E8 Funding Review

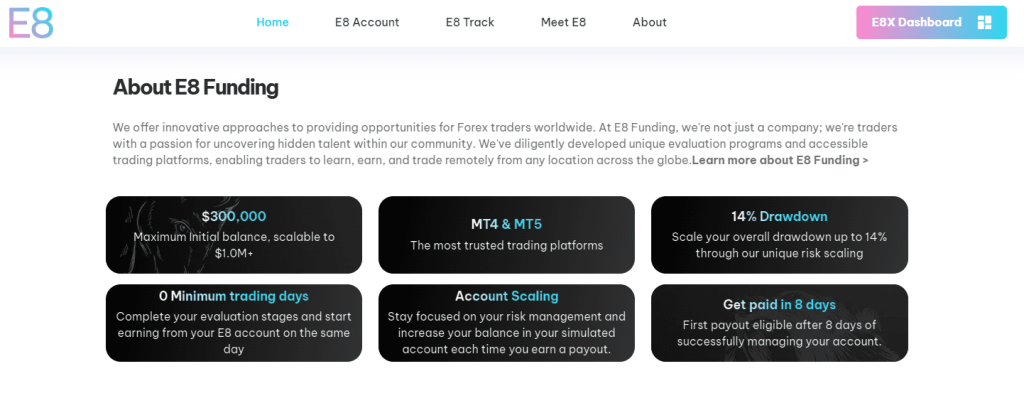

Trader capital can be managed by proprietary trading firms, also referred to as “prop firms,” instead of the traders’ own. These companies provide a number of benefits, including sophisticated trading platforms and high leverage. With an emphasis on Forex markets, E8 Funding is a recent entrant to this industry. It was established in 2021, is based in the US, and offers four different kinds of funded accounts in addition to MT4 and MT5 platforms and Expert Advisors (EAs).

I’ll examine E8 Funding as a seasoned trader with firsthand knowledge. For a complete picture, this assessment will also take into account user input. Important subjects such trading platforms, review processes, and special features will be covered. To assist you in determining whether E8 Funding is the best prop firm for you, we’ll also go through any constraints.

What is E8 Funding?

E8 Funding is a US-based proprietary trading company that also operates in the Czech Republic. With the organization, most regional obstacles are eliminated for dealers operating worldwide. The organization is led by expert traders and investors, with headquarters located in Dallas and Prague.

The company offers accounts with maximum scaling potential of $1 million, with sizes ranging from $25,000 to $250,000. This makes E8 Funding a flexible choice for traders with varying capital needs.

Their trading platform stands out for its user-friendliness. Designed to provide traders with crucial market data, the platform is built on top-tier technology. It also includes simulated market feeds, giving traders real-time conditions to practice and refine their strategies.

Advantages and Disadvantages of Trading with E8 Funding

Benefits of Trading with E8 Funding

I have firsthand experience with E8 Funding’s generous profit-sharing arrangement. 80% of your trading profits are yours to keep, which is far more than the 40–70% industry average. This is a substantial benefit for any trader trying to optimize profits.

Together with Tier 1 liquidity, the company provides significant leverage and enhanced trading capital. Traders can enter and exit positions more easily while maximizing earnings thanks to these features.

E8 Funding offers a variety of tools and familiarity for Forex trading on the MT4 and MT5 trading platforms. Additionally, they provide a trial period so that traders can evaluate the services and platform before committing fully.

The accounts’ scalability is an additional benefit. You can increase your funded account balance to an incredible $1 million with E8 Funding. This is especially tempting to dealers who want to trade large quantities.

For the added protection of new traders, the company offers a refund policy for evaluation expenses. Additionally, normal accounts do not require a minimum number of trading days, providing more flexibility.

E8 Funding Pros and Cons

Pros

- Keep 80% of Profits

- High Trading Capital

- $1 Million Account Cap

- Strong Leverage and Liquidity

- Automated Payouts

- Trial Period Available

- No Minimum Trading Days

- Refundable Evaluation Fees

- Efficient Dashboard

Cons

- 14-Day Withdrawal Limit

- Email-Only Tech Support

- Upfront Audition Fees

- Limited Support Hours

Difficulties Met by the Traders Who Participated in the Brokers Challenge

Stringent Profit Targets

One of the most common difficulties faced by traders in brokers challenges is meeting stringent profit targets. Often, traders must achieve a certain percentage of gains within a specified time frame. Failing to meet these goals usually results in disqualification or loss of initial fees.

How to Overcome the Difficulty

The key to overcoming this challenge is preparation. Studying market trends, backtesting strategies, and using risk management tools can give traders a better chance of hitting the required profit targets. Discipline in following a trading plan is essential.

Limited Time Frame

Another obstacle is the limited time frame. Traders may have only 30 or 60 days to prove their trading skills. This often results in rushed decisions and compromises the quality of trading strategies, increasing the risk of failure.

How to Overcome the Difficulty

Having a pre-planned approach is the best way to handle the time constraint. Rather than attempting to trade every move in the market, concentrate on high-probability deals. Having a well-thought-out plan can also reduce the temptation to overtrade, which often happens under time pressure.

Upfront Fees

Upfront fees can be a significant hurdle, especially for novice traders. These fees serve as an entry ticket to the challenge but may vary greatly depending on the brokerage. The pressure to recover these fees while also hitting profit targets can be stressful.

How to Overcome the Difficulty

Budgeting for upfront fees as an investment is crucial. Some brokerages refund these fees for traders who successfully complete the challenge. Knowing this can relieve some of the stress associated with the initial investment. Moreover, preparation and a well-planned strategy can increase the chances of success, making the upfront fees a worthwhile investment.

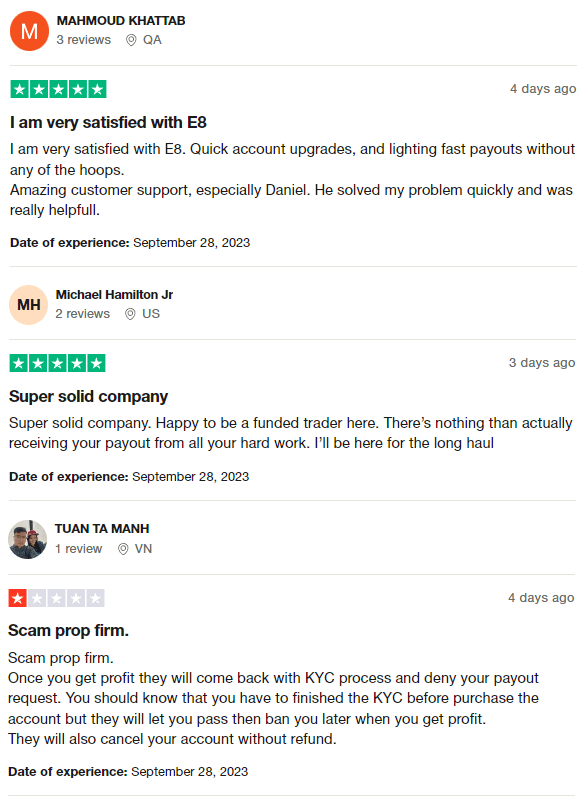

E8 Funding Customer Reviews

E8 Funding has received mixed but largely positive customer reviews, boasting a 4.7-star rating on Trustpilot. Many traders commend the company for its quick account upgrades and fast payout process. Customer support, particularly representatives like Daniel, is often highlighted for efficiency and helpfulness.

However, there are some negative reviews that claim issues with the Know Your Customer (KYC) process and profit withdrawals. These reviews allege that E8 Funding denies payouts and cancels accounts without refunds after traders have made profits. Overall, while the majority of the feedback is positive, potential users should be aware of these isolated claims and exercise due diligence.

E8 Funding Fees and Commissions

In the world of proprietary trading, E8 Funding stands out for its low-cost structure. Unlike many prop firms that partner with brokers, E8 Funding works directly with first-level providers. This setup allows traders like me to benefit from the lowest spreads and trading fees possible. When it comes to costs, the company is pretty straightforward.

They charge an initial fee that can range from $138 to $988, depending on the account type and balance. There are no other hidden charges or monthly fees to worry about. Another important thing to note is that E8 Funding takes a 20% cut from net profits, which is pretty standard in the prop trading industry.

Account Types

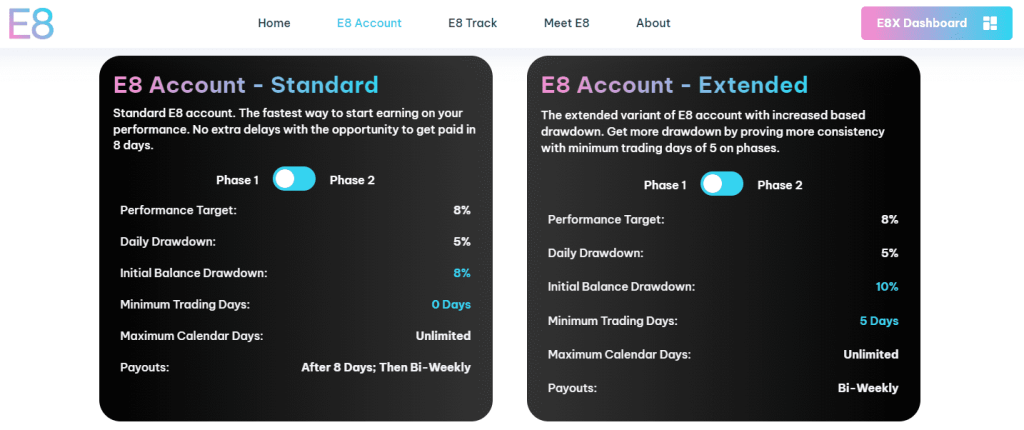

Based on my own testing, E8 Funding offers two primary account types designed to suit different trading needs. Each account type is divided into two phases with distinct trading conditions.

E8 Account – Standard

- Performance Target: 8% (Phase 1), 5% (Phase 2)

- Daily Drawdown: 5%

- Initial Balance Drawdown: 8%

- Minimum Trading Days: 0

- Maximum Calendar Days: Unlimited

- Payouts: After 8 days, then bi-weekly

E8 Account – Extended

- Performance Target: 8% (Phase 1), 5% (Phase 2)

- Daily Drawdown: 5%

- Initial Balance Drawdown: 10%

- Minimum Trading Days: 5

- Maximum Calendar Days: Unlimited

- Payouts: Bi-weekly

The Standard Account is more flexible, allowing traders to start earning without any minimum trading days. The Extended Account, on the other hand, requires a minimum of 5 trading days but offers an increased initial balance drawdown, which can be beneficial for certain trading strategies. Both accounts offer payouts after 8 days, then switch to a bi-weekly schedule.

How to Open Your Account

- Visit the official website of the prop firm.

- Click on E8X Dashboard at the top right corner or Get Funded in the center of the page.

- For E8X Dashboard, click Sign up. If Get Funded, directly fill in your details like first and last names, country, phone number, and email.

- Create a password, agree to the terms of service, and click Sign up.

- Open your email and click the confirmation link you receive.

- Once confirmed, go to E8 Dashboard Review.

- In the dashboard, click your name, then Profile, and then Verification. Upload an identity document.

- Return to the home screen, choose an account type and balance, input initial fee payment details, and await payment confirmation before you can start trading.

E8 Funding Customer Support

In my experience, E8 Funding takes customer support seriously, but there’s room for improvement. The firm offers a few avenues for traders to get their questions answered: an FAQ section, email support, and live chat.

However, the live chat isn’t always available, and there’s no call center for immediate voice support. You can send an email or use the chat feature both on the website and within your user account. This approach helps, but it’s essential to note that responses might not be instantaneous.

Advantages and Disadvantages of E8 Funding Customer Support

Contact Table

Security for Investors

Withdrawal Options and Fees

According to my observations, funded traders have flexible withdrawal choices with E8 Funding. The eighth day of trading is when you can begin taking money out of your account, which is rather handy. In order to request another withdrawal, you must wait at least two weeks after your previous one due to the company’s 14-day withdrawal policy.

Several withdrawal options are supported by E8 Funding, including bank cards, bank transfers, and electronic wallets. This facilitates dealers’ access to their profits. With no upper or lower bound on the amount they can withdraw, traders are free to manage their money however they see fit.

Although there are no fees associated with withdrawals from E8 Funding, it’s vital to keep in mind that there may be fees from other parties. Always be on the lookout for any potential fees from your bank or virtual wallet provider.

What Makes E8 Funding Different from Other Prop Firms

The generous profit-sharing model of E8 Funding is a significant distinction. While many prop businesses share profits between 40 and 70 percent, E8 Funding goes above and above by allowing traders to keep as much as 80 percent of their earnings. This is a powerful motivator for traders who want to increase their profits.

The automated payout mechanism and quick account processing are two other noteworthy features. Withdrawals from many prop firms are processed slowly, but with E8 Funding, traders can begin taking money out as early as the eighth trading day. This makes the firm more appealing by enabling you to access your money quickly.

Additionally, to meet the demands and objectives of traders, E8 Funding provides a variety of account kinds with varying criteria. Regardless of your level of experience, there is an account type that will work for your trading preferences. It differs from other businesses that provide more inflexible account structures because of this flexibility.

Last but not least, E8 Funding stands out because of its support for MetaTrader 4 and 5, two of the most well-liked and feature-rich trading platforms available on the market. Because of the many services these platforms provide, many people view this as a positive, even though it may be a drawback for those used to other platforms.

How Can Asia Forex Mentor Help You Pass E8 Funding’s Evaluation?

Since founding Asia Forex Mentor in 2008, I’ve been committed to creating a community where traders can learn and excel. What began as a small group of friends interested in forex trading has expanded to include professionals from trading firms and banks, all seeking to enhance their skills. The cornerstone of what we offer at Asia Forex Mentor is the AFM Proprietary One Core Program. This all-inclusive course covers everything from building a reliable trading system to mastering market analysis and account management.

The One Core Program is my attempt to create a comprehensive forex trading masterclass. It features 26 full lessons and over 60 subtopics, each supported by high-quality online videos. To simplify complex trading concepts, I’ve integrated hand-picked examples and straightforward explanations into every lesson.

So, how can this program help you pass E8 Funding’s evaluation? Simple. The One Core Program provides the in-depth knowledge you need to meet and surpass any prop firm’s evaluation criteria. If you’re aiming to excel at E8 Funding, the skills and techniques you’ll gain from the One Core Program can be your ticket to success. It’s a low-risk, beginner-friendly course designed to equip you for trading proficiency.

Our Journey at Asia Forex Mentor

Here at Asia Forex Mentor, I’ve been honored to guide a diverse range of traders, from complete beginners to professionals in institutional settings. Many of my students have transitioned from being novices to becoming full-time traders or even fund managers. The One Core Program encapsulates the best of my trading wisdom, offering a well-rounded approach that covers everything from backtesting strategies to trading psychology.

I cover important topics in the One Core Program that are usually skipped over in other courses. I discuss the value of keeping a trading journal and offer insights into the processes involved in being a successful FX trader. The application also delves further into the idea of free trading, presents novel tactics like the “set-and-forget” approach, and provides a special auto stop-loss tool. I also explain the subtle differences between various stop-loss levels so you can trade more profitably.

If you’re prepared to begin this life-changing program, you can sign up for a free seven-day trial here. There is a $997 one-time cost for the entire curriculum. However, I offer a direct pricing of $940, skipping the trial period, for those who are already committed and want to get straight into the learning. By doing this, you can improve your trading abilities and become a part of our expanding network of prosperous traders.

Conclusion: E8 Funding Review

To sum up, a lot of traders consider E8 Funding to be a dependable and effective platform. They frequently receive positive feedback for their prompt payouts and customer service, as shown by their 4.7-star rating on Trustpilot. They therefore present a compelling choice for anyone wishing to enter the proprietary trading market.

But it’s critical to understand the constraints. Some traders have brought attention to concerning withdrawal issues as well as a less-than-transparent KYC procedure. Furthermore, they do not offer license or regulation data, which may worry certain traders.

In addition, E8 Funding provides a range of account types and trading circumstances. These choices are appropriate for both novice and seasoned traders. Low fees and commissions are another noteworthy benefit that traders value greatly from them.

Even with these advantages, doing your research is always a good idea. It’s important to be aware of the platform’s benefits and drawbacks as not everyone will find it suitable. Before committing, be sure to carefully read their terms and conditions and perhaps speak with a trading expert.

Also Read: FTMO Review 2024

E8 Funding Review FAQs

Are there any withdrawal fees?

No, E8 Funding does not charge withdrawal fees, although other transaction fees may apply.

Is customer support available 24/7?

No, customer support is limited to business hours and is not available around the clock.

Is E8 Funding regulated?

No, they don’t provide license or regulation data.