Deriv Review

As a trader, you're always looking for new ways to make profit and expand your investments. To accomplish this goal, you need a reliable broker with features and tools that helps you get a better understanding of the trading marketplace. After all, choosing a good broker guarantees your trading success. If you're among those who don't know where to begin, look no further than the Deriv online brokerage platform.

Deriv is ranked among the top 5 best binary options brokers, and for a good reason. This intuitive broker aims to provide expert market analysis and deliver a first-class experience to its traders. Additionally, it offers derivatives on stocks and indices, forex, commodities, cryptocurrencies, and CDFs. However, before you venture into Deriv and commit your hard-earned cash, let's review and ensure it meets our evaluation criteria and assist you in deciding whether it is right for you.

What is Deriv?

Deriv is an online broker that has been active since 1999 and aims to make trading accessible to all traders. Through the years, it has gained popularity worldwide as it guarantees its traders a low deposit requirement and a user-friendly experience. Deriv also provides traders with various assets such as stocks, forex, options, CDFs, indices, commodities, and cryptocurrencies to choose from.

Deriv offers various trading platforms such as DMT5, DBot, and DTrader to its traders to easily navigate the system without difficulty. Also, these proprietary platforms analyze the markets and give the traders an outlook of the trading spacing, which helps them make informed decisions on what assets to trade on. Because of these trading platforms, traders are able to stay ahead of the market and maximize their profits.

What makes Deriv a trusted and well-respected broker is all the regulations and licenses surrounding it. It holds licenses from international bodies such as VFSC, UK Financial Conduct Authority (FCA), Malta, and Labuan Financial Services Authority. Additionally, what sets Deriv aside from the pack is that it is a member of the Financial Commission, which ensures traders' rights are respected and defended during the trading process.

Advantages and Disadvantages of Trading with Deriv

Benefits of Trading with Deriv

Whether you're an expert or new to the trading sector, Deriv offers an array of benefits to its traders. First and foremost, to ensure you have a hassle-free experience, Deriv has a free demo account that you can use to familiarize yourself with the platform. It ensures that you have a risk-free experience before investing your money. The demo account helps you make an informed decision about whether Deriv is the right broker.

In terms of carrying out your transactions, Deriv got you covered! It has a variety of withdrawal and deposit methods, all with zero payment fees. Whether you use Visa, Bitcoin, Neteller, or any other providers, rest assured of Deriv's affordability and accessibility when transferring funds from one account to another. In addition, these providers enhance Deriv's flexibility as traders can withdraw their money regardless of location.

As a trader increasing profits and reducing risks in all your investments is the first agenda you have at hand. Deriv ensures that you maximize returns in all your investments by offering its traders 100+ assets. This means that using statistics from the market, you can know which asset is performing and which is underperforming before deciding the one to invest in. Furthermore, this broker has multipliers where traders with successful predictions can get more out of their investments, thus increasing their profits.

Being a regulated brokerage platform by bodies from various countries, you're sure that all your transactions and investments are safe. Furthermore, Deriv has top-notch customer service available 24/7 and extends its services on weekends. To ensure you do trading to your satisfaction, Deriv ensures you trade up to 18 hours daily, and in return, you're sure to stay ahead of the market.

Deriv Pros and Cons

Pros

- 100%+ payouts

- Deriv uses an SSL encryption security measure to safeguard your data and account.

- Traders' money protection: In insolvency, you're sure to get back all your invested money because Deriv stores its customers' money in secured financial institutions.

- Diversified portfolio with various options.(In Bullet Points, give 4 Pros and 2 Cons. No need to Explain)

Cons

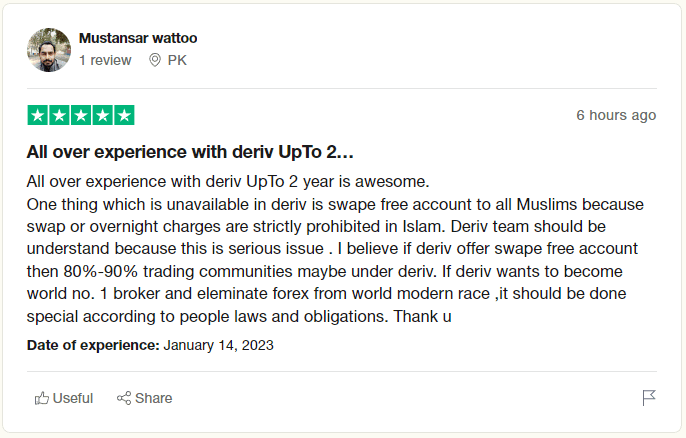

- Does not have an Islamic account.

- No bonuses and promotions for its traders.

Deriv Customer Reviews

With a rating of 7.5/10, Deriv has consistently shown a high level of satisfaction to traders using its services and platforms. In the top three Deriv customer reviews, one trader said they love the broker. The customer described Deriv's platforms as clear, visually pleasing, and convenient. These are all good qualities of a good brokerage platform. The trader went ahead and gave a thumbs-up to Deriv's minimum deposit condition and the various payment agents it has. However, this customer was disappointed by the support team and did not find it convenient to communicate with a bot.

Another customer said they have never been disappointed in their 5 years of trading using Deriv's platform. The user describes the respective market operating hours as favorable, with high-quality trading services and a user-friendly interface. Also, the customer applauds the DTrader platform and says how conveniently it carries out activities on its own. Touching on security, the trader was pleased and considered it solid.

Another user found Deriv reliable because of its licenses and regulations. The collaboration between the broker and the user was surprisingly pleasing. The low deposit requirement and expert trading terminals are what won them over. The interfaces are friendly, wide, convenient, and functional, enabling the trader to switch between terminals and accounts. Nevertheless, the user felt that for rookies, there should be more educational tutorials, guides, and an outline of what strategies to use when trading.

Deriv Spreads, Fees, and Commissions

If you're looking for a cost-effective trading platform, Deriv is a great option. It offers competitive spreads from 0.5 pips on forex currencies such as the USD/EUR, ensuring great value for your money. These spreads ensure that despite your expertise in trading, all have equal chances of making profits in all their investments. Because of these spreads, you have more control over your losses and profits as you can accurately analyze the market. Furthermore, these spreads are a combination of prices from various sources throughout the DMT5 platform, thus bringing out the best price at any given time.

For those searching for a broker with flexible commissions and fees, Deriv is an excellent choice. It does not charge any fee for your account maintenance but will charge a fee to your account if it has been inactive for 12 consecutive months. Additionally, it does not charge any fee when withdrawing funds. This enables you to get your profit as you have earned; however, there may be charges from third-party payment facilitators.

In order to carry over your trading positions to the following day's session, Deriv does charge a swap fee. For Muslim traders, Deriv does not allow them to convert live accounts to Islamic accounts, which means they will be subject to overnight fees if the positions stay open after the trading day ends. It is important to note that commissions at Deriv are fixed, although they may vary in size depending on the account type and asset.

Account Types

The following is a detailed list of Deriv accounts:

Demo Account

Novice wholesale and retail traders should not worry about familiarizing themselves with the trading platform because the Deriv demo account ensures your trading success without risking money. As an advantage, the account is free to all users. This account enables you to get a grasp of Deriv's trading tools, fees, commissions, and instruments. You can learn a few trading strategies from the account to analyze the market.

Standard Account

Whether you're a novice or a professional trader, this account gives you a chance to diversify your portfolio. From it, you can access cryptocurrencies, commodities, and exotic and major currency pairs with a flexible leverage of 1:1000. This makes the account affordable to all traders at different levels. Additionally, the account has educational resources that enlighten the traders on the platform tools and what market strategies are best to put into practice when trading.

Financial STP Account

If you are interested in the forex market, try out the Financial STP account. With it, you can access exotic, minor, and major currency pairs with low spreads and high trade volumes. This is an advantage to traders as they can confidently make trading moves in over 150 assets present in this account. Transactions in this account are quick and at a low cost making it more reliable and a viable choice for all forex traders around the globe.

Synthetic Account

This account is considered transparent because each account is inspected by a separate independent third party to guarantee reliability and fairness. The synthetic account is perfect if you want to maximize your profits on indices and CDFs. The account offers a leverage levels of up to 1:1000, a 100% margin call level, and a 50% stop-out level to ensure its user's investments are protected from unnecessary risks and losses.

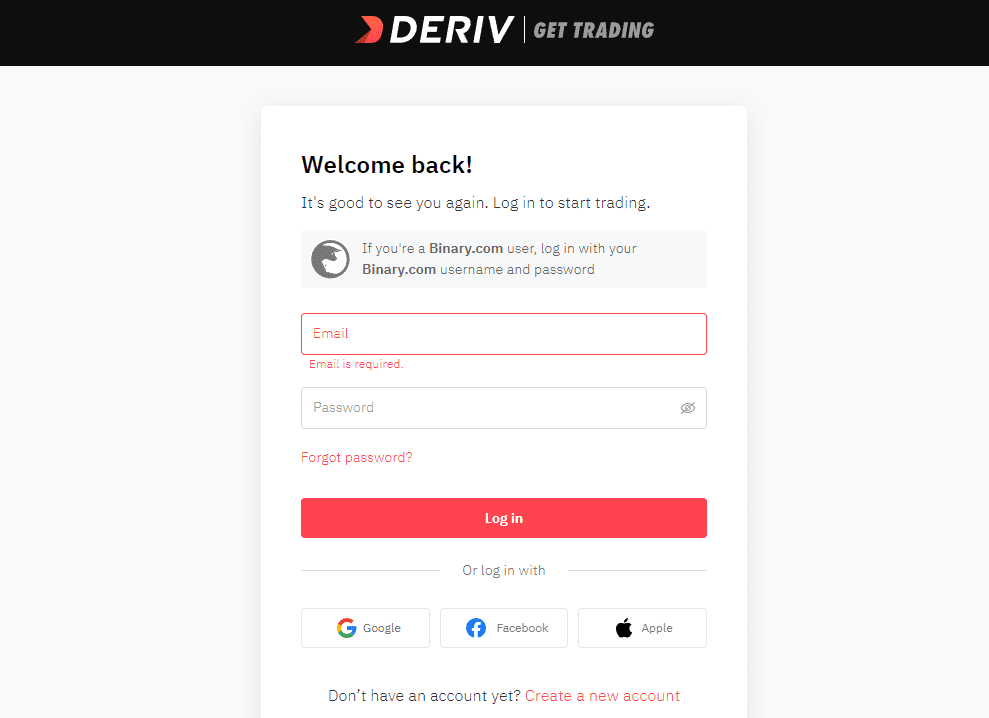

How To Open Your Account

For new traders who are ready to get started with Deriv, the process of opening an account is straightforward. To be considered, you must be 18 years and from an eligible country. Additionally, you'll need to provide some personal documents to authenticate your identity. This may include; full name, phone number, and email address.

The opening process is similar whether it is the demo, synthetic or financial STP account. Follow this procedure in opening your account:

- Visit Deriv's certified website

- Click on your preferred account type

- Select your currency

- Provide personal details

- Read the terms and conditions, and agree.

If you face any challenges while opening the account, Deriv's support team is available 24/7, even on weekends, to ensure you have ample experience. Do not hesitate to ask any questions you might have. Once everything has been clarified, make a deposit and start trading.

What Can You Trade on Deriv

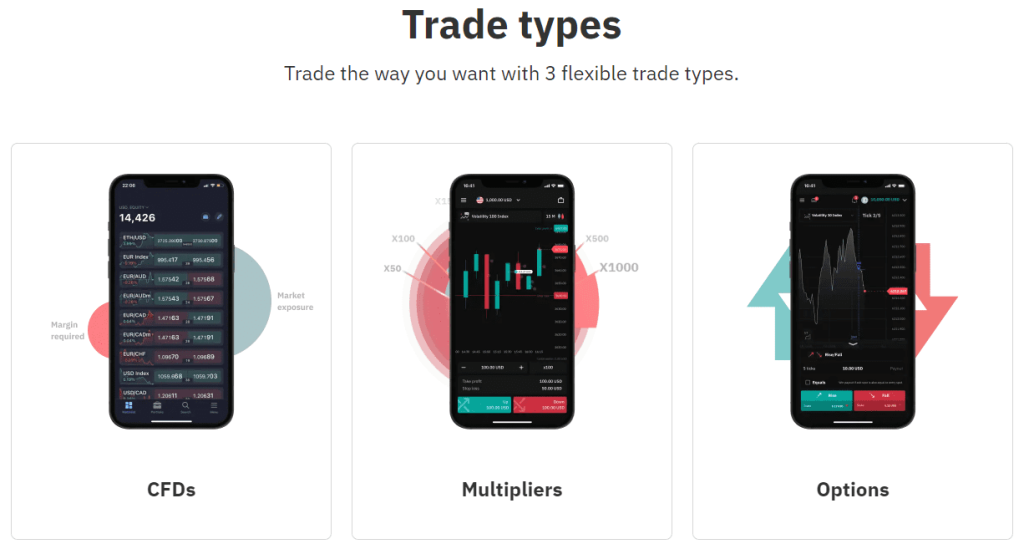

As a trader, you want a broker with various assets and instruments you can trade-in. Deriv is no exception! This broker diversifies your portfolio to a greater level than you expected. The broker has over 100 assets you can invest in, including CDFs and forex. The tradeable assets are further categorized into stock, indices, commodities, synthetic indices, cryptocurrencies and multiplier options.

In the case of forex, Deriv has over 30 currency pairs that include minors, majors and exotics. The stock indices, on the other hand, hypothesize price advances across larger stock indices in European, Asia and the USA. Synthetic indices replicate the market conditions using a random secured generator and convey consistent volatility because of their 24/7 availability.

The available commodities include precious metals like Silver, Gold and energies such as oil. Deriv also allows you to engage in multipliers and options trading. Multipliers allow traders to invest on leverage to multiply their positions and thus increase returns. There are various options available, and you only profit from them if you predict the price movements correctly.

Deriv Customer Support

Deriv is known to please its traders with an immersive customer support system. Regardless of your questions, you're guaranteed answers. What makes the customer service appealing is that they are available 24/7, with no exception for weekend trading. For general queries, visit the Help Centre. This self-service portal assists in queries such as platform issues and account questions.

Deriv has live chat support services for its customers from its official website. For those who would love to visit their offices, Deriv has a business centre in France, Malta, Guernsey, Cyprus, Malaysia, Singapore, Dubai, Jordan, Belarus, Rwanda, Paraguay, Cayman Islands and Vanuatu

You can also contact Deriv through their partnership business centre official site. From this support, you can ask questions about IB and affiliate programmes and those concerning agent payment programmes. For additional support, email Marketing@deriv.com.

Advantages and Disadvantages of Deriv Customer Support

Contacts Table

Security for Investors

Withdrawal Options and Fees

Account replacements and withdrawal methods of profits at Deriv are secure, reliable and straightforward. With an array of withdrawal and replenishment options available, you can choose a method that best suits your needs. These options include banking solutions (PayTrust, bank transfer, ZingPay, Help2Pay, and Dragon Phoenix), bank cards such as debit cards, cryptocurrencies and e-wallets.

Note that the processing of each transaction varies from one payment agent to another. For instance, replenishments carried out through bank debit cards are instant, and withdrawals take one business day. Generally, the applications' processing period is instantly done or takes up to three working days.

Deriv neither charges commissions nor fees for any transaction that takes place. But, these fees can be incurred by the payment agents. Also, it is important to note that each payment agent has its maximum and minimum withdrawal and replenishment amount. All novice and professional traders must verify their identity to carry out any transaction at Deriv.

Deriv Vs Other Brokers

#1. Deriv vs IQ Option

An intelligent trader should always compare online brokers to choose one that suits their requirements, trading style and standards. Comparing Deriv and IQ Option in terms of client satisfaction, IQ Option outdoes Deriv with a rating of 4.6. The minimum deposit amount for Deriv is $5, while IQ Option is $10. Deriv has a maximum leverage of 1:1000 with tight spreads that range from 0.5 and does not charge any commissions. IQ Option's leverage is 1: 500 and has very high spreads ranging from 1. These high spreads indicate high risk on your capital.

IQ Option has received awards from BinaryOptions for being a trusted broker in 2020, 2019, 2018 and 2017. In 2021 it was awarded as the best Binary Options broker by DayTrading.com. So far, Deriv has not received any awards. Deriv trades on instruments such as Forex, CDFs, Stocks, Multipliers, Commodities and Indices. On the other hand, IQ Option trades on instruments like CDfs, Crypto, Forex, Stocks and Digital Options.

Both Deriv and IQ Option carry out margin trading where IQ Option has a margin rate of 0.2% while Deriv has not indicated its margin requirements yet. Deriv is involved in copy trading, where experienced traders' positions are replicated using the DMT5 platform's signals. IQ Option does not carry out copy trading. Deriv is involved in Spot trading while IQ Option is not, but both carry out Forex trading. From our thorough analysis, Deriv outperforms IQ Option, especially in terms of trading instruments and other derivatives.

#2. Deriv vs Pocket Option

Deriv is regulated and licensed by several international bodies, such as the Malta financial services authority, Vanuatu Financial Services Commission, UK Financial Conduct Authority (FCA), and Labuan Financial Services Authority. In contrast, Pocket Option is regulated by one body, the International Financial Market Relations Regulation Center. Pocket Option were awarded as the best Binary broker in 2022, but Deriv has not received any awards yet.

The minimum deposit for the Pocket Option is $50 and allows clients to trade on instruments such as Currencies, Binary Options, Indices, Commodities and Stocks. For Deriv, the minimum deposit is $5 and the instruments it offers include CDFs, Forex, Multipliers, Commodities, Indices and Stocks.

Both brokers offer binary options whereby in Pocket Options, the binary options are short-term with payouts of 92%, and in Deriv, the binary options are premium with 100% payouts. The expiry times of these options are 5 seconds to 4 hours for the Pocket Option and 15 seconds to 365 days for Deriv. Deriv offers ladder and boundary options and guarantees its traders negative balance protection. From the above analysis, it is clear that Deriv outdoes Pocket Option in many sectors.

#3. Deriv vs RaceOption

Deriv allows traders to trade on instruments such as Forex, CDFs, Indices, Stocks, Multipliers and Commodities, while RaceOption offers binary options and CDFs only. Deriv has a minimum deposit of $5, while the minimum deposit for RaceOption is $250. Additionally, Deriv assures its clients a negative balance protection while RaceOption does not.

Regarding regulations and licenses, Deriv outperforms RaceOption because it is regulated by bodies such as Vanuatu Financial Services Commission, UK Financial Conduct Authority (FCA), Malta and Labuan Financial Services Authority. RaceOption is neither regulated nor licensed by any international body.

Deriv offers first-class binary, ladder and boundary options with 100% payouts. For RaceOption, binary options are offered in well-known financial markets. It also offers ladder options but not boundary options; the payouts are 90%. From our detailed analysis and customer reviews, it is evident that Deriv outperforms RaceOption.

Conclusion: Deriv Review

Deriv is an online broker that allows its traders to diversify their portfolios by offering them a variety of instruments to trade in. From CDFs to commodities, there's something for everyone. With a leverage of 1:1000 and a minimum deposit of $5, Deriv has proven to be a cost-effective trading platform that helps traders to minimize risks while maximizing potential returns.

Offering its clients reliable customer support, you're guaranteed answers whenever you have questions. You will always be served whether you contact them via live chats, the self-service portal or emails. When carrying out your transactions, the replenishment and withdrawal options are varied to suit your needs.

Deriv is regulated and licensed by various international bodies, making it a reliable and safe brokerage platform. Comparing it with other brokers, it is clear that Deriv outperforms them in many fields. Therefore, Deriv is an excellent choice for traders because it guarantees them safety, high payouts and strategies to navigate the market.

Deriv Review FAQs

Is Deriv legit?

Yes. Deriv is an online brokerage platform licensed and regulated by various bodies from different countries. These bodies include Vanuatu Financial Services Commission, UK Financial Conduct Authority (FCA), Malta and Labuan Financial Services Authority.

How does Deriv make profit?

Deriv neither has hidden charges nor charges commissions. It considers this unethical. However, it earns money through initial deposit fees, swap fees, and spreads.

How reliable is Deriv?

Deriv guarantees its traders a conducive trading environment. For instance, it has segregated accounts in case of insolvency, has negative balanced protection and is licensed by several international bodies.