FXNovus Review

CMTrading is an online trading platform that provides access to forex trading, commodities, and CFD trading for various global markets. Known for catering to beginner and intermediate traders, CMTrading offers educational resources like webinars and tutorials to help users improve their trading skills. This approach makes it a go-to platform for those who want to learn and trade in a single place.

A standout feature of CMTrading is CopyKat, a tool that lets users copy the trades of seasoned traders. This feature can benefit beginners by reducing the learning curve and allowing them to see real strategies in action. Users also have access to a demo account, which provides a risk-free environment to practice before diving into live trading.

CMTrading also includes customer support options and trading tool that cater to different levels of experience. The platform offers MetaTrader 4 (MT4) and Sirix, both popular and user-friendly trading platform. These tools make it easier for traders to analyze the market, make informed decisions, and manage their trades efficiently.

What is CMTrading?

CMTrading is an online forex broker platform that allows users to trade in various financial markets, including forex, commodities, indices, and stock CFDs. It is designed to be accessible to both beginners and experienced traders, offering tools like MetaTrader 4 (MT4) and a proprietary tool called CopyKat, which enables users to copy trades from successful traders. The platform also includes educational resources like webinars, market analysis, and tutorials, making it an option for those looking to both learn and actively trade.

To help users build skills, CMTrading provides educational resources such as webinars, tutorials, and market insights. These resources make it easier for new traders to understand the basics while actively trading on the platform.

CMTrading Regulation and Safety

CMTrading is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, ensuring compliance with established financial guidelines. This regulation helps protect user funds and promotes transparency in the platform’s operations. Traders can feel more confident knowing the platform meets industry standards for safety.

In addition to regulatory oversight, CMTrading uses secure technology to protect user data and transactions. Encryption and other security measures aim to keep user information private and safe from cyber threats. These steps enhance the overall security of the platform, making it a safer choice for forex trading.

For traders concerned about security, CMTrading offers a trustworthy environment to manage trades. By combining regulatory compliance with strong digital safeguards, the platform builds confidence among users. This security focus benefits both beginners and experienced traders looking for a secure trading experience.

CMTrading Pros and Cons

Pros

- Regulation

- User-friendly

- CopyKat feature

- Successful trading

Cons

- Occasional delays

- Swap fees

- Limited platform options

- No U.S. clients

Benefits of Trading with CMTrading

Trading with CMTrading offers users a range of benefits, particularly through its user-friendly tools and resources. The platform provides access to MetaTrader 4 (MT4), a widely respected tool for analyzing and managing trades, which is beneficial for both beginners and advanced traders. This ease of use allows traders to focus more on strategy and less on platform navigation.

Another key advantage is CMTrading’s CopyKat feature, which enables users to follow and replicate trades from experienced traders. This feature is especially helpful for beginners who want to learn by observing successful strategies in real time. It allows new traders to potentially earn while they learn, building confidence without starting from scratch.

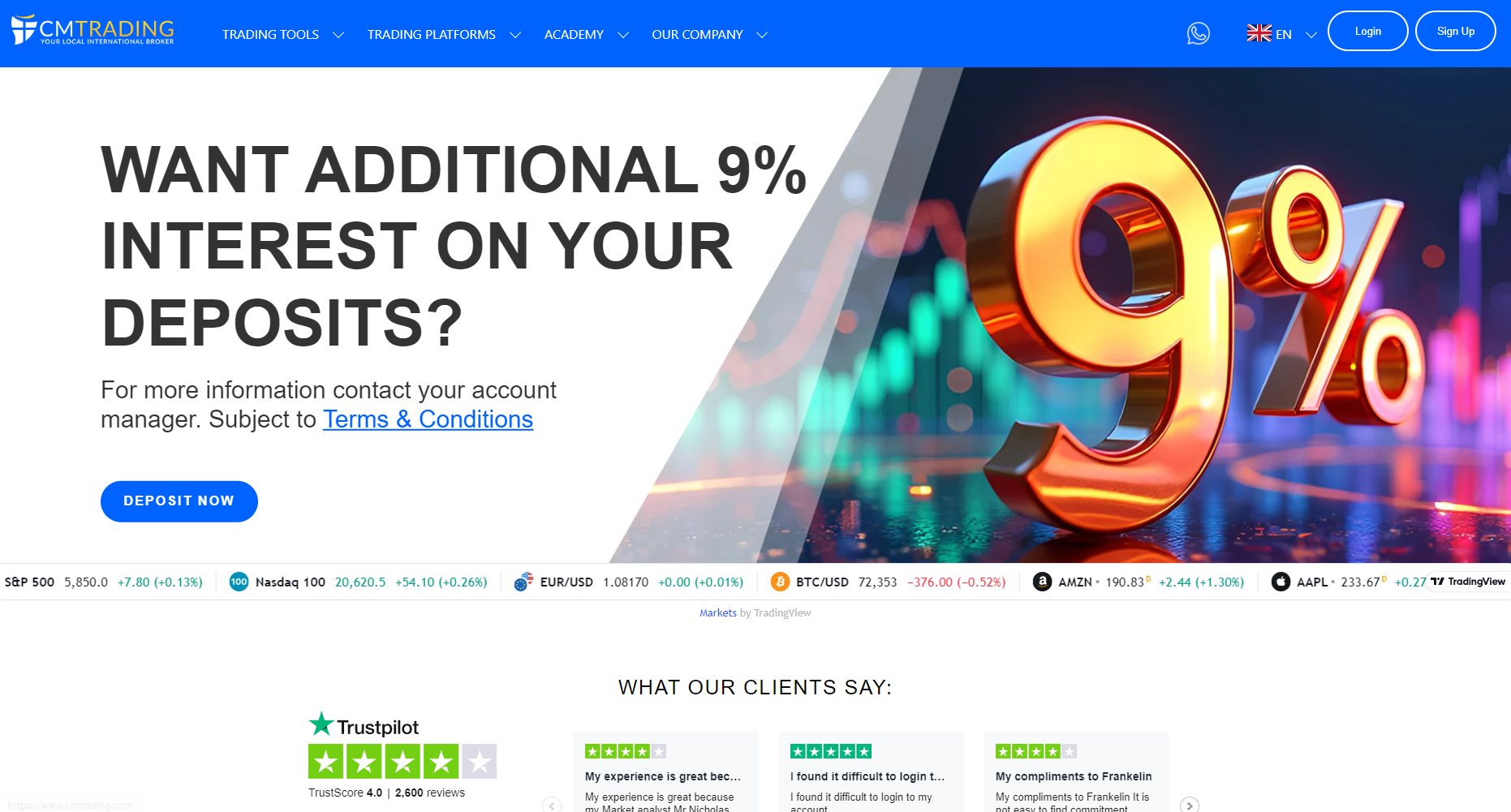

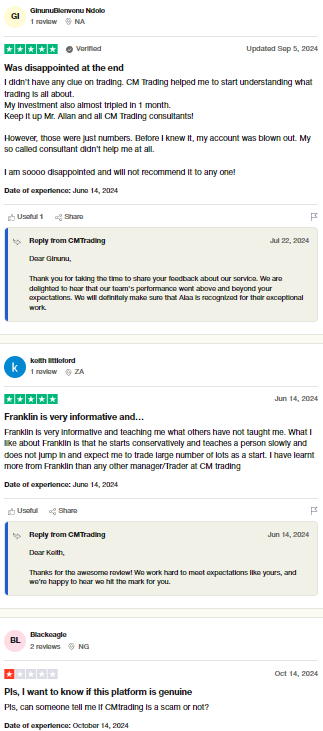

CMTrading Customer Reviews

Customer reviews of CMTrading generally highlight the platform’s user-friendly interface and accessibility for beginners. Many traders appreciate the CopyKat feature, which allows them to mirror the strategies of experienced traders, making it easier to get started without advanced knowledge. This feature has earned positive feedback, especially from those new to trading who want to see real-world strategies in action.

Another common praise in reviews is the range of educational tools offered, such as webinars and tutorials. These materials help users better understand market trends and trading techniques, adding value for those aiming to improve their skills over time. Beginners and intermediate traders often find this focus on education a strong reason to choose CMTrading over other platform.

On the other hand, some reviews point out areas where CMTrading could improve, such as response times in customer support. While the platform offers various support options, a few users have mentioned slower-than-expected replies. Despite this, the platform generally maintains favorable reviews for its easy-to-use tools and focus on customer education.

CMTrading Spreads, Fees, and Commissions

CMTrading offers competitive spreads, fees, and commissions designed to meet the needs of different traders. The platform generally applies variable spreads on major forex pairs, with spreads starting as low as 1.5 pips on standard accounts. This setup provides flexibility, allowing traders to choose accounts based on their trading frequency and budget.

In terms of fees, CMTrading does not charge direct commissions on standard account trades, making it a suitable choice for traders who prefer cost-effective trading. However, other account types may have different fee structures, and it’s essential for users to understand these before selecting an account. For those trading on a larger scale, premium accounts offer additional features and may have narrower spreads.

CMTrading also charges swap fees for positions held overnight, which vary depending on the instrument and market conditions. Traders can avoid these fees by closing positions within the trading day if preferred. Overall, CMTrading’s approach to spreads, fees, and commissions aims to balance affordability with flexibility, catering to a wide range of trading styles and preferences.

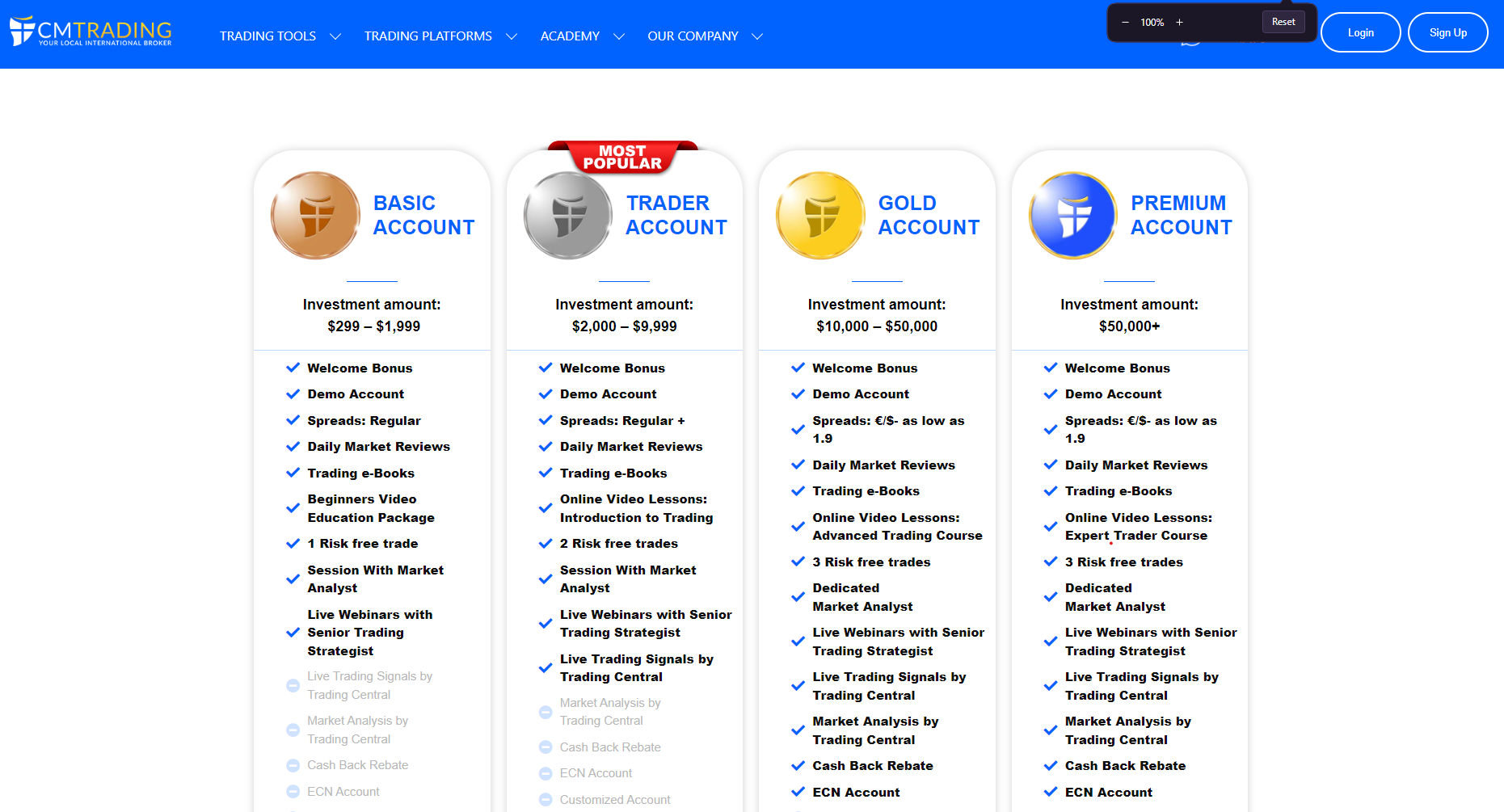

Account Types

CMTrading offers several trading accounts to meet the varying needs of traders, from beginners to experienced professionals. These trading accounts comes with its own features and benefits, tailored to suit different trading styles and investment levels:

Basic Account

The Basic Account is ideal for beginners or those new to CMTrading. It requires a lower minimum deposit and provides access to essential trading tool and resources, such as educational materials and customer support, making it an entry-level option for new traders.

Silver Account

The Silver Account caters to intermediate traders who seek additional features beyond the basics. With a slightly higher minimum deposit, this account type offers tighter spreads and access to more in-depth market analysis, supporting a more strategic approach to trading.

Gold Account

The Gold Account is suited for more experienced traders looking for enhanced trading conditions. It includes lower spreads, access to premium resources, and personalized account support, making it a good choice for those trading at higher volumes.

Premium/Platinum Account

The Premium or Platinum Account is designed for professional traders with a high trading volume. It offers the lowest spreads, exclusive access to premium tools and insights, and dedicated support, providing an advanced experience for serious traders who require more comprehensive resources.

The broker must choose a trading account that aligns to the trader’s preferences and forex market standard. There are more than three risk free trades opportunities for traders to acquire. Client funds are safe in these accounts because of the regulatory exercise of this forex broker. Risk free trade and transparent trading environment just like the other forex brokers do as their segregated accounts are safe because of high level encryption and algorithms.

How to Open Your Account

Opening an account with CMTrading is a straightforward process that new users can complete in a few simple steps. Here’s a guide on how to get started:

Step 1: Visit the CMTrading Website

Users begin by visiting the CMTrading website and clicking on the “Sign Up” or “Open Account” button. This leads to the registration page, where users enter basic information such as name, email, and phone number.

Step 2: Complete the Registration Form

On the registration form, users fill in the required fields with accurate details. They may also select their preferred account type and currency for trading.

Step 3: Verify Identity

To meet regulatory requirements, CMTrading requires users to verify their identity. This step involves submitting a valid ID, like a passport or driver’s license, along with proof of address, such as a utility bill or bank statement.

Step 4: Fund the Account

Once identity verification is complete, users can fund their account. CMTrading provides multiple deposit options, including bank transfers, credit/debit cards, and e-wallets, allowing users to select the most convenient method.

Step 5: Start Trading

With the account funded, users are ready to start trading. They can access the platform, explore available assets, and begin trading with CMTrading.

Apply trading strategy in an effortless way just like the other forex traders do. Dedicated market analyst are assigned to every traders who open live trading accounts.

CMTrading Trading Platforms

CMTrading offers trading platform to meet the needs of various traders, with a focus on ease of use and functionality. The primary trading platform is MetaTrader 4 (MT4), a popular choice for forex and CFD trading due to its advanced charting tools, technical indicators, and customizable interface. MT4 is available on desktop, web, and mobile, providing flexibility for traders to manage trades from anywhere.

In addition to MT4, CMTrading also offers the Sirix WebTrader, a web-based platform that requires no downloads. Sirix is designed for traders looking for simplicity and accessibility, allowing them to trade directly from their browser. It includes essential tools, real-time analytics, and an intuitive layout that makes it easy to navigate, especially for beginners.

CMTrading’s platforms are also integrated with the CopyKat tool, allowing users to mirror trades from experienced traders directly within their chosen platform. This feature benefits new traders who can learn by following seasoned traders, and it is easily accessible through both MT4 and Sirix. By offering both MT4 and Sirix, CMTrading ensures that traders have options tailored to their experience level and trading style.

What Can You Trade on CMTrading

CMTrading offers a diverse range of trading instruments across several major markets, allowing users to diversify their portfolios and explore various asset classes. The platform supports trading in the following categories:

Forex

Forex trading is a core offering on CMTrading, where users can trade major, minor, and exotic currency pairs. With access to global currency markets, traders can speculate on currency movements around the clock, capitalizing on shifts in international markets.

Commodities

CMTrading also offers commodities trading, including popular assets like gold, silver, oil, and natural gas. Commodities provide an alternative to traditional stocks and can act as a hedge against inflation, making them an attractive option for many traders.

Indices

Indices trading allows users to trade on the performance of entire markets rather than individual stocks. With access to major global indices like the S&P 500, NASDAQ, and FTSE, traders can speculate on market trends and economic health.

Stock CFDs

Through Stock CFDs (Contracts for Difference), CMTrading enables users to trade shares of popular global companies without owning the actual stock. This option offers the flexibility to go long or short, giving traders more strategic options based on market performance.

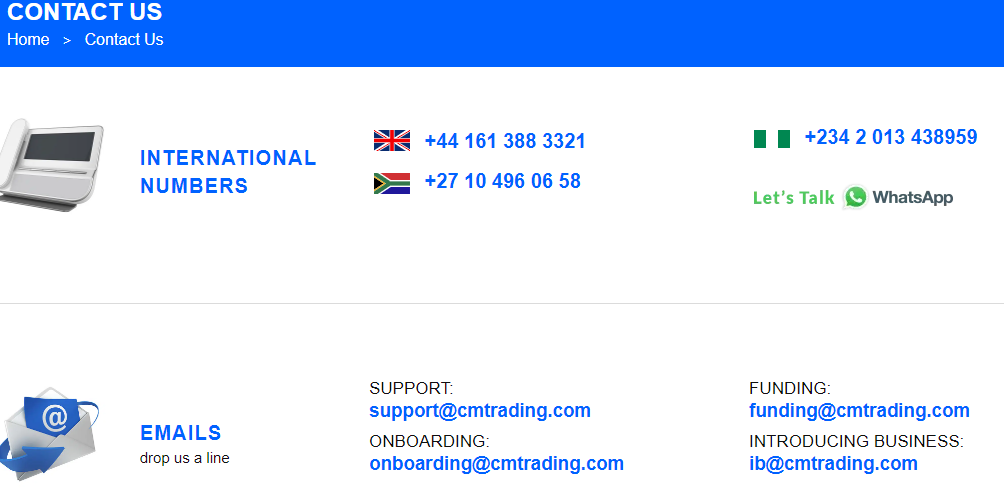

CMTrading Customer Support

CMTrading provides customer support through multiple channels to assist traders with any questions or issues. Users can reach the support team via live chat, phone, and email, ensuring quick access to help during trading hours. This range of options makes it easy for traders to get timely assistance, whether they prefer a quick chat or a more in-depth conversation over the phone.

The platform also offers an FAQ section on its website, covering common questions about account setup, deposits, withdrawals, and trading features. This self-help resource is useful for users looking to solve basic issues without contacting support directly. The FAQs help streamline the support process, allowing customers to find answers on their own.

Customer feedback on CMTrading’s support is generally positive, though some users have noted occasional delays during peak trading times. Despite this, the platform’s multi-channel support structure aims to make customer service accessible and responsive, contributing to an overall smooth trading experience.

Advantages and Disadvantages of CMTrading Customer Support

Withdrawal Options and Fees

CMTrading provides several deposit and withdrawal methods, catering to different user preferences for speed and convenience. Each method has its unique processing times and fees, allowing traders to choose the option that best aligns with their needs and schedules. Here’s an overview of the available withdrawal methods:

Bank Transfer

Bank Transfer enables users to withdraw funds directly to their bank accounts. This option is often chosen for larger withdrawals but may require three to five business days for processing, with applicable fees based on the bank’s policies.

Credit/Debit Card

Credit or Debit Card withdrawals allow users to withdraw directly to their Visa or Mastercard accounts. This method typically takes up to two business days for processing and may incur minimal fees depending on the card issuer.

E-wallets

E-wallets, including Neteller and Skrill, offer a faster and more flexible option for withdrawals. Processing times for e-wallet withdrawals are generally instant or within 24 hours, although fees vary by provider.

Cryptocurrency

Cryptocurrency withdrawals are available for users who prefer digital assets like Bitcoin. This option provides rapid processing, typically within minutes to a few hours, with fees depending on blockchain network traffic.

CMTrading Vs Other Brokers

#1. CMTrading vs AvaTrade

CMTrading and AvaTrade are both established online trading platforms, but they differ in focus and features. CMTrading primarily serves African markets and is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, which is ideal for local traders looking for regional support and currency options. It offers unique tools like CopyKat for copy trading and focuses on simplicity, making it appealing to beginners. AvaTrade, in contrast, operates globally and is regulated across multiple regions, including the EU and Australia, making it an option for traders seeking broader market access and comprehensive regulatory oversight. AvaTrade also offers a broader range of trading platforms, including MetaTrader 5 (MT5) and AvaOptions, supporting more advanced trading strategies and sophisticated trading tools.

Verdict: For traders focused on the African market and seeking a straightforward, beginner-friendly experience, CMTrading may be the better choice. Meanwhile, AvaTrade suits those looking for global reach, advanced platform options, and a range of supported assets for a more diversified trading experience.

#2. CMTrading vs RoboForex

CMTrading and RoboForex are both online brokers, but they differ in their offerings and target markets. CMTrading is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, catering primarily to African traders with a focus on providing accessible trading tool like CopyKat for copy trading and educational tools for beginners. RoboForex, on the other hand, is an international broker with regulation from IFSC Belize, targeting a global audience and offering a wider variety of account types, including options specifically tailored for high-frequency trading and ECN accounts. RoboForex also provides access to advanced trading platforms, such as MetaTrader 5 (MT5) and cTrader, which appeal to more experienced traders who need sophisticated trading tool and faster execution speeds.

Verdict: CMTrading is well-suited for beginner to intermediate traders in Africa who value simplicity and local support. RoboForex, with its global reach, advanced platform options, and specialized account types, is a stronger choice for experienced traders seeking diverse trading conditions and higher-speed execution.

#3. CMTrading vs Exness

CMTrading and Exness each bring unique features to the online trading space, catering to different trader needs. CMTrading is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, which primarily targets African markets and provides localized support with beginner-friendly features like CopyKat for copying trades from experienced traders. This makes CMTrading accessible and useful for novice traders. Exness, on the other hand, is an internationally regulated broker with oversight in multiple regions, including the EU, providing access to a wider array of global markets. Exness offers highly competitive spreads, instant withdrawals, and both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which attract professional traders seeking low-cost trading and advanced trading tools for scalping or automated trading.

Verdict: CMTrading is ideal for beginner and intermediate traders in Africa seeking straightforward tools and local support. Exness is better suited for advanced traders who prioritize low trading costs, global market access, and instant withdrawals for a more efficient trading experience.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH CMTRADING

Conclusion: CMTrading Review

In conclusion, CMTrading is a versatile platform that caters to traders of various experience levels with its accessible tools, educational resources, and support features. The availability of MetaTrader 4 and Sirix provides flexibility, while the CopyKat feature adds value for beginners looking to learn from experienced traders. CMTrading’s regulation by the FSCA, competitive spreads, and focus on customer education make it a reliable option for those entering the world of forex and CFD trading.

The platform also stands out for its commitment to security, combining regulatory compliance with technology that safeguards user data and funds. Although there can be occasional delays in customer support during peak hours, CMTrading’s multi-channel assistance and comprehensive FAQs contribute to a positive user experience. Overall, CMTrading provides a solid trading environment, especially for users who value both safety and education in their trading journey.

CMTrading Review: FAQs

Is CMTrading regulated?

Yes, CMTrading is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, which helps ensure it follows financial guidelines that protect trader funds and promote transparency.

What trading platforms does CMTrading offer?

CMTrading provides access to MetaTrader 4 (MT4) and Sirix WebTrader. MT4 is known for its advanced features suitable for all trading levels, while Sirix is a web-based platform that offers simplicity and convenience for those who prefer trading from a browser.

Does CMTrading charge fees or commissions?

CMTrading primarily offers variable spreads without direct commissions on standard accounts. Swap fees apply to positions held overnight, and premium accounts may have narrower spreads or other fee structures.

OPEN AN ACCOUNT NOW WITH CMTRADING AND GET YOUR BONUS