DAX Approaches Previous High

The DAX index gained momentum on Monday, continuing its climb towards recently established all-time highs. Gains in the utilities, food and beverages, and chemicals sectors contributed to the positive movement. Hints of summer rate cuts by the ECB lifted the market sentiment.

Early trading on Tuesday showed small gains, with the index now just over 100 points from the mid-May high at 18,935. Beyond this point, the price will enter uncharted territory.

Last week, support emerged at the trendline from the April low, with the price briefly dipping below the early April highs of 18,636. The overall bullish outlook remains strong.

Dow Faces Pressure Amid Recent Weakness

US markets were closed for Memorial Day on Monday, and the Dow continues to hover around last week’s low. The index dropped sharply on Thursday following negative news for Boeing, resulting in its worst day in a month. All 30 components fell for the first time since December 20.

Bulls are looking for stabilization above the 50-day simple moving average (SMA) and a revival back above 39,400 to help establish a low. This could set the index on course to test the 40,000 area again.

A close below the 50-day SMA would pressure the index, potentially leading to the late April high at 38,500 and possibly down towards 38,000.

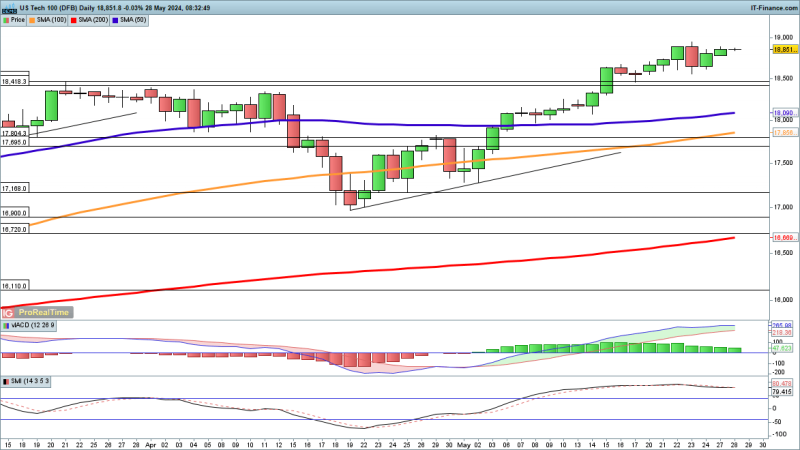

Nasdaq 100 Nears Record High

Boosted by Nvidia’s earnings, the Nasdaq 100 shrugged off Thursday’s dip, unlike the Dow, and moved higher towards the end of the week.

In the shortened week, the Nasdaq 100 is on track to test last Thursday’s record high at 18,949. Beyond this, the 19,000 level is the next major milestone.

A short-term bearish outlook would require a close below 18,552, Thursday’s low, which would then test the record high set in March around 18,500.