City Index Review

In the world of trading, selecting the right Forex broker is crucial for both novice and experienced traders. A reliable broker acts as your gateway to the global markets, offering the tools and support needed to navigate the complexities of foreign exchange trading. Forex brokers play a pivotal role in providing access to currencies from around the globe, enabling traders to buy and sell with the aim of making a profit. Therefore, understanding the importance of choosing a broker that aligns with your trading needs cannot be overstated.

City Index emerges as a standout option in this competitive landscape. As a global CFD broker, it is backed by the assurance of regulation by numerous financial authorities, including the top-tier UK FCA. This regulation is a key indicator of the broker’s reliability and commitment to adhering to the highest standards of financial security and transparency. City Index is distinguished not only for its low forex trading fees but also for its minimal non-trading fees, such as low withdrawal fees. The broker simplifies the journey for traders with fast and smooth account opening processes, alongside providing an array of high-quality research tools designed to empower users with the insights needed to make informed trading decisions.

This detailed City Index review aims to deliver a comprehensive analysis of what sets the broker apart, while also addressing potential areas for improvement. By exploring the various account options, deposit and withdrawal processes, and commission structures, we intend to offer a clear and balanced view. Merging expert analysis with real trader experiences, our goal is to furnish you with all the essential information required to determine if City Index aligns with your trading aspirations. As we delve into the specifics of City Index’s offerings, our balanced perspective seeks to guide you towards making an informed decision about whether to consider City Index as your brokerage of choice.

What is City Index?

City Index stands as a prominent provider in the global trading scene, specializing in spread betting, FX (forex), and CFD (Contracts for Difference) trading. This brokerage is designed to cater to a diverse range of trading needs, offering a wide array of markets for traders to participate in. It’s a platform that bridges the gap between individual traders and the vast opportunities available in the financial markets.

As a subsidiary of the Nasdaq-listed StoneX Group, City Index boasts a strong foundation and reputable backing. This affiliation not only underscores its financial stability but also reflects the broker’s commitment to providing secure and reliable trading services. The broker is tightly regulated by several authoritative bodies, including the Financial Conduct Authority (FCA) in the UK, the Australian Services and Investment Commission (ASIC) in Australia, and the Monetary Authority of Singapore (MAS) in Singapore. These regulations are crucial for traders looking for a broker that adheres to strict standards of operation and client protection.

City Index’s global presence is marked by its offices located in the United Kingdom, Australia, and Singapore. This wide geographical reach ensures that the broker can offer localized support and services tailored to meet the specific needs and preferences of traders from various regions. The presence of offices in these key financial hubs also facilitates a deeper understanding of global market dynamics, benefiting the traders who use City Index as their trading platform.

Benefits of Trading with City Index

Trading with City Index has offered me a multitude of benefits, enhancing my trading experience significantly. The platform’s wide selection of trading instruments has enabled me to diversify my portfolio across forex, CFDs on stocks, indices, commodities, metals, and cryptocurrencies. This diversity not only expands my trading opportunities but also helps in managing risk more effectively.

One of the standout features of City Index is its low forex trading fees. This cost-efficiency has been a major advantage, allowing me to maximize my trading profits. Coupled with the absence of hidden fees and commissions on deposits and withdrawals, City Index ensures that my trading costs are predictable and transparent.

The availability of MetaTrader 4, alongside user-friendly web and mobile platforms, has provided me with the flexibility to trade from anywhere, at any time. The platforms are equipped with high-quality research tools and integrated market insights, which have been instrumental in making informed trading decisions. Furthermore, the addition of features like SMART Signals and the award-winning PlayMaker risk management tool significantly enhances my trading strategy.

City Index Regulation and Safety

City Index operates under the strict oversight of the British Financial Conduct Authority (FCA), a regulator renowned for its stringent requirements and standards for brokers. This regulation is crucial because it ensures that City Index adheres to high levels of financial integrity and consumer protection. For traders, knowing that a broker is regulated by the FCA is a sign of reliability and security, providing peace of mind in the fast-paced trading environment.

One of the FCA’s mandates includes the use of segregated accounts for storing customer funds, a practice City Index follows diligently. This means that traders’ funds are kept separate from the company’s operating funds, significantly reducing the risk to traders’ capital. In the event of financial mismanagement or insolvency of the broker, these segregated accounts ensure that traders’ funds are not used to settle the broker’s debts. This separation of funds is a vital safety feature that protects traders’ investments.

Furthermore, City Index offers an additional layer of security through the Financial Services Compensation Scheme (FSCS), which guarantees compensation of up to £85,000 to traders in case of the broker’s failure to fulfill its obligations. This scheme is an essential safety net that provides traders with a level of financial protection, highlighting the importance of trading with a broker that offers such guarantees.

The availability of a license and a regulator, coupled with the protection measures like segregated accounts and guaranteed compensation, are fundamental aspects traders should consider when choosing a broker. These factors were observed firsthand after trading with City Index, offering tangible evidence of the broker’s commitment to trader security. It’s worth noting that while this information highlights City Index’s regulatory adherence and safety measures, specific documents detailing these practices are not readily available in the public domain, underscoring the importance of conducting thorough research and due diligence when selecting a broker.

City Index Pros and Cons

Pros

- Broad range of trading options

- Choice between floating and fixed spreads

- Access to MetaTrader 4, along with web and mobile platforms

- Recognized with the 2024 Annual Award for the #1 Risk Management Tool: PlayMaker

- Mobile app includes research and market insights

- Produces 200 unique trading signals weekly via SMART Signals

Cons

- Sometimes faces trading platform glitches

- Few options for deposits and withdrawals

- Possible denial of account applications due to lack of trading experience or insufficient capital

- Does not offer MetaTrader 5 support

City Index Customer Reviews

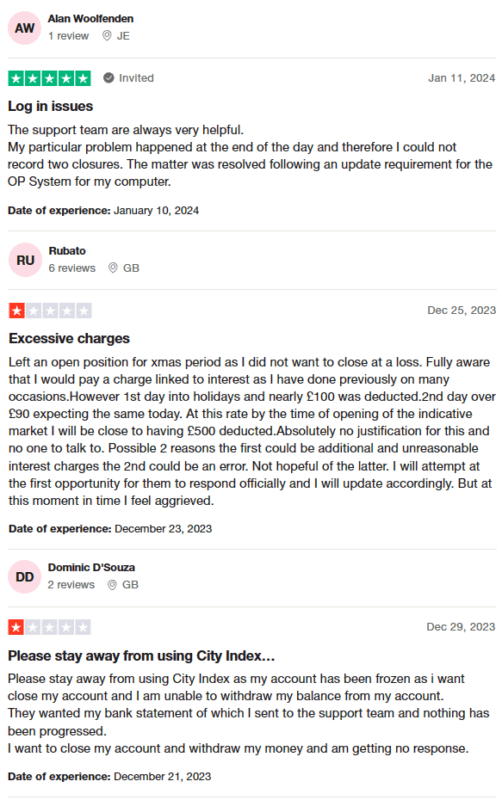

Customers have shared mixed experiences with City Index, highlighting the quality of support received but also expressing concerns over specific issues. Some users commend the support team for being very helpful, especially in resolving technical issues like software updates that affected trading operations. On the other hand, frustrations arise regarding financial charges during periods of inactivity, such as the Christmas holidays, where users experienced higher-than-expected deductions from their accounts due to interest charges or potential errors, with a lack of immediate support to address these concerns.

Additionally, there are reports of challenges in account management, including difficulties in closing accounts and withdrawing funds, despite providing necessary documentation to the support team. These reviews suggest a mix of satisfaction with customer service responsiveness in some areas while highlighting areas for improvement in transparency and efficiency in handling account-related queries and financial policies.

City Index Spreads, Fees, and Commissions

When I explored City Index for its costs associated with trading, I discovered a transparent fee structure that’s straightforward and user-friendly. Firstly, the broker assures traders there are no hidden fees, which is a significant relief, especially for those of us cautious about unexpected charges that can eat into profits. I appreciated the fact that City Index does not impose any commissions on depositing or withdrawing funds, regardless of the payment method chosen. This policy makes managing my trading funds easier and more cost-effective.

City Index offers the flexibility of choosing between floating and fixed spreads, which vary depending on the trading instrument. This flexibility allows me to strategize my trades based on market conditions and my personal trading style. However, it’s important to note that there is a fixed commission for swaps when transferring a position to the next trading day. This fee is standard in the industry for holding positions open overnight, and being aware of it helps in planning trades that might extend beyond a single trading day.

Account Types

At City Index, traders have access to two straightforward account types:

Real Account

- Suitable for experienced traders

- Enables trading with all offered assets in real-time

- Trading conditions vary depending on the assets used

Demo Account

- Ideal for testing trading conditions or trying out new strategies

- Offers a risk-free environment without the potential for profit or loss

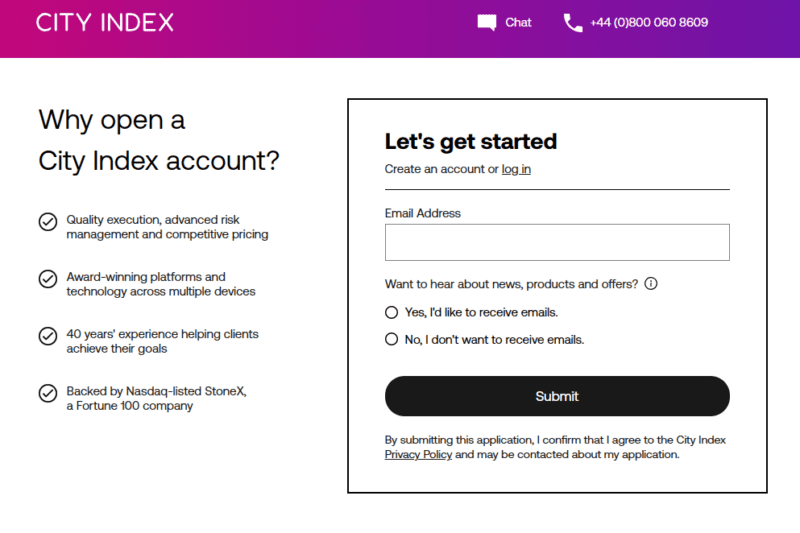

How to Open Your Account

- The user begins by navigating to the main page and selecting the “Create account” button to initiate the account opening process.

- The user is required to complete a form with personal information such as country of residence, marital status, name, surname, date of birth, email address, mobile phone number, account name, password, and preferred trading instruments like CFDs or spread bets.

- In the following step, the user must provide current residential address details, including the city, postal code, citizenship, and Tax Identification Number (TIN).

- The process continues with the user detailing employment status, trading experience in forex and other markets, and financial information including preferred currency, annual income, other income sources, and the amount available for the initial deposit.

- To finalize the application, the user confirms acceptance of the account and acknowledges the risks associated with trading in the markets. This is also the stage to opt-in for notifications via email, SMS, or phone calls.

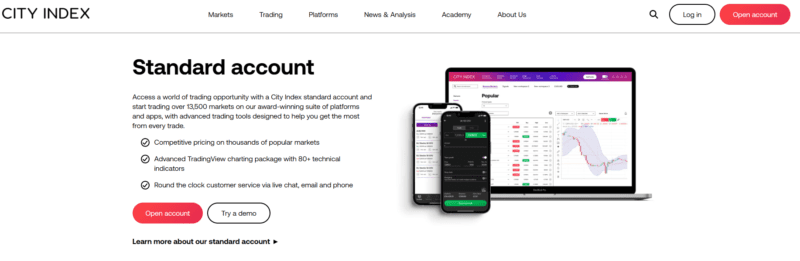

City Index Trading Platforms

Based on my experience, City Index offers traders access to the MetaTrader 4 (MT4) platform, which is widely regarded as a leading platform in the forex trading world. MT4 is renowned for its robust features, including advanced charting tools, a wide array of technical indicators, and the ability to support automated trading systems known as Expert Advisors (EAs). This platform caters to both novice and experienced traders, offering a versatile environment for trading a variety of instruments.

The accessibility of MT4 through City Index allows me to engage with the markets effectively, leveraging the platform’s comprehensive analysis tools to make informed decisions. Its user-friendly interface, combined with the depth of analytical capabilities, makes it a preferred choice for traders aiming to navigate the complexities of forex and CFD trading. Additionally, the support for EAs enables me to automate my trading strategies, optimizing my trading process and potential for success.

What Can You Trade on City Index

Based on my experience with City Index, traders have the opportunity to engage with a wide array of trading instruments that cater to various interests and strategies. This diverse range includes currency pairs, allowing traders to delve into the forex market, which is known for its liquidity and 24/5 availability. Forex trading with City Index provides access to major, minor, and exotic pairs, offering a broad spectrum for currency trading.

In addition to forex, City Index offers CFDs on stocks, indices, commodities, metals, and cryptocurrencies. Trading CFDs (Contracts for Difference) on these instruments allows for speculation on price movements without owning the underlying asset. This can be particularly appealing for traders looking to take advantage of price volatility across global markets. Whether interested in the tech industry’s stocks, the overall movement of major indices, the fluctuations in precious metals, or the dynamic realm of commodities and cryptocurrencies, City Index equips traders with the tools to explore these markets.

City Index Customer Support

From my experience, City Index’s customer support is both accessible and accommodating, offering several channels through which traders can seek assistance. Traders can reach out to support through a local phone number for more immediate, region-specific inquiries or use an international number for broader questions. This flexibility ensures that traders worldwide have a reliable way to get in touch with City Index’s support team.

For those who prefer written communication, City Index provides the option to send letters via email or utilize the online chat feature on the broker’s website. These methods offer convenience and efficiency, especially when dealing with non-urgent queries or when detailed documentation is necessary to resolve an issue.

Accessing customer support is straightforward, whether directly from the broker’s website or within your personal account. This ease of access to support services has significantly enhanced my trading experience, as I’ve always found the help I need without undue delay. City Index’s commitment to customer service is evident in the variety of support options available, catering to traders’ diverse preferences and needs.

Advantages and Disadvantages of City Index Customer Support

Withdrawal Options and Fees

When I wanted to withdraw funds from my City Index account, I found the process to be straightforward and cost-effective. City Index does not impose any fees for withdrawal operations, which also applies to the payment systems used for these transactions. This fee-free approach makes it more convenient for traders like me to manage our finances without worrying about additional costs.

For withdrawals, I had the option to use either Visa or MasterCard bank cards, or opt for a bank transfer. This flexibility allowed me to choose the method that best suited my needs. On average, funds were credited to my card within 24 hours, which is impressively quick and ensures that I have timely access to my money.

Additionally, City Index supports transactions in several major fiat currencies, including EUR, USD, and GBP. This variety means I can withdraw and deposit funds in the currency that I prefer or that I use most frequently, further simplifying the financial management aspect of trading.

City Index Vs Other Brokers

#1. City Index vs AvaTrade

City Index and AvaTrade are both reputable brokers in the online Forex and CFD trading space. City Index, known for its comprehensive range of trading instruments and strong regulatory framework, stands out for its low forex trading fees and a wide selection of research tools. On the other hand, AvaTrade differentiates itself with a commitment to providing a full trading experience, heavily regulated across multiple jurisdictions, and offering over 1,250 financial instruments to its large global client base.

Verdict: City Index might be a better choice for traders looking for a broker with a stronger focus on research tools and low trading costs. However, AvaTrade could be more appealing for traders seeking a broader range of financial instruments and those who value heavy regulation across different countries.

#2. City Index vs RoboForex

City Index offers a robust trading platform regulated by top-tier authorities, featuring low forex trading fees and an array of research tools. RoboForex, in contrast, emphasizes providing superb trading conditions using advanced technologies and offers a vast selection of over 12,000 trading options across eight asset classes. RoboForex’s strength lies in its diverse platform offerings, including MetaTrader, cTrader, and RTrader, catering to various trading preferences.

Verdict: For traders prioritizing a wide selection of assets and platform choices, RoboForex could be the more suitable broker. However, City Index is potentially more fitting for those who value strong regulatory compliance and a focus on forex and CFD trading with competitive fees.

#3. City Index vs Exness

While City Index boasts low forex trading fees, a fast account opening process, and a range of high-quality research tools under a stringent regulatory environment, Exness is recognized for its impressive trading volumes, offering CFDs for stocks, energy, metals, and over 120 currency pairs. Exness stands out for its beneficial working conditions, including low commissions, immediate order execution, and the unique offering of infinite leverage, allowing for earnings on small deposits.

Verdict: Exness might appeal more to traders looking for high leverage options and a diverse range of trading pairs, including cryptocurrencies. Meanwhile, City Index is likely a better option for those prioritizing a research-rich environment, competitive fees, and a broker that is heavily regulated.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH CITY INDEX

Conclusion: City Index Review

In conclusion, City Index stands out as a reliable and competitive broker in the Forex and CFD trading landscape, offering a broad spectrum of trading instruments, low forex trading fees, and a rich array of research tools. Its regulation by top-tier financial authorities such as the UK’s FCA adds a significant layer of trust and security, assuring traders of the platform’s commitment to adhering to high standards of operation and client protection.

However, it’s important for potential users to be aware of City Index’s drawbacks, including the occasional trading platform issues and the limited options for deposits and withdrawals. These cons, while noteworthy, are relatively minor when compared to the comprehensive services and benefits that City Index provides to its users.

Also Read: Fibo Group Review 2024 – Expert Trader Insights

City Index Review: FAQs

Is City Index regulated?

Yes, City Index is regulated by top-tier financial authorities, including the UK’s Financial Conduct Authority (FCA), ensuring a high standard of security and transparency in its operations.

What trading platforms does City Index offer?

City Index offers the MetaTrader 4 platform, alongside its own web and mobile platforms, providing traders with versatile and user-friendly options for their trading activities.

Can I trade cryptocurrencies with City Index?

Yes, City Index provides the option to trade CFDs on cryptocurrencies, among other financial instruments, allowing traders to speculate on the price movements of major digital currencies.

OPEN AN ACCOUNT NOW WITH CITY INDEX AND GET YOUR BONUS