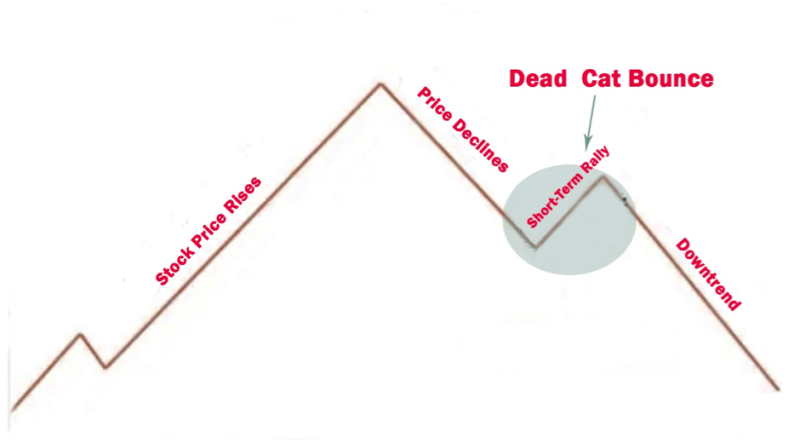

The morbid term dead cat bounce gets used to describe a temporary recovery of the price of an asset after a protracted decline. The name of the term refers to the idea, that even a dead cat that’s dropped from a height will bounce after hitting the floor.

The hidden meaning is that traders that believe that the observed rally during dead cat bounce is sustainable are fooling themselves.

Most traders know that downtrends get disrupted by short periods of improvement, basically tiny rallies that create a momentary price spike.

The biggest drawback of the pattern from a technical aspect, is that it can be spotted only after it occurs.

After the bounce, the price increase for a short time, and is followed by a new price decline.

Making it difficult to figure out if the increase in the price is a legitimate recovery or just a dead cat bounce hitting the market.

Also Read: How Do You Trade With A Volatility Indicator?

Contents

- What the Dead Cat Bounce Indicates about the Stock Price

- Difficult to Identify on Time

- The Length of Dead Cat Bounces

- Example of a Dead Cat Bounce

- Limitations in Observing a Dead Cat Bounce

- Shorting a Dead Cat Bounce

- Conclusion

- FAQs

What the Dead Cat Bounce Indicates about the Stock Price

The dead cat bounce is used in technical stock analysis, and typically having solid knowledge of business s fundamentals is the more practical method for quality market returns.

However, understanding certain technical analysis concepts make it possible to recognize if a price is rising, because the company that has issued it is improving its performance. Or trades are drawn to the asset because the lower price is more attractive after a prolonged decline.

The aim of properly recognizing a dead cat bounce is to resolve the dilemma as an asset increasing in value following a sustained decline and will it stay the course.

If an investor sells a given stock short and observes the rise in price as a dead cat bounce, they can choose to keep the short position. Alternatively, when an investor observes a price movement as a continuous increase, then the investor can close the short position.

Difficult to Identify on Time

The biggest problem with the dead cat bounce is that traders are not able to identify it with reasonable accuracy, and is most obvious when the market gets retrospectively analyzed in hindsight.

Plenty of analyst’s attempt to incorporate statistical tools to predict the existence and stop possible losses for the trader.

No conclusive data is apparent immediately, only after a given period can things get understood in the proper perspective.

Although there is sufficient information for serious financial analysis to simultaneously identify a dead cat bounce.

The Length of Dead Cat Bounces

The size of a dead cat bounces is not predetermining and frequently is in different lengths of time. When a dead cat bounce happens it can be a couple of days to a few months.

The irregularity of the dead cat bounce complicates things even more preventing precise observation of a dead cat bounce.

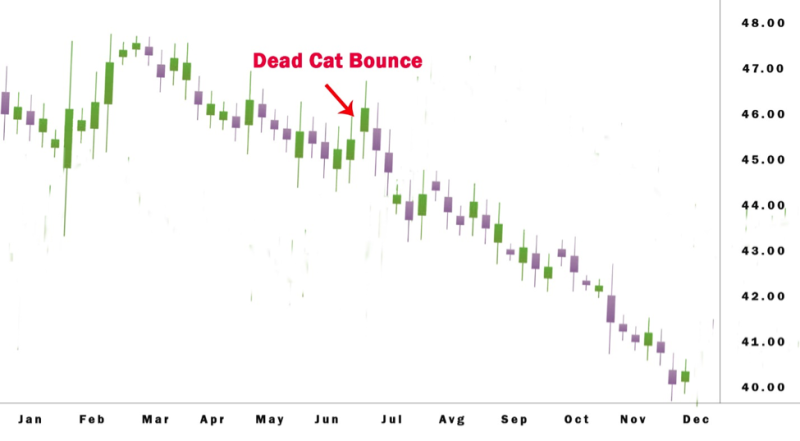

Example of a Dead Cat Bounce

Let's consider a fictitious example that can help us to illustrate the application of the dead cat bounce. The stock prices for ABS Computers reaches an all-time high at $94 per share in June before declining to $12 in December.

ABC Computers observes a dead cat bounces in the ensuing months, recovering to $30 by February next year, just to decline again, this time to $11 in April. At the end of the year, the stock charts signal the stock gets traded at $25, which is nearly a quarter of the peak price.

Limitations in Observing a Dead Cat Bounce

The biggest problem as previously stated is that the dead cat bounce becomes apparent only after the fact. Creating a potential trap for investors who observed the failed rally following a drastic fall in price value, but are unsure if the new rise is temporary or a signal of a stable uptrend.

Most traders are trying to figure out a solution to the question of whether the upward movement is a signal of a reversal in the trend or a dead cat bounce giving false hope.

So far there hasn’t been much progress in creating a tool for identifying a market bottom with absolute certainty.

Shorting a Dead Cat Bounce

The dead cat bounce typically results from news, most often earnings reports that are published overnight. Investors observe the prices' sharp decline, and the moment it begins to bounce, they are prepared to go short.

They select this option because the stock is not reinvigorated it’s still the same low-performing asset, what has changed is other investors are panicking and trying to offload the stock in effect driving the price lower and making it possible for day traders to step in and short-sell in the market.

Soon the price will come back into the area of its starting price. It’s important to know that the zone encompassing the open price is probably the resistance level.

Investors aim for the price to move near the open price, however it can remain under or over. When the price joins the proximity of the open price, it can be ready to begin a short position.

The short position should get assumed after the price begins to decline for a second time.

This patient move expecting the decline close to the open price makes it possible for the trader to get verification of a dead cat bounce.

Also Read: What is Short Selling: Profit Making Strategy?

Conclusion

The dead cat bounce is used by technical analysts to describe a situation when an asset has a short-term spike in upward movement in what was previously generally a downward trend.

This interim rally in the price of a stock is not sustainable and usually returns to the prior low or archives new lows.

Dead cat bounce is problematic because the pattern is identified after the fact, making it of little value in real-time trading. Short-term traders try to spot the bounce to profit for the interim peak in the assets price.

FAQs

Why Do Dead Cats Bounce?

The dead cat bounce is a price pattern, that occurs when a price makes a short-term rise, just to decline under its previous low. It's normal for downtrends to experience brief rallies, causing the prices to temporarily rise.

How Long Does a Dead Cat Bounce Last?

The occurrence of a dead cat bounce can last from a couple of days to a few weeks or months.

How Can You Tell if a Dead Cat Is Bouncing?

The dead cat bounce has a drastic fall in a stock's price, which is followed by a short rise and a new decline. Investors observe the decline in price fall. and when the bounce commences trades are ready to go short.

Where Did the Term Dead Cat Bounce Come from?

The term gets borrowed from the fact that if a dead cat gets dropped from a large height will bounce off the floor and raise a certain length before coming down again.