Degiro Review

Degiro is a Netherlands-based online broker that has been making waves in the financial markets since 2013. The company offers its clients access to a variety of global markets, providing our clients with the tools they need to succeed – stocks, bonds, options, and futures. This review delves deeply into DeGiro’s services to equip you with the knowledge required to decide whether their brokerage is right for you.

We will be diving into the details of Degiro’s trading platform, fees, account opening process, withdrawal process, and customer support, among other things.

This review aims to help traders make an informed decision about whether Degiro is the right broker for their trading needs. By the end of the review, you will have a comprehensive understanding of DeGiro’s services and be better equipped to decide whether it is the right brokerage for you. Let’s explore DeGiro in-depth and evaluate its offerings objectively.

What is Degiro?

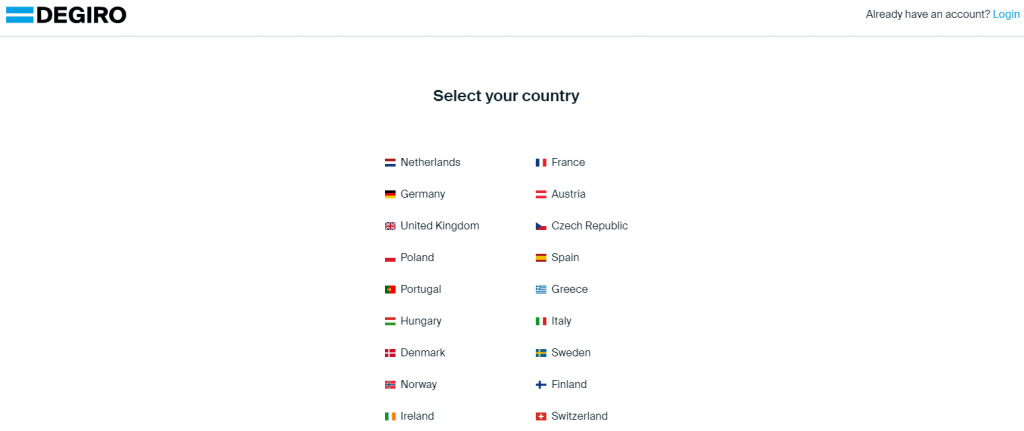

Founded in 2008 by a team of former Binck Bank employees, Degiro burst onto the scene with its stock brokerage services to retail investors. With online access to security exchanges worldwide, it quickly became one of Europe’s most popular brokers, accumulating over two million clients spread across 18 countries.

Degiro is renowned for its highly low-cost trading model, with low commissions. This makes it a good choice for traders who want to lower their trading costs. The company has created a scalable system that allows them to pass on savings directly to customers and make this unbeatable fee structure possible.

Boasting a user-friendly platform, this company offers various tools and resources to arm traders with the information necessary for making educated decisions. The platform offers a variety of order types, including limit and stop orders, and provides real-time quotes and market news. Additionally, DEGIRO offers a mobile app that allows traders to monitor their portfolios and execute trades on the go.

Degiro stands out among the competition for its attractive pricing, a vast selection of financial instruments, and intuitive platform.

Advantages and Disadvantages of Trading with Degiro

Benefits of Trading with Degiro

For investors and traders, Degiro trading offers countless advantages, including:

The Ability to Open Transactions on European and American Exchanges: By utilizing Degiro’s international market access, traders can diversify their portfolios and capitalize on numerous regional markets. Whether in Europe or America, Degiro provides vast exchanges that enable users to take advantage of various market conditions.

Low Trading Fees and Commissions: Degiro has some of the industry’s lowest trading fees and commissions, making it an affordable option for traders. The fees for financial instruments are also relatively low. Additionally, there are no account maintenance or inactivity fees, which makes it cost-effective for traders who could be more active.

User-Friendly Trading Platform and Mobile App: Company’s trading platform is incredibly user-friendly, so newcomers and pros alike can easily maneuver their way around. Plus, with its availability in multiple languages and customizable dashboards to personalize the experience for each trader, there is something for everyone. The mobile app provides all the same features as the desktop version – allowing traders to stay on top of their portfolios from anywhere.

Real-time Quotes and Market News Provided: Degiro equips investors with the most up-to-date real-time quotes and market news, so they can make well-informed decisions as they trade. Furthermore, traders also benefit from an array of educational resources, such as research analysis by top analysts to enhance their knowledge of financial markets – making it perfect for both beginner and experienced investors alike.

Degiro Pros and Cons

Pros:

- Low trading fees and commissions

- Regulated by higher authorities, strict policies regarding AML and KYC.

- Relatively high withdrawal speed

- No costs to open a Degiro account

Cons:

- No possibility of depositing funds using a credit or debit card.

- No cryptocurrencies or forex are available

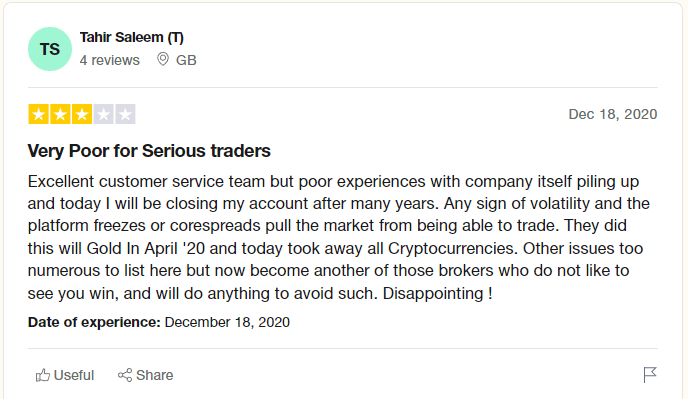

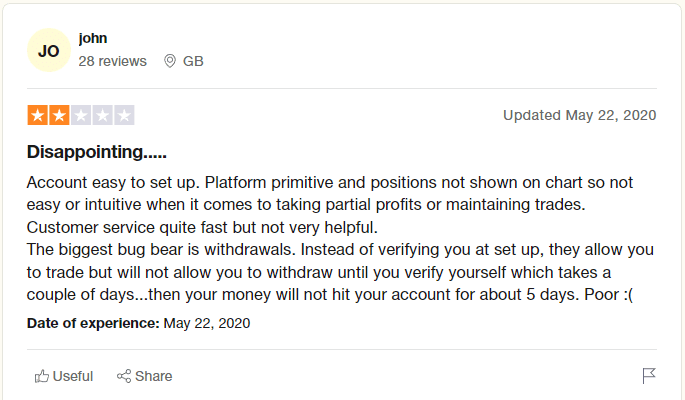

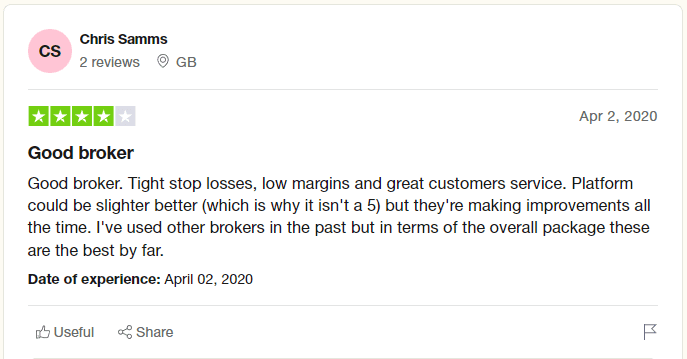

Degiro Customer Reviews

The majority of the reviews for Degiro are positive, with customers praising the low fees, user-friendly platform, and wide range of financial instruments available for trading. Many users also appreciate the ability to trade on various international markets.

However, some customers have reported issues with customer support and technical glitches on the platform. There have been complaints about account verification delays and difficulties transferring funds to and from the platform. A few customers have also expressed concern about the lack of investor protection, as Degiro is not covered by the Financial Services Compensation Scheme (FSCS).

Despite some negative reviews, the positive feedback outweighs the negative, with many customers recommending Degiro for its low fees, extensive range of financial instruments, and user-friendly platform.

Degiro Spreads, Fees, and Commissions

Degiro offers attractive spreads, fees, and commissions policy. Here’s more information on the various fees and commissions that this broker charges:

Spreads: the company does not charge spreads on any of the assets it offers.

Fees: When compared to other brokers, Degiro’s trading costs for numerous assets are relatively inexpensive. The fees charged by Degiro include transaction fees, connectivity fees, and exchange fees. The transaction fees vary depending on the asset being traded, with the most popular ETFs and stocks traded on the platform being charged zero commissions. Connectivity fees are charged for using specific trading platforms, while exchange fees vary depending on the market.

Commissions: broker offers zero commissions on trading in select ETFs and stocks. For a variety of financial instruments, however, commissions are charged relative to the asset being traded and the market it is transacted in. Degiro offers traders an economical option because its commission fees are typically lower than those of conventional brokers.

Overall, spreads, fees, and commissions are very competitive, making it a cost-effective option for traders looking to trade in different financial instruments. However, traders should be aware of the various fees charged by Degiro and consider them when deciding on their trading strategy.

Account Types

Degiro offers different types of profiles to suit the needs and preferences of different investors. Basic, Custody, Active, Trader, and Day Trader account types exist. Each profile has its features, benefits, and restrictions.

Basic Account

This is the default account available to all users and provides basic trading functionalities. Among the key features of a Basic Account is even lower trading fees. You may also be eligible for tax-free dividends depending on your situation. A basic profile may only grant you full access to some assets and features. This will require an upgrade to an ActiveTrader, or Day Trader profile which you can do at no extra cost.

Custody Account

Custody Account offers additional asset protection by keeping them in a separate custodian account. Your holdings are kept separate from the Degiro lending pool, and this does not occur under the terms of the account type.

Active Account

This account is similar to the Custody and Basic account, but traders have access to leverage. The Active account is designed for active traders and provides access to real-time data and other advanced trading tools.

Trader Account

Trader Account is suited for more experienced traders and provides access to advanced order types and other professional trading features. Its account allows users to buy on up to 100% of their available margin.

Day Trader Account

This account is designed for professional traders and provides access to professional trading platforms and other advanced features.

Different profiles offered by Degiro cater to the needs and preferences of different types of investors, from casual investors to active traders. Some of the above account types may not be available in some countries. For more information on what account type can be opened in your country, go to the website for your specific country.

How To Open Your Account?

Creating an account with Degiro is a hassle-free and straightforward procedure. Here’s what you need to do:

- Go to the Degiro website and click the “Open an account” button in the top right corner of the homepage.

- Choose the account type that best suits your needs, such as Basic, Custody, or Active.

- Fill out the online application form with your personal details, including your name, address, and contact information.

- Provide information about your financial situation, investment experience, and trading objectives.

- Verify your identity by providing a copy of your ID or passport and a proof of address document.

- Fund your account with the minimum deposit amount required for your chosen account type.

Once your account has been approved, you can start trading immediately.

It is essential to be aware that Degiro is a regulated broker and, as such, implements rigid verification processes to authenticate all users. This procedure prevents the broker and the user from becoming victims of either fraud or money laundering attempts.

What Can You Trade on Degiro

The platform provides access to over 50 exchanges across 30 countries, allowing users to trade on global markets.

The company is committed to offering a vast selection of stocks from major exchanges such as NYSE, NASDAQ, and London Stock Exchange. On top of that, we grant access to several other alternative trading venues and smaller markets worldwide.

Degiro allows investors to grow their portfolios and reduce risk by investing in global government bonds, corporate bonds, and other reliable fixed-income securities. This can be a particularly advantageous way of diversifying your investments.

With ETFs, the broker provides investors with a wide selection of offerings from major providers like iShares, Vanguard, and SPDR, as well as numerous smaller players. This vast assortment enables them to access different sectors and markets easily while ensuring maximum efficiency in their investments.

Degiro also has investment funds such as mutual funds, index funds, and exchange-traded funds. Nevertheless, it is essential to remember that certain financial products may differ depending on the account type and region of residence.

Degiro Customer Support

Degiro provides outstanding customer support in a variety of languages, offering phone and email assistance to users from the 18 countries they serve. The response time for phone support is fast. However, there is no live chat or 24/7 support, which may be a drawback for some users. The average response time for email support is around two days, which is considered mediocre.

In terms of response speed, Degiro’s phone support is very quick, with an average wait time of less than a minute. However, email support can be unpredictable, with some users receiving responses quickly while others have to wait for up to 2 days. When it comes to response relevance, Degiro provides all the necessary information on the phone, paying attention to users’ concerns and providing clear answers. Similarly, via email, Degiro provides detailed and clear summaries of users’ queries.

Degiro’s customer service is considered to be of mixed quality. While phone support is great, and users can contact customer service in their own language, the lack of live chat and 24/7 support may be a disadvantage for some users. However, users can get relevant answers to their queries, and phone support is very quick. If users require assistance, they can contact Degiro’s customer service through phone and email support.

Advantages and Disadvantages of Degiro Customer Support

Security for Investors

Withdrawal Options and Fees

Degiro makes it effortless for investors to withdraw their funds from a brokerage account. According to their website, the company charges $0 for withdrawals. The withdrawal process is usually executed within 1 day.

Degiro only offers one withdrawal option, which is via bank transfer. The platform does not offer any other options such as credit/debit cards or electronic wallets. Additionally, investors can only withdraw funds to accounts that are in their name. While this may limit some investors, it does offer an extra layer of security to ensure that funds are not being sent to an incorrect account.

One thing that investors should be aware of is the currency conversion fees that may apply when the base currency of their Degiro account and the bank account’s currency differ. If investors are charged a conversion fee, it will depend on their personal bank. The company offers a range of base currencies, including CHF, DKK, GBP, SEK, EUR, CZK, and PLN. To avoid high conversion fees, investors may consider opening a multi-currency account at a digital bank.

Degiro Vs Other Brokers

#1. Degiro vs AvaTrade

Regarding fees, Degiro has lower commissions for stock trading, but AvaTrade has no commission fees for forex trading, which may be advantageous for traders primarily interested in currency pairs. However, AvaTrade does have wider spreads, which can affect trading costs. Both brokers offer different trading platforms, with Degiro’s web-based platform being more user-friendly for beginners and AvaTrade’s platform offering more advanced features and customization options.

#2. Degiro vs Roboforex

Roboforex offers a wider range of trading instruments, including forex, stocks, commodities, and cryptocurrencies, while Degiro specializes in stocks and ETFs. Degiro also has lower fees for trading stocks, while Roboforex has competitive fees for forex trading. Additionally, Roboforex offers more advanced trading platforms and tools, while Degiro’s platform is simple and easy to use. Roboforex is more suitable for Forex traders, while Degiro will fit long-term investors and beginners.

#3. Degiro vs Alpari

Degiro and Alpari are two different brokers with different offerings. When it comes to fees, Degiro has significantly lower fees for trading stocks, while Alpari’s fees are higher but more competitive for forex trading. When it comes to fees, DEGIRO is typically cheaper than Alpari. Degiro charges no account maintenance fees, no deposit fees, and no fees for most trades.

On the other hand, Alpari charges account maintenance fees, deposit fees, and fees for most trades. However, Alpari does offer more products and services than Degiro, so it may be worth paying a higher fee for some traders. Degiro may be a better choice for traders primarily interested in low fees and a large selection of investment products. However, traders interested in Forex trading or other more complex products may find Alpari better fits their needs.

Conclusion: Degiro Review

Investing with Degiro is an attractive proposition for many traders and investors due to the low fees it offers and its access to a wide range of international markets. However, customer support options are limited in some countries and Degiro services are only available in select nations right now. Despite the possible drawbacks, investing with Degiro can still be beneficial.

Investors looking to save money should be intrigued by Degiro’s remarkably low fees, as they are significantly lower than those charged by many other brokers. The convenient platform provides an extensive selection of investment products such as stocks, ETFs, options, futures, and bonds.

On the other hand, the lack of 24/7 customer support options may be seen as a disadvantage. Additionally, some investors may be concerned about the fact that Degiro is not insured by the Securities Investor Protection Corporation (SIPC), which provides protection for investors in the event of a broker’s bankruptcy.

Degiro is a solid option for investors who are looking for low fees and access to a wide range of investment products.

Degiro Review FAQs

Is Degiro regulated?

Yes, Degiro is regulated by several top-tier financial authorities, including the Netherlands Authority for the Financial Markets (AFM) and the Dutch Central Bank (DNB). It is also regulated by the German Federal Financial Supervisory Authority (BaFin) after it merged with flatexDEGIRO Bank AG.

What is Degiro’s minimum deposit?

Degiro does not have a minimum deposit requirement.

Is Degiro good for the long term?

Degiro can be a good option for long-term investing, particularly for buy-and-hold investors looking for a low-cost platform to invest in a wide range of asset classes. The company offers some of the lowest fees in the industry, which can significantly reduce the cost of long-term investing. For instance, Degiro does not charge any account maintenance fees, and its transaction fees are much lower than those of traditional brokers.