In 2017, the trading community received a new player in the form of Pocket Option. And since then, it has made an impact in binary options trading. Although binary options trading gets perceived as a risky strategy by selecting Pocket Option, investors get a reliable broker. Creating an account on the brokerage platform is straightforward for novice and experienced traders.

It’s one of the most versatile trading platforms, with hundred assets accessible for trading and numerous payment methods that facilitate online trading for international investors. It’s a global community at Pocket Option that benefits from the various opportunities for trading.

The review of Pocket Option will provide a comprehensive guide on the advantage of using the platform, but also the account types available, types of asset users can make transactions with, and other impressive features that offer practical trading.

Most importantly, in the binary options market, Pocket Option offers some of the most lucrative payouts.

Also Read: Basic Options Trading Strategies You Need to Know

Contents

- What is Leverage Trading in Crypto Markets?

- Types of Leverage Trading

- How does Leveraged Trading Work?

- Advantages and Disadvantages of Leverage Trading?

- Best Exchanges For Crypto Leverage Trading

- Why Use Leverage to Trade Crypto?

- How to Manage Risks With Leveraged Trading?

- Conclusion

- FAQs

What is Leverage Trading in Crypto Markets?

Leveraged trading is the practice used to trade cryptocurrencies and other assets with borrowed capital. It increases your purchasing or potential profits, allowing you to trade with much more money than you may have available in your balance. You might get a loan of up to 100 x your cash account based on the crypto exchanges you trade with.

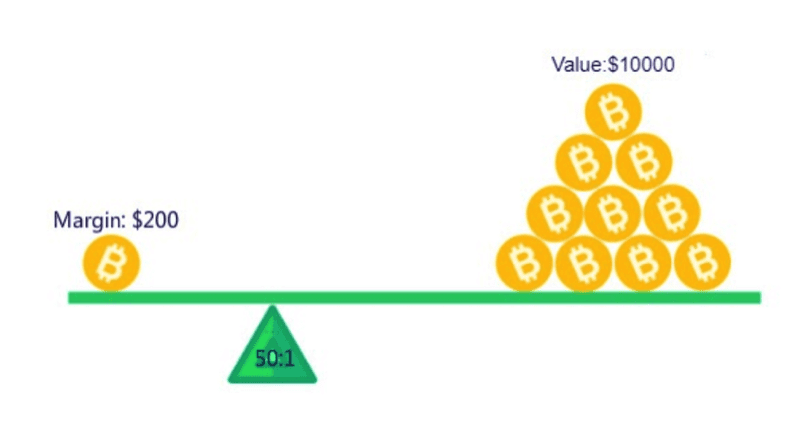

An amount of leverage can be expressed in ratios like 1:5 ratio is a 5x leverage, 1:10 ratio is a 10x leverage, and 1:20 ratio is a 20x leverage. It displays the number of times your starting capital has been expanded. Consider the following example: you got $200 in your crypto trading account and wish to create a trading position size of $4,000 bitcoin. That $200 will get the same purchasing power as $4,000 with a 20x leverage.

Varieties of crypto derivatives can be traded with leverage.

Types of Leverage Trading

The commonly known types of leveraged trading are margin trading, futures contracts, and leveraged tokens. These types are leveraged trades are supported by major crypto exchanges.

Margin Trading

In cryptocurrency, margin trading is borrowing money from a crypto exchange and utilizing it to execute a contract. Margin traders increase the size of their trades beyond the current funds they have available to trade with, margin trading is the most popular form of leveraged trading.

Futures Contracts

A derivative trading product is a futures contract. These are legal trading agreements in which involved sides agree to sell or buy an underlying asset at a certain price on a specific date. The underlying asset in the context of Ethereum futures would be Ethereum.

Leveraged tokens

Some cryptocurrency exchanges provide leveraged tokens, which are a form of derivative token. They’ve taken on a leveraged exposure with no margin, criteria, liquidation, or risk. As a result, leveraged tokens provide a simple way to obtain access to leverage. They’re more responsive to up-and-down oscillations than their traditional spot equivalents.

;How does Leveraged Trading Work?

You must first load funds in your crypto trading wallet so that you can take out funds and then begin trading with high leverage. We refer to the first capital you deposit as collateral. The amount of collateral you’ll need is determined by the amount of leverage you’re using and the overall size of the position you intend to take. The margin shows the difference between your position size and your actually collateral.

Let’s assume you wish to put $10,000 into Internet Computer Protocol (ICP) and leverage it 10 times. The needed margin is one-tenth of ten thousand dollars, which means you must have $1000 in your wallet as security for the loaned asset. Your necessary margin would indeed be considerably smaller if you used a 20x leverage ($500 collateral on a 20x leverage). However, please note that the larger the leverage, the more likely you are to be liquidated.

You might need to have a margin threshold on your crypto trades aside from your initial margin amount. If the price in the market moves in the opposite direction than predicted and your margin falls below the preservation barrier, you’ll have to deposit more money into the account to keep it from being liquidated. The management margin is another name for the threshold.

Long and short plays can both benefit from leverage positions. When you execute a long position, you’re betting that the price of a token or coin will rise. Taking a sell position, on the other hand, indicates that you expect the asset’s price to decline. While this may appear to be conventional spot trading, leverage enables you to sell or purchase assets only on the basis of your collateral, rather than your actual holdings. If you don’t own an asset, you can acquire one and sell it if you believe the market will fall.

Advantages and Disadvantages of Leverage Trading?

Trading with borrowed money has its advantages and disadvantages to traders. There are several of these pros and cons.

Advantages of Leverage

Increased trading power

Leverage increases the amount of money accessible to invest in different markets. With a 100:1 leverage, for example, you may effectively manage $10,000 in a single trade with just $100. As a result, you’ll be able to dedicate significant resources to different trading opportunities in your portfolios.

No interest

Leverage is borrowing from your broker that allows you to execute larger trades in the market. Furthermore, there are no responsibilities in the sort of interest or charge with this loan, plus you can use it in whatever way you like while trading.

Larger Profits

Leveraged trading enables investors to benefit from transactions that go in their favor by multiplying their winnings. Revenue is generated on the trading position size that is managed, never on the margin that is placed. This also implies that traders may make a lot of money even if the underlying assets only fluctuate a little bit in pricing.

Low Volatility Risk Mitigation

Market price movements are frequently accompanied by periods of highs and lows volatility. The majority of traders enjoy trading since it allows them to profit from market swings. As a result, low volatility periods may be extremely irritating for traders due to the lack of market movement. Fortunately, leveraged trading allows traders to possibly make more money including during these apparently boring periods of low volatility.

Trading Premium Markets

Traders might use leverage to trade items that are seen to be very costly or prominent. Some products have premium pricing, which can keep many retail investors out. However, these markets or assets may be traded using leverage, exposing the typical retail trader to the numerous trade possibilities they provide.

Disadvantages of Leverage

Amplified Losses

While dealing with leverage, the main danger would be that, like profits, losses are increased whenever the market turns against you. Although leverage requires a little initial investment, damages can be enormous because trading success is reliant on the overall lot size you manage.

Margin Call Risk

Once soaring losses exceed your utilized margin, your broker will issue a scary liquidation Call. If you have active trade contracts in the rapid financial markets, there will always be the potential of a margin call since leverage magnifies losses.

Best Exchanges For Crypto Leverage Trading

Below is an explanatory list of the top infamous crypto leveraged trading exchanges for trading digital assets. Attributes, uses, leverage maximum, customer help, prices, and privacy are all factored into this assessment.

Binance

This company has developed at a fast pace since its establishment in 2017. It is presently the largest global cryptocurrency exchange platform, with 1.4 million operations every second. Binance trading application is accessible on Android, Apple, and Microsoft Windows devices. That’s the most widely used cryptocurrency application because it’s easy to use and has flawless functionality.

Using the application, you’ll be able to keep track of your profits and losses, and also learn more about your trading history. In order to be able to take leverage positions on Binance , customers must first go through the KYC procedures, which entails validating their identity and, most importantly, confirming that their country of residence isn’t on the exchange’s ban list.

FTX

FTX is the exchange for you if you are seeking a unique and innovative crypto exchange platform. This system, which began operations in the middle of 2019, provides insurance money as well as a large amount of cash to its customers. FTX.US is essential for people in America. FTX is not available to Americans.

The FTX liquidity mechanism is three-tiered, allowing for a huge number of marginal tokens. Keep an eye on all funding rates because they can fluctuate at any moment.

ByBit

This exchange platform was founded in 2018 and is specialized in financial derivatives. Exchange platforms like Bybit are perfect for obtaining large liquidity for margin trading.

Newcomers can also benefit from the ByBit mobile application’s user-friendly design and make use of its protection money to cover damages in the event of insolvency. It has around 2 million active monthly users and is based in Singapore.

By now, you ought to have a clear idea of the best cryptocurrency leverage marketplaces around the globe. Unfortunately, since these platforms deal with such big quantities of cash, the risk of funds fraud increases.

Due to this factor, apply discretion when trading on these exchanges with any form of leverage or day trade. One of the most important benefits of using these services seems to be that they offer improved security mechanisms like 2-factor authentication (2FA).

Why Use Leverage to Trade Crypto?

Traders utilize leverage to raise the value of their positions plus the potential profits. However, leveraged trading can result in significantly larger losses.

Some other motive for traders to employ leverage is to increase their capital liquidity. For example, instead of having a 2x leverage position in a particular exchange, they may have a 4x leverage position with much less capital. It would enable traders to put the rest of their capital to better use.

How to Manage Risks With Leveraged Trading?

Trading with a high level of leverage may need less capital at first, but it also raises the risk of liquidation. When your exposure is too large, even just a slight price change might result in huge losses. Your volatility threshold will be reduced as your leverage increases. Lower leverage or reduced leverage allows you to buy and sell with a larger error margin. This is the main reason why major crypto exchanges have reduced the highest leverage users can trade.

Stop-loss (SL) and take-profit (TP) orders are two trading strategies that assist reduce losses in margin trading. Stop-loss pending orders may be used to instantly terminate a trade at a certain price, which is useful when the market moves in an opposite direction. Stop orders can help you avoid large losses. Take-profit orders, on the other hand, terminate automatically once your profits reach a particular level. This enables you to lock in your profits before the market condition deteriorates.

It should be evident by now that high leverage trading is a double-edged sword that may dramatically magnify both your losses and gains. It is fraught with dangers, particularly in the volatile crypto markets. Always proceed with the utmost caution, and always remember to Do Your Own Research (CYOR) to learn how to correctly manage leverage ratio and prepare your trading positions.

Conclusion

Utilizing Crypto Leveraging Trading is the best approach to generating electronic currency while a global epidemic is occurring. Investors must be informed of cybercriminals in order to protect their cryptocurrency exchange platform against malicious intrusion. For best protection, leave your money on these trading sites for as minimal a period as feasible. To protect your funds, use a reliable cryptocurrency hardware wallet, and take your gains.

Margin trading seems to be a little scary at the first impression. You will, eventually, be able to trade in a large market once you have gained expertise. Should you decide to invest in cryptocurrency trading, make our time to comprehend the distinctive traits and risks associated. You may learn the basics of leverage trading from a multitude of different sources after conducting significant study, but you should invest your money in the right platform. Leverage trading with smaller quantities allows you to gain mastery while decreasing the risk of huge losses.

FAQs

What is crypto leverage?

Leveraging is the procedure of a borrower borrowing funds in a tradable currency as well as a financial product. This increases your buying power and enables anyone to deal with more money on hand. You may acquire up to 100 times that amount on some crypto trading sites.

What is the best leverage for crypto?

The best leverage doesn’t exist, the most appropriate leverage is determined by risk tolerance and financial goals.

Does crypto allow leverage?

Users can leverage trade on most crypto trading exchanges.