CPT Markets Review

CPT Markets is a brokerage that provides trading services across Forex, commodities, indices, and cryptocurrencies to give forex traders trading strategies in the financial markets. Known for its straightforward trading platforms and tools, CPT Markets aims to support both novice and professional traders with diverse trading opportunities and tools.

The broker offers multiple account types tailored to different trading needs. These accounts come with varying levels of spreads, commissions, and leverage options, allowing flexibility for forex traders based on their experience and financial goals.

Security is a priority for CPT Markets, with regulatory oversight from authorities such as the FCA. This regulation ensures a level of transparency and safety, making it a trustworthy option for those cautious about trading with reputable oversight.

CPT Markets also delivers solid customer support through multiple channels, including live chat, email, and phone support, aiming to offer quick assistance to traders at any level of need in terms of trading platforms, trading strategies, financial markets and any topic about trading.

What is CPT Markets?

CPT Markets is a regulated online brokerage that offers trading services in Forex, commodities, indices, and cryptocurrencies. It provides a range of account options and user-friendly platforms, making it suitable for both new and experienced traders. The broker’s trading platforms are very popular in the financial markets, it fits in every trading strategies of the traders. CPT Markets is capable on giving advanced trading tools and advanced trading platforms for every trading accounts.

Regulated by the Financial Conduct Authority (FCA), CPT Markets prioritizes security and transparency, giving traders confidence in the safety of their funds. It also supports clients with responsive customer service through live chat, email, and phone, making it accessible and reliable for traders worldwide. This makes CPT Markets financial markets and trading account safe. Traders trading accounts are safe and regulated.

CPT Markets Regulation and Safety

CPT Markets operates under the regulation of the Financial Conduct Authority (FCA), a well-respected regulatory body. This oversight means CPT Markets must follow strict guidelines to ensure a fair and transparent trading environment.

The FCA regulation provides traders with a level of fund protection and compliance, which helps reduce the risks associated with online trading. CPT Markets UK Limited is licensed and regulated by the FCA in the UK For traders, this adds a layer of security and confidence, as their investments are handled by a regulated broker.

CPT Markets also prioritizes client fund safety by using segregated accounts to keep client money separate from company funds. This practice offers an additional safeguard, ensuring that client funds remain protected even in the unlikely event of financial issues within the company.

CPT Markets Pros and Cons

Pros

- Regulated

- User-friendly

- Diverse assets

- Responsive support

Cons

- Limited features

- High fees

- Restricted regions

- No bonus

Benefits of Trading with CPT Markets

Trading with CPT Markets offers a secure, regulated environment thanks to oversight by the Financial Conduct Authority (FCA). This regulation ensures that CPT Markets adheres to strict guidelines, giving traders confidence in the safety of their investments.

The broker provides a wide range of assets, including Forex, commodities, indices, and cryptocurrencies, catering to traders with varied interests. This variety makes CPT Markets a versatile option for those looking to diversify their trading portfolio.

CPT Markets also offers flexible account options, allowing traders to select account types that match their trading style and goals. With varying spreads, leverage, and commissions, traders can choose an account setup that best suits their needs.

Lastly, CPT Markets provides 24/5 customer support, making assistance available throughout the trading week. This accessibility helps ensure that traders can address issues or get answers when they need them most.

CPT Markets Customer Reviews

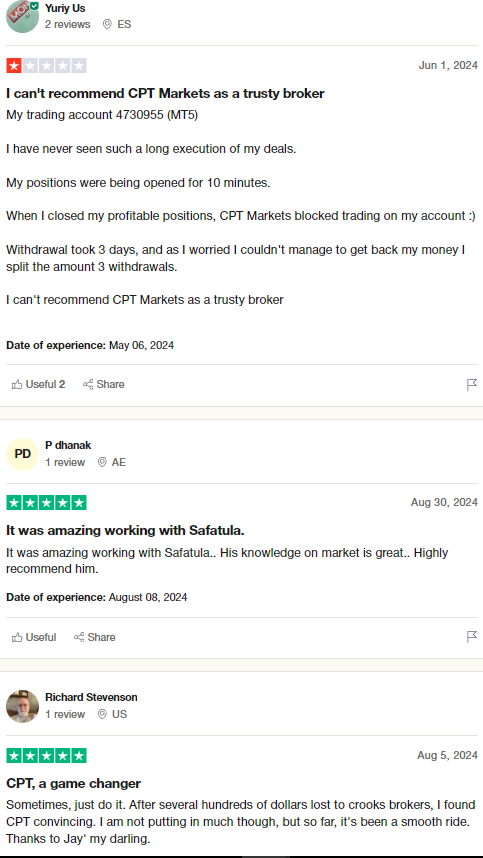

CPT Markets has mixed customer reviews, reflecting both positive and negative experiences. Many traders appreciate the broker’s regulated status and transparent practices, feeling more secure with their investments under the Financial Conduct Authority (FCA).

Traders often highlight the user-friendly platforms as a benefit, noting that both beginners and experienced traders find it easy to navigate. The range of assets available, including Forex, commodities, and cryptocurrencies, is another feature that customers find valuable.

On the downside, some customers mention higher-than-average fees and limited features compared to other brokers, which can impact overall value. However, CPTMarkets’ responsive customer support is frequently praised, as it helps resolve issues and provides timely assistance when needed.

CPT Markets Spreads, Fees, and Commissions

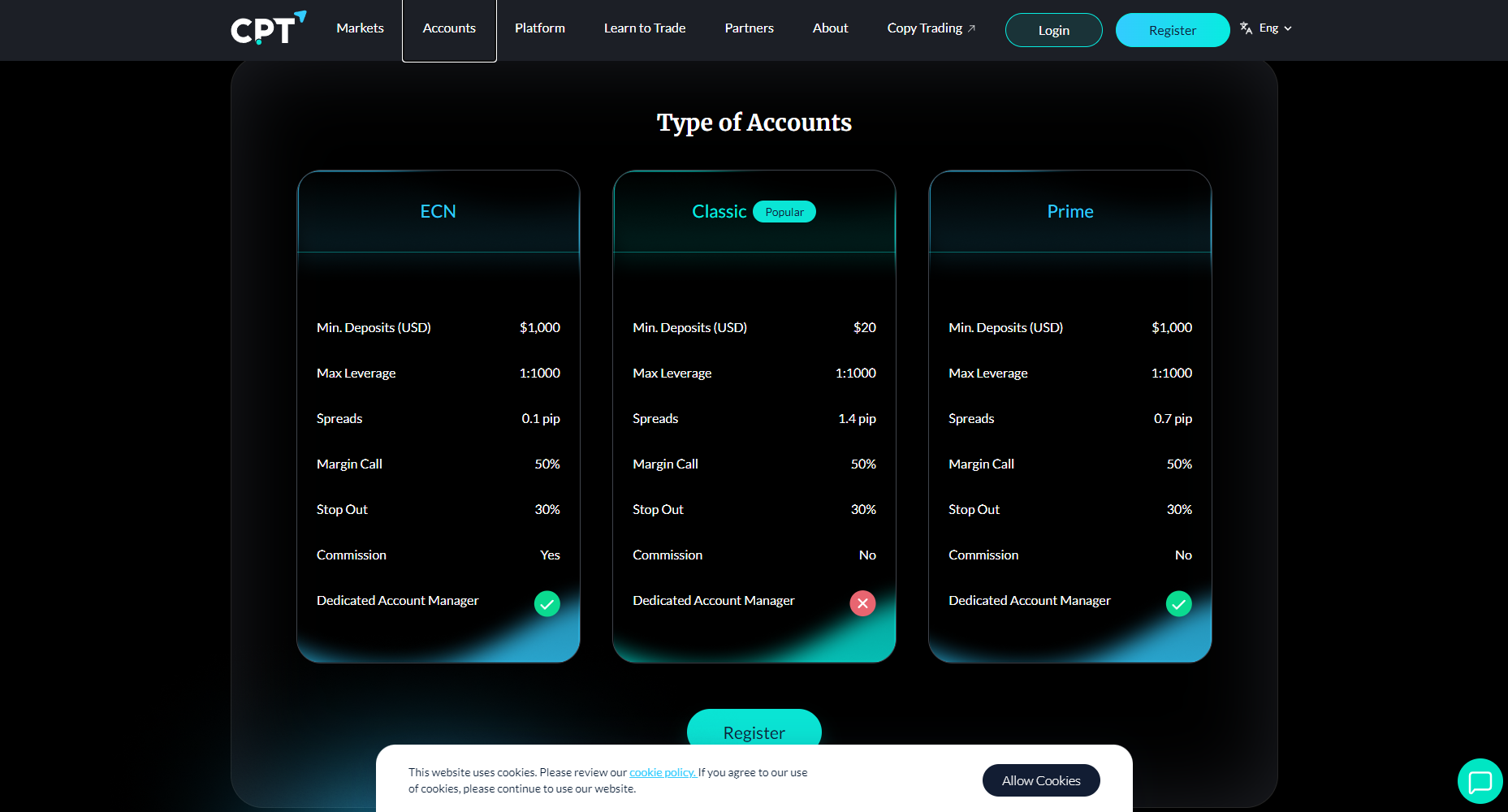

CPT Markets offers competitive yet varied spreads and fees depending on the account type selected. Traders can expect tighter spreads on premium accounts, which suit more experienced traders, while standard accounts come with slightly higher spreads, ideal for beginners.

The broker charges commissions on specific account types to accommodate different trading styles. This structure gives traders flexibility to choose between commission-based or spread-only pricing based on their trading volume and strategy.

While CPT Markets’ fees are competitive, some traders note that certain costs, like overnight fees, may add up for longer-term positions. Understanding these costs helps traders manage expenses and make more informed trading decisions.

Account Types

CPT Markets offers a variety of account types to cater to traders of different experience levels and strategies. Each account type comes with distinct features, spreads, and fees, allowing traders to choose an option that best aligns with their goals.

Classic Account

CPT Markets Classic Account is designed for beginner traders looking to start trading with straightforward features and accessible costs. It offers wider spreads compared to premium accounts, making it an ideal choice for those who are still building their trading skills and prefer a low-commitment entry point. With fewer advanced options, the Standard Account keeps things simple, allowing new traders to focus on learning the market without added complexity. Minimum deposit is required for this account type.

ECN Account

Created with experienced traders in mind, the ECN Account offers tighter spreads and lower transaction fees, making it suitable for those with higher trading volumes or more active strategies. This account type provides access to more advanced features, helping skilled traders maximize efficiency and reduce trading costs. Minimum deposit is required for this account type. By offering better trading conditions than the ECN Account, the ECN Account is suited to traders seeking to enhance their profit margins through a more cost-effective setup.

Prime Account

CPT Markets offers Prime Account, designed for high-volume traders who demand the most competitive trading conditions. It provides the lowest spreads available, exclusive perks, and priority customer support to ensure a seamless trading experience. Minimum deposit is required for this account type. With a focus on maximizing cost efficiency, the Prime Account is ideal for professional traders who regularly engage in large transactions and seek the highest level of account benefits and support.

Demo account CPT Markets also offers a free demo account allowing traders to test the platform and familiarize themselves with its features before trading with real money. While Classic and prime accounts are for early traders who’s familiar with the trading account and financial instruments using the popular trading platforms.

How to Open Your Account

Opening an account with CPT Markets is a straightforward process that enables traders to get started quickly. Each step is designed to guide users through registration, verification, and setting up their account for trading.

Step 1: Visit the Website

To begin, traders should navigate to the CPT Markets website and locate the account registration page. This page provides an overview of the account types and requirements for new traders.

Step 2: Complete the Registration Form

Users must fill out an online registration form with basic personal information, including name, contact details, and email. This step initiates the account creation process and helps CPT Markets confirm the trader’s identity.

Step 3: Submit Identification Documents

To meet regulatory standards, CPT Markets requires proof of identity and address. Traders can upload documents like a passport or utility bill, helping the broker verify the account for security purposes.

Step 4: Choose an Account Type

Based on their trading level and goals, traders can select from CPT Markets’ range of account types. Each option has unique features, so users should choose one that aligns with their needs.

Step 5: Fund the Account

After verification, traders can fund their account through various payment options available on the platform. This step is essential to activate the account and start trading.

Step 6: Start Trading

Once the account is funded, traders can begin accessing the platform, exploring available assets, and placing their first trades. CPT Markets’ resources and tools are now fully accessible, enabling users to engage in real-time trading.

MT4 and MT5 are the popular trading platforms for this forex broker, Demo accounts has also the access for this trading platforms. Beginner traders should check swap free accounts and demo accounts to identify potential trading opportunities in stock trading.

CPT Markets Trading Platforms

CPT Markets offers a selection of trading platforms to suit both beginner and experienced traders, making it easier to manage trades across different assets like Forex, commodities, indices, and cryptocurrencies. These platforms are accessible on various devices, allowing traders flexibility and control over their trading activities.

The broker provides the widely used MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust features. MT4 offers tools for charting, analysis, and automated trading, making it a solid choice for those who want powerful yet accessible trading options.

For more advanced needs, CPT Markets also offers MetaTrader 5 (MT5), which builds on MT4’s capabilities with additional features like more timeframes, advanced charting tools, and an expanded range of order types. MT5 suits traders looking for enhanced functionality and a broader set of analytical tools.

These platforms support mobile and desktop access, ensuring that traders can manage their accounts and monitor the markets on the go. CPT Markets’ platforms deliver reliable performance and connectivity, enabling smooth, efficient trading in real-time.

What Can You Trade on CPT Markets

CPT Markets offers a diverse range of trading options to accommodate various investment interests and strategies. Traders can access multiple asset classes, providing flexibility and opportunities for portfolio diversification.

Forex

CPT Markets provides access to major, minor, and exotic currency pairs, allowing traders to engage in 24/5 Forex trading. This selection supports both short-term and long-term strategies, appealing to those interested in currency markets.

Commodities

Traders can invest in popular commodities like gold, silver, and oil, which are commonly used as a hedge against inflation and market volatility. These assets provide tangible investment options with historically stable value.

Indices

With global indices like the S&P 500 and FTSE 100, traders can speculate on the performance of major stock markets. This is ideal for those looking to gain exposure to economic trends without trading individual stocks.

Cryptocurrencies

CPT Markets also offers digital assets such as Bitcoin and Ethereum, enabling traders to participate in the fast-growing crypto market. This option caters to those looking for high-risk, high-reward trading opportunities in digital assets.

This broker also offers maximum leverage for market traders for every trading options and traders can trade safe because CPT Markets is a secure and regulated broker. Stocks CPT Markets offers access to a wide range of stocks from popular markets such as the US, UK, Canada, and more. Commodity trading offers higher liquidity and volatility, making it an attractive option for traders.

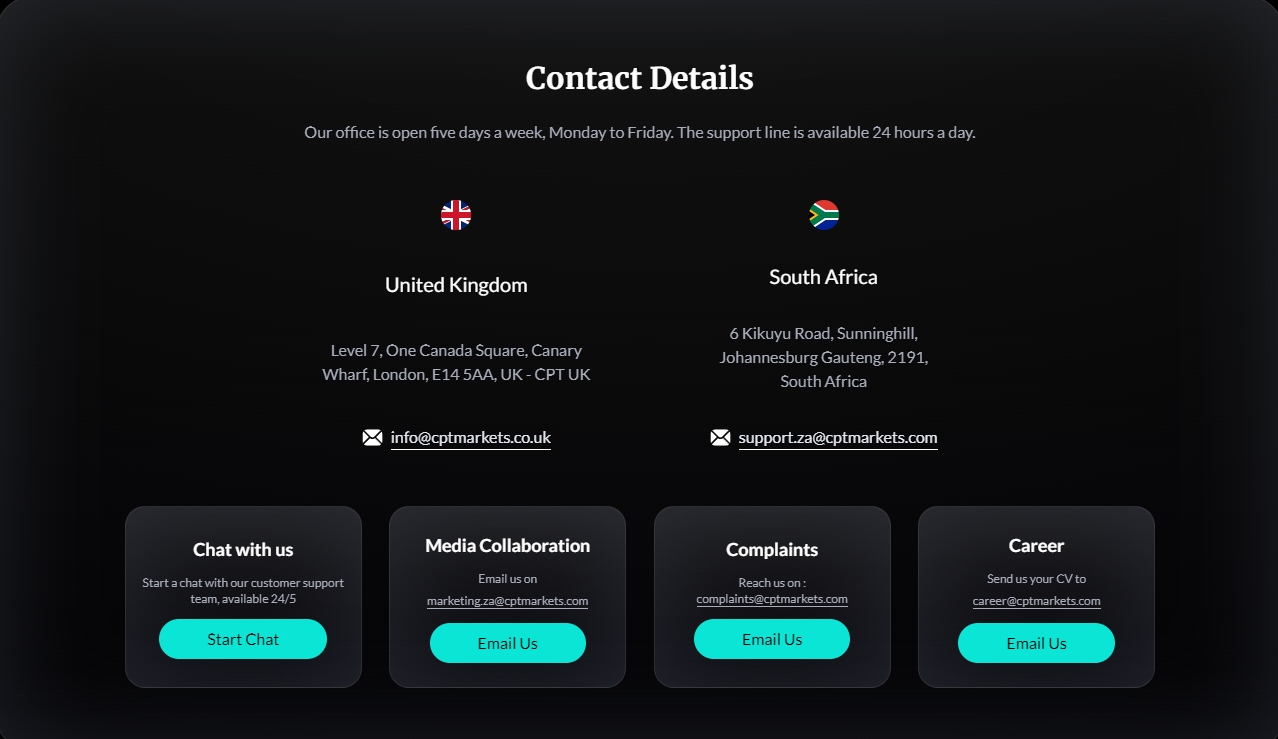

CPT Markets Customer Support

CPT Markets provides reliable customer support to assist traders with any issues or questions, ensuring a smooth trading experience. Their support team is accessible through multiple channels, including live chat, email, and phone, allowing traders to get quick assistance whenever needed.

The live chat feature offers real-time responses, making it a convenient option for immediate help with account issues or platform navigation. For more detailed inquiries, traders can reach out via email and expect a timely response from the support team.

CPT Markets’ customer support is available 24/5, aligning with market hours to offer assistance during active trading times. This level of availability is especially valuable for traders who may encounter issues while trading across global markets.

Advantages and Disadvantages of CPT Markets Customer Support

Withdrawal Options and Fees

CPT Markets provides several deposit and withdrawal options to ensure that traders can easily access their funds. Each method varies in processing time and fees, giving traders flexibility in how they manage their withdrawals.

Bank Transfer

CPT Markets allows withdrawals via bank transfer, a secure and widely used option. While it may take a few business days for funds to appear in the trader’s bank account, this method offers strong security.

Credit/Debit Card

Traders can withdraw directly to their credit or debit card, typically with faster processing times than bank transfers. This method is convenient for those who prefer direct access to funds through their card.

E-Wallets

CPT Markets supports popular e-wallets like Skrill and Neteller for withdrawals, offering quicker processing times. E-wallets are favored for their ease of use and speed, making them ideal for traders who prioritize fast access to funds.

Crypto Wallets

For those trading digital assets, CPT Markets also provides cryptocurrency withdrawals to compatible wallets. This option allows traders to directly manage their crypto holdings and is beneficial for those actively investing in digital assets.

CPT Markets Vs Other Brokers

#1. CPT Markets vs AvaTrade

CPT Markets and AvaTrade both cater to global traders but offer different strengths. CPT Markets is heavily regulated by the FCA, appealing to traders who prioritize security and transparency, while AvaTrade is regulated by multiple authorities, including the Central Bank of Ireland, providing similar reliability but with a broader regulatory reach. CPT Markets offers trading primarily on MetaTrader 4 and MetaTrader 5, known for their robust tools and analytics, whereas AvaTrade also includes its proprietary AvaTradeGO app and options like AvaOptions, catering to traders seeking platform variety. In terms of fees, CPT Markets generally has competitive spreads, although some users note higher fees on select accounts; AvaTrade also provides competitive pricing but with some specific inactivity fees that may impact cost-conscious traders. While both brokers support various assets, AvaTrade includes additional options like bonds and ETFs, providing slightly more diversity for those interested in a broader portfolio.

Verdict: CPT Markets is ideal for traders focused on the MT4/MT5 experience and FCA regulation, whereas AvaTrade appeals to those looking for additional platform options and asset variety. AvaTrade’s broader regulatory oversight may offer extra assurance, but CPT Markets maintains strong security with a focused asset range.

#2. CPT Markets vs RoboForex

CPT Markets and RoboForex each offer distinct features, catering to different trader priorities. CPT Markets is regulated by the FCA, ensuring a high level of security and transparency, while RoboForex operates under the IFSC, which has less stringent requirements. CPT Markets primarily supports MetaTrader 4 and 5, focusing on Forex and major asset classes, whereas RoboForex offers a broader selection of platforms, including cTrader and R Trader, which provide extra tools and flexibility for multi-asset trading. When it comes to fees, CPT Markets generally maintains competitive spreads, though RoboForex tends to offer lower spreads and additional options, like cent accounts, for those with smaller capital. RoboForex also provides a more extensive range of assets, including stocks and ETFs, which may be appealing for traders looking for greater diversification.

Verdict: CPT Markets stands out for its strong regulatory backing and simplicity for Forex-focused traders, while RoboForex offers more asset variety and platform options for those seeking lower spreads and additional trading flexibility. CPT Markets is best for those prioritizing regulation, while RoboForex suits traders aiming for diversified assets with lower entry costs.

#3. CPT Markets vs Exness

CPT Markets and Exness both serve as reliable brokers but target slightly different trading needs. CPT Markets is regulated by the FCA, emphasizing security and transparency, while Exness is regulated by multiple authorities, including CySEC and the FCA, offering similarly strong oversight. CPT Markets provides a straightforward trading experience on MetaTrader 4 and 5, suitable for traders focused on traditional assets like Forex and commodities. Exness, however, offers not only MetaTrader 4 and 5 but also web-based platforms with more advanced risk management tools, appealing to traders who need flexibility across different devices. Exness typically offers tighter spreads and more competitive fees, especially for high-volume traders, while CPT Markets maintains competitive spreads but with fewer account types and options. Exness also supports a wider variety of assets, including cryptocurrencies and more exotic pairs, making it ideal for those seeking diversified trading options.

Verdict: CPT Markets is well-suited for traders prioritizing a focused, secure trading experience with FCA regulation, while Exness excels in offering asset variety and lower spreads for high-volume or diverse traders. Exness appeals to those seeking flexibility and broader asset exposure, whereas CPT Markets is a solid choice for those valuing simplicity and security.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH CPT MARKETS

Conclusion: CPT Markets Review

In conclusion, CPT Markets is a reliable brokerage with a strong emphasis on security and transparency, thanks to its FCA regulation. With accessible MetaTrader 4 and 5 platforms, it provides a user-friendly environment for both beginner and experienced traders.

While its asset range covers major classes like Forex, commodities, indices, and cryptocurrencies, CPT Markets may not offer the variety seen in other brokers but compensates with solid customer support and competitive spreads on its account options. Overall, CPT Markets is a good fit for traders who value regulatory assurance, simplicity, and a straightforward trading experience.

CPT Markets Review: FAQs

Is CPT Markets regulated?

Yes, CPT Markets is regulated by the Financial Conduct Authority (FCA), which ensures security and transparency for traders.

What trading platforms does CPT Markets offer?

CPT Markets provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both widely recognized for their trading tools and user-friendly interfaces.

What is the maximum leverage offered by CPT Markets?

CPT Markets offers a maximum leverage of 1:200.

OPEN AN ACCOUNT NOW WITH CPT MARKETS AND GET YOUR BONUS