Dollar Cost Averaging Benefits

There are a couple of ways to reduce your investment risk as an investor. One of them is to use a dollar-cost averaging strategy. However, this means that you have to give up on some lucky returns on your investments. So, what is the Dollar Cost Average definition and what will dollar cost averaging benefits should you consider?

Content

- Dollar Cost Averaging Example and Definition

- Dollar Cost Averaging Benefits

- Disadvantages of Dollar Cost Averaging

- Dollar Cost Averaging – Formula to Success

Dollar Cost Averaging Example and Definition

Let us start with the basics. The strategy is simple. You just invest a certain amount of money into an asset over a period of time. You might want to buy Apple stocks but do not want to risk all your life-saving in one go. Comparing dollar-cost averaging vs lump sum, the latter involves putting all your money in one go. Dollar-cost averaging has a different approach.

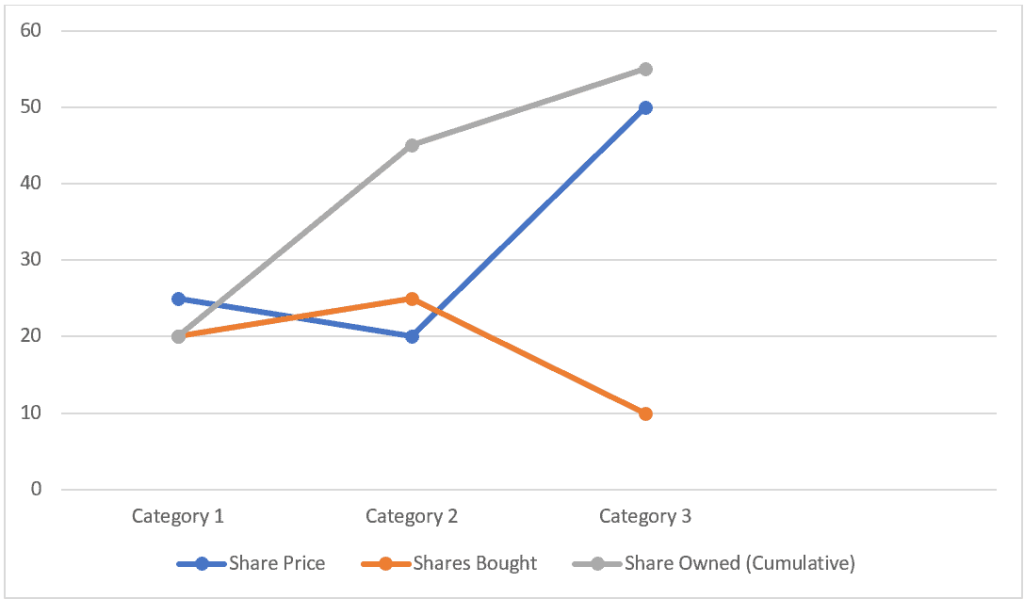

Instead, you just put in a small amount every month. Suppose that you set aside $500 every month. So, if the stock is at $25, you buy 20 shares. If the price falls to $20 a share next month, you buy 25 additional shares. By then, you hold 45 shares. If the price goes up to $50 a share, you would have 55 shares after acquiring another 10 shares this month.

This is basically your 401k plan. If you invest a little bit of your cash into your portfolio every month, the number adds up quickly. It might not seem like much to set aside some loose change every month, but you would be surprised how much money you would have upon retirement. Of course, this strategy requires a long-term commitment.

This is perhaps the safest investment option for many people not because of its immediate and massive profits. Rather, it is a way to create good habits where you learn how to save cash where you can and put it into something more worthwhile. By the time you retire, you would have plenty of cash going forward.

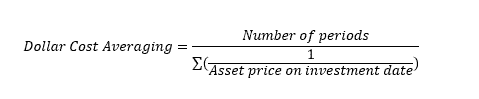

If you want to know how much money you will get from this strategy, you can use a dollar cost averaging calculator. There are plenty of those out there that can give you an idea of how much your saving can amount up to in the next few decades. If you are curious, the dollar cost averaging formula is:

Keep in mind that this strategy is an extremely long-term investment intended to secure your retirement on the finance frontier. In other words, it is not an investment that will yield high returns in a short period of time. The idea is to simply establish a good habit of saving so that you would be aware of your financial health.

Before you jump in, though. It is worth knowing what an average strategy may look like. You would need to do three main things.

First, you decide how much money you want to put in each month. This amount can be flexible as your income increases when you advance in your career. Just make sure that the amount is financially prudent and affordable so you can consistently invest every interval.

From there, you go for an investment or group of investments that you want to commit to long-term. This can be ten years or longer. This is important because if you invest in a failing company, your savings would go down the drain.

Also read: How to start forex trading

Next, you just sit back and invest a certain amount at regular intervals. People usually do it monthly, but you can do it weekly or quarterly. Some brokers even have a plan to do it automatically for you.

There are drawbacks and benefits to this strategy that you need to consider before you put your feet down and go ahead with this.

Dollar Cost Averaging Benefits

The biggest advantage of this strategy is that there is little to no emotional component in this strategy. You just invest a certain amount of money into a certain asset at a certain time. How many stocks or units of asset you get is determined by the price at the time of purchase. Nothing more, nothing less. This pretty much eliminates the emotion component since you just buy as much stock or asset as you can with the money you set aside for the purpose.

It does not matter how wild the price is right now. Of course, during such a price dip, investors may be tempted to bail out and cut their losses. But if you choose the right asset, this is an opportunity to get more assets at a low cost. You don’t have to worry too much about the stock price dipping because that just means you can buy more, which would benefit you in the future.

Another benefit lies in the timing. If you pour all your cash in at once, you run the risk of losing all your investment when there is a market downturn. If you space out your investment intervals, at least some of your money would be protected.

That being said, it is nigh impossible to tell whether a market is going to bottom out. So, while dollar-cost averaging can protect you from this event, it is just as likely that all of it would go down the drain in the future. Even so, you can still do something with the money you currently have. This also means that you must diversify your portfolio. Putting all of your investment into a single asset or stock is just asking for trouble.

Also read: Forex vs stocks

Disadvantages of Dollar Cost Averaging

One of the biggest drawbacks to this strategy is that it really is not a good investment strategy. To be fair, it is a very passive investment strategy for those who want to save up for their retirement. In that aspect, dollar-cost averaging is effective. For a venture investor who wants to make a lot more money in a short period of time, this strategy just won’t cut it. In other words, you should not consider this to be a substitute for identifying good investments.

Another problem is that this passive investment strategy would only work if you put your money into the right stocks or assets. That could be index funds because dollar-cost averaging stocks is basically 401k. But if you want to take matters into your own hands, you still need to do your own research and determine which asset is worth investing in long-term. If it turns out to be a bad option, you would be putting your money into a failing investment. For instance, dollar cost averaging Bitcoin is probably not a good idea since it is an unstable asset.

Being passive also comes with another cost. Since you just put your money in at certain intervals and forget about it, you cannot respond to the change in the market. If you keep track of the news, you might see something that makes you reconsider your investment approach.

For instance, if you know that Apple would acquire Google in the near future, that means Apple’s stock price would soar to levels never seen before. Before that happen, you can try to buy up as many Apple stocks as you can before that price surge. Unfortunately, a dollar-cost averaging approach does not give you the room to change course.

Also read: Forex trading for dummies

Dollar Cost Averaging – Formula to Success

After explaining Dollar Cost Averaging definition and its benefits, at the end of the day, dollar-cost averaging is a viable strategy. That is, assuming that you are a novice trader who just wants to have a simple investment path that is relatively risk-free and resistant to market swings.

However, if you are an experienced trader, comparing dollar-cost averaging vs timing the market, the latter is better. You can get more money by actively participating in the market equipped with a more sophisticated strategy. But if you are new and want to try your hands at the investment game, consider enrolling in our One Core program here at AsiaForexMentor.

At AFM, we have trained many traders who consider us to be their last stop before they start to make some serious profits. They walk away from our course with an effective trading system that works regardless of the market, be it stock, forex, cryptocurrency, commodity, option, so long as it has a chart.

While we cannot promise millions of dollars overnight, what we are certain is that our system is ROI-driven. After all, so long as you are making returns, be it big or small, you are winning, and that is what we strive for. This is why our trading system is so effective and loved by all.

If you don’t want to enroll in our One Core program, that is fine. Consider checking out our five-part trading system course, which you can get for free and it will surely help you in your trading career. What you will get there is a sample of what we have to offer in our mentorship program. You do not have to chase after the dollar cost averaging benefits when you can make a lot more money using our trading system.