The Concealing Baby Swallow candlestick pattern is a distinctive and rare candlestick formation in forex trading, primarily used to signal potential bullish reversals or bearish continuations, depending on the context of its appearance. Understanding this pattern and knowing how to trade it can provide valuable insights for traders.

Mastering the recognition of this pattern allows traders to anticipate market movements more accurately, enhancing their ability to make informed trading decisions. This pattern’s reliability, combined with its clear structure, makes it a valuable addition to a trader’s toolkit, especially when used in conjunction with other technical analysis methods.

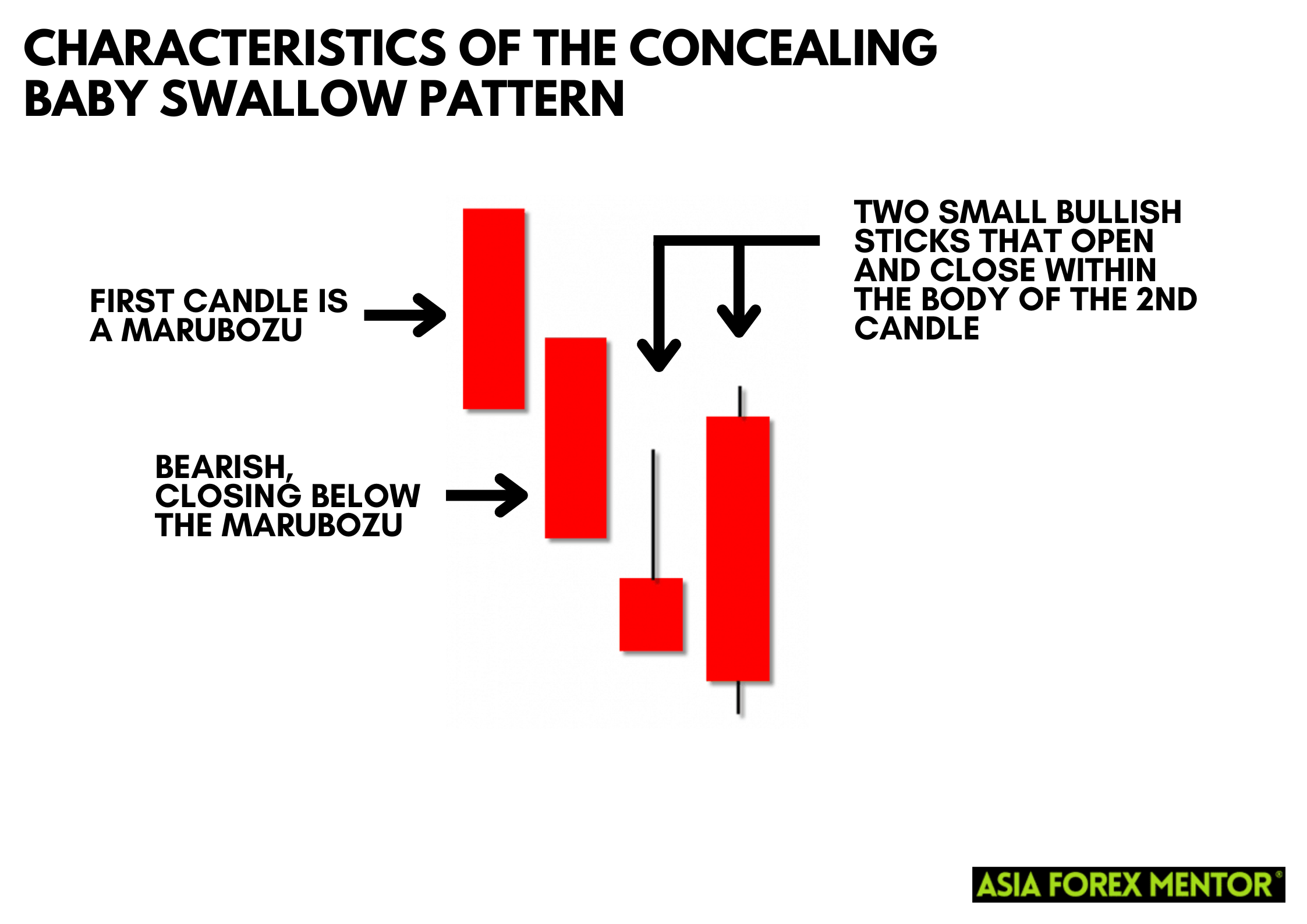

Characteristics of the Concealing Baby Swallow Pattern

- First Two Candles: Both are bearish Marubozu candles, indicating a continuation of the downtrend with strong selling pressure.

- Third Candle: Opens lower than the second Marubozu, moves upwards during the session, but closes at or near its low, within the second candle’s body.

- Fourth Candle: Engulfs the third candle completely and closes at a new low, reinforcing the bearish trend.

Also Read: The 28 Forex Patterns Complete Guide

How to Trade the Concealing Baby Swallow Pattern

What is the Concealing Baby Swallow trading strategy? Trading the Concealing Baby Swallow pattern involves identifying its formation and understanding the context in which it appears. Here’s a step-by-step guide:

Entry Point

- Bullish Reversal: If the pattern forms near a strong support level during a downtrend, look for a bullish candlestick following the pattern to confirm the reversal. Enter a long position at the close of this bullish confirmation candle.

- Bearish Continuation: If the pattern appears in the middle of a downtrend, it is likely to continue the bearish movement. Enter a short position at the close of the next bearish candle following the pattern.

Stop Loss

- Place the stop loss slightly below the low of the pattern for a bullish trade. This minimizes risk if the market reverses against the expected trend.

- For a bearish trade, set the stop loss above the high of the pattern to protect against unexpected bullish reversals.

Profit Target

- Measure the size of the pattern from the high of the first Marubozu to the low of the fourth candle. Apply this measurement from the entry point to set a minimum profit target. This approach often yields a risk-reward ratio between 1:1 and 1.5:1, though it can go as high as 2:1 or more depending on the pattern’s size and market conditions.

Pros and Cons

Pros

- High Reliability: When identified correctly, the Concealing Baby Swallow pattern offers a high probability of indicating significant market movements, whether it’s a reversal or continuation. This reliability can be an asset in making informed trading decisions.

- Clear Structure: The distinct four-candle formation provides clear and straightforward identification, which helps traders avoid ambiguous signals and focus on well-defined patterns.

- Effective in Volatile Markets: This pattern is particularly useful in volatile market conditions, helping traders to spot potential turning points quickly before the broader market catches on.

- Supports Risk Management: The defined entry and exit points, along with stop loss and profit target strategies, allow for better risk management, minimizing potential losses and maximizing gains.

- Integration with Other Tools: The pattern can be used alongside other technical analysis tools, such as moving averages, trend lines, and oscillators, to provide a more comprehensive market analysis and confirm signals.

Cons

- Rarity: The Concealing Baby Swallow pattern is rare, which means traders may not encounter it frequently. This rarity can limit its utility for those looking for more commonly occurring patterns to base their trades on.

- Complex Identification: Despite its clear structure, correctly identifying the pattern can be challenging, especially for novice traders. Misidentification can lead to incorrect trading decisions.

- Requires Confirmation: To mitigate the risk of false signals, traders need to wait for additional confirmation (e.g., subsequent candlesticks or indicators), which can delay entry and potentially reduce the profit potential.

- Market Context Dependency: The effectiveness of the pattern heavily depends on the market context and existing trend. Misinterpreting the trend or context can lead to poor trading outcomes.

- Emotional Discipline Needed: Executing trades based on this pattern requires strict adherence to the trading plan, including stop loss and profit targets. Emotional discipline is crucial, and deviations can undermine the strategy’s effectiveness.

Conclusion

The Concealing Baby Swallow pattern, while rare, is a powerful tool in the arsenal of a forex trader, signaling potential reversals or continuations. Successful trading of this pattern requires careful identification, confirmation, and strategic placement of stop-loss and profit targets. As with any trading strategy, it is essential to combine this pattern with other technical analysis tools to improve accuracy and manage risks effectively.

Also Read: What is the Kicker Pattern?

FAQs

What is the Concealing Baby Swallow pattern used for in forex trading?

The Concealing Baby Swallow pattern is used to signal potential bullish reversals or bearish continuations in the market. This four-candlestick pattern helps traders identify key points where the market trend may change direction or continue its current path.

How do you confirm a Concealing Baby Swallow pattern before trading?

To confirm the Concealing Baby Swallow pattern, traders look for a subsequent candlestick that supports the expected trend direction (bullish or bearish). For a bullish reversal, a bullish candlestick should follow the pattern, while a bearish candlestick should follow for a bearish continuation. Additional technical indicators, such as moving averages or support/resistance levels, can also be used for confirmation.

What are the risk management strategies for trading the Concealing Baby Swallow pattern?

Effective risk management for trading the Concealing Baby Swallow pattern includes setting a stop loss below the pattern’s low for bullish trades and above the pattern’s high for bearish trades. Profit targets should be set based on the pattern’s size, typically aiming for a minimum of a 1:1 risk-reward ratio. Traders should also ensure they stick to their predetermined entry and exit points to mitigate emotional decision-making.