DBG Markets Review

DBG Markets is a forex and CFD broker that provides trading access across a range of asset classes, including forex, commodities, indices, and stocks. Their platform is designed to cater to both beginner and professional traders, offering flexibility in account types and competitive spreads for efficient trading.

One of the key advantages of DBG Markets is its use of the industry-standard MetaTrader 4 and MetaTrader 5 platforms, which are known for robust features and user-friendly interfaces. With these tools, traders have access to advanced charting, automated trading, and multiple execution types, essential for a streamlined trading experience.

What is DBG Markets?

DBG Markets is an online forex and CFD brokerage offering a platform for trading various assets, including forex pairs, commodities, indices, and stocks. They cater to traders of all experience levels by providing access to popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their advanced features and usability.

The broker is focused on delivering a user-friendly experience and comprehensive financial services with competitive spreads, multiple account types, and a range of educational resources to support traders. DBG Markets also claims to prioritize security by following regulatory guidelines and maintaining client funds in segregated accounts, making it a potentially viable option for those seeking a secure trading environment.

DBG Markets Regulation and Safety

DBG Markets is regulated by multiple bodies, including the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) in South Africa, among others. The broker says it follows tight regulatory rules and keeps client cash in segregated accounts from operational monies. This is a frequent precaution to protect client assets if the broker runs into financial trouble.

Additionally, DBG Markets claims to apply modern security methods to protect user data and trading activity. They deploy encryption and secure server infrastructure to protect online trading data. However, traders should check the broker’s regulatory credentials and licenses to guarantee they meet local regulations.

Traders should verify DBG Markets’ regulatory status to understand their protections. This may affect dispute settlement and compensation, which are crucial to client confidence in their trading platform. That’s why regulators lang Financial Sector Conduct Authority (FSCA) doing the overseer for traders to trust this broker.

DBG Markets Pros and Cons

Pros

- Competitive spreads

- Multiple platforms

- 24/5 support

- Educational resources

Cons

- Limited regulations

- No U.S. clients

- Withdrawal fees

- Inactivity fees

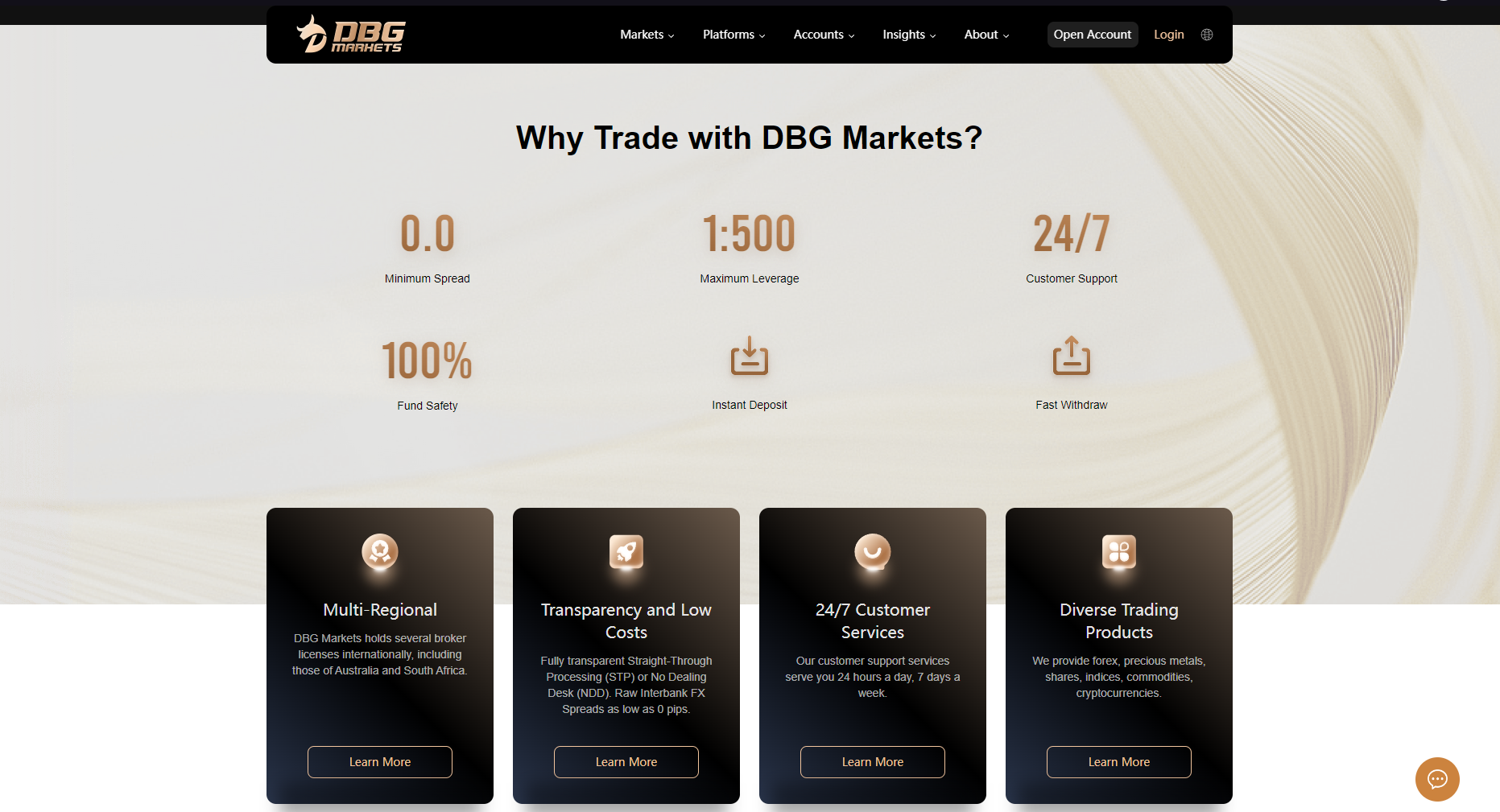

Benefits of Trading with DBG Markets

DBG Markets offers competitive spreads to decrease trading costs and boost profits. This helps high-frequency traders find cost-effective trading circumstances across asset classes.

The broker offers MetaTrader 4 and MetaTrader 5, two prominent trading platforms with comprehensive charting and automated trading. With these systems, traders can easily undertake technical analysis, develop automated strategies, and execute precise trades.

DBG Markets offers 24/7 customer service via numerous methods to help traders. For beginner traders, the broker offers seminars and courses to develop skills.

DBG Markets observes regulations and segregates customer funds for security. This protects traders’ funds and boosts platform trust.

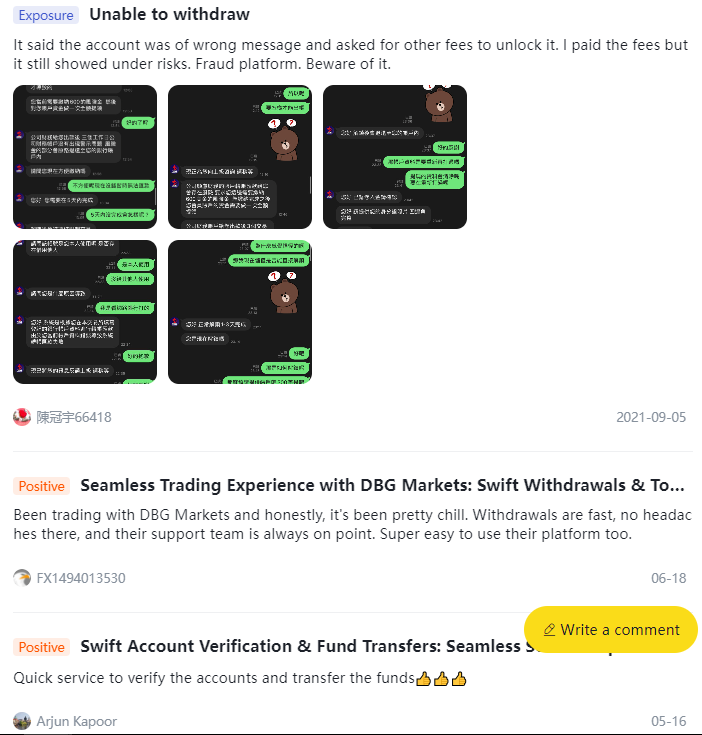

DBG Markets Customer Reviews

Customers generally appreciate DBG Markets for its user-friendly platforms, especially the availability of MetaTrader 4 and MetaTrader 5. Many reviews highlight the convenience of these platforms for charting and trade automation, which enhances the overall trading experience.

Positive feedback often mentions the broker’s responsive 24/5 customer support, with traders noting quick resolutions to inquiries. This level of support can be a key advantage for those who may need assistance outside of standard business hours.

DBG Markets Spreads, Fees, and Commissions

For cost-conscious traders, DBG Markets offers reasonable spreads on main forex pairings. Active traders may afford spreads as little as 1.0 pip for major currency pairs like EUR/USD.

Along with spreads, DBG Markets imposes non-trading fees. Certain payment methods have withdrawal fees, which might harm traders who often transfer funds. Unused accounts incur an inactivity fee, thus active account management is crucial to avoid fees.

DBG Markets makes money on spreads, not commissions, on ordinary accounts. However, traders utilizing particular account types or higher leverage levels may incur various fees, so it’s vital to study their charge schedule to understand their total trading costs.

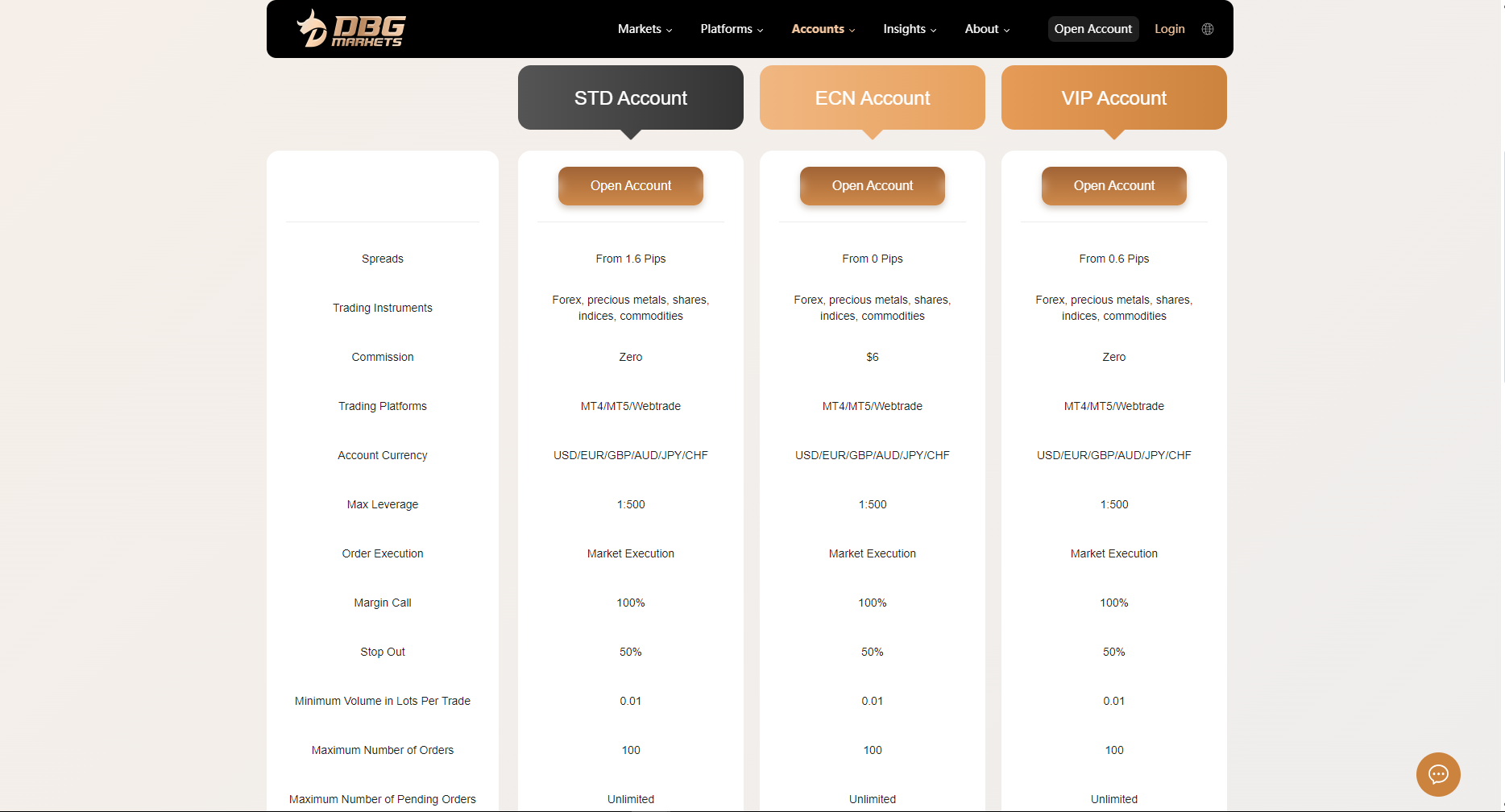

Account Types

DBG Markets offers a range of account types designed to accommodate traders of all experience levels, from beginners to professionals. Each account provides unique features, and including competitive spreads, customizable trading options.

Standard Account

The Standard Account is designed for beginner and intermediate traders, offering access to all major asset classes without any commissions on trades. It features competitive spreads starting from 1.0 pip and allows for flexible leverage, providing an entry-level trading experience with minimal costs.

ECN Account

The ECN Account targets more experienced traders, offering tighter spreads and lower trading costs compared to the Standard Account. This account may include small commissions on trades to offset the reduced spreads, appealing to high-frequency and professional traders seeking a more cost-effective setup.

VIP Account

The VIP Accounts are tailored for high-net-worth or professional traders who require the best possible trading conditions. With access to the lowest spreads, priority customer support, and customizable trading options, the VIP Account is ideal for those trading at higher volumes and looking for premium account features.

There are options like the demo accounts. Demo accounts are good option to practice the culture in this journey. Depending on traders trading strategies, DBG Markets clients must be careful and analyze every account on what trading instruments, maximum leverage, minimum deposit, and market solutions and ideas they are chasing for. These accounts has different approach and benefits.

How to Open Your Account

Opening an account with DBG Markets is a straightforward process designed to get traders started quickly and securely. The following steps outline what new users can expect, from registration to funding their account, ensuring a smooth onboarding experience.

Step 1: Registration

To begin, go to DBG Markets official website users must fill out a registration form on the DBG Markets website, providing basic information like name, email, and phone number. Once submitted, they’ll receive a confirmation email to verify their account and proceed to the next step.

Step 2: Account Verification

DBG Markets requires new users to complete a verification process to comply with regulatory standards. This involves uploading documents like a government-issued ID and proof of address to confirm identity and residency, which is essential for account security.

Step 3: Account Selection

After verification, traders can choose the account type that best fits their trading needs, such as the Standard, Pro, or VIP Account. Each account type offers different trading conditions, so selecting the right one can enhance the trading experience.

Step 4: Fund Your Account

Once an account is selected, users can deposit funds through various methods, including bank transfers, credit/debit cards, or e-wallets. DBG Markets provides multiple payment options to accommodate different preferences, allowing traders to fund their accounts conveniently.

Step 5: Start Trading

With a funded account, users can now access DBG Markets’ trading platforms and begin trading. They can explore a range of assets and take advantage of available tools and features to execute trades and manage their portfolios effectively.

DBG Markets Trading Platforms

DBG Markets offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two popular trading platforms for market analysis and trade execution. The configurable charts, automated trading with Expert Advisors (EAs), and easy navigation for all experience levels make MT4 perfect for FX and CFD traders. MT5 adds stocks, commodities, improved charting, and an economic calendar for market insights.

DBG Markets offers WebTrader, a browser-based version of MT4 and MT5 for immediate access without downloads, and an iOS and Android mobile trading platform app for flexibility. Traders can watch markets and manage their accounts from anywhere using the trading platform mobile app, making it easy to stay connected and active in the markets.

What Can You Trade on DBG Markets

DBG Markets offers a range of tradable assets, allowing traders to diversify their portfolios across different financial markets. From forex to commodities, DBG Markets provides access to popular and widely traded instruments, each offering unique opportunities and trading conditions.

Forex

DBG Markets provides access to major, minor, and exotic currency pairs, enabling traders to participate in the world’s largest financial market. With competitive spreads and leverage options, forex trading on DBG Markets is suitable for both short-term and long-term trading strategies.

Commodities

Traders can trade popular commodities like gold, silver, and oil, which can be ideal for hedging or diversifying portfolios. These assets are influenced by global economic events, providing traders with opportunities tied to supply-demand dynamics and geopolitical factors.

Indices

DBG Markets allows trading on major global indices, including the S&P 500, NASDAQ, and FTSE 100. Trading indices lets traders speculate on the performance of entire market sectors or economies rather than individual stocks, making it a popular option for broader market exposure.

Stocks

With DBG Markets, traders can access a selection of international stocks from major companies, providing opportunities for trading individual equity movements. Stock trading allows users to capitalize on company-specific news, earnings reports, and broader market trends.

Cryptocurrencies

DBG Markets offers cryptocurrency trading on major coins like Bitcoin, Ethereum, and others, giving traders exposure to this rapidly growing digital asset class. Crypto trading provides high volatility, making it suitable for traders seeking potential high-reward opportunities in short time frames.

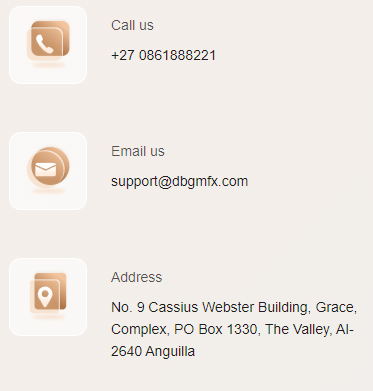

DBG Markets Customer Support

DBG Markets provides 24/5 customer support to assist traders with any issues or questions throughout the trading week. Their support team can be reached through live chat, email, or phone, giving traders multiple contact options to resolve concerns quickly.

The broker’s responsive support aims to help with account setup, technical platform issues, and general trading inquiries. For beginners, DBG Markets also offers educational resources, including tutorials and webinars, to help improve trading knowledge and skills, making it easier to navigate the platform and understand market dynamics.

Advantages and Disadvantages of DBG Markets Customer Support

Withdrawal Options and Fees

DBG Markets offers several withdrawal methods to provide flexibility and convenience for traders looking to access their funds. Each withdrawal methods comes with its own processing times and potential fees, so traders can choose the one that best suits their needs.

Bank Transfer

Bank transfers allow traders to withdraw directly to their bank accounts, a secure option suitable for larger amounts for deposit and withdrawal transactions. Processing times typically range from 3 to 5 business days, and fees may vary depending on the bank and region.

Credit/Debit Card

Withdrawals via credit or debit card are commonly used for their speed and ease, with processing typically completed within 1 to 3 business days. While convenient, these transactions may incur a small fee depending on the card provider and location.

E-Wallets

DBG Markets supports popular e-wallets like Skrill and Neteller, which offer quick processing times, often within 24 hours. E-wallets can be a fast, low-fee option, though specific fees depend on the e-wallet provider.

Cryptocurrency

For traders using digital assets, DBG Markets offers cryptocurrency withdrawals, allowing direct transfer to a crypto wallet. This method is generally fast, with transactions processed within hours, but may include blockchain network fees based on the cryptocurrency used.

DBG Markets Vs Other Brokers

#1. DBG Markets vs AvaTrade

DBG Markets and AvaTrade offer liquidity in forex, commodities, indices, and cryptocurrencies, but they target different traders. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms from DBG Markets offer flexibility for traders who choose these powerful and popular tools. AvaTrade offers its own AvaTradeGO app and social trading platforms like DupliTrade for copy trading and automated techniques. AvaTrade has regulatory licenses in Europe, Australia, and Japan, which may give risk-averse traders confidence, while DBG Markets has fewer regulations. Both brokers offer educational resources, however AvaTrade’s huge library and specialized starter assistance may appeal to newbie traders, while DBG Markets’ reduced spreads may appeal to cost-sensitive, experienced traders.

Verdict: AvaTrade is a strong choice for traders seeking varied platforms and comprehensive regulatory oversight, especially for beginners or those interested in social trading. For traders focused on lower spreads and the MetaTrader platforms, DBG Markets could be the more cost-effective option.

#2. DBG Markets vs RoboForex

DBG Markets and RoboForex offer forex, commodities, indices, and cryptocurrency markets, but their platforms, account types, and fees differ. RoboForex offers MT4, MT5, cTrader, and its proprietary R Trader platform, which allows for customizable trading solutions and additional tools. DBG Markets focuses on MT4 and MT5, which are popular platforms. RoboForex now offers cent accounts for micro-lot trading and ECN accounts for ultra-tight spreads to fit a variety of budgets and trading methods. RoboForex has flexible leverage options and competitive spreads, sometimes lower than DBG Markets, however DBG Markets’ account setup may be simpler. Both brokers offer educational resources, but RoboForex’s large selection and VPS support appeal to expert traders.

Verdict: RoboForex is ideal for traders looking for a wider choice of platforms, diverse account types, and extra features for advanced trading. DBG Markets, with its focus on MT4/MT5 and a simpler account setup, is better suited for traders who prefer a straightforward, user-friendly experience.

#3. DBG Markets vs Exness

DBG Markets and Exness offer forex, commodities, indices, and cryptocurrencies, however their platform diversity, account options, and cost transparency varies. To attract traders who want familiar, trustworthy trading tools, DBG Markets uses MetaTrader 4 (MT4) and MetaTrader 5 (MT5). However, Exness offers MT4 and MT5 together with its web-based trading platform for a more flexible, accessible trading experience. Exness offers Standard, Professional, and 0 accounts with spreads as low as 0 pips, which may appeal to high-frequency traders seeking inexpensive expenses. DBG Markets’ simpler account structure makes it easier for inexperienced traders, but minimum spreads are greater. Both brokers stress competitive costs and fast execution, while Exness’ real-time support and 24/7 assistance may benefit traders who trade 24/7.

Verdict: Exness stands out for traders seeking flexible account options, ultra-low spreads, and round-the-clock customer support. DBG Markets, with its straightforward account types and focus on MetaTrader platforms, remains a solid option for those prioritizing ease of use and reliable platform choices.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH DBG MARKETS

Conclusion: DBG Markets Review

DBG Markets is a reliable broker option for traders looking to use the popular MetaTrader 4 and MetaTrader 5 platforms. It offers access to forex, commodities, indices, and cryptocurrencies, catering to a range of trading interests with competitive spreads and account options suited for both beginners and experienced traders.

Customer support is available 24/5, with multiple contact methods, though 24/7 support isn’t provided. While DBG Markets follows regulatory guidelines and segregates client funds for security, its regulatory coverage is more limited compared to some other brokers. Overall, DBG Markets is a practical choice for traders focused on cost-effective trading with solid platform features.

DBG Markets Review: FAQs

What platforms does DBG Markets offer?

DBG Markets provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), popular platforms known for advanced charting, multiple order types, and automated trading capabilities.

Is DBG Markets regulated?

DBG Markets claims to follow regulatory standards and keeps client funds in segregated accounts, though its regulatory scope is more limited than some other brokers. Traders are encouraged to verify regulatory details directly with DBG Markets.

What types of accounts are available?

DBG Markets offers Standard, Pro, VIP, Demo, and Islamic accounts. Each account type provides different trading conditions, spreads, and features tailored to suit various trading needs.

OPEN AN ACCOUNT NOW WITH DBG MARKETS AND GET YOUR BONUS