The Cypher pattern is an obscure harmonic trading formation. Maybe the enigmatic name is the reason for the lack of prominence, yet it’s a quality tool for trading in financial markets.

It’s important to know that the Cypher pater can be both bearish or bullish and is a reversal pattern that identifies market trends.

Geometric patterns get frequently used in Forex price charts. As previously mentioned, the Cypher pattern is a harmonic trading pattern with the highest winning rate.

The Cypher pattern is an extension of the consolidated price action pattern that can be found in all markets. By itself, the pattern can offer investors a quality trading strategy.

Brokers that have used other harmonic patterns in the past are aware of the benefits in detecting reversal points. And that with these patterns in the toolbox successful trading is possible to meet the investment objectives.

Great instrument for locating a downward trend or to check if the asset is trending upwards.

Also read: Harmonic Patterns: A Complete Guide

Contents

- What are Harmonic Patterns?

- The Cypher Pattern Rules

- Drawing the Cypher Patterns

- Bullish Cypher Pattern

- Bearish Cypher Pattern

- Cypher Pattern Trading Strategy

- Cypher Pattern Strategy Success Rate

- Conclusion

- FAQs

What are Harmonic Patterns

Harmonic patterns are trend reversal patterns formed from geometric formations, Fibonacci extensions, and retracement levels. The ability to forecast price movements is the crucial benefit traders receive from a harmonic pattern indicator.

By locating patterns of contrasting degrees and dimensions and administering Fibonacci numbers to them, day traders can predict the movements of assets. Harmonic patterns are an accurate tool for identifying reversals.

The Cypher Pattern Rules

Every trading pattern relies on guidelines for its implementation. In the case of the Cypher pattern, traders must be on the lookout for five different points. Letters from the alphabet get used to indicate the points, and they are A, B, C, D, and X points. The lines between each point get referred to as the legs.

The pattern starts with the XA leg, and the D point exhibits the pattern wrap up. The AB, BC, and CD are the remaining legs.

The B point has to retrace in the reversal ranging of 38.2%, and 61.8% of XA, with a minimum of 38.2% but not over 61.8%.

The C point is a protracted leg and goes ahead of A – but must be at least 127.2%, while it’s normal to go up to 113% and 141.4%.

The leg CD should deflect the XC at the 78.6% level.

The potential reversal zone of point D is a wide range where the price is going, and the price can move amid 38.2% and 61.8%.

The pattern that doesn’t meet these demands doesn’t qualify as a Cypher pattern and can be miss understood as a valid pattern. Investors need to know that there are plenty of XABCD patterns on the market.

In comparison to other harmonic patterns, the Cypher pattern has fewer rules to follow.

On the other side, the success is not as high as other patterns, yet the ease of use makes the pattern popular among newbie traders.

The best results get achieved when the market is tranquil. The reliability declines after a strong trending market.

Drawing the Cypher Patterns

If you want to start drawing cypher patterns click the harmonic pattern indicator located in the menu of the trading software you are using. Locate the initial point X on the chart, it can be any crest or trough of the wave pattern.

When you identify it observe and follow the trend of the market. To constitute the Harmonic patterns in trading the minimum is four trending low or high points connected.

The legs of the pattern have to be in line with the rules for the Cypher trading pattern.

When implementing the Cypher Patterns, investors have to observe the reversal in theCD leg. When the leg comes to 0.786 of the XC leg, trades can interpret it as a signal to purchase. An additional recommended point to start purchasing is the preceding point of the XC leg.

Its also important to place Stop Loss, which should be under the X point on the trend. These position offers advantages and can protect from unexpected losses in case there is a break under the point.

Normally you are doing all these works to make a profit, so where do you place the take profit point. Focus to take your profit when the asset you are trading reaches point A on the pattern.

Because the Cypher patters are known for their retracing attributes it is a priority to take your profit as fast as possible before there is new backtracking of the market at any given time.

Waiting can be costly, dot risk accumulating losses because of the new swing in the direction of the trend. Do not postpone taking your profit.

Understandably, the more conservative profit limits that are afforded by the pattern can make for a tempting idea to wait a while and get more, still, it’s preferable to know when to quit a situation and keep your winnings.

If you guide yourself by the above-mentioned steps, you can play it safe and the best-case scenario is to level the trade with minimal losses. tern has a conservative target of making a profit. It would be better to take profits once you reach point A of the pattern. Yes, you heard me right. You must!

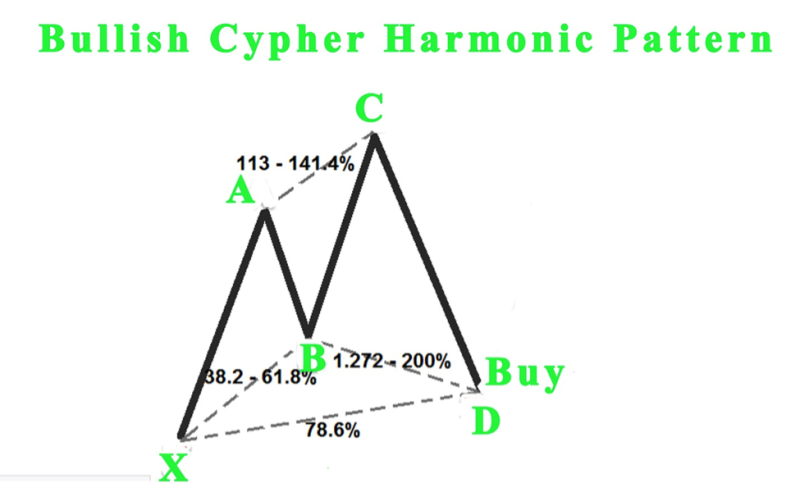

Bullish Cypher Pattern

The bullish cypher patterns rules identify the crucial points X, C, and D. In the case of the bullish cypher pattern, X needs to be the pattern low while the high gets represented by the C. We can examine the aspects of the bullish variation of the Cypher pattern.

The basic leg is the XA leg, which rallies higher from the beginning point at X. While the AB leg goes lower to backtrack the XA leg. The retracement can bring prices amid 38.2 to 61.8% level of the XA leg.

The CD leg goes lower and ends close to 78.6% retracement level of the price move from point X to point C. While BC leg goes higher and takes out the swing high at point A, ending amid the 127.2 and 141.4 extensions of the initial XA leg.

When the price comes to the 78.6% retracement level at point D, the bullish Cypher pattern finishes, and the expectation is the price to start climbing.

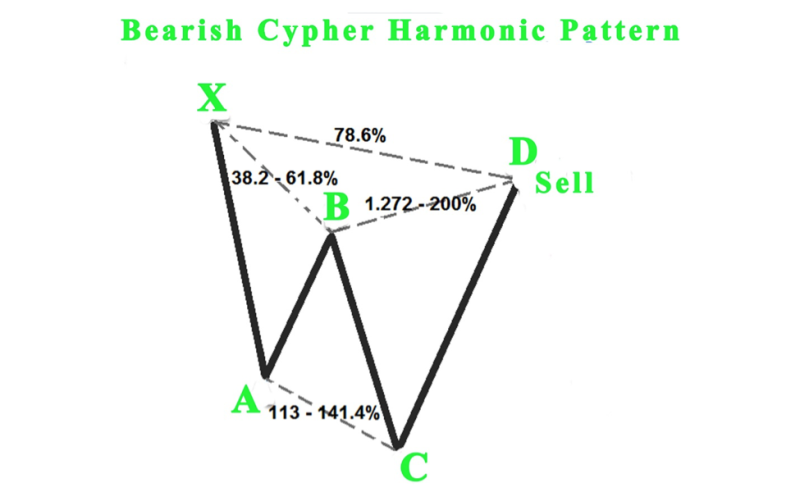

Bearish Cypher Pattern

A bearish cypher pattern makes it’s high at X and it’s low at C. The bearish variation of the Cypher begins with the first XA leg, taking a downturn from the initial x point.

The AB leg goes higher to backtrack the XA leg. This retracement can bring prices between 38.2% to 61.8% level of the XA leg. While CD leg goes higher and ends close the 78.6% retracement level of the price move from point X to C point.

The BC leg goes lower and takes out the swing low at point A, and ends between 127.2 and 141.4 projection of the starting XA leg.

When the price comes to the 78.6% retracement level at point D, the bearish Cypher pattern is perceived as finished, and the expectation is for the price to go down.

Cypher Pattern Trading Strategy

When trading with the Cypher harmonic pattern, traders have to be aware of the importance of the nullification level of this pattern. The Forex trading community can use technical analysis or trade patterns as a strategy.

Yet the cypher pattern strategy has to be original to produce profits, because of that it’s advisable to use this pattern for technical analysis and then do the opposite and use analysis to invest with a given strategy.

The first thing to define is the entry point, which has to be after the break of point B or if you are using this pattern as a strategy.

The next moment is to locate the invalidation point that happens when the price goes over point X will be the nullification level in case of a bearish pattern. The price under point X will be an invalidation level in case of a bullish cypher pattern.

While the take profit level begins with point C is signaling the take profit level. The advantage of this pattern is the high risk-reward.

Cypher Pattern Strategy Success Rate

Every trader knows that no harmonic Cypher pattern is 100% precise. The average success rate is around 70% when using the Cypher patterns.

Still, many traders have advocated for 40% as the minimum an investor can perceive as a solid rate that works in his interest. Anything under these percentage levels signals unproductive results of the strategy. You will have to use your own experience to decide if the reported success rates are beneficial to your strategy. As previously mentioned, no technical indicator or chart pattern is precise totally.

The Cypher pattern is one of the most profitable harmonic patterns and is useful for risk management, because of the large success rate. Traders can minimize losses if they follow the Cypher trading rules and meet the profit target. But they need to be careful because losing money rapidly is a possibility, if traders are not focused on the pattern and implement the correct actions.

It’s one of the most exciting harmonic patterns, making for a good addition to a profitable forex trading strategy. Yet any trading system can be effective, only if the rules are understood completely, and is implemented correctly. The best investment advice is that there are no shortcuts to maximize profits.

At first glance, the specific Fibonacci ratios can create doubt in one’s mind if the pattern can be traded correctly. Yet most software trading platforms implement the technical aspect correctly, without much input from users.

It’s up to the trader to interpret the data and make the decision that navigates the course of a trade. It’s an exciting harmonic pattern to use because the visual representation on the chart is can show either rising peaks inside price channels.

The pattern is a technical wave pattern that shows a trending market, with a tendency to perform drastic reversals on a trading day.

The crucial thing about the bullish Cypher is that both the lows and the highs will be moving upwards. While the opposite is correct in the case of a bearish pattern.

Cyphers can emerge in price channels that have been formed. When the Cypher is formed during a reversal at the D point it can turn into a where the price goes amid the lows and highs.

Look for the bearish Cypher points if you are using a bearish Cypher pattern. And remember it may be the most exciting harmonic pattern, but that doesn’t make it precise, use it because of the good track record but be careful in the long run.

Conclusion

Interestingly the success rate of the Cypher Patterns has not made it a staple on trading charts, although it offers better results than other harmonic patterns.

The Cypher pattern is not perfect. The biggest minus of the pattern is the impulse to create trading setups, where the ratio of risk to reward gravitates more toward risk.

To further complicate things if the CD leg continues to backtrack after starting a trade, then you have to adapt the Fibonacci retracement of the CD leg.

That means the take-profit levels will move closer to the entry point. There are no guarantees that the CD leg will not backtrack.

The best way to handle the reward to risk problem is by filtering out Cypher pattern setups that don’t begin with a reward to risk ratio of one to one or better.

Most investors vouch for the relatability of a Cypher patterns trading strategy. If you plan to make serious profits in the forex market, then you should learn the pattern, and use it in trading strategies.

Experience has shown that the pattern is most productive in a calm market, naturally, any new information that can disrupt the dynamic of the situation make the pattern less useful for gauging the upcoming trend.

Investors can guide themselves by the rule if the pattern is bigger and that means it will take for the pattern to emerge and reveal the support and resistance.

Brokers can use Cypher pattern forex input if trading currencies and benefit from a reversal strategy. Making profits is not easy, if that was the case everybody would have been a broker. It takes experience and knowledge to be effective in the market.

The Cypher pattern rules are pretty straightforward. Yet that should not be understood as it is all easy. That type of approach offers false encouragement to beginners, who need a comparative trading strategy, so research other technical indicators and patterns before committing your fund in a trade.

FAQs

What Is Cypher Pattern?

Cypher Pattern is a technical pattern that reveals the trending movement of a market that makes fast reversals in the trading day. The pattern can be both bearish and bullish.

How Accurate Is Cypher Pattern?

Cypher pattern achieves precision levels of 70% if correctly identified.

How do You Calculate Cypher Pattern?

The Cypher pattern needs to satisfy a few rules, AB is among 0.382 to 0.618 retracement of the XA swing leg, while BC extends to a minimum of 1.272 and a maximum 1.414 of the XA swing leg. The CD then backtrack to 0.786 of the XC swing leg.

Who Discovered the Cypher Pattern?

Darren Oglesbee discovered the pattern. From a technical aspect, it’s an advanced pattern formation, but it’s frequently connected with harmonic patterns.