify their portfolios and explore various strategies. Here’s what you can trade on the platform:

Forex

Major, minor and exotic currency pairs are accessible, majorly for popular ones such as EUR/USD and GBP/JPY. Such liquidity supports trading strategies that base action on the movement of currencies.

Commodities

EC Markets provides commodities that include gold (XAU/USD), silver, and crude oil. With this, clients are able to take advantage of price changes in these critical markets.

Indices

Trade world’s major stock indices with access to the S&P 500 and FTSE 100. This will create the possibility of speculating upon a particular performance of a wider market segment.

Cryptocurrencies

EC Markets allows access to popular cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH), offering opportunities in the fast-moving crypto market for those interested in digital assets.

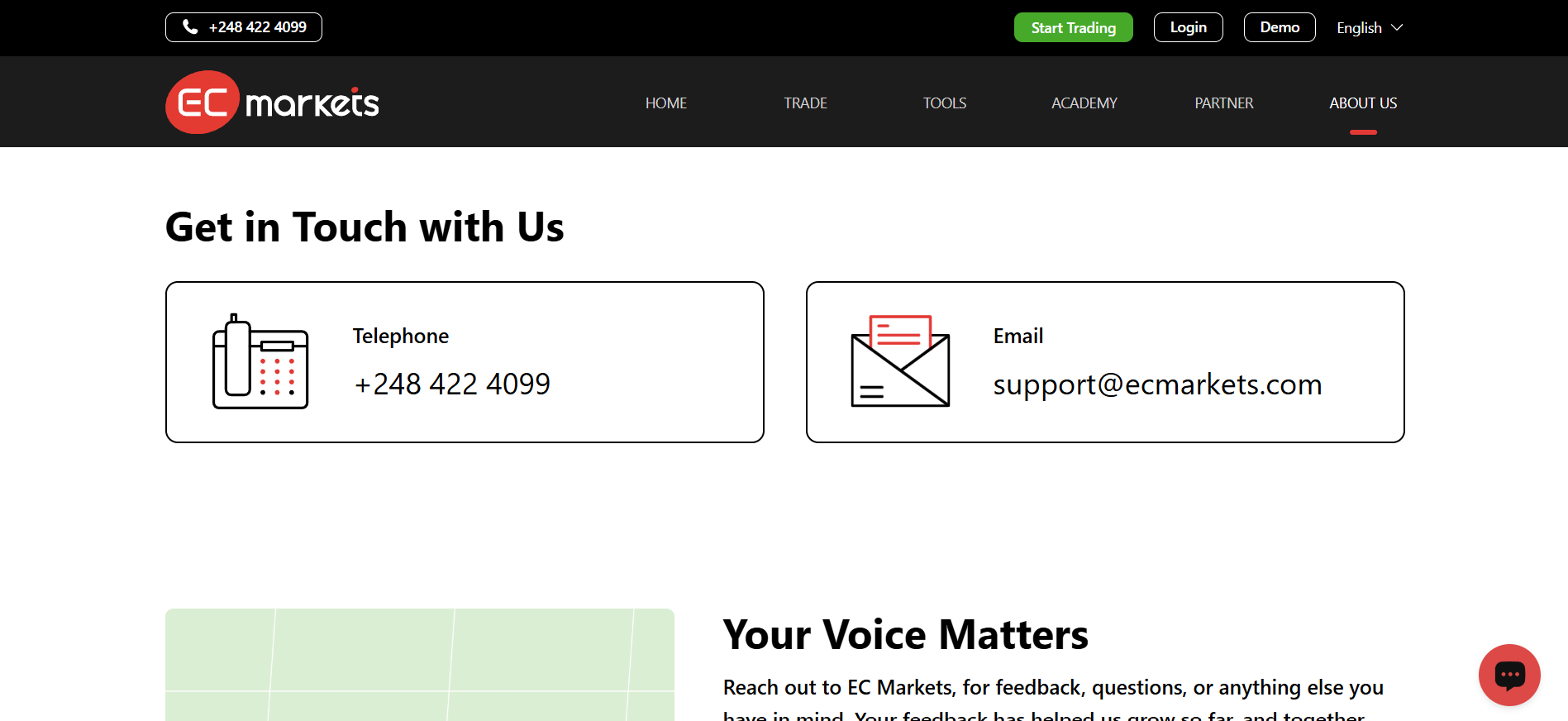

EC Markets Customer Support

EC Markets provide responsive customer support for your inquiries and issues. You would find help if you wanted to trade or have technical assistance with regard to opening accounts. A dedicated team was always there to help. You could email them on support@ecmarkets.com, or you could reach them through the phone line +248 422 4099.

EC Markets are on a mission to offer excellent customer service so that you would have a good trading experience. Their support team is reachable just one message away to resolve queries at a faster pace for your convenience. Contact them today for support.

Advantages and Disadvantages of EC Markets Customer Support

Withdrawal Options and Fees

EC Markets has provided numerous available withdrawal options, including UnionPay and OTC365, wire transfer, Thai QR Payment, VN Pay, and Poli. Regional-specific options such as bank transfer to Malaysia and ATM transfer to Indonesia can also be availed of for the flexibility of every trader.

The platform makes a convenient feature in fast withdrawal processing time, which takes 2 hours to process. Also, EC Markets does not charge any fees for deposits, though clients must check with the customer support about withdrawal charges applied depending on the chosen method of withdrawal.

EC Markets Vs Other Brokers

#1. EC Markets vs XM

EC Markets and XM are there to serve the needs of different traders but with entirely different features. EC Markets specializes in institutional trading, holding robust tools and tight spreads- perfect for professional traders, while XM is more accessible and friendly to retail traders with the low minimum deposits, and flexible leverage and educational content. XM also stands out for having various types of accounts and strong regulation, while EC Markets stresses personalized service and premium account options. Both platforms offer popular trading platforms such as MetaTrader 4 and 5, ensuring a smooth trading experience.

Verdict: EC Markets is ideal for experienced professionals who seek professional-grade tools, while XM appeals to the retail trader seeking flexibility and accessibility. It is a choice between an experience level and requirements of a trader.

#2. EC Markets vs RoboForex

EC Markets and RoboForex cater to different needs. EC Markets puts a large emphasis on the simplicity of trading, providing regulated environments and competitive spreads and appealing to professionals. RoboForex, however provides a wider variety of types of accounts, bonus offers, and trading tools, offering something for beginners and also for advanced traders. While EC Markets ensures simplicity and transparency, RoboForex prioritizes versatility and added perks, including cent accounts and automated trading options.

Verdict: For traders valuing simplicity and regulated frameworks, EC Markets is the better choice. However, those seeking diverse tools and account flexibility may find RoboForex more suitable.

#3. EC Markets vs Exness

Among the noteworthy brokers for various needs are EC Markets and Exness. EC Markets serves the needs of institutional trading and features competitive spreads with access to deep liquidity appealingly to professional traders, whereas an Exness seems more focused on ease of access with a relatively friendly interface, low minimum deposit requirements, and flexible leverage conditions targeting beginners and retail traders. EC Markets has less product in the trading profile but highly advanced frequency infrastructure, while Exness, on the other side, covers a lot more diverse assets with a wider variety of cryptocurrency available to the asset allocator.

Verdict: Exness is easier for new traders and caters to traders looking for greater flexibility in their trading journey, while EC Markets is a broker more inclined toward meeting institutional and professional clients sophistication-driven requirements. It is the trading skills and needs that separate the two.

Also Read: XM Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH EC MARKETS

Conclusion: EC Markets Review

EC Markets is a reliable broker, emphasizing transparency, regulatory compliance, and secure trading environments. With features like competitive spreads, advanced platforms, and educational resources, it appeals to both novice and seasoned traders. However, limited availability in certain regions and reliance on MetaTrader platforms may be drawbacks for some users.

EC Markets provides a solid trading experience for those seeking a regulated and professional broker. Its strengths in security and customer support make it a compelling choice for traders prioritizing safety and efficiency.

Also Read: TitanFX Review 2024 – Expert Trader Insights

EC Markets Review: FAQs

Is EC Markets regulated?

Yes, EC Markets is regulated by reputable authorities, including the FCA, ASIC, and FSA, ensuring a secure and transparent trading environment.

What are the deposit and withdrawal options?

EC Markets supports multiple payment methods, including UnionPay, wire transfers, and regional options like Thai QR Payment, ensuring flexibility for global traders.

Does EC Markets charge deposit fees?

No, EC Markets does not charge deposit fees, but traders should confirm withdrawal fees based on their chosen method.

OPEN AN ACCOUNT NOW WITH EC MARKETS AND GET YOUR BONUS