Core Liquidity Markets Review

Are you an active or day trader looking for the multi-asset online brokerage of your dreams? If yes, consider Core Liquidity Markets (CLM) a viable option. Established in 2013, this brokerage is becoming the go-to choice for traders worldwide.

Registered in Saint Vincent and the Grenadines and regulated by the Financial Services Authority (FSA), Core Liquidity Markets has provided a wide range of trading services from Forex and Indices to crypto, commodities, and indices. Their cutting-edge technology and services allow traders to enjoy a low-cost trading environment with lightning-fast execution, powerful analytics, free signals, robots, and more.

In this Core Liquidity Markets review, we will take a closer look at their services and features, so you can decide if this is the right broker for you. Our review experts will also discuss the pros and cons of CLM, security for investors, details about fees and commissions, and much more.

So, let’s get into it.

What are Core Liquidity Markets?

Core Liquidity Markets is an English forex broker established in Melbourne, Australia, in 2013. This broker offers their services to retail traders and institutional clients — including investment banks. Being an Australian-based broker, it operates according to the strict regulations of ASIC. Furthermore, it also runs through Saint Vincent and the Grenadines, with a sound reputation amongst industry professionals and traders.

In addition, the broker offers money manager programs with MAM and PAMM accounts that supply access to a range of services and trading options. For increased safety, the broker houses its MetaTrader 4 platform in two well-secured EFX1 suites; Equinix LD4 (London) and Equinix NY4 (NYC). Moreover, you can trade several instruments like forex, metals, commodities, indices, equities, and cryptocurrencies.

Core Liquidity Markets provides customers with an advantageous experience through its FIX API, enabling them to acquire rapid real-time price feed. This technology also allows users to submit trade requests effortlessly and set and adjust orders while receiving automated confirmations of trading activities at a faster rate than before.

Advantages and Disadvantages of Trading with Core Liquidity Markets

Benefits of Trading with Core Liquidity Markets

Core Liquidity Markets provides traders with many benefits trailing stop and two-stop orders. This platform has a multilingual interface allowing users to perform one-click order execution. Moreover, more than 30 technical indicators help traders make informed decisions.

Moreover, this brokerage firm provides retail and corporate customers with top-notch financial services for Forex trading. For active traders and investors, CLM offers favorable financial market trading conditions. Core Liquidity Markets offers competitive spreads and execution of orders in real-time.

Core Liquidity Markets caters to both traders and passive investors alike. With a vast selection of over 100 instruments, PAMM accounts, and DupliTrade, any level of investor can make the most out of their trading journey without worrying about experience levels. Moreover, with the availability of 2 different account types, traders can choose the one that suits their trading style best.

Core Liquidity Markets Pros and Cons

Below are the pros and cons of the Core Liquidity Markets:

Pros

- Copy trading

- MetaTrader 4 integration (servers hosted by Equinix)

- Fast order execution speed

- Competitive spreads and commissions

Cons

- No Islamic swap accounts are available

- Demo account for the limited time period

- Limited educational content for beginner traders

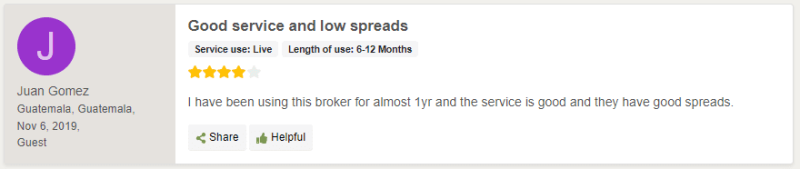

Core Liquidity Markets Customer Reviews

Our review team at Asia Forex Mentor gathered the following reviews from customers who have traded with Core Liquidity Markets. Many traders appreciate the wide selection of instruments, favorable conditions and spreads, fast order execution speed, and reliable customer support. However, several traders have withdrawal issues, and their customer support is less responsive than expected.

Core Liquidity Markets Spreads, Fees, and Commissions

Below are the details of the spreads, fees, and commissions at Core Liquidity Markets:

Core Liquidity Markets Spreads

On CLMForex, the spreads are not fixed and vary to the account type, instrument, and market conditions. The spreads start from 1.3 pips for the Standard account and 0.1 for the ECN account.

Core Liquidity Markets Fee

Deposit Fee

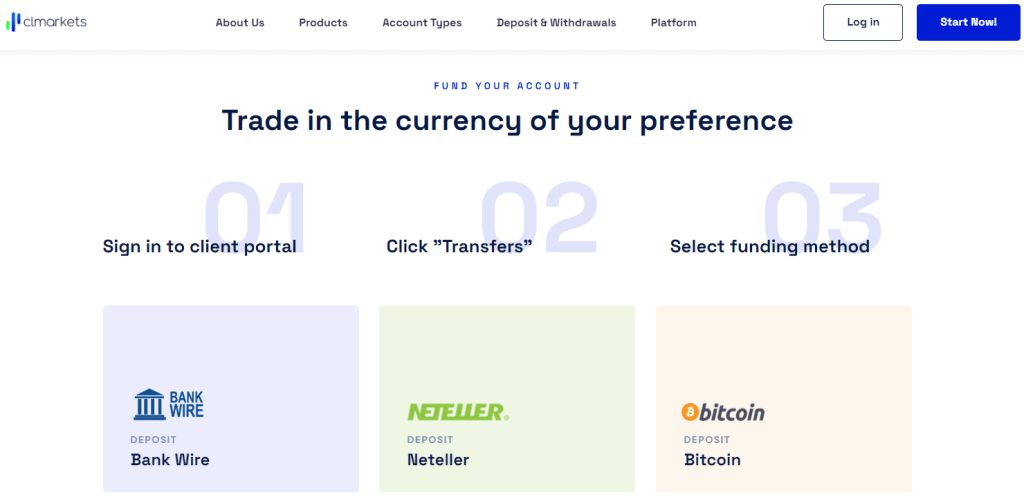

The deposit fee at Core Liquidity Markets varies depending on the payment mode you will use. For example, the bank charges a fee of $20 to $45. On the other hand, Neteller and bitcoin charged the 5% (waived*) fee on your withdrawal amount.

Withdraw Fee

The withdrawal fee at Core Liquidity Markets also depends on the payment mode you use to withdraw funds. For example, bank withdrawal charges are $15, and for Neteller and Bitcoin, it’s 2%. However, for Skrill, a fee of 1% is charged.

Minimum Deposit Fee

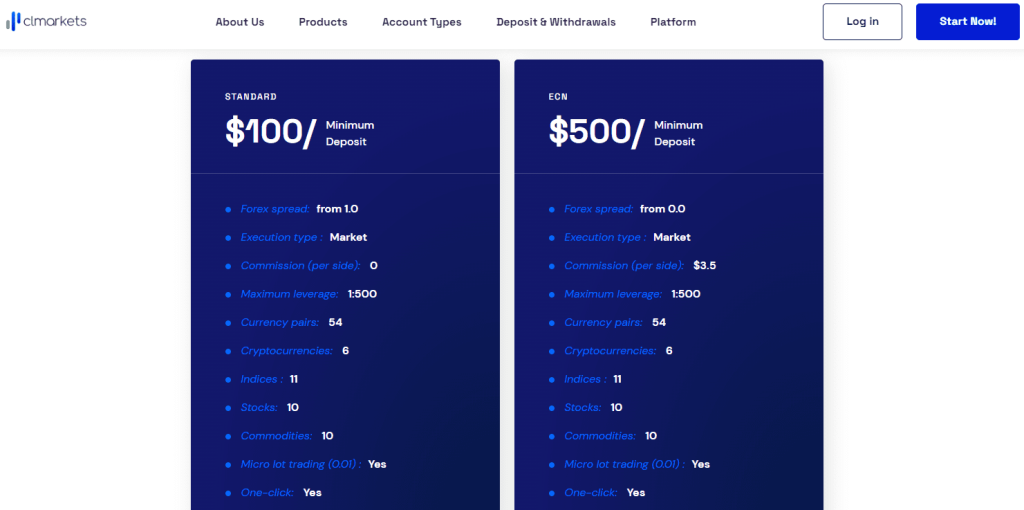

At Core Liquidity Markets, the minimum deposit fee for a standard account is $100; on an ECN account, the fee is $500. In addition, you can deposit funds through bank transfers, credit cards, and various online payment services.

Inactivity Fee

Core Liquidity Markets does not charge an inactivity fee. However, the swap charges are applied for overnight trades.

Core Liquidity Markets Commissions

The commission on Core Liquidity Markets depends on the account types. With the Standard account, you don’t have to worry about paying any commission. On the other hand, with the ECN account, a $3.5 per side cost must be considered.

Account Types

Core Liquidity Markets offer 2 different types of accounts, and traders can choose the one that suits their trading style.

Standard Account

With this type of core liquidity markets account, traders can benefit from spreads starting from 1.3 pips. In addition, there are no commissions or hidden fees charged for this account type. You can access vast trading instruments such as forex, CFDs, and cryptocurrencies. Moreover, the minimum deposit amount for this account type is $100.

ECN Account

This type of account is recommended for advanced traders and investors. It offers tighter spreads, starting from 0.1 pips, and requires a minimum deposit of $500. The commission on this account type is $3.5 per lot on both sides of the trade. A maximum of 100 instruments are also available for trading with this account type.

Demo Account

Core Liquidity Markets offers a demo account, allowing you to try the platform with virtual money. It is valid for 30 days, and after that, you need to deposit funds to continue trading. The demo account is a great way of getting familiar with the platform and practicing your strategies without risking your own funds.

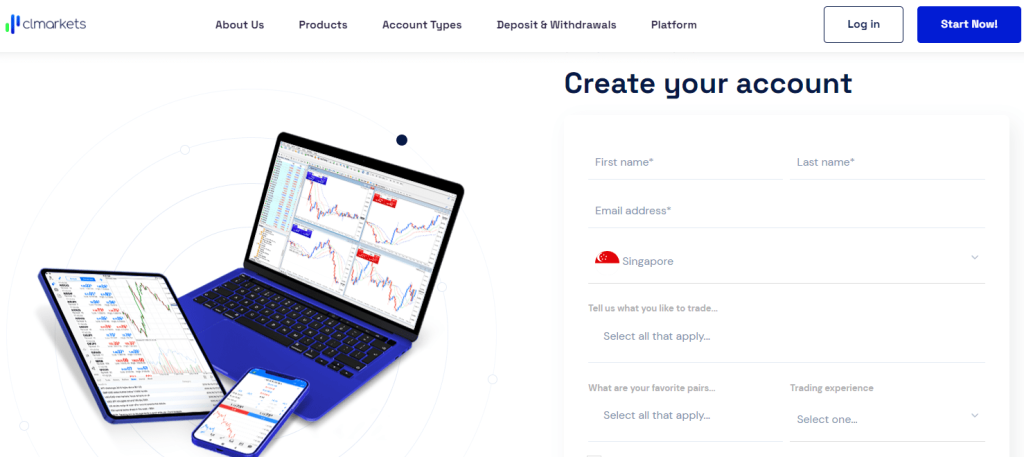

How To Open Your Account?

Here is a step-by-step guide to opening a trading account on Core Liquidity Markets:

- Step 1: Go to the official website and click ‘Start Now.’

- Step 2: In the next screen, add your details like name, email, country, trading experience, and instruments.

- Step 3: Click on Demo or Live account and choose the account type you want to open.

- Step 4: Go to the email and follow the instructions to continue; the email will provide login information and a link to download MT4.

- Step 5: Download and install MT4 and log in using the details you sent by email.

- Step 6: Start trading!

Following these steps, you can easily open a live or demo account on Core Liquidity Markets and start your trading journey.

What Can You Trade on Core Liquidity Markets

Core Liquidity Markets allow traders to trade with a wide variety of instruments that includes:

#1. Forex

You can trade around 54 currency pairs using Core Liquidity Markets, including major, minor, and exotic ones.

#2. Cryptocurrencies

Core Liquidity Markets allows traders to invest in cryptocurrencies such as Bitcoin, Ethereum, Litecoin, etc.

#3. Indices

You can gauge the overall performance of the market by trading indices like USA.30 (Dow Jones Industrial), SPX500 (S&P 500), NAS.100 (Nasdaq), HKG.33 (Hong Kong 33), and more.

#4. Stocks

Traders can trade with stocks of the biggest companies like Apple, Microsoft, Tesla, and many more.

#5. Commodities

Core Liquidity Markets allow traders to diversify their portfolios by trading with commodities like Gold, Silver, Turmoil, and more.

Core Liquidity Markets Customer Support

Core Liquidity Markets provides industry-leading customer support services, including a contact form on their website, a phone number (+442035146538), and an email address (support@clmforex.com). Their knowledgeable team of specialists can assist clients from across the globe.

However, their customer support could be faster, and there is no live chat option to get instant help. There is a WhatsApp chat option, but the response is not immediate and can take several hours. The support team of CLM is available from Monday to Friday from 9:00 AM to 6 PM GMT. Moreover, you can also visit their social media channels like Instagram, Facebook, and Twitter.

Their website has an FAQ section to help traders with basic questions. It is quite helpful for beginner traders and contains answers to the most common questions about the platform, trading conditions, deposits, withdrawals, and more.

Contact Details

- Phone no: +44 2 035 146 538

- Email: support@clmforex.com

- Address: CLMarkets Ltd., Suite 305, Griffith Corporate Centre Beachmont, Kingston, St. Vincent, and the Grenadines

Advantages and Disadvantages of Core Liquidity Markets Customer Support

Security for Investors

Core Liquidity Markets, the tradename of CLMarkets Ltd., has been registered by the Financial Services Authority of St Vincent & Grenadines (SVGFSA) as an International Business Company (IBC), with registration number 24750-IBC-2018.

SVGFSA does not issue licenses for brokerage services but rather registers brokers and provides a certificate number logged within the general register. In addition, it oversees companies registered in Saint Vincent and the Grenadines relating to financial matters and managing disputes between brokerages and their customers.

Investors and money managers can invest through their social trading platform and PAMM accounts, all while leveraging automated advisors for additional assistance. But it continues; partners and referrers even have an opportunity to generate more revenue by referring potential traders who join this brokerage firm. Again, however, there is no negative balance protection in place.

Core Liquidity Markets is a great option for traders and investors looking to leverage more sophisticated technology to trade with various assets. With their extensive list of assets, customer support, and social trading platforms, investors can get the most out of their trading experience.

Withdrawal Options and Fees

Core Liquidity Markets offers several convenient and secure methods for withdrawing funds from your account, including credit cards, bank wire transfers, Skrill, Neteller, and Bitcoin. The minimum withdrawal limit for banks is $100 and $50 for Skrill, Neteller, and BTC.

Fees are also charged to withdraw money from the account. For example, there is a 1% fee on Skrill 2% fee on Neteller and Bitcoin. However, for bank withdrawals, the charged fee is $15. In addition, all payments are processed in 24 hours except bank transfers, which may take 3 to 5 business days.

If the deposits are made via EPS, any profit or withdrawal must go to the exact same wallet. The rules for withdrawing with a bank transfer are identical. Only that cash can be withdrawn from your wallet if the money was put in through a card. All profits will be safely returned to Neteller, Skrill, or your chosen bank account.

Moreover, Core Liquidity Markets’ verification process for withdrawal requests is quite stringent. The procedure requires traders to provide documents such as a valid ID, proof of address, and a bank statement.

Core Liquidity Markets Vs. Other Brokers

Below is the in-depth comparison of CLM with other top-rated brokers in the market:

#1. Core Liquidity Markets vs. AvaTrade

AvaTrade offers extensive resources and analysis tools that provide automated trading, low commissions, narrow spreads, and ultra-quick order executions – proven by over a hundred satisfied customers. In addition, with DupilTrade, you can access numerous trading platforms from the same broker for even more convenience.

With AvaTrade, traders can trade without hassle with various payment options, top-quality customer service, and cutting-edge tools to make informed decisions. Besides that, automated systems are in place, giving you the ultimate freedom and flexibility to take charge of your unrestricted trading possibilities.

In addition, AvaTrade is a more reliable and trustworthy platform than Core Liquidity Markets as the top 7 financial authorities regulate it, such as the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), the Financial Services, and more.

On the other hand, Core Liquidity Markets are regulated by just 2 regulatory bodies, making them slightly less secure. Furthermore, Core Liquidity Markets doesn’t provide features such as automated trading, and the customer support service is not as helpful with customer queries.

AvaTrade and Core Liquidity Markets have unique benefits when choosing the best broker for you. Still, if you’re seeking a comprehensive trading solution with automated tools and outstanding customer service, AvaTrade is your choice. Its wide range of features backed by world-class assistance surpasses Core Liquidity Markets in providing an all-inclusive brokerage experience.

#2. Core Liquidity Markets vs. Roboforex

RoboForex delivers significant benefits to traders, such as small spreads and commissions, swift order executions, and top-notch customer service. Their trading platform is user-friendly while supplying a wealth of trading tools. Moreover, the broker provides copy trading services and automated solutions that can straightforwardly assist traders in achieving market success.

RoboForex is an unrivaled partner for those in the financial industry, boasting many awards and honors. They possess licenses from FSC Belize and EU-based CySEC (license No. 191/13 Robomarkets Ltd) and are recognized as international leaders in delivering superior services worldwide.

In addition, to start trading with this broker, you just need $10 in your account to get started. On the other hand, CLM has a minimum requirement of $100 to start trading. Moreover, RoboForex has several account types depending on the trader’s expertise and leverage of 1:2000, while CLM only offers leverage of 1:200.

The customer support of RoboForex is far better than CLM as they offer 24-hour support in multilingual languages through phone, emails, chat, and Skype. Meanwhile, the customer support of Core Liquidity Markets could be faster, and the response time could be more satisfactory.

In conclusion, RoboForex outshines CLM in terms of features and customer service. With its remarkable suite of products and services, RoboForex is the perfect option if you’re looking for a reliable broker. Furthermore, they have an easily accessible minimum account requirement and higher leverage, making them the go-to choice compared to Core Liquidity Markets.

#3. Core Liquidity Markets vs. Alpari

Alpari is a trusted broker with fully regulated entities in numerous countries around the globe. This award-winning forex and CFD provider gives its traders access to various markets and asset classes with competitive spreads, advanced tools, and fast execution.

This broker also offers trading services on the popular MetaTrader 4 platform, which is highly recommended for traders of all levels. It is feature-rich yet user-friendly, allowing you to control your trading performance fully. The broker also provides its own web-based platform, offering users an intuitive and easy-to-use online experience.

In addition, Alpari offers leverage of 1:3000, and the minimum deposit is just $1. On the other hand, Core Liquidity Markets offers a maximum leverage of 1:500 and has a minimum requirement of $100 to start trading. Moreover, withdrawals and deposits on Alpari are ultimately free, and there is no cost involved, whereas there is a processing fee of up to $15 for withdrawals and deposits on CLM.

With 21 years of experience in the industry, Alpari also provides comprehensive customer support via phone, email, and live chat. Meanwhile, CLM’s customer support is not as reliable as Alpari, and they do not have automated trading or demo accounts.

Overall, Alpari is better than Core Liquidity Markets due to its high leverage, user-friendly platform, and customer service. In addition, the wide range of services and its low-cost and reliable trading environment make Alpari the perfect choice for seasoned traders or beginners. With Alpari, you get a world-class broker that provides everything you need to succeed in the financial markets.

Conclusion: Core Liquidity Markets Review

Core Liquidity Markets has much to offer experienced traders and those just starting in the forex market. Their straightforward trading platform makes it easy to get started, and their social trading platform, PAMM accounts, and referral program offer additional ways to generate income.

For potential traders and investors, CLM offers a wide range of assets and instruments, attractive spreads, and reliable customer support. Withdrawal options and fees are reasonable, and the stringent verification process embodies their commitment to secure transactions.

However, the customer support of Core Liquidity Markets is not as reliable as other brokers, and their maximum leverage is only 1:500. Moreover, their minimum account requirement is $100, which might be too high for beginners.

Therefore, if you are looking for a broker with reliable customer service, high leverage, and low minimum account requirements, RoboForex or Alpari are better brokers. In addition, these brokers offer competitive spreads, comprehensive customer service, advanced tools and trading platforms, and more.

Core Liquidity Markets Review FAQs

Is Core Liquidity Markets regulated?

Core Liquidity Markets is regulated by the Financial Services Authority of St Vincent & Grenadines (SVGFSA) with registration number 24750-IBC-2018. Moreover, it is also regulated by the Australian Securities and Investments Commission (ASIC).

What is Core Liquidity Markets minimum deposit?

The minimum deposit for CLM is different for both its account types. The standard account requires a minimum deposit of $100, while the ECN account requires a minimum deposit of $500

Does Core Liquidity Markets charge withdrawal fees?

Core Liquidity Markets charges a withdrawal fee depending on the payment method. Below is the fee charged when making a withdrawal:

Skrill: 1%

Bank withdrawal: $15

Neteller and Bitcoin: 2%