Hey, traders! Ezekiel here with your market updates and some extra tips to elevate your trading skills. Here’s the scoop:

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• The dollar dips but stays strong near a two-year high

• Markets spiral despite rate cuts already being priced in

• Boost your strategy with the Bellow Stomach Pattern explained

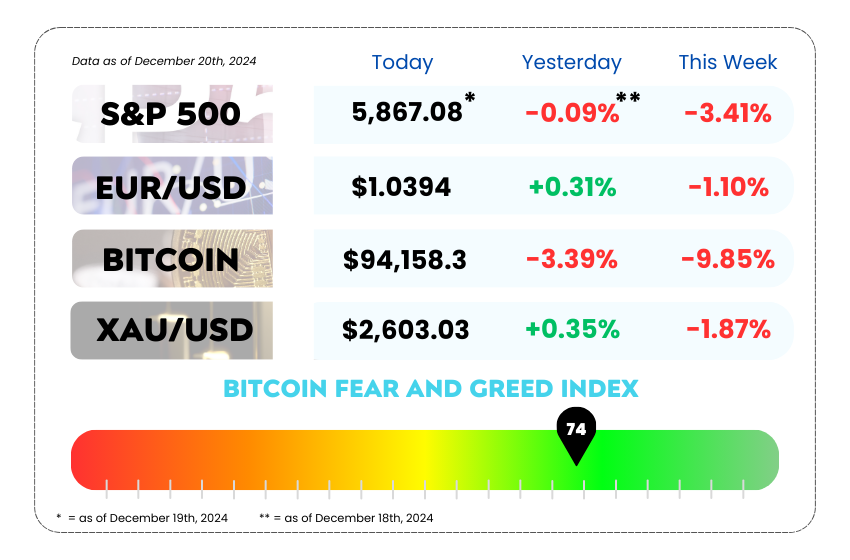

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚗 Dollar Stays in the Driver’s Seat, While Sterling Hits the Skids 📉

The dollar took a little breather Friday, slipping 0.2% after flexing its muscles to hit a two-year high earlier in the day. It’s been a solid three-week rally for the greenback, but now the markets are chewing over global central bank moves and the looming drama of a potential U.S. government shutdown. 🍿

Dollar Moves 💵

• Dollar Index: Down 0.2% at 108.2 but earlier hit a peak of 108.54, the highest in two years. 📈

• The rally’s ripple effects:

• South Korean won? Sinking to a 15-year low. 😬

• Canadian dollar? Weakest in 4+ years. 🥶

• Aussie and Kiwi dollars? Languishing at two-year lows. 🐨🦜

US Dollar Index Daily Chart as of December 20th, 2024 (Source: TradingView)

Euro’s Rollercoaster 🇪🇺

The euro stumbled to $1.03435, a one-month low, after comments from U.S. officials that the EU needs to buy more U.S. oil and gas to balance its trade deficit—or face tariffs. But the single currency didn’t stay down for long, bouncing back to $1.038, up 0.16% by the day’s end.

Analysts are already bracing for tensions ahead. Michael Brown from Pepperstone quipped, “This feels like trade war 2.0 between the U.S. and Europe.” 🔥

Shutdown Showdown 👀

The U.S. government might close its doors tonight at midnight if lawmakers don’t pass a funding bill. (Spoiler: They didn’t. 🤦)

• What’s at stake?

• Border enforcement, national parks, and paychecks for 2M+ federal workers. ✋

• Economic impact? A 0.15% GDP dip for each week the government is shut, says Goldman Sachs. But hey, growth bounces back when it’s resolved. 🤷

Yen Gets Wobbly 🌊

• Fell to a five-month low of 157.93 per dollar before clawing back to 156.66. 🐉

• Japanese officials aren’t thrilled, saying they’re “ready to intervene” if forex moves get too wild. 🥋

• The Bank of Japan is playing it cool, keeping rates steady while hinting that any hikes are a “maybe someday” scenario.

Sterling Stuck 🇬🇧

Dropped to $1.2475 (a one-month low) but later bounced back to $1.2499. Not much to celebrate here. 🤐

The Bank of England is split on what to do next, voting 6-3 to hold rates steady. Inflation’s still a problem, but the economy is slowing. Pick your poison, right? 🍵

The dollar’s resilience is underpinned by expectations of prolonged higher U.S. interest rates. Markets are pricing in fewer rate cuts for 2025, giving the greenback an edge over its peers.

The core PCE price index, a key U.S. inflation measure, could provide critical clues about the Fed’s future rate moves. Keep an eye on Japan’s potential intervention in the forex market, any action could shake up the yen’s trajectory. 🚀

📊Fed Cuts Rates, Markets Crash: Is 2025 the New 1974? 😬

The Fed just cut rates by a quarter point, and while that move was widely expected, the markets reacted like Powell showed up to the presser in his tie…and nothing else. 🤯

The Dow extended its losing streak to 10 sessions, marking its longest slump since 1974, and the S&P 500 tumbled nearly 3%, its worst day in four months. 📉

Here’s the kicker: the Fed’s “dot plot” showed two rate cuts on deck for next year, aligning with market expectations.

So why the meltdown?

Powell called the economy strong and dropped “uncertain” 17 times like it was his new favorite buzzword, citing the unclear fiscal policies of the incoming Trump administration.

When Markets Overreact

The market’s response? A classic case of “If You Give a Mouse a Cookie.” 🐭 Peter Boockvar from Bleakley Financial nailed it: “The Fed gives the market guidance, and the market runs wild with it.”

Basically, Wall Street priced in a couple of rate cuts ages ago, but now they’re acting like it’s breaking news.

Piper Sandler’s Michael Kantrowitz added: “Markets are funny—they price things in slowly, then overreact when it’s official.” And boy, did they overreact. 😬

“Higher for Longer” Woes

The “higher for longer” mantra (for both interest rates and inflation) has been around for months, but this time, it hit different. Powell warned we’re essentially “walking into a dark room full of furniture”—AKA, prepare for some bumps, especially with fiscal policies still up in the air.

As if the uncertainty wasn’t enough, Elon Musk and Trump stirred the pot further, rallying against a government funding bill in real time during Powell’s presser. This showdown could lead to a government shutdown, leaving thousands without paychecks just before Christmas. 🎄

Rate cuts are expected, but market uncertainty is fueling volatility and trading opportunities. The U.S. dollar might weaken if doubts over rate cuts grow—or strengthen if fiscal uncertainty rises.

Key catalysts like a potential government shutdown or Trump’s fiscal policies could shake markets further. 2025 will be a wild ride, so stay nimble and ready to seize opportunities. 🚀

MEMES OF THE DAY

Mastered? More like mastered the art of doing the exact opposite! 🤦♂️

Why learn charts when a meme can predict the market? 🤡📊