CommEX Review

CommEX is a cryptocurrency exchange registered in the Seychelles, and it has been associated with several controversial activities. The platform was built on a business acquired from Binance, but despite its domain being active for some time, it remains entirely anonymous. The exchange closely resembles Binance in terms of its interface and functionality but lacks transparency regarding its operations and legal standing.

The broker has been blacklisted due to its scam nature and multiple user complaints. CommEX has a troubling history: in 2017, the Cyprus Securities and Exchange Commission (CySEC) revoked its license and fined its operators €400,000 due to various regulatory violations. Furthermore, the platform has been criticized for not providing registration documents or any verifiable contact information, creating a high risk for traders who might find it difficult to resolve disputes, particularly regarding the withdrawal of funds. The exchange is also known for unfair practices related to fee structures, adding to its notoriety as a potentially fraudulent entity.

What is CommEX?

CommEX is a cryptocurrency exchange that emerged as a successor to Binance’s operations in Russia. Officially registered in the Seychelles, CommEX was launched shortly before Binance announced the sale of its Russian business to this new entity. The exchange claims to focus primarily on the Commonwealth of Independent States (CIS) and Asian markets. However, details about the company’s founders, owners, and executives remain unclear, as inquiries have not been addressed. The platform offers trading in various cryptocurrencies and emphasizes its similarities to Binance, with shared user interfaces and functionalities.

There are notable inconsistencies in CommEX’s registration claims and overall transparency. While the company asserts it is an independent entity, several aspects, such as its privacy policy and terms of use, are nearly identical to Binance’s. This resemblance has led to speculation that the exchange is essentially a rebranded extension of Binance’s existing operations, especially since former Binance CIS team members are reported to have joined CommEX. Furthermore, the exchange’s lack of verifiable corporate information and its connections to Binance have raised concerns about its legitimacy and independence.

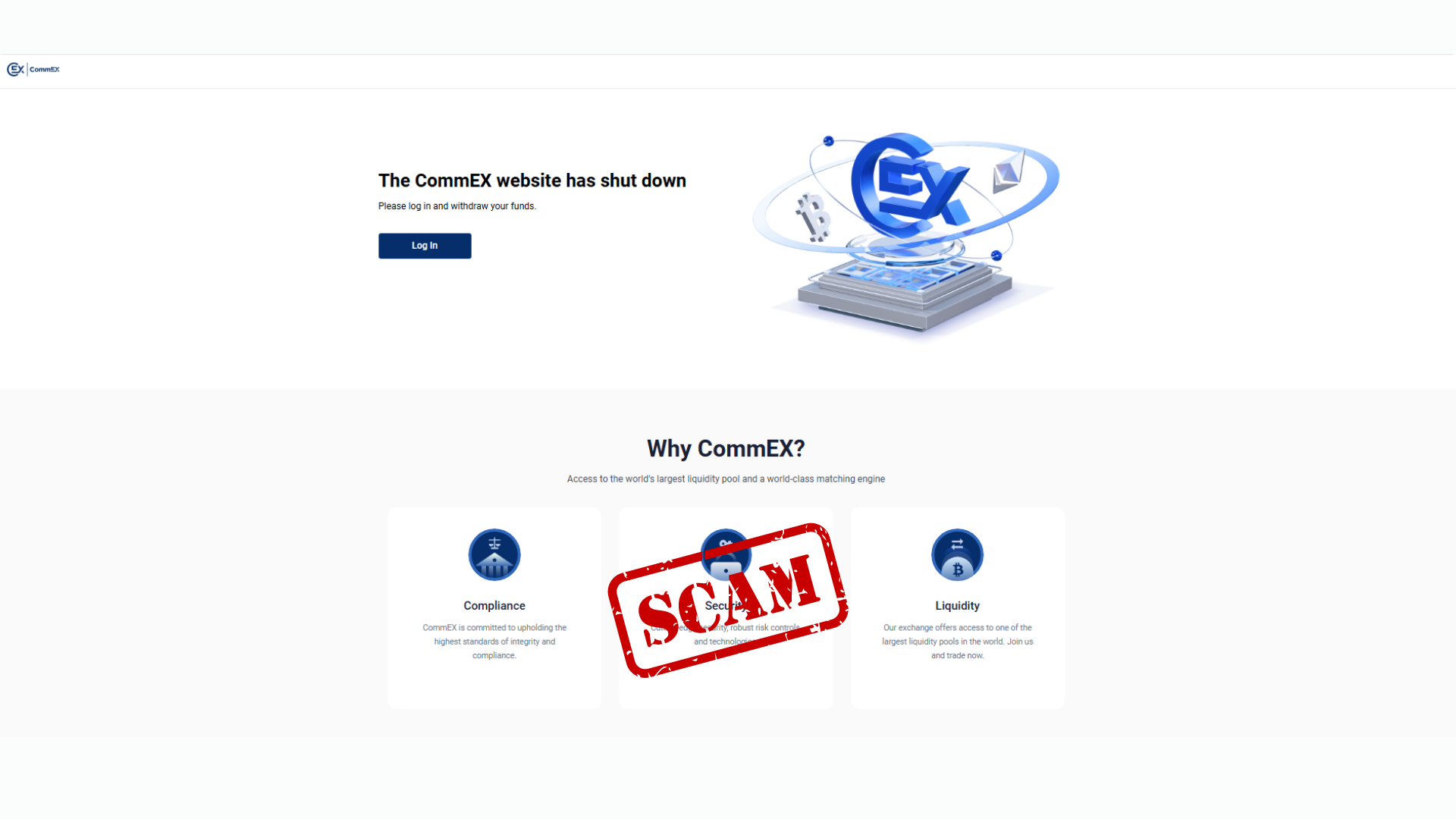

CommEX Website Status

CommEX is currently facing significant operational issues. The platform has announced a phased shutdown, beginning with the suspension of new user registrations and asset transfers as of March 25, 2024. This process will culminate with the complete shutdown of its website by May 10, 2024. The exchange cited “strategic planning adjustments” as the reason for this closure. Users are advised to withdraw their assets promptly to avoid additional management fees of 1% per day on any remaining balances after the shutdown date.

Further complicating matters, CommEX has encountered several registration problems and lacks clarity in its corporate details. Initially claiming to be a successor to Binance in Russia, the platform did not provide adequate transparency regarding its ownership or management, leading to skepticism about its independence and legitimacy. Many users and industry observers have noted that the exchange’s shutdown follows a series of regulatory challenges and operational difficulties, including the cessation of various trading services well before its planned closure.

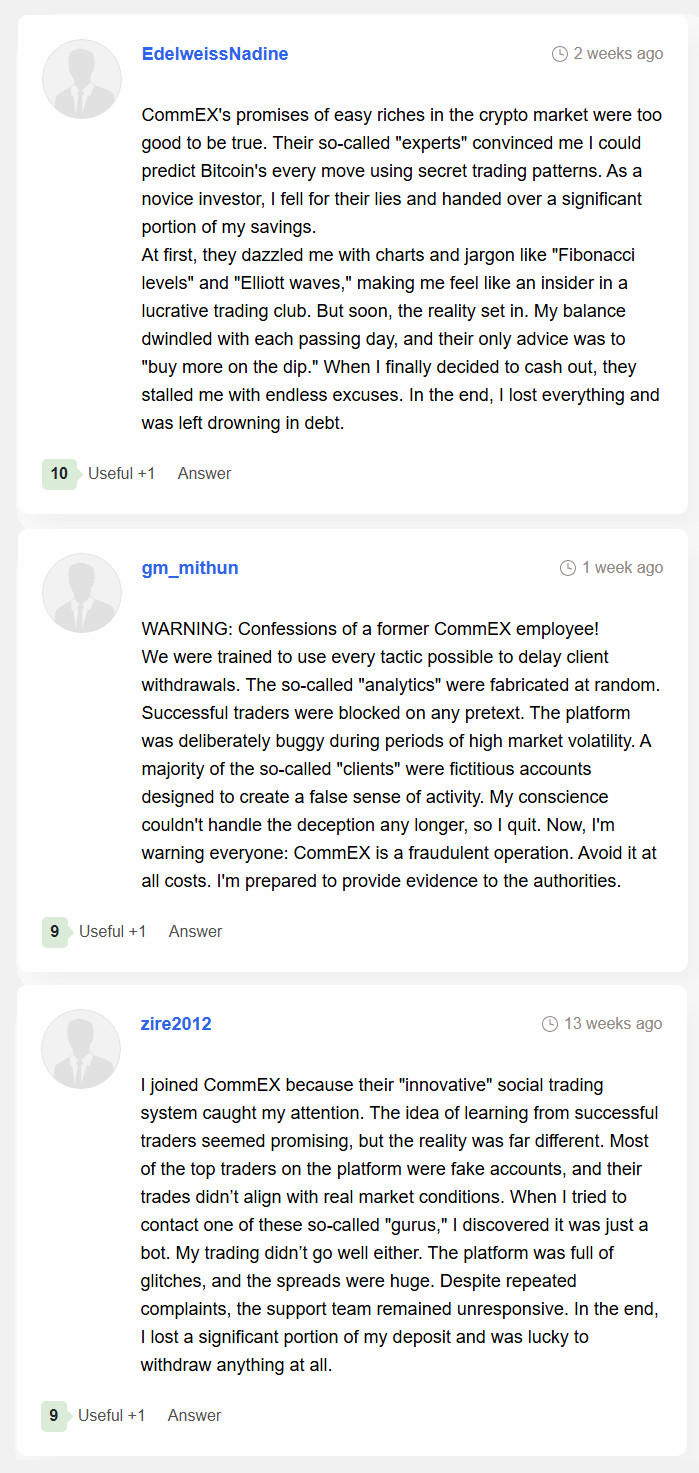

CommEX Customer Reviews

CommEX has received overwhelmingly negative reviews from both customers and former employees, with many alleging it operates as a fraudulent scheme. Users report being misled by so-called “experts” who promise quick profits through secret trading strategies, only to see their investments rapidly diminish while facing delayed or blocked withdrawals. Former employees have confessed that the platform manipulates trading data, creates fake accounts, and deliberately makes the system buggy during market volatility to frustrate genuine traders. Customers have complained about non-responsive support, large spreads, and glitches that result in substantial financial losses, warning others to avoid the platform entirely.

CommEX Regulatory Status

CommEX claims to be a regulated entity but lacks verifiable proof from recognized regulatory bodies, which raises significant concerns about its legitimacy. While it suggests it is registered in the Seychelles, this jurisdiction is known for its lax oversight, providing little reassurance to investors. The absence of transparent regulatory information means that traders dealing with CommEX may face high risks, including potential loss of funds without any legal recourse.

Trading with an unregulated broker like CommEX can expose investors to numerous dangers. Without regulation, there is no guarantee of fund protection or fair trading practices, and the broker could engage in unethical activities such as price manipulation or delaying withdrawals. Unregulated brokers are also more susceptible to fraudulent schemes, making it crucial for traders to exercise caution and prioritize brokers that provide clear regulatory credentials.

Conclusion: Is CommEX a Scam?

Yes, CommEX is a scam.

CommEX has made claims about being a legitimate and regulated cryptocurrency exchange, but these assertions do not hold up under scrutiny. The broker is registered in the Seychelles, a location known for its lax regulatory oversight, and it lacks the transparency and verifiable documentation typically associated with genuinely regulated entities. The risks associated with unregulated brokers like CommEX are significant; traders are left vulnerable to losing their funds with little to no recourse, as such brokers operate outside the jurisdiction of major financial regulators. This information was gathered after trading with the broker and reveals the discrepancies between their claims and actual status.

Asia Forex Mentor Reminds You

Asia Forex Mentor is committed to identifying and exposing scam brokers to protect traders and investors. The increasing presence of unregulated brokers offering forex and CFDs trading services across different regions has become a major concern. These brokers present significant risks to those involved in trading. It is crucial to exercise caution and avoid unauthorized brokers to safeguard your investments and ensure a secure trading environment.