You may have noticed that every time you exchange a local currency for an international currency, you don’t receive the same amount in the different denominations, there is a certain discrepancy in the number of banknotes.

The reason is the exchange rate that determines the worth of a particular currency in association with other currencies.

This gets estimated with the currency strength, which is the relative purchasing power of a currency and is most obvious when one currency is a trader for a product.

The currency strength gets measured by looking at the number of services or products that can be bought for a unit of the currency. When the value of a currency is high it offers more purchasing power.

Also read: Strongest Currency In The World

Contents

- Currency Pairs in Forex Market

- Calculating the Currency Strength

- Trading with Currency Strength

- What Is a Currency Strength Meter?

- How Can the Meter be Useful?

- Is the Currency Strength Meter Accurate

- The Meter Is Updated Regularly

- The Advantage of the Currency Strength Meter

- Conclusion

- FAQs

Currency Pairs in Forex Market

The strength of a currency is a product of the interaction of different factors, most importantly supply and demand in the exchange markets, inflation in the local economy, and interest rates set by the central bank.

Three factors determine the overall strength of a currency.

- Utility: Is it used for financial estimation and is an exchange medium in international economies.

- Value: The buying potential relation to other currencies.

- Reserve: Is it used in international trade, and if foreign central banks use it as a reserve.

When a local manufacturing capacity experiences growth it creates value to the economy, producing more buying power that stimulates consumerism. The spike in demand and supply encourages trade. The local currency gets adopted by international trading partners; whose central banks start to use it as a reserve.

This situation offers trade benefits because it eliminates middlemen, which usually are in the form of stronger currencies like the US dollar.

The extra benefit is that f the trading partner’s currency starts to lose value, the national currency rises in value in the money markets.

Currently, a strong currency is the US dollar. Because the USA has the biggest consumer market, its currency is globally used in trade and as a reserve currency.

Also read: Best Forex Pairs To Trade

Calculating the Currency Strength

In a local economy, the currency strength is estimated as the buying power when purchasing domestic products and gets established on statistics about salaries, that shows the earnings of the population.

The given income value is then modified to the rate of inflation to discover the correct value of the earnings. The true income reveals the correct economic appraisal of the earnings in the pre-inflation economic conditions.

In exchange markets, the potential of a currency gets calculated in association with other currencies pairs in the Forex market. For example, CHF/CAD is one pair of two currencies from countries with strong economies.

Deferent factors can influence the forex market rate of the CHF to CAD, and they can be trade balance, internal economic factors, and political climate.

Alternatively, when a currency of an emerging markets Brazil, in that case, their strength is calculated counter to a global reserve currency. If the Brazilian Real rises contra the U.S. Dollar in the USD/BRL currency pair, the Brazilian economy will get prominence in the global market.

There are currency strength indicators that measure the strength of a currency in the global financial markets. The US Dollar index is the most preferred currency strength meter and has a tradeable derivative ETF in the Intercontinental Exchange.

The USD Index analyzes the strength of the American Dollar contra currencies of large trading partners of the U.S. It estimates a weighted average price of the USD currency pairs. The Euro is the currency that has the most strength in the Dixie with 57% weight, and the weakest currency is the Swiss Franc with only 3.7% weight.

Trading with Currency Strength

In financial markets, the strength of the currency decides the price rates of the Forex currency pairs. Short-term investors follow and analyze economic events that create market confusion, to make decisions. The aforementioned economic events are reports about GDP, central bank meetings, unemployment rates, interest rates, and consumer price index.

When an economic event occurs, the preceding data and the predicted numbers are published, and traders dissect the data to find insight that will offer profitable strategies.

If the current result is compatible with predictions, the strength of the currency will appropriately rise or decline. Contributing to the national currency growth in value or depreciation.

What Is a Currency Strength Meter?

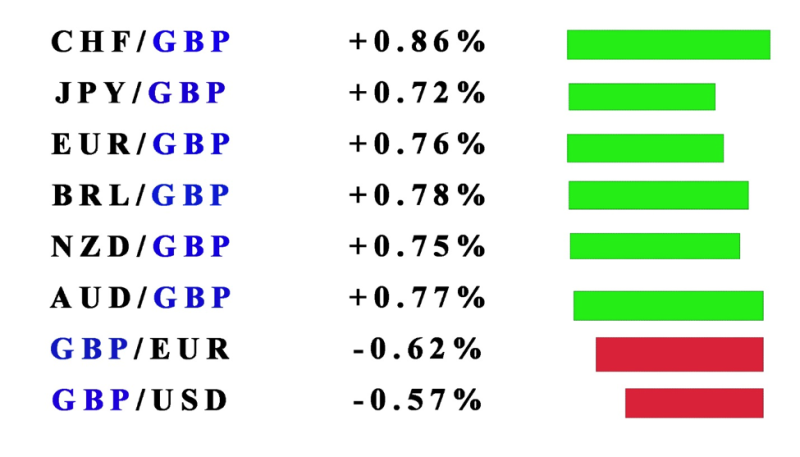

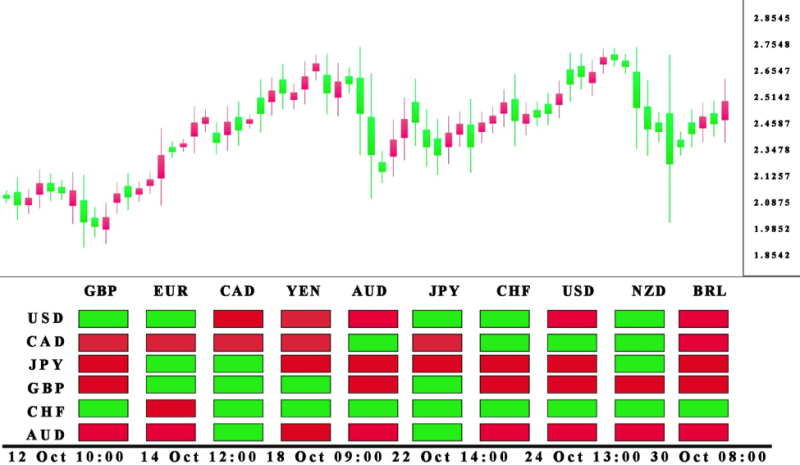

The currency strength meter offers a graphical representation of the relative currency strength. Typically, the meters examine the previous 24 hours. Usually, as a tool, it displays the potential of one currency that's traded contra another currency, basically revealing what currency pairs are doing.

Different versions of a currency strength meter integrate every pair related to a currency to calculate the general value of a currency. The information gets displayed as a line graph, or in the format of a heat map.

Currency strength meter implements live exchange rates to estimate cumulative rates, applies weighted averages to appraise the currency of the strength contra other currencies.

Correlated to the simple currency strength meters, the more sophisticated one relay on weighted averages in their estimations, by using the weighted averages of currencies investors get an all-inclusive meter that provides quality information.

When using simple currency meters, you only get currency fluctuations. This metric does not help forecast future trends, because of the focus on previous prices, they project past performance without any applicability for the future.

This is the crucial reason to implement a currency strength meter that uses cumulative exchange-rate price equations to estimate strength.

The result of these computations is displayed on charts, enabling traders a forecasting power in movements of currency pairs. Implementing a currency strength meter in a trading strategy makes it possible to have an informed fundamental analysis and a trading strategy that benefits from that data.

How Can the Meter be Useful?

It is practical in emphasizing the currency you should focus on. But also, the ones you should ignore as not a perspective option for trading. An example would be a situation where a given currency is gaining strength while another is declining in value, signaling a good trading option.

This type of alteration among pairs signals momentum. When 2 currencies are strong, weak, or average strength, there is frequently a range or sideways movement occurring. Then distance your trades from those pairs.

Is the Currency Strength Meter Accurate

Investors can manually differentiate the results of a currency if they believe the data offered by the strength meter is not reliable. If the GBP gets represented as strong, but you observed that it is declining, you may doubt the usefulness of the currency meter you are using.

Selecting the appropriate currency strength meter comes down to your satisfaction with how it incorporates the strategy being used. There are few currency strength indicators offered and the best course of action is to experiment and figure out which is the best for your trading methods.

The Meter Is Updated Regularly

Typically, a currency strength meter is updated hourly, in some cases it can be literally by the minute to deduce the present strength. When using trading software changes will be displayed automatically or if the page gets refreshed. Some platforms offer the option to set the periods when you want updates to get implemented.

The Advantage of the Currency Strength Meter

In the process of trading in the foreign exchange market, investors work with sets of currencies. There is an option to purchase a currency and not have to sell a currency for it. if planning to purchase a Canadian dollar (CAD) you can sell your New Zealand (NZD) to trade for those dollars. In that case, investors are trading the currency pair NZD/CAD “short” – selling the NZD to purchase the CAD.

Forex traders attempt to discover how a currency pair is going to move. The problem they have is forecasting the trend. Investors harness the potential of technical indicators like chart patterns and currency oscillators, but results have not been desirable.

On the other side of the spectrum, the currency strength meter is also all-powerful and guarantees a profitable trading strategy. Still, it is a practical instrument for improving trading decisions.

Investors can test their strategies and implement the currency strength meter data to check how it influences the process. In case the data improves the trading plan. Then traders can use it. If the currency strength data is not productive, forget about using it when you trade.

Conclusion

Trading works on several principles that usually don't change concerning the market, you can be trading in stocks, currency, or alternative commodity markets.

The key is to have an understanding of different factors that work in a given market. In Forex markets investors need to figure out the forex currency strength, which gets influenced by demand and supply and political and economic policies.

Currency strength indicators identify markets that experience disparity and can get used for making a profit.

Strength Meter is a productive instrument that can get integrated with a trading strategy. nderstanding the strength of a currency and the market conditions will create a trading opportunity. The currency strength meter is a good indicator that reveals opportune pairs to trade or verifies current strategies.

Trades can use the standard formula or use a free currency strength meter to evaluate forex pairs and check to see if a bullish or bearish trend is on the horizon.

Depending on your trading style, to be a successful trader you have to predict the currency's strength. The relative strength of the individual currency can be a useful metric in an existing strategy by indicating trading opportunities.

Several merits are useful in a quality currency strength meter, starting from simplicity, there are free online versions, practical for short-term trades, reducing unplanned hedging of funds indicate risk and reduce losses.

FAQs

What Is the Best Currency Strength Indicator?

When defining the best indicator, it's important to know what parameters get used in making that judgment. Currently, the Advanced Currency Strength Indicator is perceived as the best because it shows the real movement in the market.

How do You Measure the Strength of a Currency?

The strength of the currency is measured by analyzing the interaction of different factors like demand and supply in the exchange markets, inflation, interest rates of the central bank, the local GDP, and trade balance.

How do You Know if Currency Is Strong or Weak?

The best option to learn if a currency is weak or strong is to examine its purchasing power, the more stuff you can buy with a given currency the greater its strength, but if you can buy fewer products then it’s a weaker currency.

Which Currencies are Strong now?

The strongest currencies are the US Dollar, the Euro, and the Swiss Franc.