A proper understanding of the crack spread is crucial for investors, traders, and market participants looking to navigate the volatile waters of the oil market. This term influences a broad array of factors from crude oil prices and refining margins to the decision-making processes behind crude oil futures trading and refined products futures trading.

This article will break down the concept of a crack spread, making it easily comprehensible to the general public, and illustrate its vital role in the global oil trading sphere.

Understanding Crack Spreads

The term ‘crack spread‘ might initially strike as odd to those unfamiliar with futures trading. However, in the sphere of the oil market, it is an indispensable concept that gives investors, traders, and refiners an understanding of their potential profit margins.

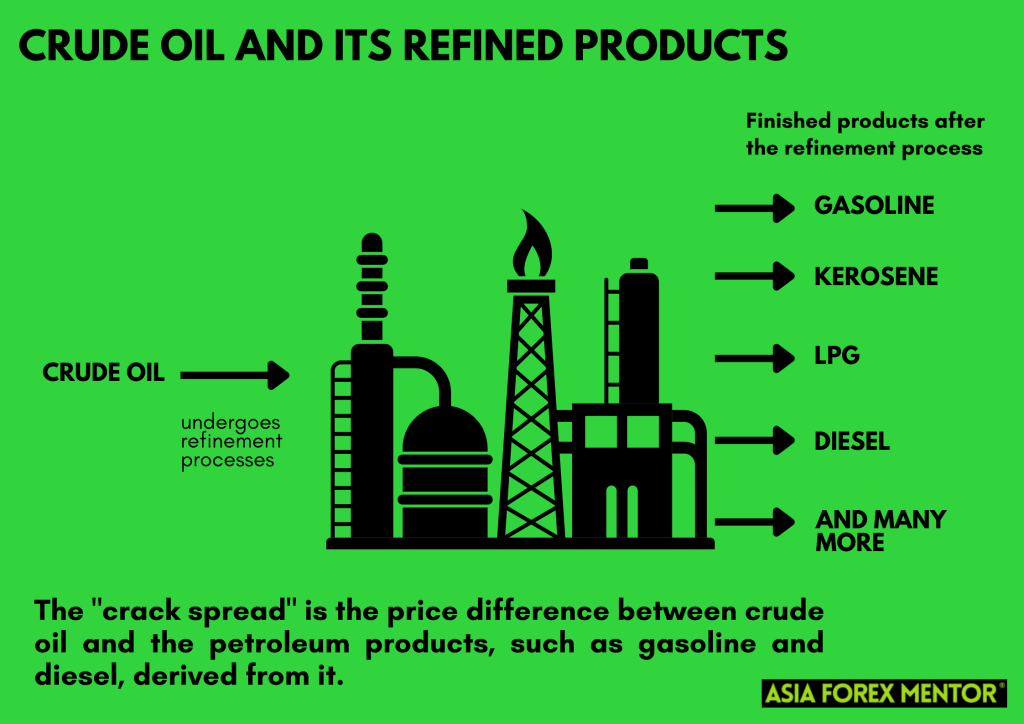

A ‘crack spread’ is a term coined in the oil industry to depict the price difference between crude oil and the petroleum products, such as gasoline and diesel, derived from it. In essence, it represents the economic spread that refiners can expect when they purchase crude oil and sell the refined products derived from it. It’s the pulse of the refinery business, gauging the profitability of turning crude oil into consumable products.

Also Read: How to Trade Futures

Crude Oil: The Key Element

Black gold, as it’s often called, crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. Crude oil forms the primary ingredient of the crack spread. It’s the raw material that refiners buy and process into various refined products.

Its price, typically denoted per barrel, can significantly fluctuate due to the multifaceted dynamics of global supply and demand, geopolitical tensions, production policies of oil-exporting nations, and technological advancements.

Traders have the option to buy crude oil futures to lock in a price today for delivery at a future date. Understanding these crude oil futures and the factors that influence their price is integral to comprehending the dynamics of the crack spread.

Refined Products: Gasoline and Diesel Fuel

While crude oil is a commodity with immense inherent value, it is practically useless in its raw state. To be of use to end consumers, crude oil must undergo a refining process to produce various petroleum products.

This refining process is where crude oil, a relatively homogenous raw material, is transformed into a range of refined products like gasoline, diesel, heating oil, and jet fuel. Gasoline and diesel fuel are two major refined products derived from a barrel of crude oil in a typical refinery.

Gasoline, used primarily in automobiles, and diesel fuel, used in both vehicles and industrial applications, have vast consumer bases, and their demand and price variations play a crucial role in determining the crack spread. Therefore, the crack spread inherently depends on the prices that these refined products can fetch in the market relative to the cost of crude oil.

The Refining Process and Refining Margins

The journey from crude oil to usable petroleum products is a fascinating process involving several stages. Crude oil is fed into a refinery, and through a process called distillation, it is broken down, or ‘cracked,’ into its component parts. This refining process involves heating the crude oil to high temperatures, causing it to vaporize. The vapors then move through a distillation column, separating into different petroleum products based on their molecular structure and boiling points.

The distillation process produces a range of products, including gasoline, diesel fuel, and heating oil. The ratio in which these products are produced can vary depending on the type of crude oil used and the specific settings of the distillation process. This ratio, known as the ‘crack ratio,’ is a crucial factor in determining refining margins.

The refining margin is essentially the difference between the value of the refined products and the cost of the crude oil. This margin represents the potential profit that a refiner can make from turning a barrel of crude oil into refined products. It’s important to note that refining margins can vary widely, reflecting changes in the prices of crude oil and the demand for different refined products.

The Role of Crack Spreads in Futures Trading

Crack spreads play an indispensable role in futures trading, particularly for those involved in the oil industry. By examining crack spreads, traders can make educated predictions about the profitability of refining crude oil into gasoline and other products, guiding their buying and selling decisions.

Crack spreads serve a crucial function as a hedging tool in futures trading. A trader, often a refiner, can hedge against the risk of adverse price movements by simultaneously entering into futures contracts to buy crude oil and sell refined products. This practice allows them to lock in their refining margin and secure potential profit.

For example, if a refiner anticipates that crude oil prices will rise but refined product prices will remain stable, they can buy crude oil futures at the current lower price and sell futures contracts for the refined products at their current prices. This action allows the refiner to lock in a specific crack spread, essentially protecting their profit margin against future price fluctuations.

Crack spreads also allow traders to speculate on changes in the oil market. If a trader believes that refining margins will widen (due to either rising refined product prices or falling crude oil prices), they can “buy” the crack spread by purchasing crude oil futures and selling refined product futures. If the crack spread does widen, they can then sell the crude oil futures and buy back the refined product futures at a profit.

Crack Spread Trading

Trading crack spreads has become an integral part of the strategy of many traders, refiners, and other market participants involved in the oil industry. Through this trading practice, they can hedge against or speculate on potential changes in refining margins, shaping their decisions based on forecasts of market dynamics.

In the context of crack spread trading, you are either buying or selling the crack spread, depending on your prediction of market movements.

Buying the Crack Spread

When you buy the crack spread, you expect the spread to strengthen, or in other words, you predict an increase in the refining margins. This situation occurs when the price of crude oil is falling or if the demand for refined products is growing, both scenarios leading to an increased spread.

To execute this, you buy crude oil futures and sell refined product futures. This means that you are locking in the price of crude oil at a lower rate now, expecting it to increase in the future. At the same time, by selling futures contracts for refined products, you secure the current higher prices for those products. If the crack spread indeed strengthens as anticipated, you stand to gain from the increased difference in the prices of crude oil and refined products.

Selling the Crack Spread

On the other hand, if you sell the crack spread, you expect the spread to weaken, signaling a decrease in refining margins. This expectation can arise due to the anticipated weakening demand for refined products or the tightening of the spread due to changes in oil pricing. In such a scenario, traders would sell the refined product futures and buy crude futures.

This strategy involves selling refined product futures contracts to capitalize on current high prices before they decrease. Simultaneously, buying crude oil futures allows you to lock in the price of crude oil at current high rates before a potential drop. If the crack spread does indeed narrow, the traders could realize a profit from this strategy.

Crack Spread Calculation: A Simple Example

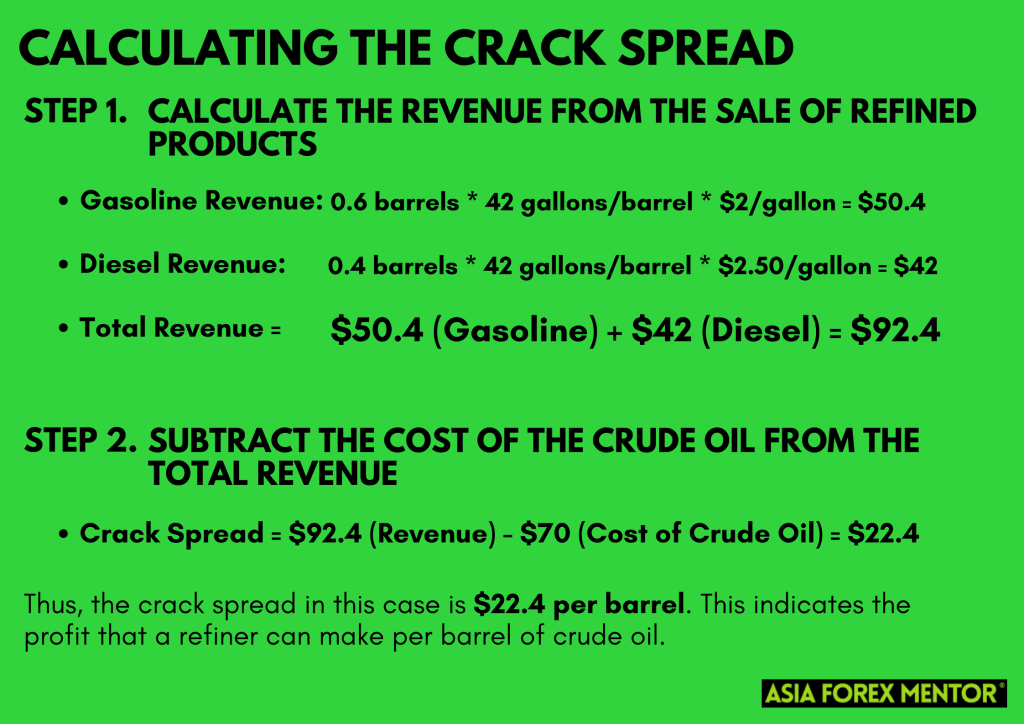

To further illustrate the concept, let’s dive into an example of how a crack spread is calculated.

Imagine a refinery that can crack one barrel of crude oil into 0.6 barrels of gasoline and 0.4 barrels of diesel. The current price of crude oil is $70 per barrel, gasoline is $2 per gallon, and diesel is $2.50 per gallon. Note that there are 42 gallons in a barrel.

Let’s calculate the crack spread:

Variations in Crack Spreads: 3-2-1, 5-3-2, and More

While we provided a simple example above, crack spreads can be more complex depending on the specific products being refined and the ratios in which they are produced. The most common crack spread is the 3-2-1 spread. This spread reflects the yield of a typical U.S. refinery that produces two barrels of gasoline and one barrel of heating oil from three barrels of crude oil.

In a 3-2-1 crack spread, a trader might buy three crude oil futures contracts and sell two gasoline futures contracts and one heating oil futures contract. The profit or loss from this position would represent the crack spread.

Other variations exist, such as the 5-3-2 crack spread, which includes the production of gasoline, diesel, and jet fuel. The specific spread used will depend on the specific refining capabilities and product demand a refiner is facing.

Crack Spreads: A Barometer for the Oil Market

Beyond serving as a hedging tool for refiners and traders, crack spreads can also provide valuable insights into the health of the oil market. When crack spreads are wide, indicating healthy profit margins for refiners, it suggests strong demand for refined products. Conversely, narrow crack spreads may imply weaker demand or oversupply, possibly signaling a slowdown in economic activity.

The crack spread thus plays a vital role in the futures trading world, allowing traders and refiners to hedge their price risk, guide their trading strategies, and even gauge the state of the overall oil market. As with any market indicator, it’s vital for traders to understand what a crack spread means and how it’s calculated before using it as part of their trading strategy.

The Impact of Crack Spreads on the Broader Economy

Crack spreads have a wider impact beyond the trading realm. A widening crack spread often indicates an increasing demand for oil, potentially signaling an uptick in economic activity. Meanwhile, a shrinking crack spread could indicate a potential slowdown.

Furthermore, crack spreads can influence gasoline prices. If crack spreads are wide, it could result in higher gasoline prices, impacting consumers at the pump. Conversely, narrower crack spreads might translate to lower gasoline prices, providing relief for consumers.

Conclusion

In the complex and interconnected world of futures trading, the crack spread stands out as a powerful tool and an important market signal. The ability to understand and interpret the crack spread’s intricacies can provide traders and investors with valuable insights, potentially leading to more informed decision-making and improved trading outcomes.

The crack spread reflects the economic realities of the oil refining industry, representing the profit margin that refiners can expect from turning a barrel of crude oil into refined products. In the trading realm, the crack spread allows market participants to hedge against price risks and speculate on price movements, offering avenues for strategic decision-making that could lead to profitable outcomes.

Also Read: Future Trading Strategies You Can Try

FAQs

What does the crack spread indicate about the oil market?

The crack spread provides a snapshot of the profitability of oil refining at any given time. It shows the price difference between crude oil and petroleum products derived from it. When the crack spread widens, it typically indicates that refining margins are improving, either because crude oil prices are falling, or demand for refined products is increasing. Conversely, a narrowing crack spread may signal deteriorating refining margins, potentially due to rising crude oil prices or decreasing demand for refined products.

How does crack spread trading work?

In crack spread trading, a trader either buys or sells the crack spread based on their market predictions. Buying the crack spread means the trader expects the spread to strengthen due to either falling crude oil prices or growing demand for refined products. Selling the crack spread, on the other hand, means the trader expects the spread to weaken due to either rising crude oil prices or decreasing demand for refined products. Crack spread trading can help traders hedge against potential risks and seize profit opportunities.

Why is the crack spread significantly for refiners and traders?

The crack spread serves two key functions for refiners and traders. Firstly, it’s a valuable hedging tool that allows refiners to lock in their refining margin, protecting against price fluctuations in the crude oil and refined product markets. Secondly, it serves as an important market signal, helping traders predict future price movements. A widening or narrowing crack spread can provide insights into potential changes in crude oil and refined product prices, helping traders make informed decisions.