Charterprime Review

Charterprime is a renowned and secure provider of financial services, specializing in Forex, commodities, and index futures markets. Since its inception, the company has garnered a reputation as an award-winning brokerage, recognized for delivering superior services and innovative solutions tailored to the individual needs of its customers. Notably, Charterprime operates across several key regions and regulatory domains, under the oversight of the ASIC and the New Zealand FSP.

This review aims to provide an in-depth analysis of Charterprime, assessing both its strengths and potential weaknesses. We will delve into its features, fee structure, account types, transaction methods, and more, offering a comprehensive perspective that combines expert analysis and actual trader experiences.

What is Charterprime?

Established in 2012, Charterprime is a global Forex and financial broker known for its customer-centric approach to providing bespoke trading conditions within a trusted trading environment. The company operates under the regulation of New Zealand authorities and is a registered financial provider in Australia, a testament to its credibility. Charterprime continues to strengthen its global presence, maintaining offices in key locations worldwide and consistently enhancing its service offerings. Its commitment to service excellence is evidenced by the consistent quality of its offerings.

CharterPrime currently functions through its overseas division in St. Vincent and the Grenadines – Charterprime Limited is officially registered as an International Business Company under the jurisdiction of the Financial Services Authority of St. Vincent and the Grenadines.

Advantages and Disadvantages of Trading with Charterprime?

Benefits of Trading with Charterprime

One of the many advantages of trading with Charterprime is the provision of a demo account that allows new traders to familiarize themselves with the platform without incurring real-world losses. Moreover, Charterprime has received multiple industry accolades, an attestation of its excellent service and favorable trading conditions.

Charterprime’s integration with MetaTrader 4, a widely used trading platform, is another noteworthy advantage. It also boasts stringent regulatory oversight, and a low minimum deposit, and supports multiple account currencies and payment methods, enhancing accessibility and convenience for its clients.

Charterprime Pros and Cons

Pros:

- Recipient of global industry awards

- Offers tight, low spreads

- Provides both standard and ECN trading

- Regulated by FSP and registered by ASIC

Cons:

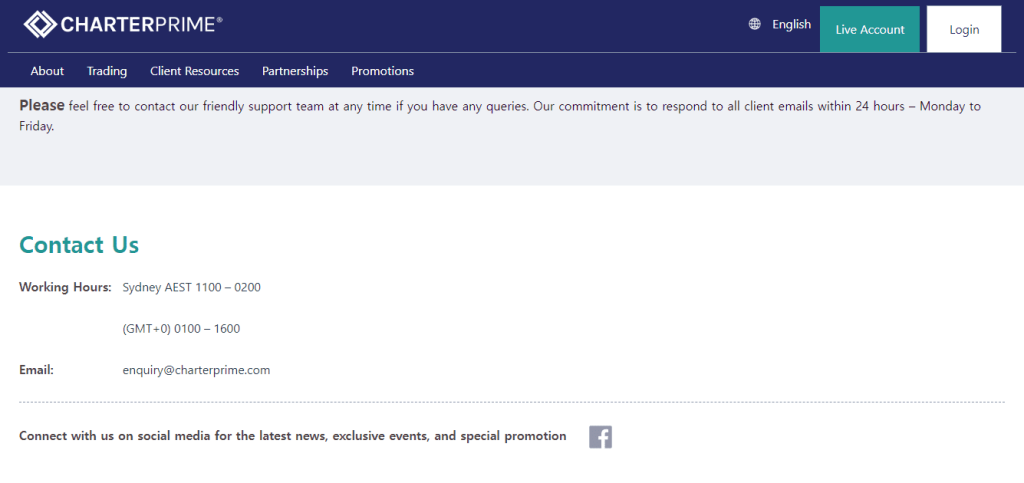

- Lack of 24/7 customer support

- Absence of negative balance protection

- Slightly high Forex fees on a standard account

- No proprietary platform

Charterprime Customer Reviews

Many customers have lauded Charterprime for its quick and efficient online chat support. The platform is commended for its reliable execution, low lag, and STP trading provision, which is particularly beneficial for scalping. While users appreciate the prompt withdrawal processing and multiple deposit methods, some have highlighted relatively high spreads and fees as areas of concern. However, the general consensus is positive, acknowledging Charterprime as a stable and reliable platform for Forex trading.

Charterprime Spreads, Fees, and Commissions

When trading with Charterprime, traders can expect fees starting from $8 USD and spreads from as low as 0.0 pips, with commission-free trading available depending on the selected account. The Variable Account is solely based on spread charges, while the ECN Account operates with raw spreads and imposes an $8 commission per lot. Notably, the Swap-free Account presents variable spreads and levies a commission of $40 per lot each Wednesday.

Account Types

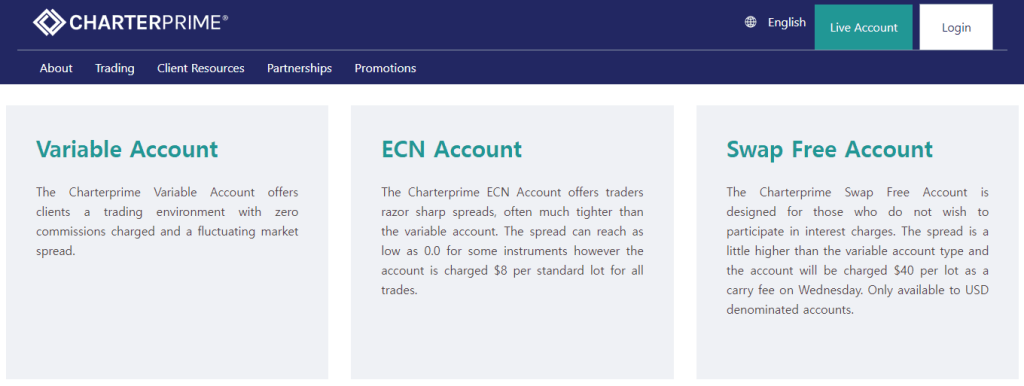

Charterprime offers accounts where each is designed to cater to different trading needs:

Variable Account

This option provides a trading environment with no commissions and a fluctuating market spread.

ECN Account

With razor-sharp spreads, this account can offer as low as 0.0 for some instruments. However, a fee of $8 per standard lot is charged for all trades.

Swap Free Account

Designed for those who wish to avoid interest charges, this account has slightly higher spreads and incurs a $40 per lot fee on Wednesdays. It’s available only to USD-denominated accounts.

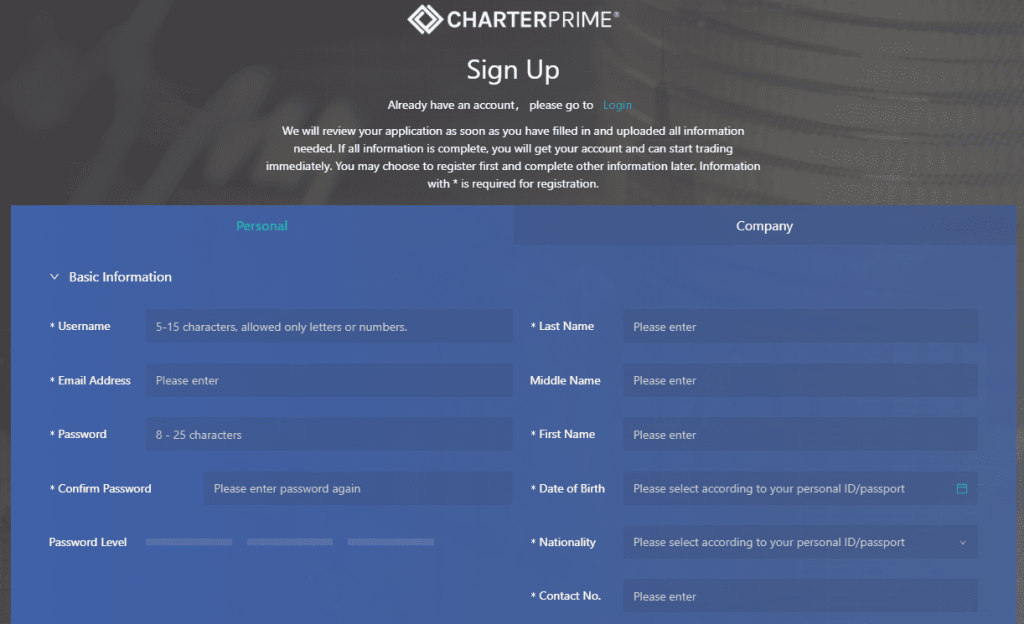

How to Open Your Account

Opening a trading account with Charterprime is a hassle-free process:

- Navigate to the “Live Account” page on the Charterprime website.

- Input the required personal information such as your name, email, and phone number.

- Verify your personal data by submitting necessary documentation, including proof of residence and a valid identification document.

- After account activation and identity verification, you can deposit funds into your account and start trading.

What Can You Trade on Charterprime

Charterprime provides traders with a wide array of trading instruments. This variety caters to the diverse needs and preferences of traders, enabling them to optimize their trading strategies.

- CFDs: One of the key instruments that traders can trade on Charterprime is Contracts for Difference (CFDs). These are derivative products that allow traders to speculate on the price movements of various financial markets such as commodities, indices, and shares, without needing to own the underlying asset.

- Forex: For Forex enthusiasts, Charterprime offers numerous currency pairs, ranging from major pairs like EUR/USD, GBP/USD, and USD/JPY, to minor pairs and even exotic pairs. This diversity allows Forex traders of all experience levels to find suitable trading opportunities.

- Commodities: Commodities trading is another option provided by Charterprime. Traders can speculate on the prices of various commodities such as oil, natural gas, and precious metals like gold and silver. Trading commodities can be a good way for traders to diversify their portfolios and hedge against market volatility.

- Metals: Furthermore, Charterprime offers the trading of precious metals, a valuable choice for those looking to hedge against inflation or currency fluctuations. Precious metals trading often includes gold, silver, platinum, and palladium.

- Index CFDs: Traders interested in the global equity markets can also opt for Index CFDs. By trading these, individuals can speculate on the price movements of leading global indices such as the S&P 500, FTSE 100, or Nikkei 225.

- STP System: Lastly, Charterprime employs a Straight Through Processing (STP) system. This allows for orders to be directly passed to liquidity providers the broker cooperates with. As a result, traders can benefit from speedy execution and reduced chances of requotes or slippage.

Charterprime Customer Support

Charterprime is committed to providing exemplary customer support. The brokerage understands that quick, reliable, and effective support is an integral part of a trader’s overall experience and success. To this end, the customer support team is trained to handle various situations and provide insightful and timely responses to all kinds of inquiries.

The primary way to reach Charterprime’s customer support team is through live chat, which allows for real-time interaction. This method is particularly useful for addressing urgent queries or issues that require immediate attention. Traders can typically expect quick responses during their operating hours.

For less urgent matters, or more complex queries that require a detailed response, clients can reach out to Charterprime’s customer support via email. The support team aims to provide comprehensive responses within a reasonable time frame.

Another method of reaching Charterprime’s customer support team is through the contact form available on their website. This can be useful for general inquiries or feedback.

Advantages and Disadvantages of Charterprime Customer Support

Security for Investors

Withdrawal Options and Fees

Charterprime offers several withdrawal options, including popular methods like bank transfer and credit cards. While fees may vary depending on your chosen bank or payment provider, Charterprime generally does not charge fees for deposits or withdrawals. However, some methods may incur a commission due to international policies, like Tether block-chain wallets that add a 5% fee for both deposits and withdrawals.

Charterprime Vs Other Brokers

#1. Charterprime vs AvaTrade

Charterprime and AvaTrade are both recognized for their commitment to delivering high-quality trading services. However, they come with distinct features and offerings that may appeal differently to various traders.

Charterprime, established in 2012, has made its name by offering personalized trading conditions and creating a trusted trading environment. It provides trading in Forex, commodities, and index futures. With its focus on innovation and top-notch services, it has garnered various industry awards. One of its main attractions is its low minimum deposit requirement and the range of payment methods available.

On the other hand, AvaTrade, founded in 2006, is one of the industry’s leading brokers known for its expansive offering of more than 1,250 financial instruments. AvaTrade’s main advantage lies in its global presence, with clients from over 150 countries. It is heavily regulated, ensuring a safe and secure trading environment. Moreover, AvaTrade allows its users to execute a whopping two million monthly transactions, showcasing its robust and efficient platform. However, it should be noted that AvaTrade does not cater to US traders.

Verdict: AvaTrade edges out Charterprime due to its wider range of financial instruments and its global reach. Its commitment to stringent regulatory compliance provides added reassurance to traders, making it a more appealing choice for traders seeking a diversified portfolio.

#2. Charterprime vs RoboForex

Both Charterprime and RoboForex have made a strong presence in the industry, albeit with different focus areas and service offerings.

Charterprime, as mentioned, focuses on providing personalized trading services. Its strengths lie in its regulatory oversight, multiple account types, and various payment methods. It is notable for its STP system, which directly connects orders to liquidity providers.

RoboForex, on the other hand, has been operating since 2009 and prides itself on providing superb trading conditions through advanced technologies. It offers an impressive range of more than 12,000 trading options across eight asset classes. Additionally, RoboForex provides a variety of trading platforms, including MetaTrader, cTrader, and RTrader. An interesting feature of RoboForex is ContestFX, where traders can participate in contests and potentially win prizes.

Verdict: While Charterprime provides a more personalized trading experience, RoboForex wins out with its vast range of trading options and platforms. The contests offered by RoboForex provide added incentives for traders, making it a better choice for those looking for a dynamic and diversified trading experience.

#3. Charterprime vs Exness

Comparing Charterprime and Exness reveals two brokers with strong offerings but different strengths.

Charterprime provides a flexible trading environment with multiple account types, and it is recognized for its low minimum deposit requirement. It also provides various payment methods, which adds to its appeal among traders.

Exness, a Forex broker that began operations in 2008, offers CFDs for stocks, energy, metals, and over 120 currency pairings, including cryptocurrencies and stocks. Its strength lies in its diverse offering and its conducive trading environment. Exness also offers unlimited leverage for small deposits up to $999, which could be appealing to traders with smaller trading capital. Additionally, Exness is notable for its immediate order execution and fund withdrawal services.

Verdict: While both brokers have strong offerings, Exness is the better choice here due to its wider range of trading instruments, immediate order execution, and fund withdrawal services. The unlimited leverage on small deposits provides an added advantage, particularly for traders working with a smaller budget.

Conclusion: Charterprime Review

Charterprime is a commendable broker in the Foreign exchange and CFD trading space, delivering a secure, reliable, and comprehensive trading environment. Its focus on personalization and innovation enhances its appeal to various types of traders. While it may not offer the widest range of financial instruments or cater to all trading preferences, its strengths in offering personalized trading conditions, regulatory oversight, a variety of account types, and a selection of payment methods make it a viable choice for many traders.

However, as with any financial services provider, potential users should carefully evaluate Charterprime’s offerings against their trading needs, risk tolerance, and financial capacity. It is advisable to leverage the demo account provided to familiarize oneself with the platform and its functionalities before investing real money.

As shown in the comparison with other brokers, Charterprime, while strong in its offerings, may not be the top choice for traders looking for a wider range of trading options or a more global presence. However, for traders prioritizing personalized services and secure trading conditions, Charterprime may be an optimal choice.

Charterprime Review: FAQs

What types of accounts does Charterprime offer?

Charterprime offers three types of accounts: Variable, ECN, and Swap-Free. The Variable Account offers a trading environment with zero commissions and a fluctuating financial market spread. The ECN Account offers tight spreads and charges a commission of $8 per lot for all trades. The Swap-Free Account, designed for traders who don’t want to incur interest charges, is charged $40 per lot as a carry fee on Wednesday.

How secure is trading with Charterprime?

Charterprime is a regulated broker, which lends to its credibility and safety as a financial services provider. It is regulated by the New Zealand Financial Services Provider (FSP) and registered with the Australian Securities and Investments Commission (ASIC). These regulations require the broker to adhere to strict financial standards, offering a layer of protection to traders.

Are there any fees for withdrawing funds from Charterprime?

Charterprime does not charge fees for deposits or withdrawals for most payment methods, which is a major advantage for traders. However, some methods might include a percentage commission due to international policies. It’s always recommended to consult with your bank or payment provider for detailed information on potential charges.