In the world of Forex Trading, identifying reliable entry and exit points is paramount for success. Traders employ various trading strategies to make informed decisions, but one method that stands out is Confluence Trading. This technique has gained significant attention among forex traders for its ability to improve accuracy and minimize risks.

The idea behind confluence trading is simple yet effective: multiple technical indicators and confluence factors are analyzed in unison to predict future price movements. Instead of relying on a single signal or tool, traders look for areas where various indicators align or ‘confluence.' This strategy is known for reducing false signals and increasing the probability of a successful trade. This article delves into the details of confluence trading, explaining its importance, methods, and how to implement it in your trading strategy.

What is Confluence Trading?

In Confluence Trading, the aim is to find areas or ‘zones' where multiple trade signals and technical indicators intersect. This alignment of signals is often referred to as a confluence zone, and it's where forex traders are more likely to make their moves. These zones offer a higher probability of success as they are backed by several indicators pointing towards a similar outcome, be it a rise or fall in price levels.

The confluence trading definition highlights the gathering of multiple trading indicators and confluence factors at a single point in the chart. But it's not limited to technical analysis tools alone. Fundamental and technical analysis can also be part of the equation, adding another layer of validation to the trade setup. For example, if a strong support level coincides with a bullish chart pattern and positive economic data, that would serve as a strong buy signal in confluence trading.

Watch This Video: Why Should You Not Trade Without Confluence in Forex Trading

Importance of Confluence Trading

Confluence Trading holds significant importance because it acts as a risk-mitigation tool. The accuracy of trading decisions often improves when multiple trade signals and confluence factors are considered together. By analyzing more than one aspect of the market, traders can reduce the likelihood of falling for false signals. This is particularly crucial in the volatile Forex market, where a single bad trade can result in considerable loss.

Another reason for its importance is the added layer of confirmation it provides. Confluence trading goes beyond standalone technical analysis or fundamental trading. It combines these with support and resistance levels, chart patterns, and even trend indicators to generate a more robust trading strategy. As a result, forex traders have a more holistic view of the market conditions, allowing for more informed and confident trading actions.

Tools and Indicators in Confluence Trading

Technical Analysis Tools

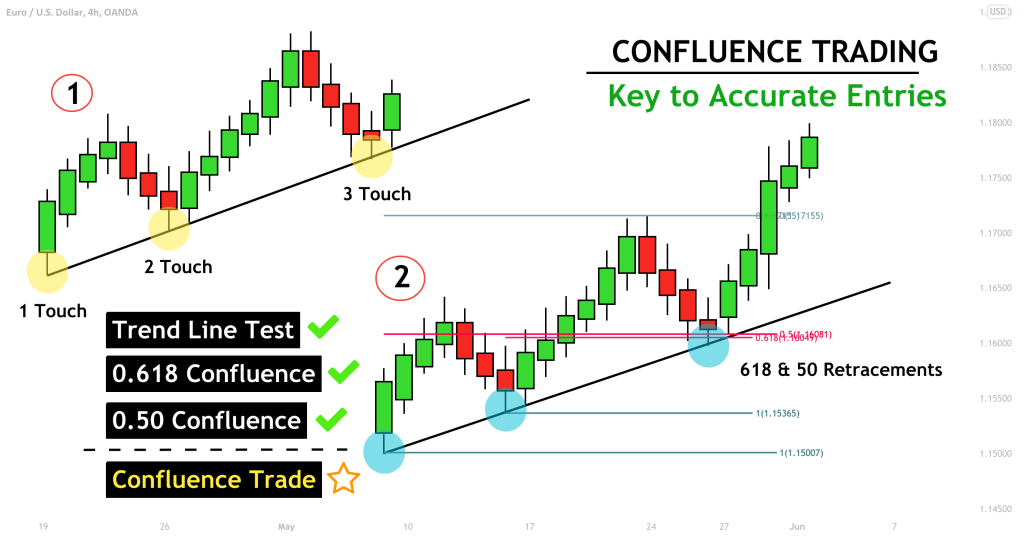

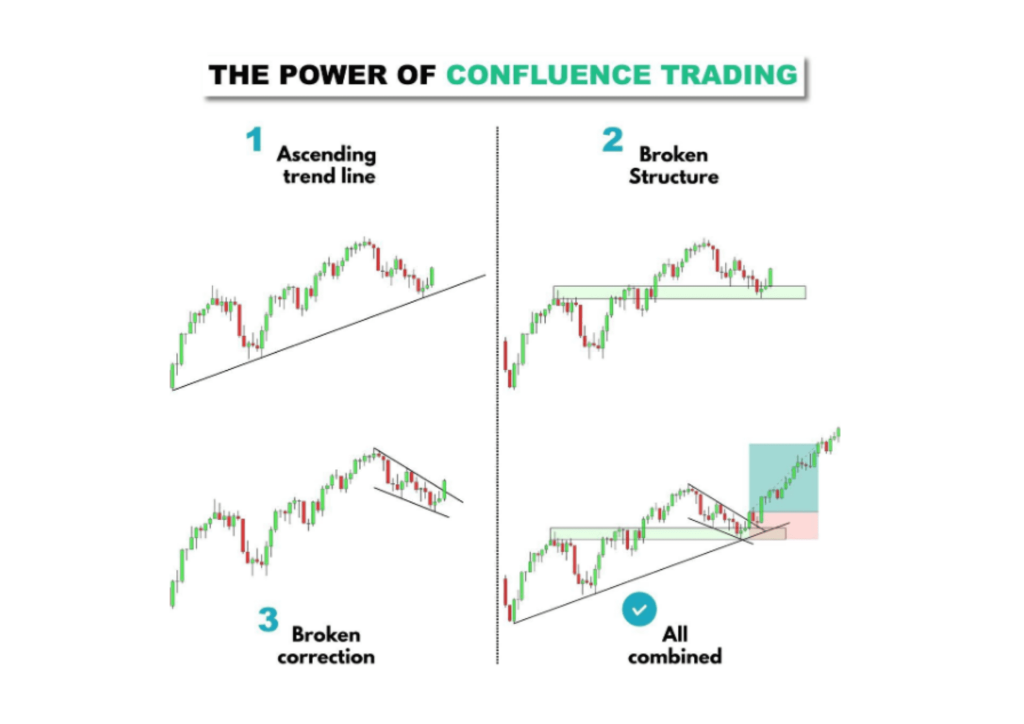

Technical Analysis Tools are indispensable for effective confluence trading. Among the most commonly used are moving averages, which help identify the market's direction over a specific period. Trend lines are another vital tool, employed to understand the market's movement in a particular direction. Fibonacci levels are used to identify potential support and resistance levels, providing traders with probable entry and exit points.

These tools don't work in isolation. The real power lies in combining them to identify confluence zones. For instance, a moving average intersecting with a Fibonacci level at the same point as a trend line can provide a strong trade signal, increasing the likelihood of a successful trade setup.

Price Action Confluence Trading

In Price Action Confluence Trading, the focus is solely on the price action of the given market. Traders scrutinize historical data, chart patterns, and support and resistance levels to anticipate future price moves. This approach often avoids the noise created by technical indicators, offering a more ‘pure' view of market behavior.

The key to price action confluence trading is the combination of different elements like trend lines, support and resistance, and chart patterns. When these factors align, they form a confluence zone that serves as a strong indicator for entry or exit points. The absence of technical analysis indicators does not make it less effective; rather, it offers a different angle for trading decisions.

Fundamental and Technical Analysis

Fundamental and Technical Analysis plays a dual role in confluence trading. Fundamental analysis looks at economic indicators like interest rates, GDP, and employment numbers to gauge market conditions. On the other hand, technical analysis concentrates on chart patterns and price levels to predict future movements.

These two forms of analysis can be used in tandem for a more robust trading strategy. For example, if technical analysis tools suggest a bullish trend and fundamental analysis confirms strong economic indicators, it creates a confluence factor that reinforces a buy signal. This multi-layered approach adds depth and reliability to trade setups, making them more compelling for forex traders.

Also Read: Forex Trading and Market Sentiment

Confluence Factors and Signals

Support and Resistance Levels

In support level confluence trading and resistance level confluence trading, traders focus on support and resistance levels where the price has previously shown a tendency to bounce or reverse. These levels serve as critical confluence factors, providing traders with areas to set entry and exit points. When these levels coincide with other indicators like moving averages or trend lines, it forms a more reliable trade setup.

It's crucial to note that support and resistance levels are not static. They can change based on market participants and historical data. Thus, the levels should be continually reassessed for their relevance in current trading conditions.

Multiple Trade Signals Lining

Multiple trade signals lining is a cornerstone of confluence trading. This concept involves the simultaneous alignment of many forex traders using different indicators to point to the same trade setup. When multiple traders draw similar conclusions from various indicators, it strengthens the validity of the potential trade, decreasing the likelihood of false signals.

This collaborative aspect provides an extra layer of validation. If multiple trading indicators like moving averages, trend indicators, and Fibonacci levels all point toward a particular trade, it creates a powerful confluence zone. This zone can significantly boost the chances of a successful trade, making it a favored approach among forex traders.

Fibonacci Level Confluence Trading

Fibonacci Level Confluence Trading employs Fibonacci retracements to locate potential confluence zones. These Fibonacci levels serve as natural support and resistance levels, and when they intersect with other technical indicators like trend lines and moving averages, they produce a strong trade signal.

The strength of Fibonacci level confluence trading lies in its versatility. These levels can be used in conjunction with price action, chart patterns, or any other technical analysis tools to create a robust trading approach. Therefore, traders often integrate Fibonacci retracements into their strategies to refine entry and exit points, enhancing their overall trading strategy.

Conclusion

Confluence trading offers a robust framework for market participants, especially those engaged in forex trading. By employing a mix of technical analysis tools, fundamental and technical analysis, and multiple trade signals, traders can make more informed and stronger trading decisions. This method brings together different combinations of indicators and factors to create confluence zones, elevating the confidence level for a particular trade.

Moreover, the beauty of confluence trading lies in its adaptability and depth. Whether you're a beginner or a seasoned trader, incorporating confluence factors into your trading strategy can significantly increase your chances of identifying more reliable trade setups. Thus, confluence trading not only enhances your current trading approach but also contributes to long-term success in the forex market.

Watch This Video: Insights on Confluence, Fibonacci

FAQs

Can I Use Confluence Trading with Other Market Instruments Besides Forex?

Yes, while confluence trading is popular among forex traders, its principles can be applied to other financial markets like stocks, commodities, or cryptocurrencies. The key is to adapt the confluence factors and technical indicators relevant to your chosen market. Price action, support and resistance levels, and trend indicators are universal concepts that work across different types of markets.

How Do I Handle False Signals in Confluence Trading?

Confluence trading is designed to reduce the risk of false signals by incorporating multiple trade signals and confluence factors. However, it's not foolproof. Traders often use risk management strategies like stop-loss orders to mitigate the impact. Additionally, continually reassessing support and resistance levels based on current historical data can also improve accuracy.

How Does Psychological Level Play Into Confluence Trading?

Psychological levels refer to price levels that traders perceive as significant, often because they are round numbers or have historical significance. These levels can serve as additional confluence factors. For instance, if a psychological price level coincides with a Fibonacci retracement level and a trend line, this adds another layer of confluence, making the trade setup more reliable.