Dizicx Review

Forex brokers play a pivotal role in the trading world, serving as intermediaries between retail traders and the foreign exchange market. They offer platforms where traders can buy and sell foreign currencies, making the selection of the right Forex broker a critical decision for any trader. Dizicx stands out in the crowded Forex broker landscape by offering a comprehensive suite of services tailored to meet the diverse needs of its clients. Since 2016, Dizicx has facilitated currency pairs and CFD trading, distinguishing itself with a broad spectrum of assets and customizable account types.

In this detailed review, I aim to delve deep into what makes Dizicx a noteworthy contender in the Forex brokerage industry. From examining its varied account options to exploring the efficiency of its deposit and withdrawal processes, and dissecting its commission structures, we will provide a comprehensive analysis. This review combines expert insights with actual trader experiences to present a well-rounded view of Dizicx, offering you the vital information needed to consider whether Dizicx is the right brokerage service provider for your trading endeavors.

What is Dizicx?

Dizicx is a global Forex and CFD broker that has been facilitating traders since 2016. It specializes in currency pairs and CFD trading, catering to a broad audience with its diverse range of assets. This broker stands out by offering multiple account types, enabling clients to tailor their trading experience to their specific needs and goals. Dizicx prides itself on its flexibility and its ability to provide suitable pricing structures and partnership models for its varied clientele.

Operating on an international scale, Dizicx delivers its services to traders around the world. It distinguishes itself with nine commission-free deposit funding methods, appealing to traders who value convenience and cost-efficiency. Furthermore, the broker offers accounts with spreads starting from 0 pips, alongside investment solutions and a variety of trading calculators. These features are designed to support traders in making informed decisions, enhancing their trading strategies, and optimizing their investment outcomes.

Benefits of Trading with Dizicx

After trading with Dizicx, I’ve observed several benefits that enhance the trading experience. One significant advantage is the access to MetaTrader 5 (MT5), a powerful trading platform that offers advanced analytical tools and automated trading capabilities. This platform has enabled me to execute complex trading strategies with efficiency and precision, providing a robust environment for both novice and experienced traders.

Another notable benefit is the variety of trading instruments available, including Forex, CFDs on indices, cryptocurrencies, stocks, and commodities like gold, silver, gas, and oil. This diversity allows me to diversify my portfolio and take advantage of multiple market opportunities from a single platform. The option to trade in major cryptocurrencies further adds to its appeal, offering the chance to engage with the dynamic crypto market.

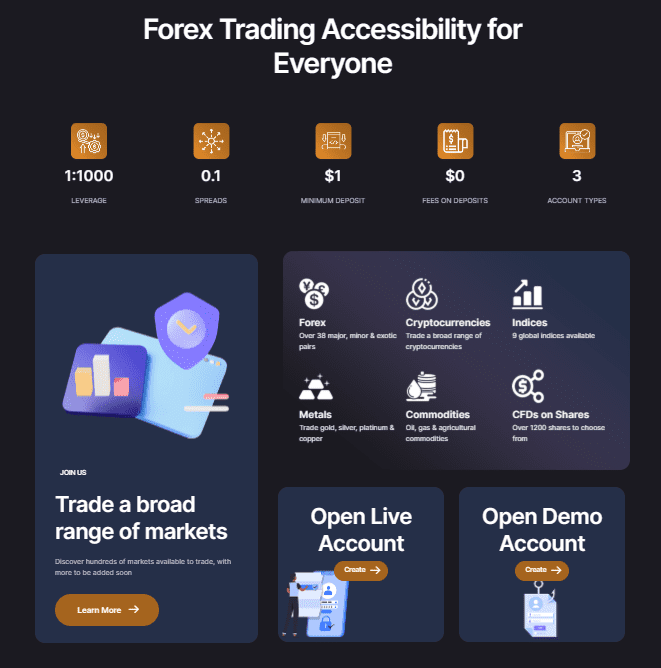

Moreover, Dizicx’s flexible account types and competitive trading conditions have been advantageous. With spreads starting from as low as 0.1 pips for the Pro account and the availability of leverage up to 1:1000, I’ve been able to tailor my trading approach to match my risk tolerance and trading style. The tiered account system, including the low minimum deposit requirement for the Standard Cent account, makes it accessible for traders at different levels of investment.

Dizicx Regulation and Safety

Understanding the regulation and safety measures of a Forex broker like Dizicx is crucial before you decide to trade with them. Dizicx Ltd, the legal entity behind Dizicx, is registered in Mauritius with the registration number 188402, operating according to the laws of this jurisdiction. This information is pivotal as it gives traders a baseline of the broker’s legal standing and operational framework. However, it’s important to note that Dizicx is currently not affiliated with any compensation funds. This lack of membership might be seen as a drawback because it means clients’ deposits do not have additional protection mechanisms in place.

The broker’s offering of trading with leverage up to 1:1000 presents a high-risk, high-reward opportunity for traders. While this can amplify gains, it also increases the risk of losses, underscoring the importance of understanding leverage before engaging in trading. Moreover, Dizicx facilitates the movement of funds through e-wallets for both deposits and withdrawals, providing a convenient option for managing financial transactions. It’s also noteworthy that negative balance protection is provided, but only for Standard and Premium accounts. This feature is essential as it prevents traders from losing more money than they have in their accounts, offering a layer of financial safety.

Dizicx Pros and Cons

Pros

- 24/7 Forex support

- Multiple execution choices

- Copy and one-click trading

- Diverse funding methods

- Swap-free, negative balance protection

- 25 liquidity providers

- PAMM for passive income

Cons

- No MetaTrader 4, not for beginners

- Unlicensed, offshore in Mauritius

- $100 minimum, no cent accounts

Dizicx Customer Reviews

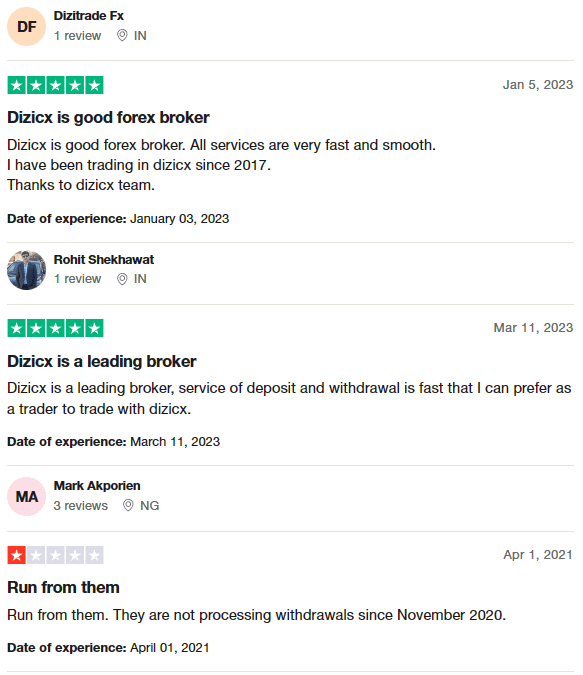

Customer reviews of Dizicx Broker offer a mixed picture of the platform’s performance and reliability. On one hand, some traders praise Dizicx for its efficient and smooth services, highlighting the fast deposit and withdrawal processes as key advantages of trading with them. These positive experiences point to a satisfaction with the Dizicx team and their ability to facilitate trading activities effectively since as early as 2017. On the other hand, there are concerns about the broker’s reliability, particularly around the issue of withdrawals not being processed since November 2020. This discrepancy in user experiences suggests potential traders should conduct thorough research and consider all aspects of Dizicx’s service before committing to trade with the broker.

Dizicx Spreads, Fees, and Commissions

When it comes to Dizicx Broker, their spreads, fees, and commissions structure is tailored to accommodate different types of traders. For those like me who prefer Standard Cent or Standard accounts, spreads begin at 1 pip, which is fairly competitive in the Forex market. These account types are particularly appealing because they come with no commission charges, making them an attractive option for traders looking to minimize costs.

For traders seeking even tighter spreads and who don’t mind paying for that advantage, the Pro account stands out. Spreads in the Pro account start from as low as 0.1 pips, offering a significant edge in trading. However, it’s important to factor in the $3 commission charged for each side of the trade when calculating overall trading costs. This fee structure is designed to cater to more experienced traders who value narrow spreads and are willing to pay a commission for it.

Account Types

When evaluating Dizicx Broker for my trading needs, I found their account types to be clearly structured, catering to various trading preferences and strategies. Here’s a straightforward rundown:

Standard Cent Account

- Base Currency Options: USC

- Minimum Deposit: $1

- Leverage: 1:1000

- Spreads: Starts from 1 pip

- Commission: No

- Trading Instruments: Forex, Metal

Standard Account

- Base Currency Options: USD

- Minimum Deposit: $25

- Leverage: 1:1000

- Spreads: Starts from 1 pip

- Commission: No

- Trading Instruments: Forex, CFD, Metal

Pro Account

- Base Currency Options: USD

- Minimum Deposit: $500

- Leverage: 1:200

- Spreads: Starts from 0.1 pips

- Commission: $3 (Both Side)

- Trading Instruments: Forex, CFD, Metal

How to Open Your Account

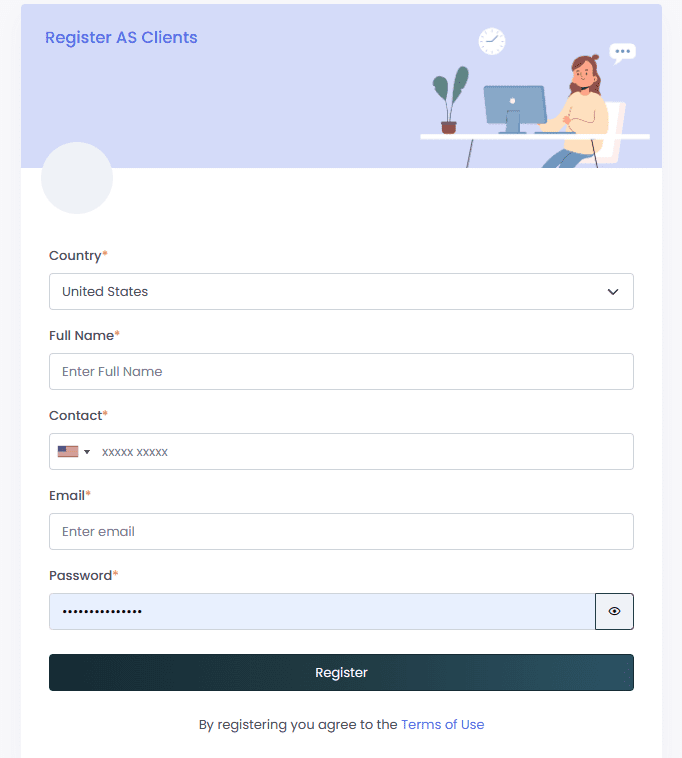

- The user starts the process by finding and clicking the “Open Live Account” button to get to the registration form.

- They need to fill in their personal information, including name, surname, phone number, and email.

- The next step requires the user to confirm their email and phone number for verification purposes.

- After verification, they must enter additional details such as residential address and date of birth.

- The user is then asked to create a password; this will be their key to accessing their account.

- With the account details set up, the next phase involves choosing the account type they wish to open, based on their trading preferences and needs.

- The user must then upload required documents for identity and residence verification.

- Finally, after submitting the application, the user waits for approval before they can start trading.

Dizicx Trading Platforms

Based on my experience with Dizicx, traders have access to MetaTrader 5 (MT5), one of the most advanced trading platforms in the market. MT5 stands out for its comprehensive analytical tools, automated trading capabilities (EAs), and advanced financial trading functions. The platform is user-friendly, catering to both new and experienced traders, and supports a wide range of financial instruments. From my perspective, MT5 provided a seamless trading experience, with real-time market access and the ability to execute complex trading strategies efficiently.

What Can You Trade on Dizicx

From my experience trading with Dizicx, the broker offers a diverse range of trading instruments that cater to various interests and strategies. Forex traders have a wide selection at their disposal, with access to 55 currency pairs, including major, minor, and exotic pairs. This variety allows for flexible trading strategies and the opportunity to capitalize on different market conditions.

In addition to Forex, Dizicx provides the option to trade CFDs on indices, cryptocurrencies, stocks, gold, silver, gas, and oil. These instruments offer traders the chance to diversify their portfolio beyond the currency market. Trading precious metals like gold and silver, along with energy commodities such as gas and oil, can serve as a hedge against inflation or market volatility. Meanwhile, the inclusion of stocks and cryptocurrencies allows traders to tap into the equity and digital currency markets, offering a comprehensive trading experience.

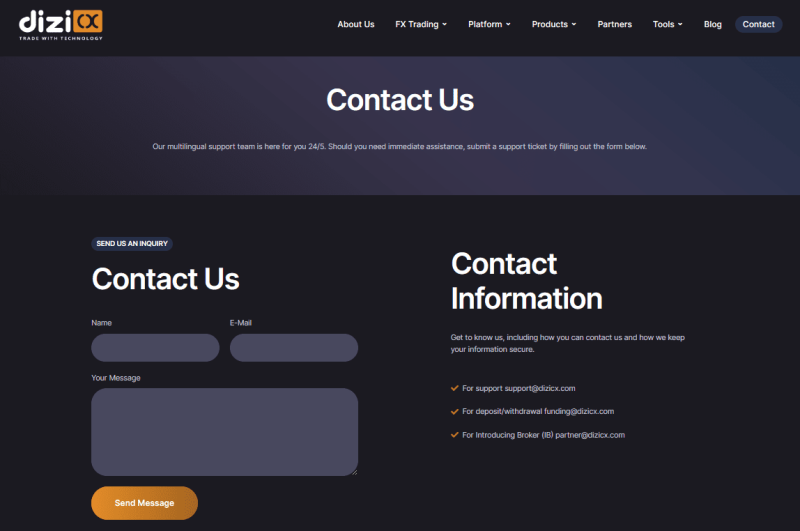

Dizicx Customer Support

Based on my personal experience, Dizicx’s customer support is accessible and user-friendly, offering several ways to get in touch. I found that using the chat feature on their website was a quick and efficient way to get answers to my questions in real-time. It’s especially helpful for immediate assistance or for clarifying smaller issues without much wait.

For more detailed inquiries or when I needed to send specific information, I opted to email the company directly. This method provided a way to communicate more complex questions or concerns and receive a comprehensive response. Additionally, the option to make a phone call allowed for direct conversation, which can be reassuring for discussing sensitive account matters or urgent issues.

As a trader with a user account on Dizicx’s official website, I also had the ability to create a ticket in the support request section. This feature is particularly useful for tracking the progress of my queries and maintaining a record of the support provided. Overall, the multiple channels of customer support offered by Dizicx contributed to a reassuring trading experience by ensuring help was always within reach.

Advantages and Disadvantages of Dizicx Customer Support

Withdrawal Options and Fees

In my experience with Dizicx, the withdrawal options and fees are straightforward but vary depending on the account type. The minimum withdrawal amount is set at $1 for Standard Cent accounts, $25 for Standard accounts, and $500 for Pro accounts. This tiered approach allows traders to choose an account that matches their trading volume and withdrawal needs.

For withdrawing funds, Dizicx offers several methods including cryptocurrency wallets in USDT and BTC, along with Skrill and Neteller. Availability may vary with location, but in some countries, options like Perfect Money and WebMoney are accessible. Particularly for residents of India, the broker facilitates withdrawals to local bank accounts, enabling them to receive funds in cash. This variety ensures that traders have flexible and convenient withdrawal options to suit their preferences.

A crucial point to note is the mandatory verification process for all Dizicx clients. This involves phone, email, and identity verifications through scanned copies of documents. It’s a critical security measure ensuring that withdrawals are safe and secure, although it might add an extra step in accessing funds. This policy aligns with the industry standards for financial security and client protection.

Dizicx Vs Other Brokers

#1. Dizicx vs AvaTrade

Dizicx and AvaTrade differ significantly in their offerings and regulatory environments. AvaTrade, established in 2006, has a robust global presence with a strong regulatory framework across multiple jurisdictions, offering over 1,250 financial instruments. Its commitment to providing a comprehensive trading experience is evident through its extensive customer base and monthly transaction volume. Dizicx, on the other hand, is known for its flexible account types and diverse trading instruments, including a significant focus on Forex and CFD trading. However, it lacks the extensive regulatory oversight that AvaTrade boasts.

Verdict: AvaTrade is better for traders looking for a broker with strong regulatory backing and a wide range of trading instruments. Its long-standing reputation and global footprint offer a sense of security and a vast array of trading opportunities that Dizicx cannot match, despite Dizicx’s competitive spreads and account options.

#2. Dizicx vs RoboForex

Dizicx and RoboForex both aim to provide traders with advanced trading conditions, but they approach this goal differently. RoboForex has been around since 2009 and offers a wide selection of over 12,000 trading options across eight asset classes, supported by various platforms including MetaTrader, cTrader, and RTrader. It is known for its innovative technologies and trading contests that cater to a broad spectrum of traders. Dizicx, while offering a comprehensive range of Forex and CFD trading options, doesn’t match the breadth of trading instruments or the platform diversity that RoboForex provides.

Verdict: RoboForex stands out as the better choice for traders seeking a vast selection of trading instruments and platform options. Its established history, diverse asset offerings, and commitment to incorporating cutting-edge technology make it a more versatile broker compared to Dizicx.

#3. Dizicx vs Exness

Comparing Dizicx with Exness reveals differences in leverage, account types, and market focus. Exness is recognized for its high monthly trading volume and offers traders extremely favorable conditions like low commissions, instant order execution, and unlimited leverage for accounts under $999. This makes it an attractive option for those looking to trade a wide range of CFDs and currency pairs, including cryptocurrencies. Dizicx, with its focus on Forex and CFD trading and flexible account options, provides a tailored trading environment but doesn’t offer the same level of leverage or the broad spectrum of instruments found at Exness.

Verdict: Exness is the superior option for traders prioritizing high leverage and a diverse array of trading instruments. Its ability to combine competitive trading conditions with a wide selection of markets makes it more appealing than Dizicx, particularly for those looking to trade in large volumes or explore various markets.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: Dizicx Review

In conclusion, Dizicx emerges as a Forex and CFD broker that caters well to traders looking for flexible account types and competitive trading conditions. Its provision of zero to low spreads, multiple withdrawal options, and a variety of trading instruments makes it a viable choice for those aiming to diversify their trading strategies. The access to MetaTrader 5 further enhances the trading experience by offering advanced tools and features necessary for modern trading.

However, potential users should approach with caution due to Dizicx’s lack of regulatory oversight and the reported challenges with withdrawal processes. These cons highlight the importance of conducting thorough due diligence and considering the risk factors associated with trading through a broker registered offshore in Mauritius. The mixed customer reviews — ranging from satisfaction with the platform’s features to concerns over withdrawal issues — underline the necessity of weighing the pros and cons based on individual trading needs and risk tolerance.

Also Read: Valutrades Review 2024 – Expert Trader Insights

Dizicx Review: FAQs

What trading platforms does Dizicx offer?

Dizicx provides traders with access to MetaTrader 5 (MT5), a platform known for its advanced trading tools, comprehensive market analytics, and automated trading capabilities.

Can I trade cryptocurrencies with Dizicx?

Yes, Dizicx allows trading in cryptocurrencies among its range of trading instruments, including CFDs on major cryptocurrencies like Bitcoin and USDT.

Is Dizicx regulated?

Dizicx is registered in Mauritius under the legal name Dizicx Ltd, but it does not hold a regulatory status with any major financial oversight authority, which is a factor potential clients should consider.

OPEN AN ACCOUNT NOW WITH DIZICX AND GET YOUR BONUS