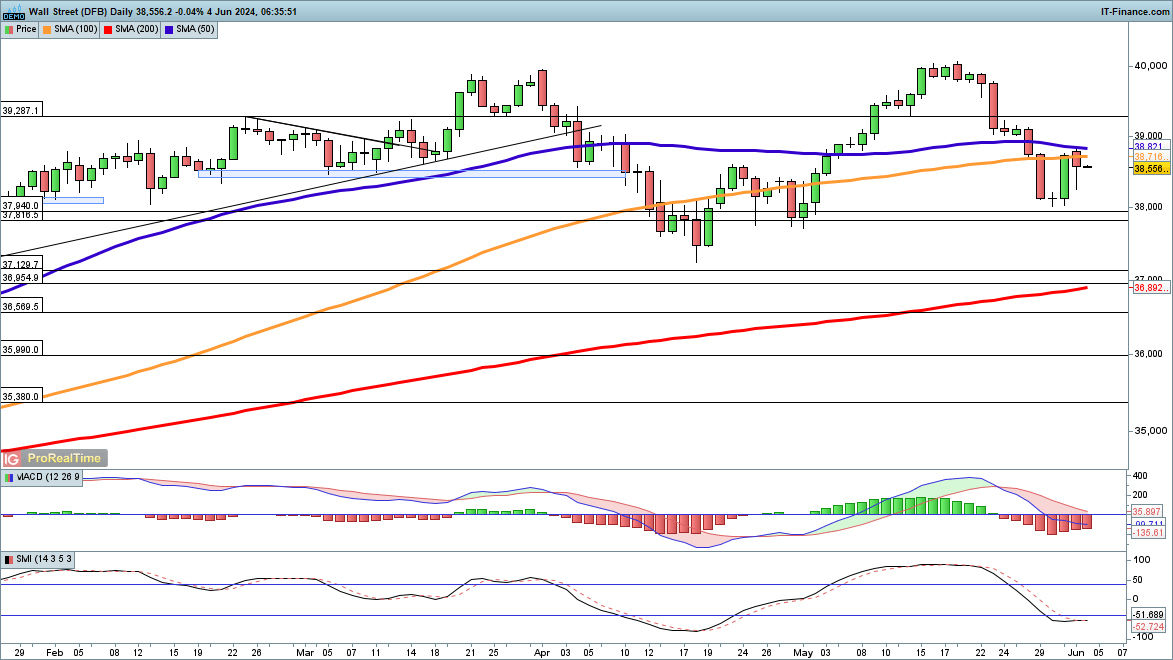

Dow Drifts Lower

The index rebounded sharply on Friday but suffered a wobble on Monday, finishing well off the lows. The situation remains finely poised; sellers might drive the price back to, and then below, 38,000, reinforcing the short-term bearish view.

Should the price close above the 50-day simple moving average (SMA), which held back gains yesterday, a new move higher toward 40,000 may begin.

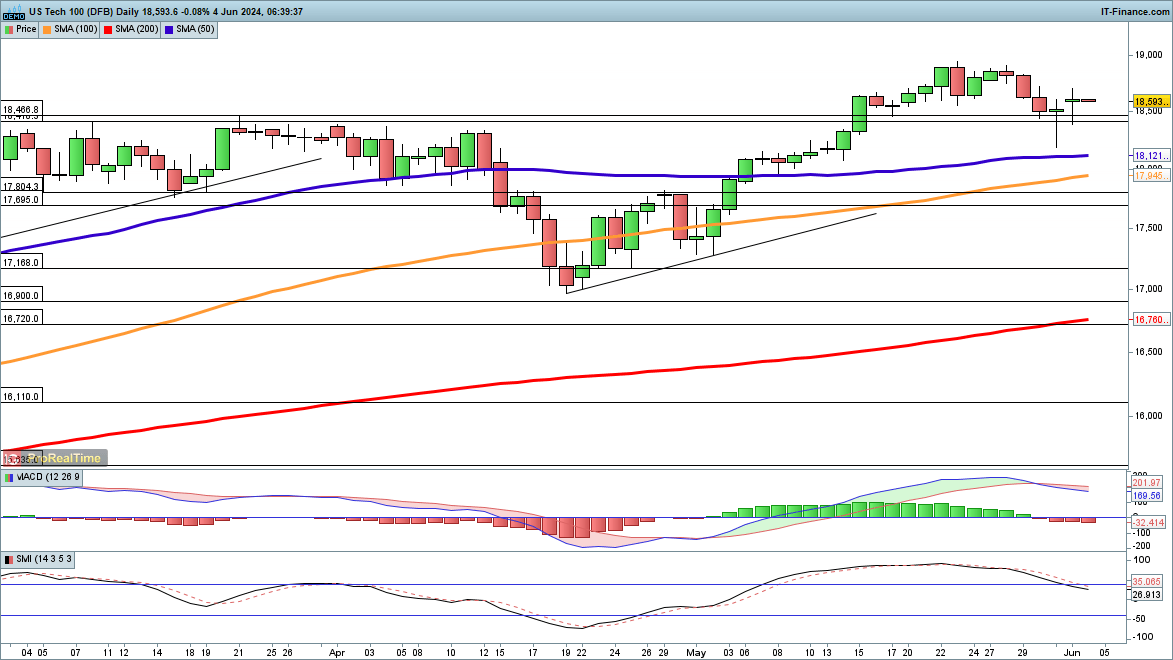

Nasdaq 100 Firmly Off Recent Lows

Both Friday and Monday saw the price rally off the lows, helping to sustain the bullish view. A reversal back below the March highs would be needed to put a dent in this view. However, the longer-term bullish outlook remains in place.

Additional gains would target the recent record highs around 18,900, with 19,000 lying just beyond it.

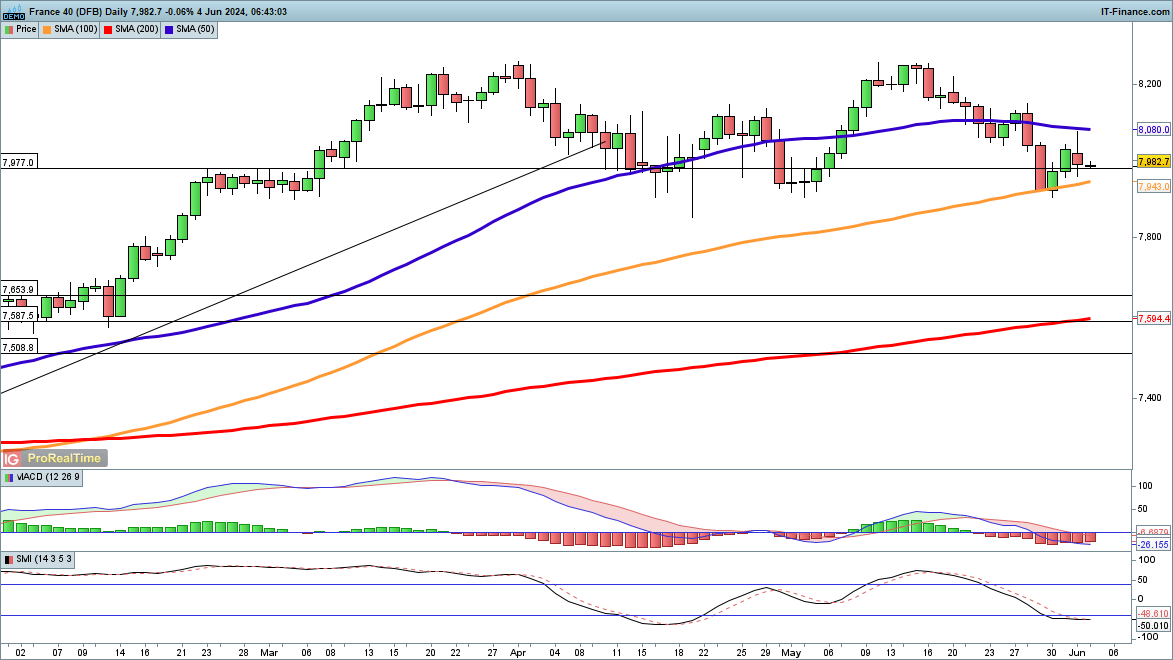

CAC 40 Rally Fizzles Out

Hopes of a sustained rebound were dashed on Monday, as the price rallied towards and then fell back from the 50-day SMA.

The price finds itself back below 8,000, and the lows of April and May around 7,900 are close by. A close below 7,850 would suggest a much deeper pullback could be in play, perhaps targeting the 200-day SMA, last tested back in January.