Deriv Review

Deriv is an online broker that offers forex, commodities, indices, and cryptocurrency trading with a focus on accessibility and simplicity. Known for its user-friendly platforms, Deriv provides multiple trading options, including its proprietary DcTrader, Deriv X, and MetaTrader 5 (MT5), allowing traders to select the platform that best suits their experience level and strategy.

The broker offers low minimum deposits and flexible account options, making it easy for beginners to start trading with minimal upfront costs. Deriv also provides a range of educational resources, helping traders develop their skills and make informed trading decisions.

With 24/7 trading availability and access to both real and synthetic markets, Deriv caters to traders looking for flexibility in trading times and asset choices. Its straightforward fee structure and range of trading platforms make it suitable for those seeking an affordable and accessible trading experience.

What is Deriv?

Deriv is an online trading broker that provides access to a variety of markets, including forex, commodities, indices, and cryptocurrencies. With its focus on user-friendly trading platforms like DcTrader, Deriv X, and MetaTrader 5 (MT5), Deriv is designed to cater to both beginners and experienced traders looking for straightforward trading options.

The broker offers low minimum deposit requirements and a transparent fee structure, making it accessible for traders with varying budgets. Additionally, Deriv allows 24/7 trading on synthetic markets, giving users the flexibility to trade at any time.

Deriv Regulation and Safety

he broker is authorized and regulated by multiple financial regulatory bodies to ensure a secure trading environment for its users. It is regulated by the Malta Financial Services Authority (MFSA), the Labuan Financial Services Authority (LFSA) in Malaysia, and the Vanuatu Financial Services Commission (VFSC), which helps provide oversight across its different markets.

To prioritize client safety, Deriv uses segregated accounts to keep customer funds separate from the company’s operational funds, reducing risks of misuse. Additionally, Deriv implements SSL encryption across its platforms, protecting traders’ personal and financial data during transactions, which reinforces its commitment to security and client confidence.

Deriv’s Regulation and Safety keeps its clients’ funds in segregated accounts, provides negative balance protection, and participates in the Investor Compensation Scheme (ICS) in Malta, which covers up to 20,000 EUR per client in case of insolvency. Trading forex in Deriv fits in the trading strategies of many traders because of its safety.

Deriv Pros and Cons

Pros

- Low fees

- 24/7 support

- Multiple platforms

- Low minimum deposit

Cons

- Limited regulation

- Withdrawal fees

- No proprietary app

- Limited language support

Benefits of Trading with Deriv

Trading with Deriv offers several benefits, particularly for those looking for accessibility and flexibility in trading. The broker supports multiple platforms—DcTrader, Deriv X, and MetaTrader 5 (MT5)—providing options for manual, automated, and advanced trading, catering to different trading styles and experience levels.

With low minimum deposits and a straightforward fee structure, Deriv is accessible to traders with varying budgets, making it easy for beginners to start trading without significant upfront costs. Additionally, Deriv’s 24/7 trading availability, especially on synthetic indices, provides flexibility for traders who want the freedom to trade at any time.

Deriv also prioritizes customer service and educational resources, offering tools and guides to help traders improve their skills and make informed decisions. This approach, combined with secure trading measures, makes Deriv a suitable option for those seeking a versatile and reliable trading platform.

Deriv Customer Reviews

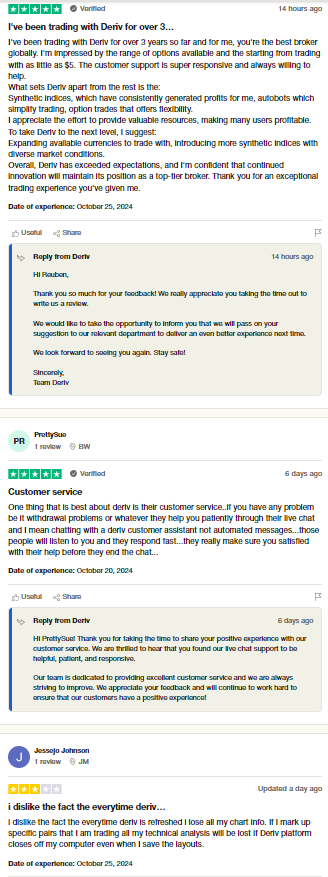

Customer reviews for Deriv are generally positive, with many traders appreciating the platform variety and flexibility it offers. Users often highlight the ease of using platforms like DcTrader for manual trading and Deriv X for automated strategies, which allows both new and experienced traders to customize their trading approach.

Additionally, Deriv’s low minimum deposit and accessible account options are praised, especially by beginners who value the ability to start with smaller amounts. Many reviews also note the convenience of 24/7 trading, particularly on synthetic markets, which provides flexibility in trading hours.

However, some customers express concerns over withdrawal processing times and limitations in customer service availability. While Deriv’s support is helpful, traders feel that extended support hours could improve the experience, especially for those in different time zones.

Deriv Spreads, Fees, and Commissions

Deriv offers a transparent fee structure with competitive spreads and minimal additional costs, appealing to cost-conscious traders. The broker’s spreads vary based on the asset and market conditions, with forex pairs generally featuring tighter spreads, particularly on popular pairs like EUR/USD.

Deriv does not charge commission fees on most trades, which keeps costs lower, especially for retail traders who prioritize affordability. However, certain account types and advanced trading options, such as high-leverage trades, may involve higher spreads to cover risks associated with increased leverage.

In addition to trading spreads, Deriv maintains minimal non-trading fees, with some charges potentially applying to specific withdrawal methods or dormant accounts. This transparent approach to spreads, fees, and commissions helps traders understand and manage their costs effectively.

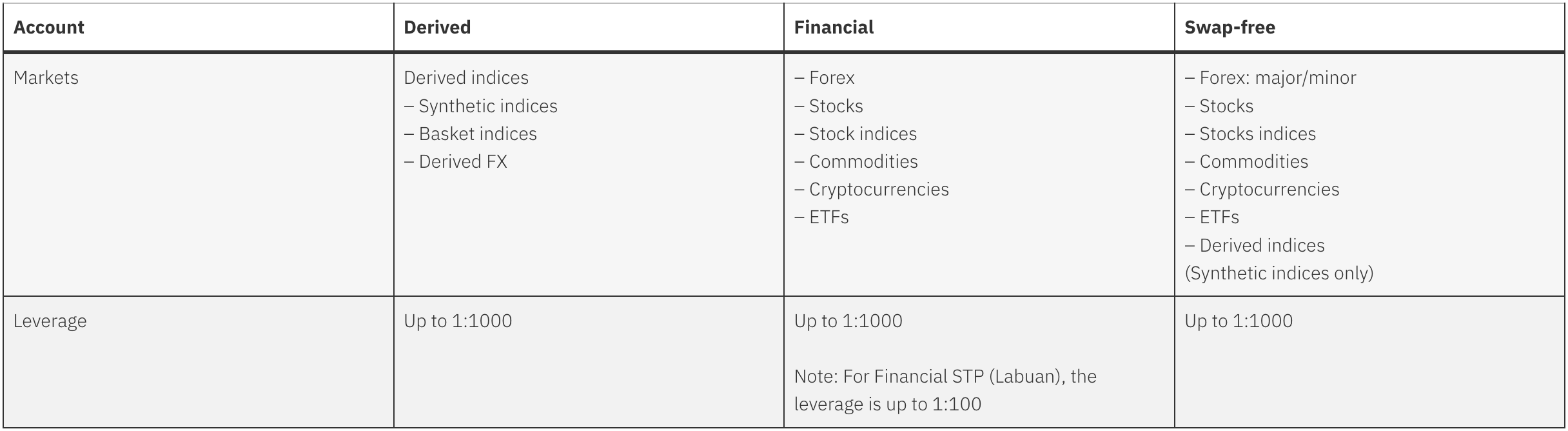

Account Types

The broker offers a selection of Deriv financial account designed to cater to different trading needs and experience levels. Each trading account type provides unique features, including access to specific markets, trading conditions, and flexible funding options, allowing traders to choose the best fit for their strategies and goals.

Derived Account

The Deriv Derived Account is ideal for most traders, offering access to forex, commodities, and synthetic indices with low spreads and no hidden fees, making it suitable for straightforward, low-cost trading.

Swap-Free Account

A Swap-Free Deriv Account is designed for traders who require interest-free trading, particularly those following Islamic finance principles. This account type excludes overnight swap fees on trades, allowing users to hold positions without incurring additional interest charges. Deriv’s Swap-Free option ensures compliance with Sharia law, making it accessible for traders who need a cost-effective, interest-free trading solution.

Financial Account

Designed for forex trading, the Financial STP (Straight-Through Processing) Deriv account allows traders to benefit from tight spreads and direct market access, suitable for those focused on forex with higher liquidity and transparency.

This broker is also offering demo account. Demo account is good for Deriv trader to stay safe and their money before they actually spend real money. Since this is a reliable broker, their online trading platform is good for retail investor accounts as they are following financial markets standard. These trading accounts are good for beginner traders.

How to Open Your Account

Opening an account with Deriv is a simple and user-friendly process that takes only a few steps to complete. Designed for ease of access, the registration process allows traders to start quickly and enjoy access to Deriv’s range of markets and trading platforms.

Step 1: Visit the Deriv Website

Go to Deriv’s official website and click on the “Create Free Demo Account” or “Sign Up” button to start the registration process.

Step 2: Complete the Registration Form

Fill out the form with basic details like your name, email address, and preferred password. You can also choose to sign up via your Google or Facebook account.

Step 3: Verify Your Identity

As required by regulations, upload identification documents, such as a valid ID and proof of address, to verify your identity and secure your account.

Step 4: Fund Your Account

After verification, choose your preferred deposit method, which can include bank transfer, e-wallets, or cryptocurrency, and fund your account with the minimum deposit to start trading.

Step 5: Start Trading

Once your account is funded, log into Deriv’s platform, select your preferred trading asset, and begin trading across forex, synthetic indices, commodities, or cryptocurrency markets.

Deriv Trading Platforms

Deriv provides traders with access to three main advanced trading platform: DcTrader, and MetaTrader 5 (MT5), and Deriv X each designed to meet specific trading needs. DcTrader is a web-based platform known for its simplicity and ease of use, making it ideal for manual trading. With a user-friendly interface, customizable charting options, and a range of trade types, DcTrader suits both beginners and experienced traders seeking a straightforward experience.

Deriv X is Deriv’s proprietary platform, offering an intuitive and customizable trading experience across various asset classes, including forex, commodities, cryptocurrencies, and synthetic indices. Designed with both beginners and advanced traders in mind, Deriv X provides powerful charting tools, flexible order types, and a user-friendly interface, allowing traders to set up their screens and strategies with ease.

With Deriv X, users can access leveraged trading and utilize a streamlined layout that emphasizes simplicity while maintaining advanced functionalities. The platform is accessible through web and mobile versions, enabling traders to stay connected and manage their positions on the go.

Deriv MT5 is available for traders seeking more advanced trading tools and analysis capabilities. MT5 supports a variety of order types, sophisticated charting, and automated trading through Expert Advisors (EAs), appealing to those who prefer in-depth technical analysis and flexibility in strategy execution. With this diverse platform lineup, Deriv accommodates a broad range of trading preferences and skill levels.

What Can You Trade on Deriv

Deriv offers a wide variety of trading instruments that enable users to explore diverse market opportunities. From traditional forex pairs to synthetic indices exclusive to Deriv, traders have access to flexible trading options across asset classes for better diversification and tailored strategies.

Forex

Trade major, minor, and exotic currency pairs with competitive spreads and flexible leverage, making forex trading accessible to both beginners and experienced traders.

Synthetic Indices

Unique to Deriv, synthetic indices are available 24/7 and mimic real-world market volatility, allowing traders to explore consistent trading opportunities around the clock.

Commodities

Access key commodities like gold, silver, and oil to diversify portfolios and hedge against inflation or market volatility to trade CFDs straightforward.

Cryptocurrencies

Deriv provides access to popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin, allowing traders to capitalize on the volatility of digital assets in a secure trading environment.

Stock Indices

Speculate on the performance of major stock Derived indices from markets worldwide, offering an opportunity to trade broad market trends without directly investing in individual stocks.

Deriv Customer Support

Deriv offers 24/7 customer service through multiple channels, including live chat, email, and phone, providing traders with assistance at any time of day. This around-the-clock availability is especially convenient for users trading synthetic indices or forex markets outside traditional hours, ensuring that help is accessible whenever needed.

Customer reviews often highlight Deriv’s responsive support team, noting quick response times and helpful resolutions to common trading and account issues. Live chat is the preferred choice for immediate support, allowing traders to quickly address questions or concerns without delay.

While Deriv’s support team is generally well-regarded, some users feel that expanding language options and offering more localized support could improve accessibility further. Overall, Deriv’s customer support structure caters well to its global user base, providing reliable assistance and guidance around the clock.

Advantages and Disadvantages of Deriv Customer Support

Withdrawal Options and Fees

Deriv offers multiple withdrawal options to ensure traders can access their funds conveniently and affordably. Each withdrawal method varies in terms of fees and processing times, allowing traders to select the best option based on their location and needs.

Bank Transfer

Bank transfers are secure for larger withdrawals but may involve higher fees and typically take 3-5 business days to process.

Credit/Debit Card

Withdrawals to credit or debit cards are usually processed within 1-3 business days, with moderate fees depending on the card provider.

E-wallets

Options like Skrill, Neteller, and Fasapay offer fast, low-cost withdrawals, often completing within 24 hours, ideal for traders who prioritize quick access.

Cryptocurrency

Cryptocurrency withdrawals support selected coins and typically have low fees and fast processing times, often taking just a few hours, making it a popular choice for crypto traders.

Deriv Vs Other Brokers

#1. Deriv vs AvaTrade

Deriv and AvaTrade are both established brokers but offer distinct trading experiences. Deriv focuses on accessibility and unique assets, providing its proprietary DcTrader, Deriv X, and MT5 platforms with features like synthetic indices that allow 24/7 trading, low minimum deposits, and straightforward fee structures. AvaTrade, however, targets a broader range of traders by supporting MT4, MT5, AvaOptions, and its proprietary WebTrader, along with extensive educational resources and social trading features, catering to beginners and those seeking community-based trading. AvaTrade also holds more robust regulatory licenses, including oversight by ASIC and the FCA, compared to Deriv’s regulation in jurisdictions such as MFSA and LFSA.

Verdict: AvaTrade is ideal for traders prioritizing strong regulation, social trading, and diverse platform options. Deriv, on the other hand, suits those who seek unique trading instruments like synthetic indices, low entry costs, and an accessible, straightforward trading experience.

#2. Deriv vs RoboForex

Deriv and RoboForex each bring unique strengths to the trading experience, catering to varied trader needs. Deriv offers simplicity and accessibility through its proprietary platforms like DcTrader and Deriv X, along with MetaTrader 5 (MT5), providing exclusive access to synthetic indices that operate 24/7, low minimum deposits, and a clear fee structure. RoboForex, by contrast, supports a broader array of platforms, including MT4, MT5, cTrader, and its R Trader platform, appealing to traders looking for advanced tools, high leverage options, and asset variety, such as stocks, cryptocurrencies, and forex. RoboForex also offers copy trading and cent accounts for micro-investing, making it flexible for traders who want additional trading styles and community engagement. In terms of regulation, RoboForex is regulated by CySEC and IFSC, while Deriv is regulated by the MFSA, LFSA, and VFSC.

Verdict: RoboForex is ideal for those seeking platform diversity, high leverage, and specialized features like copy trading. Deriv, however, is better suited for traders focused on accessibility, unique trading instruments like synthetic indices, and straightforward, low-cost trading options.

#3. Deriv vs Exness

Deriv and Exness both cater to traders seeking flexible trading conditions, though they differ in platform options and trading styles. Deriv offers proprietary platforms like DcTrader and Deriv X alongside MetaTrader 5 (MT5), featuring unique assets such as synthetic indices for 24/7 trading and accessible options with low minimum deposits. Exness, meanwhile, supports both MT4 and MT5 and offers ultra-high leverage, up to 1:2000 on select accounts, attracting traders looking to maximize position sizes. Exness also provides 24/7 customer support and is regulated by top-tier authorities, including the FCA and CySEC, which may appeal to traders prioritizing strong regulatory oversight and access to global markets.

Verdict: Exness is better suited for high-leverage traders and those seeking 24/7 support with comprehensive regulatory oversight. Deriv, however, excels in providing accessibility and unique trading instruments like synthetic indices, making it ideal for traders focused on flexibility and simplicity.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Deriv Review

In conclusion of this Deriv Review, Deriv is a versatile broker that offers a range of trading platforms, including DcTrader, Deriv X, and MetaTrader 5 (MT5), making it suitable for traders of all experience levels. The broker’s low minimum deposit, straightforward fee structure, and accessibility across multiple markets provide an attractive option for both beginners and seasoned traders.

Deriv’s 24/7 customer support and educational resources enhance the trading experience, especially for those new to the market or trading outside regular hours. Although some users may desire additional language options and more localized support, Deriv remains a strong choice for traders seeking flexibility, affordability, and consistent support.

Deriv Review: FAQs

What is Deriv?

Deriv is an online broker offering access to markets like forex, commodities, indices, and cryptocurrencies. It provides multiple trading platforms, including DcTrader, Deriv X, and MetaTrader 5 (MT5), to accommodate various trading styles and skill levels.

Is Deriv regulated?

Yes, Deriv is regulated by multiple authorities, including the Malta Financial Services Authority (MFSA), the Labuan Financial Services Authority (LFSA) in Malaysia, and the Vanuatu Financial Services Commission (VFSC), ensuring compliance with regulatory standards.

What trading platforms does Deriv offer?

Deriv provides access to DcTrader for manual trading, Deriv X for automated bot trading, and MetaTrader 5 (MT5) for advanced analysis, offering options for both beginner and advanced traders.

OPEN AN ACCOUNT NOW WITH DERIV AND GET YOUR BONUS