If somebody told you that the best way to understand the market dynamic, when preparing a trading strategy is to check the ideas of a dancer, you probably would be shocked, to say the least.

Taking a closer look at the case of Nicholas Darvas and his approach to trading reveals that his method is profitable, something that is confirmed by Darvas’s experience on the market, wherein a period of a year and a half he made $2,000,000 in the stock market.

So, how did a professional ballroom dancer turn himself from an amateur to a broker with a portfolio veteran trader are envious about.

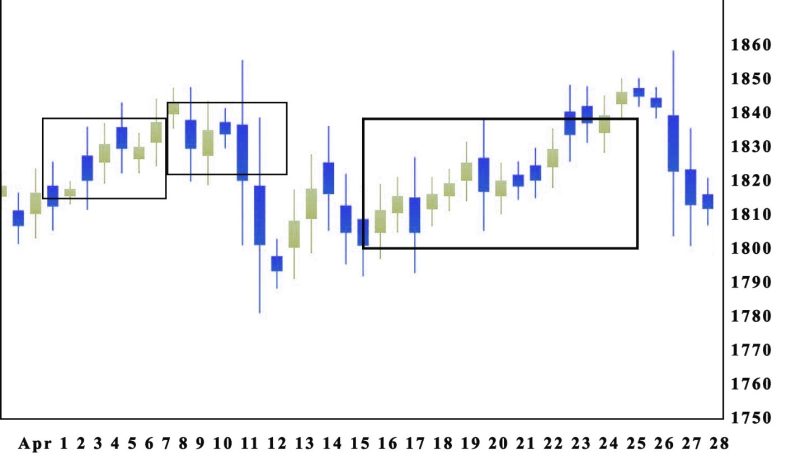

The idea behind his Darvas box trading strategy is that investors can target stocks by observing the highs and volume as important signals.

The strategy involves purchasing assets that are trading at new highs and then drawing a box around the recent highs and lows to authorize an entry and exit points and stop-loss order.

For a stock to be perceived as part of the Darvas box the price action has to go over the preceding high but goes back to a price that is not distant from that high.

Also read: What Is The TRIX Indicator

Contents

- How The Darvas Box Theory Works

- Darvas Box Strategy

- Limitations Of The Trading Strategy

- Insights From Modern Stock Market

- Example Of How Darvas Boxes Is Created

- Darvas Strategy — Breakouts from Consolidation

- Conclusion

- FAQs

How The Darvas Box Theory Works

The theory was developed in the 50s of the last century when Nicholas as a professional ballroom dancer got a subscription to the Wall Street Journal and started exploring trading opportunities.

At its core, he used a technique that pursue the momentum of stocks.

The assumption is that assets that experienced a rise in the past are more probable to repeat the same tendency in the future.

The opposite is also true of stocks that had a decline in the past, they have the potential to repeat the downward movement in the upcoming days or months.

Prices that expanded a while ago are more likely to rise in the future. The opposite is true of stock prices that were plunging before have a greater chance to decline in upcoming months.

The insight offered is that investors need to enter or exit given positions by depicting boxes all over the highs and lows over a certain period of time.

Basically, telling traders to only get long positions in boxes that signal climbing prices and use the highs of those boxes to prepare exit points. In cases when the stock price goes under that exit point, the stock has to be sold.

Darvas Box Strategy

The Darvas Box Theory is essentially a technical trading strategy that uses information about pricing and volume to give data that guide decisions made by investors.

Darvas wasn’t a total amateur he tried to educate himself on the market and utilized fundamental analysis to help him choose what stocks he should target.

The fundamental analysis incorporates watching qualitative and quantitative elements of individual investments to recommend investment decisions.

Darvas checked to see which companies were financially stable and pointed to industries that were making market-disrupting and revolutionary products and showed large potential for profits.

Basically, if a stock that is being observed in the “price box” is for example bouncing around at $22 and $28 that you can be sure that if it goes over $30 that you should buy the stock.

If the assets go back in the box that it comes to the stop-loss orders. The idea is to verify an uptrend with higher prices.

Limitations Of The Trading Strategy

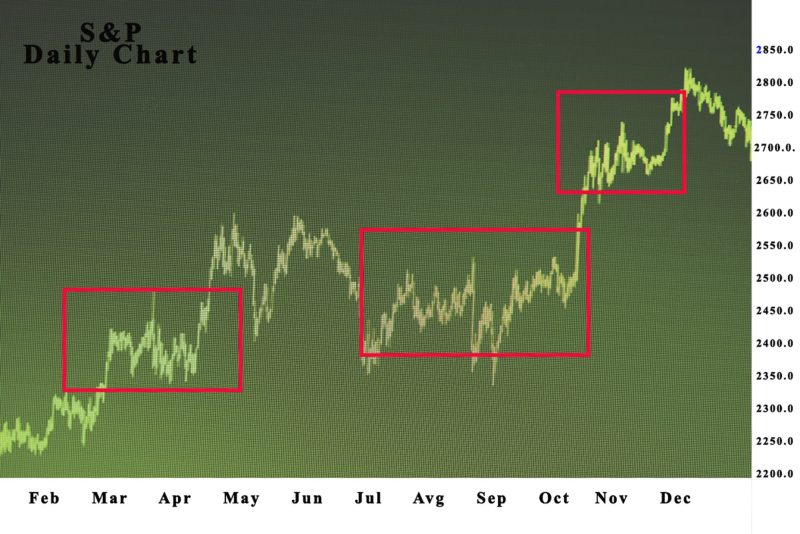

Many brokers prefer to use Darvas box theory when making decisions about market investments, but there are skeptics that claim that his success came from trading in a market with bullish tendencies, but not in a bear market, where the potential of the Darvas box for profit was not tested.

Suggesting that his theory is appropriate for bearish markets, and by implementing the box in a bear market the possibility for large losses is present, no matter the stop loss. How well it can be implemented in today’s markets is dependent on many factors.

Insights From Modern Stock Market

The Darvas box was productive when first used but it’s probably not as useful in the modern investing landscape. Information distribution is mast faster today than six decades ago when Nicolas had his big trades. Still, there are insights that can be taken from the theory and implemented in modern circumstances, namely:

- Focusing on emerging industries

- Trading high-volume securities

- Use of stop-loss orders

The idea behind the theory is for traders to concentrate on stocks with high volume because they are an indicator that a stock is displaying strong moves.

Practices like this are restricted today because the large trading volume is routinely formed by software platforms.

Darvas used stop-loss orders to reduce e losses it is a free order instruction that advises traders to sell a position when the stock goes under a given point. With a stop-loss order, investors can minimize losses.

Example Of How Darvas Boxes Is Created

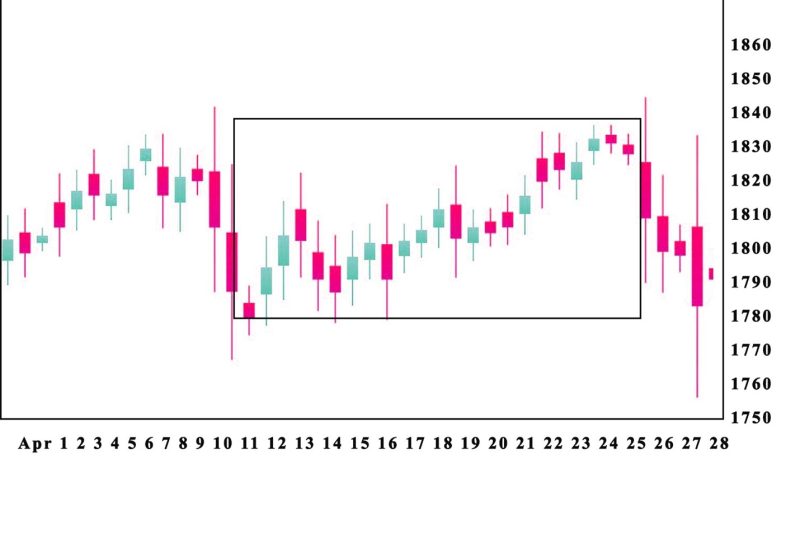

For the Darvas box to be initiated, investors need to find the 252-day high. The following step is to locate the top of the box, which is created by a four-day pattern. The initial day is the high of the original step, which is built upon with the next three days of lower highs.

The value is not important what is crucial is that they are lowered than the successive high, when the pattern is located the high is applied as the top of the box.

If you have located the top of the Darvas box the next step is to located the opposite and the easiest way is to start from the beginning from the low of the first bar. When the pattern is formed the low from the initial high turns into the bottom.

When the Darvas box has created a breach over the or under will produce a purchase or neglect the signal.

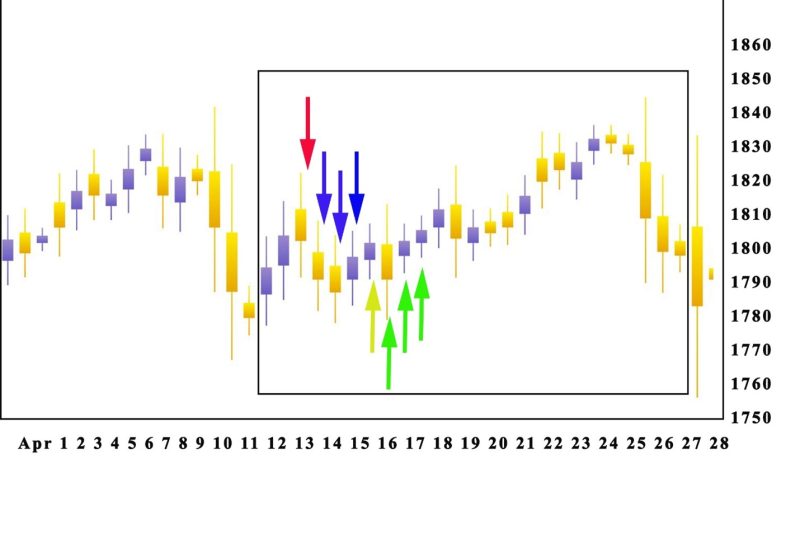

The fresh high is located (red arrow) it shows us the beginning time frame and the top cost of the box.

The high of the following three days (blue arrows) have to be smaller than the initial high.

Beginning from the first bar (red arrow) low we are observing look for three days in a row if a new low is not formed (green arrows). From this moment, the box is created with the bottom of the box equivalent to the smallest low.

The box is prolonged until it’s intrude, if it is place to near, the box should be prolonged for an extra day.

Darvas Strategy — Breakouts from Consolidation

The difference between the Darvas box and most other trade breakouts is the rules about how the box forms.

Darvas would search for highs in price but he never gave a precise number of the time frame he would use. He looked for assets that were expected to rise in his day the options were numerous.

Darvas box theory also takes into account volume to help in determining if a breakout could be continued.

Conclusion

Darvas box theory is a good technical analysis tool when trading stocks, but it has to be used with other technical tools and information about the company’s potential.

It is a market momentum theory that when used in a valid box on a chart reveals sell signal to prevent losing trade, but also in rising boxes the entry point for a profitable trade.

Learning the meaning of proper drawing boxes to find valid box top and for the price will enable many traders to find success.

The big benefit of the Darvas box technique is that they can be used in the timeframe, making them solid choices for day traders. It should not be forgotten that the success Nicholas Darvas had was in a bullish market not in a bear market.

But it cannot be done without collecting data on previous periods, that way you can make informed decisions. By collecting the trade data, investors can assess the right configuration.

Traders need to define similar parameters it is recommended to experiment with the indicator settings and discover what can be most appropriate for your technique.

Following the trading rules enable identifying entry points for day trading by looking at consecutive days of recent high in price rise.

Also read: Spinning Top Candlestick Complete Guide

FAQs

Is Darvas Box effective?

The Darvas box strategy is effective if the rules are followed, the risk that comes with Darvas’s box is minimal, but losses can result if the trend doesn’t develop as initially planned.

How do you use Darvas Box Indicator?

When an asset is making a new high over a period of a year, and after three more days the high is not exceeded. If the new high becomes the top of the box then the breakout point is causing the new high to turn into the low of the Darvas box.

When this happens purchase the break of the box when it goes over the high by several points.

Where is Darvas Box in Zerodha?

The Darvas box is present in Zerodha charts enabling attachment of an indicator to any asset.

Is Nicolas Darvas still alive?

No, Nicolas Darvas is deceased he passed away in 1977.