Position in Rating | Overall Rating | Trading Terminals |

190th  | 2.7 Overall Rating |

EBSI Forex Review

When it comes to trading in the foreign exchange market, choosing the right brokerage services is crucial. A forex broker serves as your gateway to the world of currency trading, providing the platform, tools, and support necessary for executing trades and trading services effectively. The right broker can offer competitive spreads, efficient execution speeds, reliable customer service, and a secure trading environment, all of which are essential for your trading success and peace of mind.

EBSI Forex stands out among many brokers due to its specialized focus on currency trading, offering a range of account options to cater to different trading needs. With its trading platform, including the popular MT4 and the FXTrader PRO, EBSI Forex provides flexibility in trading with both fixed and variable spreads. Additionally, it operates under the regulation of the Securities and Futures Commission (SFC) of Hong Kong, ensuring a degree of safety and trust for its clients.

In this detailed review, I aim to provide an exhaustive evaluation of EBSI Forex, emphasizing its unique selling propositions and potential drawbacks. My objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. My balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering EBSI Forex as your preferred brokerage service provider.

What is EBSI Forex?

EBSI Forex (Everbright Securities International) is a broker (part of Everbright Securities Company Limited) that specializes in trading currency pairs and is regulated by the Securities and Futures Commission (SFC) of Hong Kong. They do not support CFD transactions, focusing solely on forex trading. EBSI Forex offers competitive spreads, with options for both fixed and floating spreads, depending on the account type. The minimum deposit is $5,000, and leverage is available up to 1:20.

From my experience with EBSI Forex, one of the standout features is their use of the MetaTrader 4 (MT4) platform, which is known for its reliability and speed. Additionally, their FXTrader PRO platform offers advanced analytical capabilities, making it suitable for traders who prefer in-depth technical analysis. Account setup, however, is somewhat cumbersome as it requires an in-person visit to their office to complete the process, which might be a drawback for some traders. Also note that the company’s shares are listed under Hong Kong Stock Exchange and Shanghai Stock Exchange.

Benefits of Trading with EBSI Forex

Trading with EBSI Forex has several notable benefits that I’ve found valuable during my time with the broker. One of the primary advantages is the security and regulation provided by the Securities and Futures Commission (SFC) of Hong Kong. This regulatory oversight ensures a high level of trust and safety for your investments, making it a reliable choice for serious traders.

The trading platforms offered by EBSI Forex, including MetaTrader 4 and FXTrader PRO, are both robust and user-friendly. These platforms provide a range of tools and features that cater to different trading styles and strategies. The flexibility of choosing between variable and fixed spreads allows traders to optimize their trading conditions based on market volatility and personal preferences.

Another significant benefit is the customer support available around the clock during trading hours. Having access to knowledgeable and responsive support staff ensures that any issues or questions are addressed promptly, which is crucial for maintaining an effective trading experience. Additionally, the transparency in fee structures, with no additional trading fees and only bank transfer charges to consider, helps in managing and predicting trading costs effectively.

EBSI Forex Regulation and Safety

EBSI Forex is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring a high level of safety and reliability for its clients. This regulation means that EBSI Forex must adhere to strict standards, including maintaining sufficient shareholder and reserve capital. Client funds are held in trust accounts at Standard Chartered Bank, which provides additional security by keeping these funds separate from the broker’s capital. This is crucial information as it highlights the broker’s commitment to protecting your investments.

Having a reputable regulatory body like the SFC overseeing operations means that EBSI Forex is required to operate transparently and fairly. The broker cannot provide investment advice or trading recommendations, ensuring that there is no conflict of interest and that their main focus remains on facilitating secure trading. This level of regulation helps prevent fraudulent activities and market manipulation, which are essential factors to consider when choosing a broker.

EBSI Forex’s collaboration with Macquarie Bank and other major liquidity providers further enhances its credibility and reliability. The rigorous regulatory framework and these partnerships ensure that traders can trust the execution of their trades. This is particularly important for those who are serious about trading and need a stable and trustworthy platform. By understanding the regulatory landscape of EBSI Forex, you can trade with confidence, knowing that your funds and trades are handled securely and professionally.

EBSI Forex Pros and Cons

Pros

- Regulated by SFC

- Fixed and variable spreads

- Reliable trading platforms

- Separation of client funds

- High-quality customer support

Cons

- High minimum deposit

- No CFDs available

- Account opening process is in-person

- Bank transfer delays

EBSI Forex Spreads, Fees, and Commissions

When it comes to trading costs, EBSI Forex offers competitive spreads and transparent fee structures. For the MetaTrader 4 (MT4) platform, the spreads start from 1.1 pips, which is relatively low and attractive for many traders. On the FXTrader PRO platform, the spreads are fixed, beginning at 1.6 pips. This dual option of fixed and floating spreads allows traders to choose a setup that best suits their trading style and strategy.

There are no additional trading fees on EBSI Forex, which is a significant advantage. The absence of commissions means that the only cost traders incur is the spread itself. This can be particularly beneficial for high-volume traders who execute many trades daily. However, it’s important to note that bank transfers are the only method for deposits and withdrawals, which might incur additional charges from your bank.

In terms of account funding, EBSI Forex requires a minimum deposit of $5,000, which might be higher than some other brokers but ensures that the trading environment is robust and reliable. Withdrawals are also processed via bank transfer, and while this method is secure, it can take several days for funds to be transferred. This delay can be inconvenient for traders who need quick access to their money.

Account Types

Opening an account with EBSI Forex is the first step to start trading with the broker. The fee size depends on which platform the account is created. The minimum deposit amount is $5,000 or its equivalent in another currency. Leverage is consistent across all account types, ranging from 1:1 to 1:20.

MT4 Accounts

These accounts are on the MetaTrader 4 (MT4) platform, which offers variable spreads. This option is ideal for traders who prefer the flexibility of changing spreads depending on market conditions.

FXTrader PRO Accounts

These accounts come with fixed spread values. This setup is suited for traders who prefer a stable, predictable spread, regardless of market fluctuations.

How to Open Your Account

- Visit the EBSI Forex website to find the “Open an Account” section.

- Make an appointment by calling EBSI Forex or filling out the feedback form available online.

- During the call, a company representative will inform you of the necessary documents you need to prepare.

- Collect all required documents, which typically include identification and financial information.

- Go to the EBSI Forex office on your scheduled appointment date with your documents.

- Fill out the provided account opening forms, available for individual, joint, and corporate accounts.

- Submit the completed forms along with your documents to the EBSI Forex representative.

- Once your documents are verified, your account will be opened, and you can start trading.

EBSI Forex Trading Platforms

EBSI Forex offers two main trading platforms, each catering to different trading needs. The MetaTrader 4 (MT4) platform is known for its reliability and flexibility, offering variable spreads that adjust based on market conditions. Using MT4, I found it particularly advantageous for its wide range of analytical tools and automated trading capabilities, making it a favorite among many traders.

The FXTrader PRO platform provides a more stable trading experience with its fixed spreads. This platform is ideal for those who prefer knowing their exact trading costs ahead of time, regardless of market volatility. FXTrader PRO’s interface is user-friendly and includes advanced charting tools, which I found helpful for in-depth market analysis and making informed trading decisions.

Both platforms support mobile trading, allowing you to manage trades on the go. The ability to execute trades instantly and monitor the market in real-time from your mobile device adds a level of convenience that is essential in today’s fast-paced trading environment.

What Can You Trade on EBSI Forex

EBSI Forex offers a range of trading instruments focused primarily on currency pairs. From my experience, you can trade 38 different currency pairs, allowing for a diverse range of trading opportunities. This selection includes major, minor, and some exotic pairs, catering to both conservative traders and those looking for more volatility.

One of the highlights of trading with EBSI Forex is the ability to trade with both fixed and variable spreads, depending on the platform you choose. On the MetaTrader 4 (MT4) platform, the variable spreads start from as low as 1.1 pips, making it attractive for traders who prefer flexibility. On the FXTrader PRO platform, the fixed spreads begin at 1.6 pips, providing a more predictable trading cost which I found useful for budgeting my trades.

Additionally, EBSI Forex supports trading during extended hours, aligning with Hong Kong time. This means the market is open from Monday to Saturday, giving traders more opportunities to engage with the market outside traditional trading hours. The trading platforms also support mobile trading, enabling you to manage your trades on the go, which is a significant advantage for maintaining active trading positions regardless of your location.

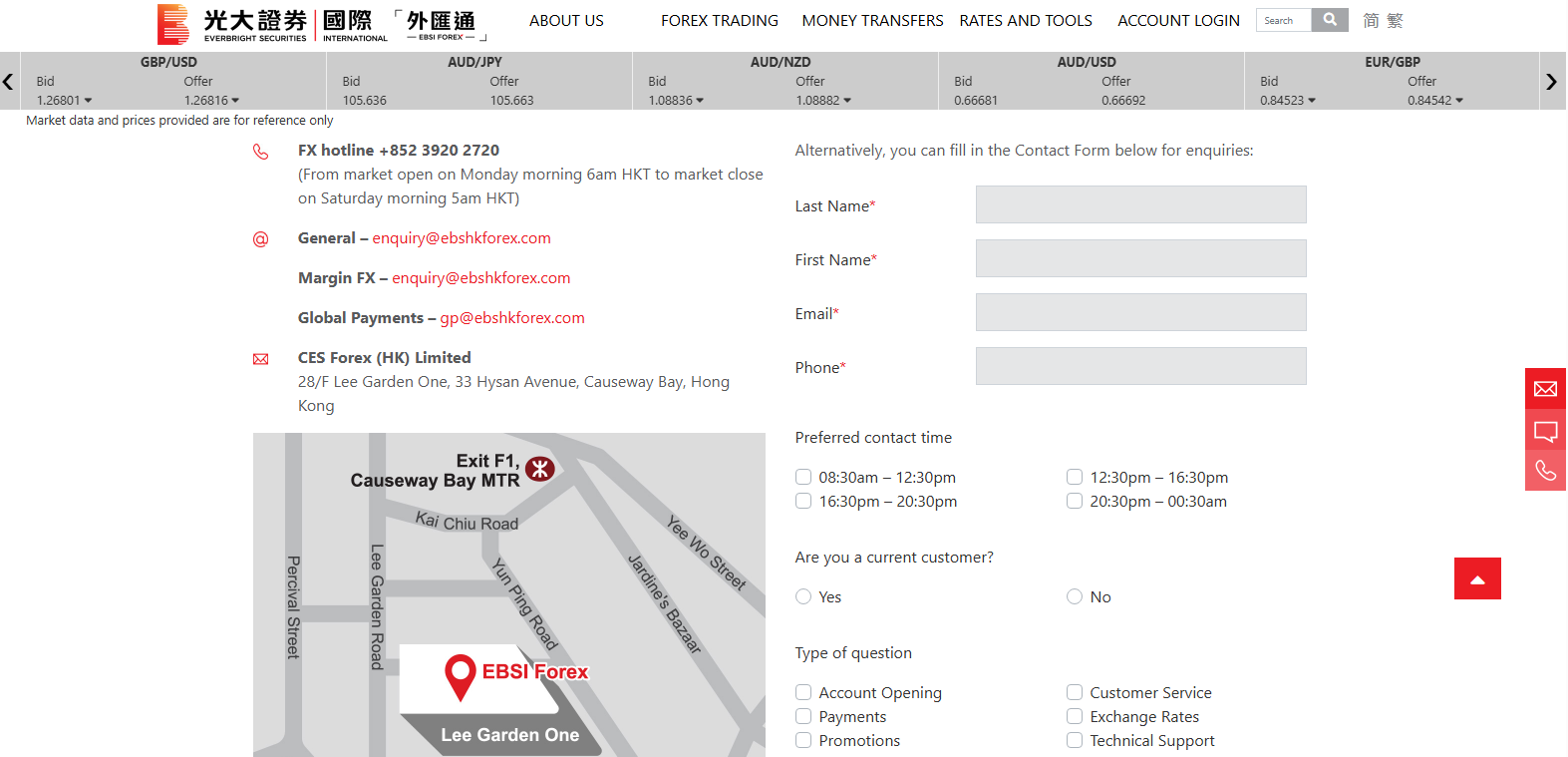

EBSI Forex Customer Support

EBSI Forex provides around-the-clock customer support during trading hours, which I found extremely helpful for resolving any issues promptly. You can reach their support team via phone, ensuring that you can get immediate assistance when needed. This level of availability is particularly useful for traders operating in different time zones or those who prefer real-time communication.

The customer support team is knowledgeable and responsive, capable of addressing various trading-related queries and technical issues. When I contacted them, they provided clear and concise answers, making the support experience efficient and stress-free. Additionally, the website offers a comprehensive FAQ section, which can be a quick resource for common questions.

For those who prefer self-service options, EBSI Forex’s website includes detailed information on account setup and trading procedures. This feature is beneficial for new traders looking to understand the platform without needing direct assistance. Overall, the customer support at EBSI Forex is designed to provide reliable and accessible help, ensuring that traders can maintain focus on their trading activities.

Advantages and Disadvantages of EBSI Forex Customer Support

Withdrawal Options and Fees

EBSI Forex offers bank transfers as the only withdrawal method for your profits from forex transactions. While this method is secure, it may take several days for the funds to be transferred to your bank account. For those who need quicker transactions, you can utilize the Global Payments system, which expedites the process.

One of the advantages of EBSI Forex is that the broker does not charge a fee for fund withdrawals. However, it’s important to be aware that your bank may impose charges for processing these transactions. This transparency in fee structure is beneficial, but you should always check with your bank to understand any potential fees they might apply.

EBSI Forex supports withdrawals in 15 major world currencies, including the offshore yuan. This flexibility is particularly useful for international traders who deal with multiple currencies. If the withdrawal currency is different from your account currency, the exchange is made at the real interbank (spot) rate, ensuring that you get a fair and accurate exchange rate. This feature helps in minimizing conversion costs and maximizing your profits.

EBSI Forex Vs Other Brokers

#1. EBSI Forex vs AvaTrade

EBSI Forex and AvaTrade both offer a range of trading platforms, but they differ significantly in their approach and foreign exchange services. EBSI Forex primarily focuses on forex trading with a minimum deposit of $5,000 and offers both fixed and variable spreads. AvaTrade, on the other hand, provides a broader range of trading instruments, including CFDs, cryptocurrencies, and options, with a lower minimum deposit requirement. AvaTrade supports multiple platforms such as MetaTrader 4, MetaTrader 5, and its proprietary platform AvaTradeGO, catering to different trading preferences and levels of expertise. Additionally, AvaTrade offers various educational tools and resources, making it more accessible to beginner traders.

Verdict: AvaTrade is the better choice for traders seeking a wider variety of trading instruments and platforms, along with extensive educational resources. EBSI Forex, while reliable, is more suited to those who are specifically focused on forex trading and can meet the higher minimum deposit requirement.

#2. EBSI Forex vs RoboForex

EBSI Forex and RoboForex offer distinct advantages tailored to different types of traders. EBSI Forex emphasizes security and regulatory compliance, with bank transfers as the primary method for withdrawals, ensuring a secure but sometimes slower transaction process. RoboForex provides more flexible funding and withdrawal options, including credit cards and e-wallets, and has a lower minimum deposit requirement. RoboForex also offers a wider range of trading instruments, including forex, stocks, indices, and cryptocurrencies, along with several trading platforms like MetaTrader 4, MetaTrader 5, and cTrader, which are highly regarded for their advanced features and user-friendly interfaces.

Verdict: RoboForex is preferable for traders who value flexible funding options and a broader range of trading instruments. EBSI Forex is more suitable for traders who prioritize security and regulatory compliance, even with a higher minimum deposit and fewer withdrawal options.

#3. EBSI Forex vs Exness

EBSI Forex and Exness both provide robust trading environments but cater to different needs. EBSI Forex offers a more traditional approach with a higher minimum deposit and a focus on forex trading through the MetaTrader 4 and FXTrader PRO platforms. Exness, however, provides a more accessible entry point with no minimum deposit and offers a wider range of trading instruments, including forex, cryptocurrencies, metals, and energies. Exness supports both MetaTrader 4 and MetaTrader 5 platforms and offers competitive spreads and leverage options, making it appealing to a broader range of traders, from beginners to advanced.

Verdict: Exness is the better option for traders looking for a more accessible and versatile trading experience with no minimum deposit and a variety of trading instruments. EBSI Forex is better for those who are focused exclusively on forex trading and can manage the higher initial deposit.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH EBSI FOREX

Conclusion: EBSI Forex Review

Based on my experience and user feedback, EBSI Forex offers a reliable and secure trading environment, particularly for those focused on forex trading. The broker is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring a high level of safety for traders. EBSI Forex provides robust trading platforms, including MetaTrader 4 and FXTrader PRO, which cater to both novice and experienced traders.

However, there are some notable drawbacks. The minimum deposit requirement of $5,000 is relatively high compared to other brokers, which may be a barrier for some traders. Additionally, the need to visit their office in person to open an account can be inconvenient, especially for international clients. While the broker does not charge withdrawal fees, the reliance on bank transfers may result in additional charges from banks and slower transaction times.

Also Read: XPro Markets Review 2024 – Expert Trader Insights

EBSI Forex Review: FAQs

What is the minimum deposit required to open an account with EBSI Forex?

The minimum deposit required to open an account with EBSI Forex is $5,000 or its equivalent in another currency.

What trading platforms does EBSI Forex offer?

EBSI Forex offers two main trading platforms: MetaTrader 4 (MT4) with variable spreads and FXTrader PRO with fixed spreads.

Are there any fees for withdrawing funds from EBSI Forex?

EBSI Forex does not charge a fee for fund withdrawals, but banks may impose their own charges for processing these transactions.

OPEN AN ACCOUNT NOW WITH EBSI FOREX AND GET YOUR BONUS