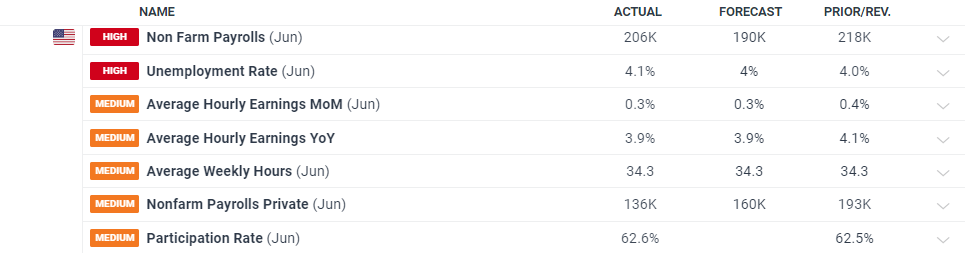

The June US Jobs Report (NFP) revealed the creation of 206k new jobs, surpassing the forecast of 190k. However, last month’s figure was revised down from 272k to 218k, a notable adjustment of 54k. The unemployment rate increased slightly to 4.1%, compared to the previous and expected rate of 4%. Average hourly earnings aligned with forecasts, showing a 3.9% y/y and 0.3% m/m increase.

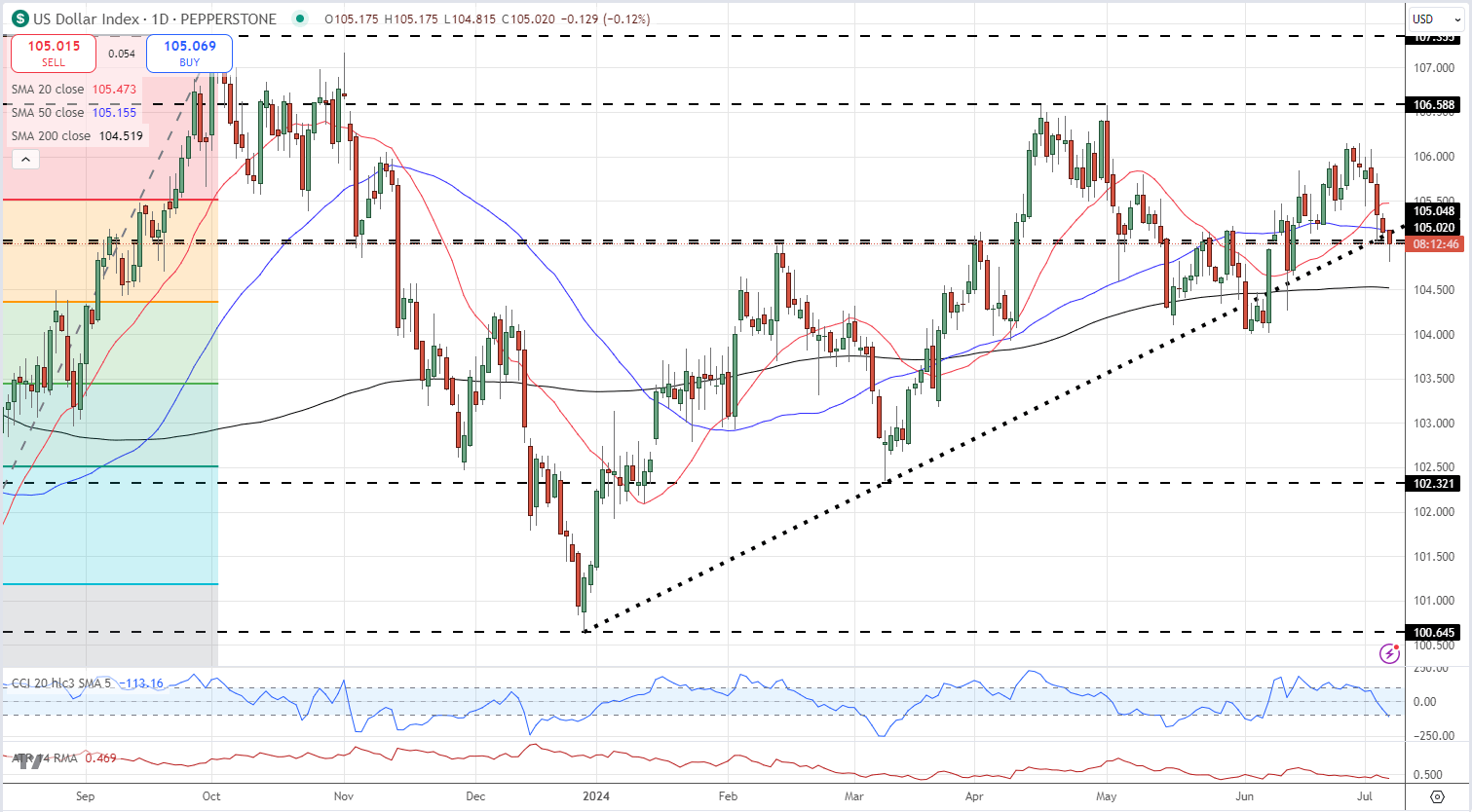

The US dollar remained largely unchanged following the report, with the dollar index (DXY) hovering around 105. US interest rate expectations increased by 4 basis points and are now fully accounting for two 25 basis point rate cuts this year.

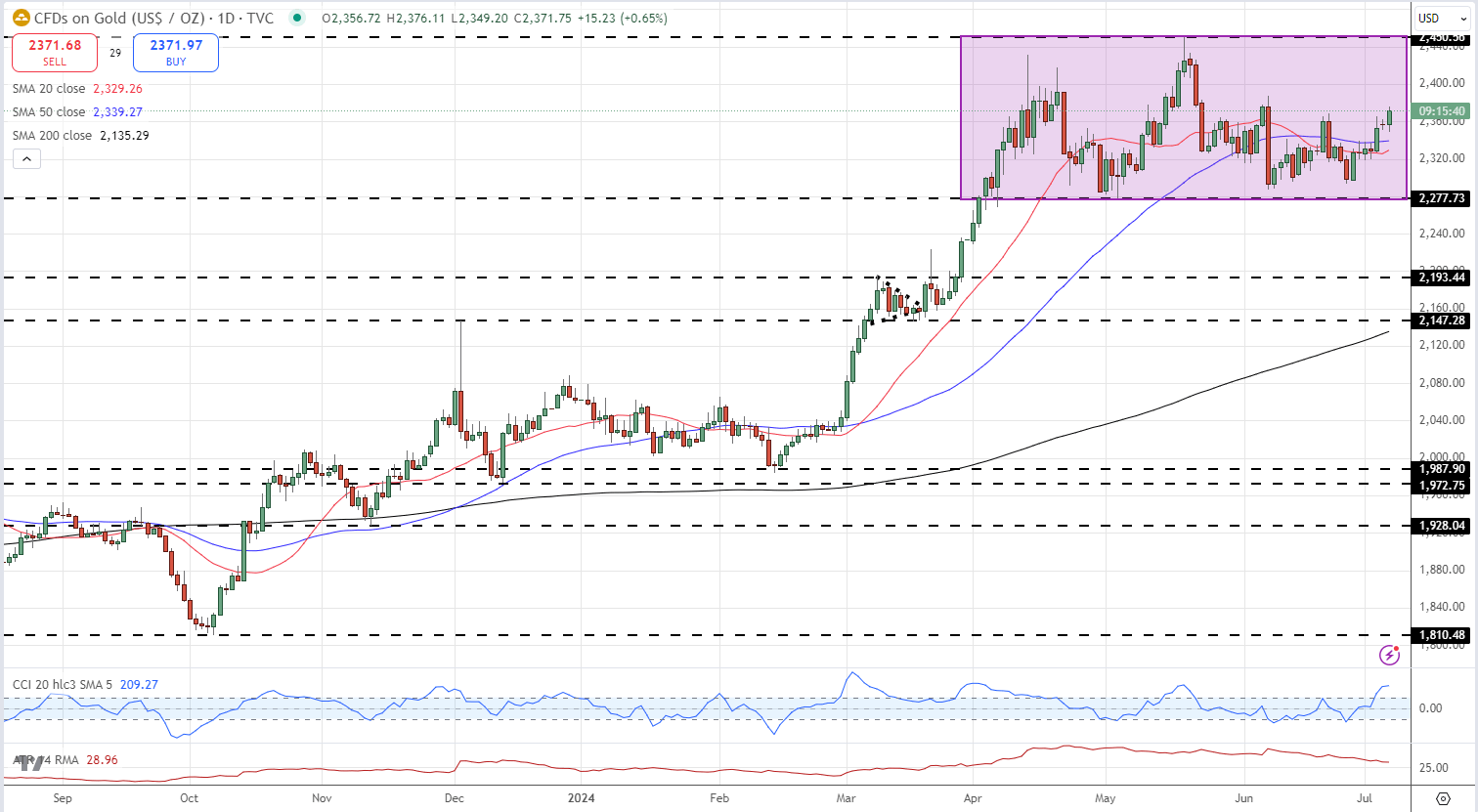

Gold continues to trade within a multi-month range and is currently testing levels last seen in early June.