Currency correlations refer to a statistical measure of currency pairs extent with values that move together. Whenever the currency pairs value rises, it forms a positive correlation. On the other hand, it creates a negative correlation whenever one currency appreciates, while the other currency depreciates.

Monitoring and understanding currency correlation is crucial for forex traders since it affects their risk level in the stock market. This article will discuss how to determine and calculate correlation, tools that can track correlations, its trades effects, and forex trading systems.

Also Read: Best Forex Strategy For Consistent Profits

Contents

- What is Forex Correlation?

- Correlation Coefficient Formula

- Forex Correlation Pairs

- Forex Correlation Table

- Currency Correlation Hedging Approach

- Commodity Forex Correlation

- Pairs Trading

- Non-Correlated Forex Pairs

- How to Trade Currency Correlation Pairs

- Currency Correlation Trading System

- FAQs

What is Forex Correlation?

Forex correlation describes the connection between currency pairs. In any case, there is a negative correlation when the pairs fluctuate in different directions and a positive correlation when the pairs move towards the same direction.

Stock pairs that showcase random movement without any detectable relationship do not correlate. The terms inverse correlation can also describe negative correlation. Although most forex traders may ignore this idea, it can impact forex trading results directly.

What Correlation Coefficient Means

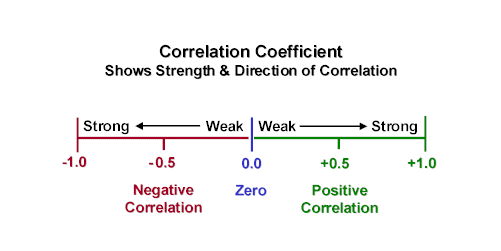

The correlation coefficient describes how weak or strong a forex correlation appears. Traders can express correlation coefficients in values ranging from -1 to 1 or -100 to 100, with a decimal point representing the coefficient.

Any value in the positive range above 1000 means that the stock pairs move in nearly the same direction. On the other hand, if it is below -100, it means that forex pairs are moving in almost identical but opposite directions. Nearly identical is a crucial term in the description since forex correlation focuses on order rather than magnitude.

For instance, one pair can move down 70 pips while the other can move up 100 pips. In such a case, the two pairs will have a higher inverse correlation, but the movement sizes are different. Where the reading is under -70 and over 70, it forms a strong correlation since the movements of the two pairs reflect each other. All in all, readings between -70 and 70 indicate that the pairs feature less correlation.

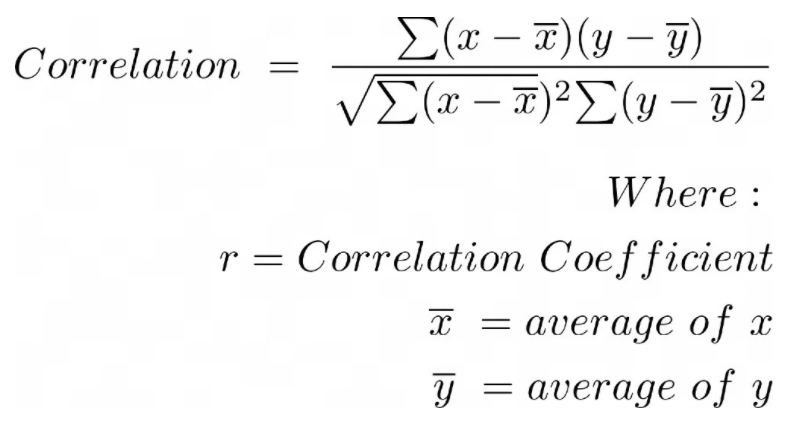

Correlation Coefficient Formula

The correlation coefficient formula may appear complicated, but that is not the case. The overall idea is that it takes data points representing two pairs (X & Y) and compares them to the average reading within the pairs. Hence, the bottom part of the equation represents the standard deviation, while the top part is the covariance.

Forex Correlation Pairs

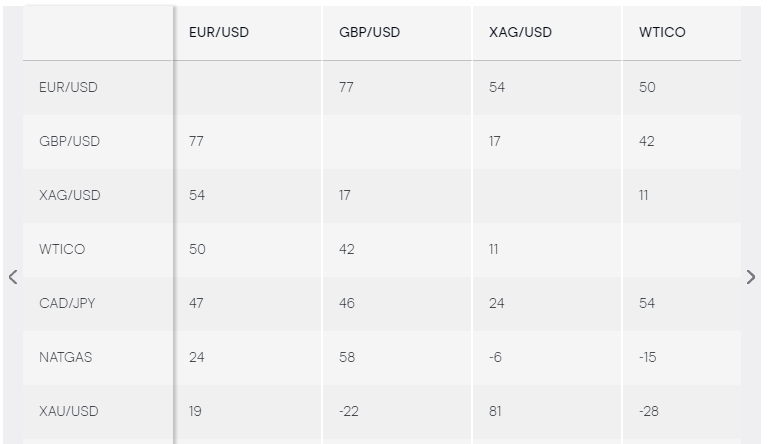

The table below showcases the forex correlation between the most traded forex pairs in the world. It would be best to compare the currencies on the x-axis to the other ones on the y-axis to understand how they correlate. For example, the forex correlation between GBP|USD and EUR|USD is 77, relatively high.

Forex Correlation Table

Although the pairs may not move in the same direction, they move together. In comparison, the EUR|GBP and GBP|USD form a strong negative currency correlation at -90. This statement implies that they move in the opposite directions most times. It is crucial to monitor currency correlations since several strong correlations may appear even in the most petite table of currency pairs.

For example, a forex trader can buy GBP|USD and vend the EUR|GBP rationally, expecting to represent two different stock market positions. Yet, the pairs feature a high negative correlation that indicates they move in opposite directions. Thus, the trader can lose or win on the two teams since they and not fully independent currency trades.

Currency Correlation Hedging Approach

Currency correlations enable forex traders to hedge stock market positions by opting for a second trade opposite the original position. In any case, you can attain a currency hedge when losses from one currency pair get offset by gains from another pair or vice versa. Hence, it can be an effective strategy whenever a trader does not intend to exit a specific position but would like to reduce or offset their loss when the pair pulls back.

Commodity Forex Correlation

Raw materials and commodities also feature a correlation currencies. The table below indicates that XAU|USD (gold) featured little correlation with other coins during that period. Nevertheless, the table shows that gold shared a strong positive currency correlation of about 81 with XAG|USD (silver). This type of analysis can be helpful for anyone trading gold and seeking to hold positions in various currency pairs.

Pairs Trading

Pairs trading involves selecting two currency pairs with a robust historical correlation of more than 80 and taking short and long-term positions on the stocks. A forex trader can sell the currency pair moving up and buy a currency pair moving down to generate profit. The idea is that this strategy allows the currency to move up again since they share a high correlation history. Thus, it can be a strategic approach for better conversions.

Nevertheless, it would be best to mention that the pairs might not go back to high correlation in some cases. Thus, some forex traders set up a stop-loss order on the positions to manage the losses. Also, a rise in one trade can offset a loss on another, even if the pairs shift back to their initial correlation. In simple words, the sold position can move down, and the bought position can move up where the pairs mean-revert. This state generates profits on both sides.

It would be best to invest in position sizing for risk management when using any forex correlation approach. Hence, you can opt to trade a small percentage of your account balance based on where you place the stop loss.

For example, taking a micro position where the stop loss is about 30 pips within the EUR|USD reflects a risk of about $3. For the $30 risk to match a 1% value of the account, the forex trader must have at least a $300 account balance. Hence, they can help to control the account risk and trade risk as well.

Also Read: How to Trade Currency

Non-Correlated Forex Pairs

In general, non-correlated currency pairs represent currencies that move independently. It occurs where the coins in each pair feature different values or come from other economic sectors.

How to Trade Currency Correlation Pairs

Several approaches to trade currency correlation pairs apply, including commodity correlation, pairs trading, and hedging. These steps are crucial for trading and making a profit from currency correlation pairs. They include:

1. Open a Live Account

The alternative for this step would be to opt for virtual fund practices available on the internet.

2. Research the Stock Market

It is crucial to research the market and improve your knowledge on currency pairs and factors such as economic data, interest rates, and inflation.

3. Select a Currency Correlation Approach

It would be best to identify and prepare a proper trading plan.

4. Risk Management

You ought to choose the most reliable risk management tools like take-profit and stop-loss orders to manage risk in volatile markets. It would be best to mention that these tools do not safeguard your investment from slippage and gapping.

5. Place the Trade

Decide whether to sell or buy and determine exit and entry points.

Currency Correlation Trading System

Most currency correlation trading strategies define the exact exit and entry points for losing and winning trades. Yet, several online platforms will enable you to check and trade currency correlations in real-time.

FAQs

1. How do currency pairs affect each other?

Forex correlations or currency correlations refer to a statistical measure of the currency pairs extent that relates in value and fluctuates together. Whenever two currency pairs increase in value together, they result in a positive correlation. Pair currencies that depreciate while the other appreciate result in a negative correlation.

2. How do you use currency correlation?

Monitoring and understanding currency correlations is crucial for forex traders since it affects their risk level in the stock market. It is crucial to research the market and improve your knowledge on currency pairs and factors such as economic data, interest rates, and inflation. Where the reading is under -70 and over 70, it forms a strong correlation since the movements of the two pairs reflect each other. Readings between -70 and 70 indicate that the pairs feature less correlation.

3. Can you encounter losses from currency correlation trading?

The pairs might not go back to high correlation in some cases. A rise in one trade can offset a loss on another, even if the pairs shift back to their initial correlation. Thus, you ought to choose the most reliable risk management tools like take-profit and stop-loss orders to manage risk in volatile markets. These tools do not safeguard your investment from slippage and gapping.