When I first jumped into Forex trading, I was excited about the potential to make profits from the ever-changing currency markets. Little did I know that technology would play such a massive role in my journey, and with it, a host of challenges that I never anticipated. Today, being a successful Forex trader is as much about understanding the technological landscape as it is about reading the markets. Let me take you through some of the top technological challenges I've faced, and how I’ve learned to tackle them.

#1. Algorithmic and AI-Driven Trading

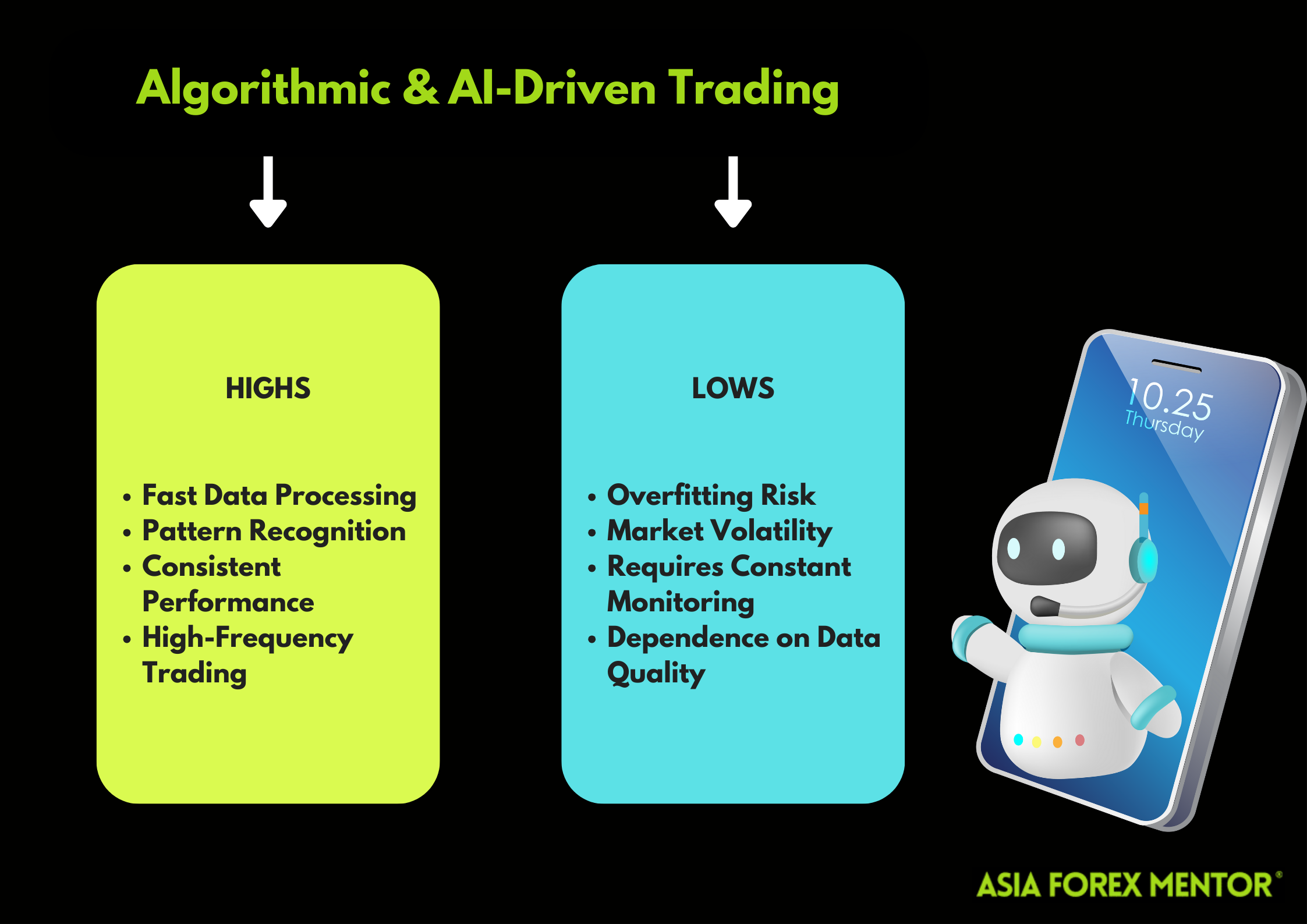

One of the biggest game-changers in Forex trading has been the rise of algorithmic trading and AI-driven strategies. When I first started using AI to analyze trends and execute trades, it felt like I had found the holy grail. The algorithms could process vast amounts of data much faster than I ever could, spotting patterns and making trades that I might have missed on my own.

But here’s the kicker—these systems are not foolproof. I vividly remember when the Brexit vote came through. My AI-driven strategy, which had been performing well, suddenly couldn’t cope with the extreme volatility that followed. The market swung in ways the AI hadn’t been trained to handle, and I took a significant hit.

This experience taught me an important lesson: while AI and algorithms are powerful tools, they should never be used in isolation. I’ve since adopted a hybrid approach, where I use these technologies to inform my decisions, but I always maintain a level of human oversight. There are just some market conditions—like sudden geopolitical shifts—that no algorithm can fully predict.

In addition to market unpredictability, there’s also the issue of overfitting. This is where an algorithm becomes so specialized in the data it was trained on that it fails to perform well in new, unseen market conditions. To avoid this, I regularly update and retrain my models with fresh data, ensuring they stay relevant as the market evolves.

#2. Cybersecurity Threats

If there’s one thing that keeps me up at night, it’s cybersecurity. In today’s digital trading environment, the threat of cyber-attacks is very real. I’ve been in trading circles where colleagues have lost significant amounts of money due to hacking. One particular case that stands out involved a trader whose account was compromised, resulting in unauthorized trades that wiped out his balance in minutes.

This incident was a wake-up call for many of us. Since then, I’ve become almost paranoid about security. I use two-factor authentication on all my trading accounts, and I’m religious about changing passwords regularly and using complex combinations that are difficult to crack. I also avoid storing sensitive information online and make sure my devices are protected with up-to-date antivirus software.

But cybersecurity isn’t just about personal vigilance. The platforms we trade on also need to be secure. I’ve switched brokers in the past because I felt their security measures weren’t up to scratch. When choosing a trading platform, I now make sure to check their security protocols, including encryption standards and their track record with cybersecurity incidents.

#3. Regulatory Compliance

Regulations in the Forex market are a bit like taxes—nobody enjoys dealing with them, but they’re necessary, and ignoring them can lead to serious consequences. Over the years, I’ve seen a steady increase in regulatory scrutiny, especially in response to the global financial crises and scandals that have rocked the financial markets.

One of the biggest regulatory changes I had to adapt to was the European Securities and Markets Authority’s (ESMA) decision to limit leverage for retail traders. Before this change, I was accustomed to trading with much higher leverage, which allowed me to amplify my profits (and losses). When the new regulations came into effect, it felt like my trading style was suddenly handicapped.

But as with everything in trading, adaptability is key. I adjusted my strategies to operate within the new leverage limits, focusing more on precision and less on volume. This shift actually improved my trading discipline, forcing me to be more selective with my trades rather than relying on high leverage to boost returns.

Regulatory compliance doesn’t just affect leverage, though. It also includes maintaining accurate records, adhering to anti-money laundering (AML) policies, and staying informed about changes in tax laws related to trading. Keeping up with these regulations can feel like a full-time job, but it’s essential for staying on the right side of the law. I’ve made it a habit to regularly review updates from regulatory bodies and consult with a financial advisor to ensure I’m fully compliant.

#4. Technological Infrastructure and Access

When I think back to some of the most frustrating moments in my trading career, many of them involve poor internet connectivity. There’s nothing worse than having a profitable trade lined up, only to lose your connection at the crucial moment. This happened to me once while I was traveling in a remote area. The internet was spotty, and I missed the window to close a trade at a profit. By the time I regained connection, the market had turned, and I ended up taking a loss.

To avoid a repeat of this disaster, I’ve invested in a few technological safeguards. First, I use a mobile trading app that allows me to monitor and execute trades from anywhere. These apps have come a long way and are almost as powerful as desktop platforms. They’ve saved me more times than I can count when I’ve been away from my primary trading setup.

I’ve also made sure to always have a backup internet connection. Whether it’s a portable Wi-Fi device or a second SIM card with a different network provider, I never want to be caught off guard by connectivity issues again. In addition, I trade using cloud-based platforms that offer greater reliability and reduce the chances of downtime during critical market hours.

#5. The Unpredictability of Market Volatility

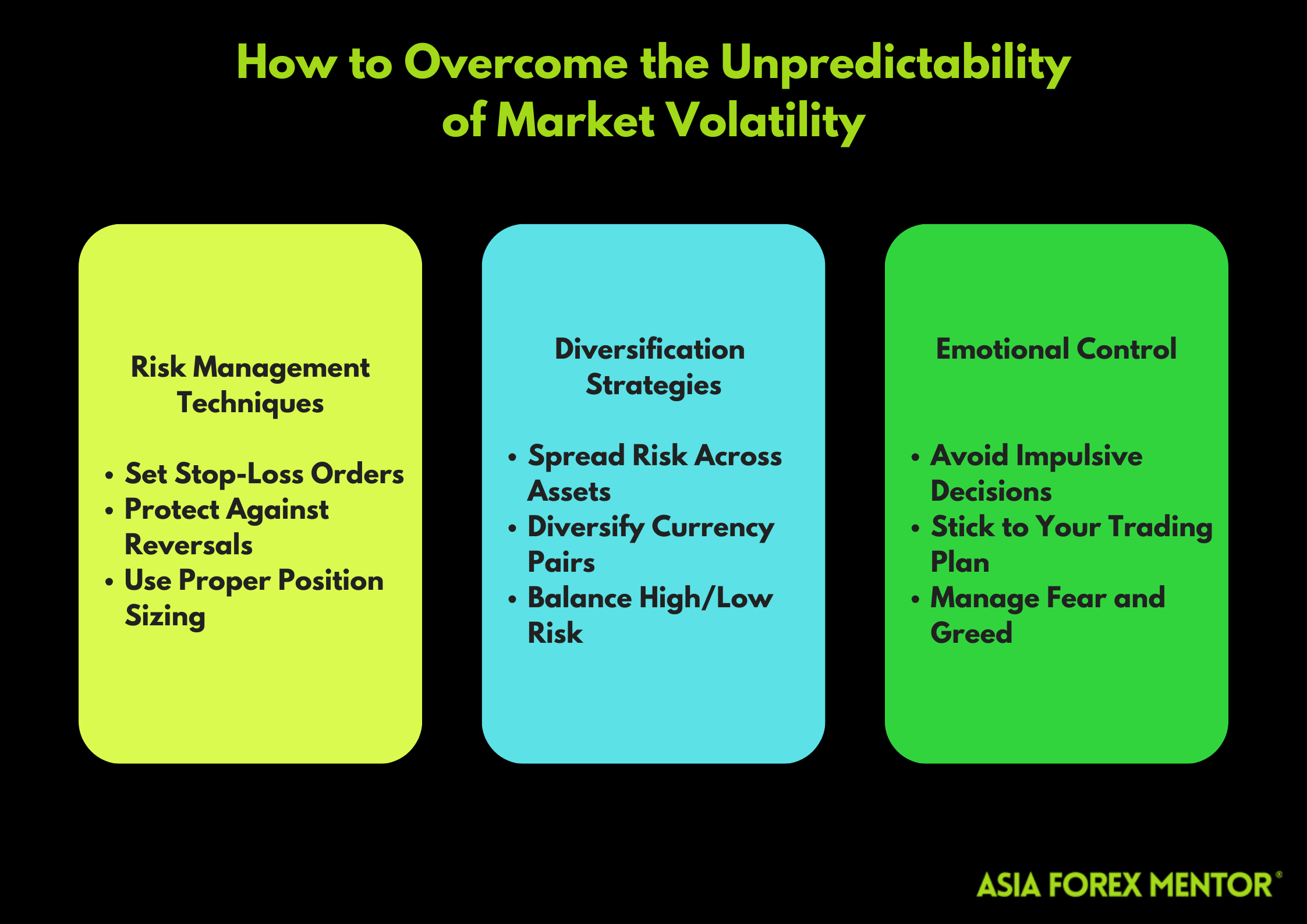

Forex markets are notoriously volatile, and this unpredictability is both a blessing and a curse. The potential for quick profits is what draws many traders to Forex, but the same volatility can also lead to significant losses if you’re not careful.

One of the most volatile periods I’ve traded through was the onset of the COVID-19 pandemic. The markets were in turmoil, with currency pairs swinging wildly as investors reacted to the unfolding crisis. Even with all my tools—technical analysis, AI, news feeds—predicting the next move felt like a gamble.

During such times, I rely heavily on risk management techniques. I always set stop-loss orders to protect against sudden market reversals, and I diversify my portfolio to spread risk across different currency pairs and asset classes. It’s also important to maintain emotional control. When the market is in chaos, it’s easy to make impulsive decisions driven by fear or greed. I’ve learned to stick to my trading plan, no matter how tempting it is to chase losses or jump on a fast-moving trend.

#6. Adapting to the Evolving Trader Demographics and Market Access

Another technological challenge I’ve noticed is the changing demographic of Forex traders and the ways they access the market. The rise of retail trading platforms and apps has democratized access to Forex markets, bringing in a wave of younger, tech-savvy traders. This shift has led to increased competition, as well as the need for brokers to offer more sophisticated tools and educational resources to cater to this new generation.

As a more experienced trader, I’ve had to adapt to this changing landscape. It’s no longer enough to rely on traditional trading strategies—I’ve had to integrate new technologies like social trading platforms, where you can follow and copy the trades of other successful traders. These platforms are popular among younger traders, and while I was initially skeptical, I’ve found them to be a useful way to gain insights and diversify my trading strategies.

#7. Managing Data Overload and Information Flow

With the explosion of information available online, managing data overload has become another significant challenge. Between news sites, social media, financial reports, and trading signals, the sheer volume of information can be overwhelming. Early in my trading career, I made the mistake of trying to consume everything, which often led to analysis paralysis—I had so much information that I struggled to make decisions.

Now, I’ve learned to be more selective about the information I rely on. I use a combination of trusted news sources, AI-driven market analysis, and sentiment indicators to keep my finger on the pulse without getting bogged down by unnecessary noise. I’ve also set up filters and alerts so that I only receive the most relevant updates, allowing me to focus on what really matters.

Conclusion

Dealing with Forex trading today means facing several technological challenges head-on. Whether it's managing the risks associated with AI-driven trading, securing your accounts against cyber threats, keeping up with ever-changing regulations, or ensuring you have the right tech infrastructure, each challenge is significant and requires a solid approach. To succeed, you need to stay informed, be adaptable, and consistently apply sound trading principles. These challenges aren't just hurdles—they're chances to sharpen your skills and get an edge in the market. If you're serious about Forex trading, addressing these issues directly is crucial for long-term success.

Also Read: 7 Common Forex Trading Myths That Many People Believe