Position in Rating | Overall Rating | Trading Terminals |

243rd  | 2.0 Overall Rating |  |

CFI Review

CFI Financial also known as Credit Financier Invest is a well-established financial services group founded in 1998. Based in Europe and the Middle East, CFI Financial offers a range of brokerage and capital management services, specializing in trading CFDs on various assets such as currencies, cryptocurrencies, stock indices, commodities, and stocks.

The group falls under the regulation of reputable financial regulatory bodies, like the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC) as well as MENA regional regulatory bodies. That’s how CFI Financial strictly complies with standards of clearness and security in dealing.

Services are not available to clients from certain countries, including the U.S., Syria, Sudan, North Korea, and others listed by the Financial Action Task Force (FATF) and MONEYVAL. These restrictions help ensure compliance with international anti-money laundering and counter-terrorism financing regulations.

The cfi review covers the important issues such as advantages, fees, deposits, withdrawals, and customer support. This highlights trading options, regulatory status, and service restrictions in CFI Financial, which makes the right decision for traders.

What is CFI?

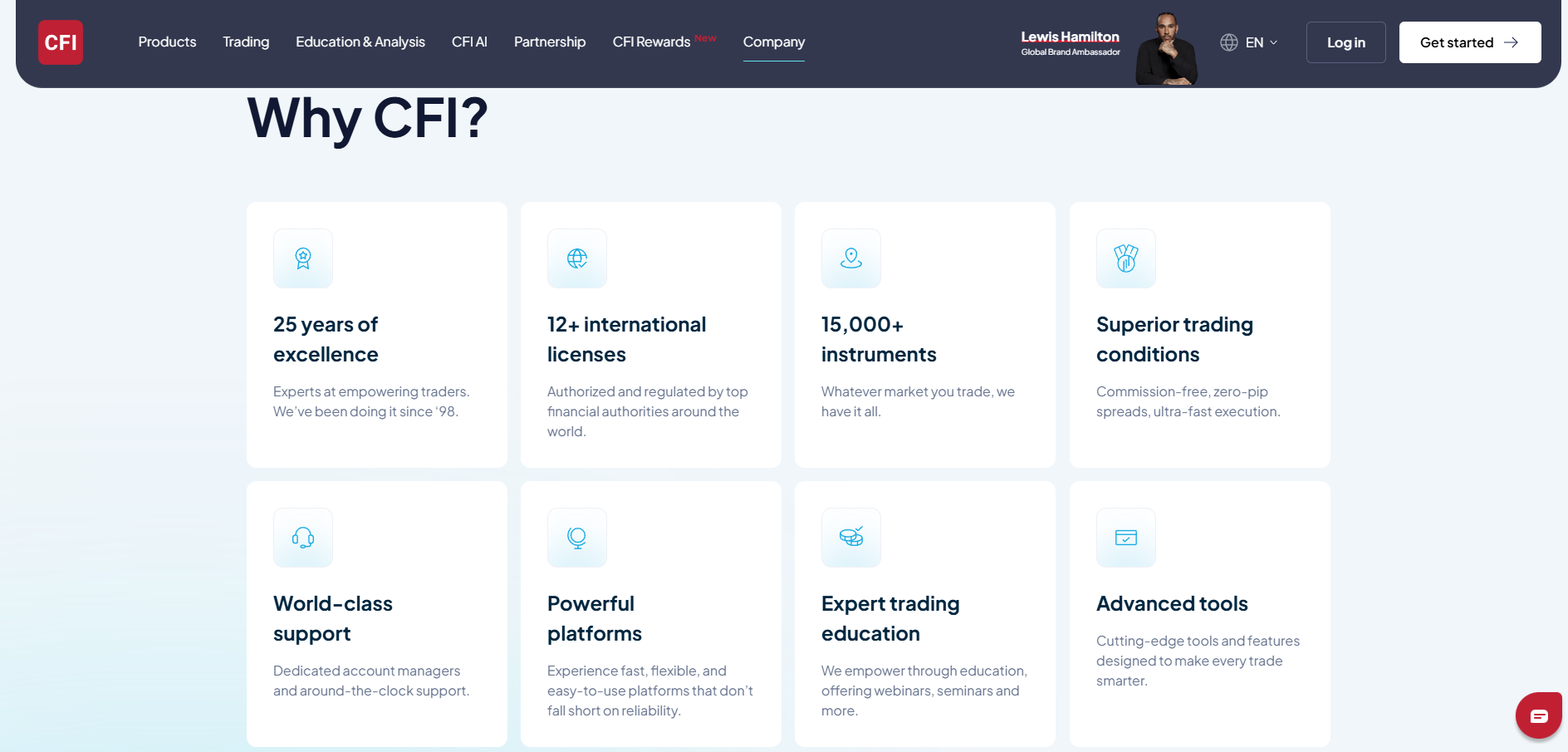

CFI is a trusted global broker with over 25 years of excellence, empowering traders since 1998. It offers access to 15,000+ instruments, covering forex, stocks, and commodities, enabling seamless market participation. CFI stands out with superior trading conditions, including commission-free trading, zero-pip spreads, and ultra-fast execution speeds. The company holds 12+ international licenses, ensuring its operations are regulated and secure. Traders benefit from world-class support with dedicated account managers and 24/7 assistance.

In addition to brokerage services, CFI offers a variety of tools, including educational resources, market analysis, and advanced trading platforms like MetaTrader 4, MetaTrader 5, and cTrader. These features make CFI a versatile option for both novice and experienced traders looking to engage in CFD trading and investment. CFI also provides expert trading education, offering webinars and seminars to help users make informed decisions in the market with learning paths focused on risk management.

CFI’s advanced tools and powerful platforms ensure reliable and flexible trading experiences for all skill levels. The integration of Trading Central analytics offers real-time support and resistance levels, detailed technical insights, and growth ratings to elevate technical analysis. With its strong global reputation, CFI remains a top choice for traders worldwide, emphasizing risk management to safeguard investments.

CFI Regulation and Safety

CFI is licensed and regulated by different financial authorities, which guarantee conformity with the standards of the industry. It holds Tier-1 licenses from the UK’s Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySec), providing investors with protection of up to £85,000 and €20,000 respectively. Other licenses include Tier-2 and Tier-3 regulators such as the Dubai Financial Services Authority (DFSA) and the Vanuatu Financial Services Commission (VFSC).

While Tier-3 regulators like the Financial Services Commission (Mauritius) and Financial Services Authority (Seychelles) offer less stringent oversight, CFI still ensures to maintain safety features like negative balance protection. This means that a client cannot lose more than their deposited funds, adding further security for retail traders.

Founded in 2009, CFI combines regulatory compliance with client protection measures to foster a safe trading environment. With oversight from a diverse range of regulators, it provides traders with flexibility and risk management.

CFI Pros and Cons

Pros

- Multiple trading platforms

- Diverse CFD offerings

- Strong regulatory oversight

- Flexible for all traders

Cons

- Country restrictions

- Higher fees

- Complex for beginners

- Limited customer support

Benefits of Trading with CFI

CFI Trading with CFI Financial offers numerous benefits for both novice and experienced traders. The platform provides access to a wide range of trading options, including over 35 currency pairs, indices, stocks, ETFs, and commodities like gold, silver, and oil. With these diverse options, traders can easily diversify their portfolios and explore various market opportunities.

CFI Financial also provides valuable education and analysis tools to help traders make informed decisions. The platform offers comprehensive educational resources, including webinars, market analysis, and trading guides, which can be especially useful for beginners. These tools are designed to improve trading knowledge and enhance overall performance.

Another important aspect of trading with CFI is the use of AI trading assistant. This innovative tool facilitates traders in making more data-driven decisions by analyzing market trends and providing actionable insights from them. With the assistance of AI technology, traders will be able to streamline strategies and potentially improve their outcome in trading.

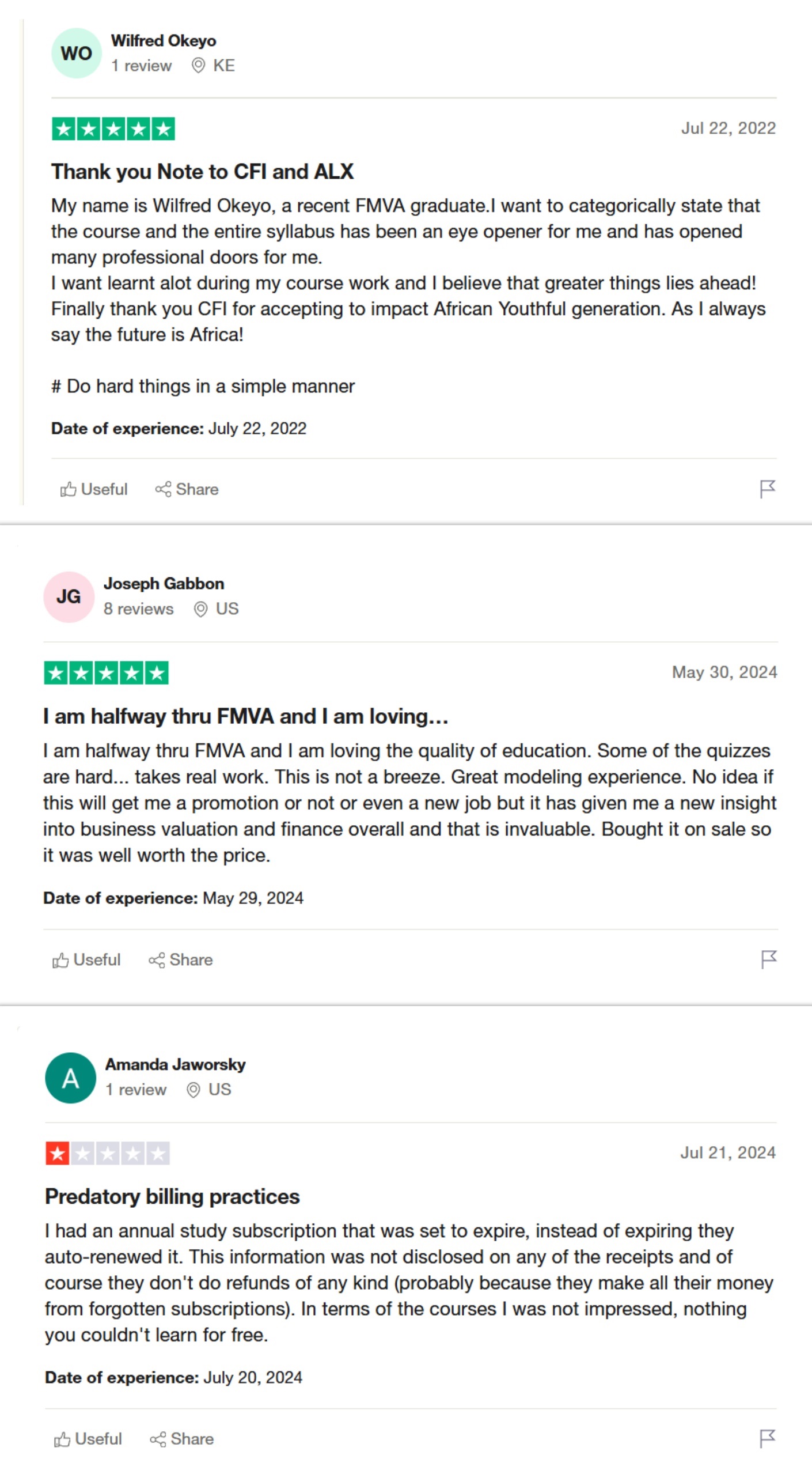

CFI Customer Reviews

CFI customer reviews reveal mixed opinions about their services. Some users expressed dissatisfaction with the billing practices, highlighting auto-renewals without prior notice and a lack of refunds. Additionally, there were concerns about the course content, with some stating it offered little value beyond what is freely available.

On the other hand, many reviewers praised the FMVA program for its rigorous curriculum and practical benefits. Users appreciated the insights into business valuation and finance, with some crediting the program for opening professional opportunities and enhancing career prospects. These varied reviews emphasize the importance of understanding subscription terms and evaluating course expectations.

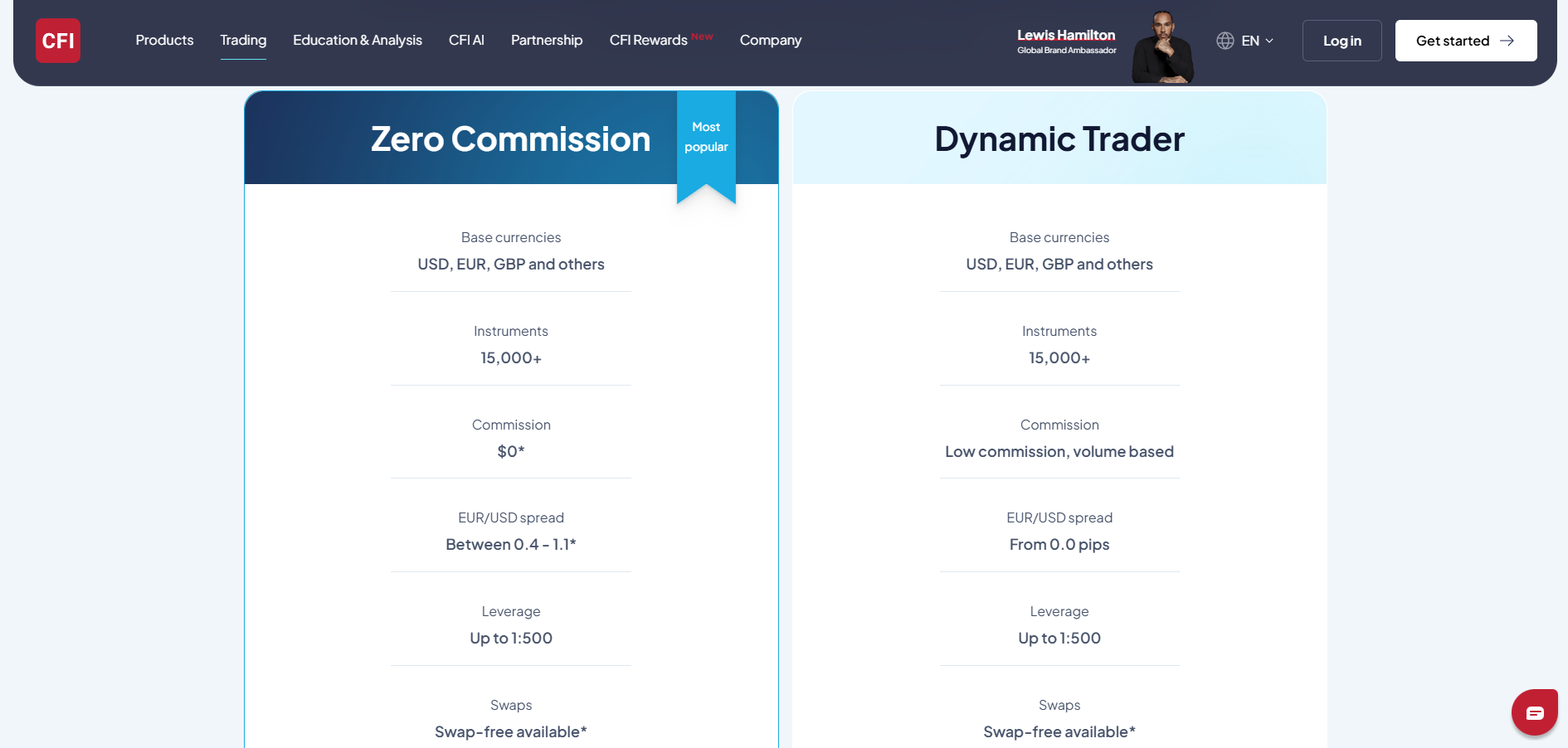

CFI Spreads, Fees, and Commissions

Competitive trading conditions are offered by CFI, with spreads starting at 0.0 pips on EUR/USD pairs, thus providing tight and cost-effective trading options. Commissions are low and volume-based or zero for certain account types, thus catering to different trading strategies and budgets. This makes the whole process affordable and transparent for traders at all levels.

Leverage reaches up to 1:500, although this is only for professional clients. CFI also supports swap-free accounts, thus helping the trader avoid overnight fees. All these features are aimed at providing various trading preferences at low cost.

Traders can access over 15,000 instruments across platforms like MT4, MT5, and cTrader. With no minimum deposit and a minimal trade volume of 0.01, CFI is accessible to new and experienced traders alike. Algorithmic trading is also permitted, adding more flexibility to the trading experience.

Account Types

CFI offers a range of account types to cater to different trading needs, providing flexibility, competitive pricing, and advanced trading tools. Each account type is designed to accommodate both beginner and professional traders with diverse strategies and goals.

Zero Commission Account

The Zero Commission account eliminates commission fees, offering spreads between 0.4 to 1.1 pips on EUR/USD. With leverage up to 1:500 for professional clients, swap-free options, and no minimum deposit, it’s ideal for cost-conscious traders. Supported platforms include MT4, MT5, and cTrader.

Dynamic Trader

The Dynamic Trader account features low, volume-based commissions and spreads starting from 0.0 pips. It supports leverage up to 1:500 and offers swap-free accounts for flexibility. With no minimum deposit and access to advanced tools on platforms like MT4 and cTrader, it caters to both beginners and experienced traders.

How to Open Your Account

Opening a CFI account is a straightforward process that allows traders to access competitive spreads, advanced platforms, and flexible trading options. Follow these simple steps to start trading and make the most of CFI‘s offerings.

Step 1:Fill Out the Registration Form

Visit the CFI website and complete the online registration form by entering your personal information, including your name, email, phone number, and country of residence.

Step 2: Verify Your Identity

Upload necessary documents, such as a valid government ID and proof of address, to complete the account verification process.

Step 3:Select Your Account Type

Choose the account type that suits your trading needs, like Zero Commission or Dynamic Trader, to proceed with the setup.

Step 4:Fund Your Account

Deposit funds into your account using one of the supported payment methods to meet your trading budget.

Step 5:Start Trading

Access the trading platform, choose your instruments, and begin trading in the financial markets with CFI.

CFI Trading Platforms

CFI offers a multiple trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, CFI Trading App, and CFI Multi-Asset, catering to traders of all levels. MT4 and MT5 are known for their advanced charting tools, customizable indicators, and automated trading options. While MT4 is ideal for beginners, MT5 adds features like extra timeframes, more order types, and multi-asset support, making it perfect for advanced traders.

For professionals, cTrader provides fast order execution, depth of market features, and precise trading tools. The CFI Trading App offers a seamless mobile experience for on-the-go trading, while the CFI Multi-Asset platform supports trading across multiple asset classes with integrated analytics and advanced plugins, making it an excellent choice for managing diverse portfolios.

What Can You Trade on CFI

CFI allows trading in major, minor, and exotic currency pairs, offering competitive spreads and high liquidity. This makes it an excellent option for traders looking to capitalize on global currency fluctuations.

Forex

CFI allows trading in major, minor, and exotic currency pairs, offering competitive spreads and high liquidity. This makes it an excellent option for traders looking to capitalize on global currency fluctuations.

Metals

Trade precious metals like gold and silver with CFI to hedge against inflation or diversify your investments. These assets offer a safe haven during market volatility, appealing to long-term and short-term traders alike.

Crypto

CFI provides access to popular cryptocurrencies, including Bitcoin, Ethereum, and others. This market offers high volatility, creating opportunities for traders seeking short-term gains or portfolio diversification.

Indices

With CFI, you can trade global indices like the S&P 500 and FTSE 100. Indices allow traders to speculate on the performance of entire markets rather than individual stocks.

Stocks

CFI offers a vast selection of stocks from global markets, enabling traders to invest in leading companies. Stock trading is ideal for those looking to build long-term wealth or capitalize on market trends.

Energies

Trade energy commodities like crude oil and natural gas with CFI to take advantage of market shifts driven by supply and demand. These instruments provide excellent opportunities for speculators and hedgers alike.

CFI Customer Support

CFI offers reliable customer support to assist traders with any inquiries or technical issues. Their 24/7 live chat feature ensures immediate assistance, allowing traders to resolve concerns at any time, whether it’s during market hours or after.

For more detailed queries, traders can reach out through email support, where the team provides clear and timely responses. This option is ideal for addressing account-related concerns or technical issues that require detailed explanations.

CFI also provides phone support for those who prefer direct communication. This allows traders to speak with a representative for urgent issues, ensuring a more personalized and efficient resolution.

Advantages and Disadvantages of CFI Customer Support

Withdrawal Options and Fees

CFI provides several withdrawal options to ensure flexibility and convenience for traders. All withdrawal methods have no minimum or maximum limits, and CFI does not impose any fees, though charges from the corresponding bank may apply.

Wire Transfer

Wire transfer allows users to withdraw funds directly to their bank accounts. While CFI does not charge fees, any costs incurred depend on the policies of the receiving bank.

SafeCharge

SafeCharge supports withdrawals via Mastercard and Visa, offering a simple and secure method for users. Like other options, no fees are charged by CFI, but additional bank charges may apply.

CFI Card by G2P

The CFI Card by G2P offers an efficient way to access funds. With no minimum or maximum withdrawal limits and no fees from CFI, it’s a user-friendly option for quick withdrawals.

CFI Vs Other Brokers

#1. CFI vs XM

CFI provides access to over 15,000 trading instruments, including forex, metals, indices, stocks, and cryptocurrencies, with spreads starting from 0.0 pips and leverage up to 1:500 for professional traders. Supporting MT4, MT5, and cTrader, CFI has no minimum deposit and offers 24/7 customer support. In comparison, XM operates in nearly 190 countries, offering 1,000+ instruments like currencies, stocks, commodities, and metals, with spreads from 0.6 pips and leverage up to 1:1000 in non-EU regions. XM ensures 99.35% of trades execute instantly, supports MT4, MT5, and its proprietary app, and offers bonuses outside the EU with a $5 minimum deposit.

Verdict: CFI suits traders seeking diverse instruments, no minimum deposits, and advanced tools, while XM is ideal for those preferring low deposits, high leverage, and bonuses. The choice depends on your trading priorities.

#2. CFI vs RoboForex

CFI offers over 15,000 instruments, including forex, metals, indices, stocks, and cryptocurrencies, with spreads starting from 0.0 pips and leverage up to 1:500 for professionals, alongside no minimum deposit. Supported on MT4, MT5, and cTrader, CFI ensures advanced tools and 24/7 customer support. RoboForex, on the other hand, provides 12,000+ instruments, including forex, CFDs on stocks, indices, and futures, with spreads from 0 pips and leverage up to 1:2000. RoboForex features MT4, MT5, and R StocksTrader platforms, along with the CopyFx program for passive income, instant withdrawals, and a $10 minimum deposit, appealing to diverse trading strategies.

Verdict: CFI suits traders seeking diverse instruments and no minimum deposit, while RoboForex offers high leverage, low deposits, and CopyFx for passive income. The choice depends on your needs.

#3. CFI vs Exness

CFI offers over 15,000 instruments, including forex, metals, indices, stocks, and cryptocurrencies, with spreads starting from 0.0 pips and leverage up to 1:500. It supports MT4, MT5, and cTrader platforms, has no minimum deposit, and provides 24/7 customer support, making it accessible and flexible for traders at all levels. Exness, one of the largest brokers globally, provides CFDs on forex, stocks, indices, and cryptocurrencies, with leverage up to unlimited (terms apply). It caters to all traders with account types like Cent, Standard, Pro, and Raw Spread, offering spreads from 0.1 pips and a $10 minimum deposit. Exness also features fast withdrawals, analytics tools, and platforms like MT4, MT5, and the Exness Trade App for a comprehensive trading experience.

Verdict: CFI is ideal for traders seeking diverse instruments, no minimum deposit, and 24/7 support, while Exness suits those preferring high leverage, low deposits, and flexible account types. The choice depends on your trading goals.

Also Read: XM Review 2024 – Expert Trader Insights

Conclusion: CFI Review

CFI is a trusted broker offering over 15,000 trading instruments, including forex, metals, indices, stocks, and cryptocurrencies. With competitive spreads starting from 0.0 pips and leverage up to 1:500 for professional traders, it provides excellent conditions for those looking for cost-effective and flexible trading. The availability of leading platforms like MT4, MT5, and cTrader, combined with no minimum deposit, makes it accessible to traders of all experience levels.

The broker emphasizes transparency and customer satisfaction through clear trading conditions and 24/7 support. Its features cater to various trading styles, from beginners exploring the markets to seasoned professionals leveraging advanced tools. With its extensive offerings, robust support, and user-friendly platforms, CFI remains a solid choice for traders seeking reliability and versatility in the financial markets.

Also Read: CWG Markets Review 2024 – Expert Trader Insights

CFI Review: FAQs

What trading instruments does CFI offer?

CFI provides access to over 15,000 instruments, including forex, metals, indices, stocks, cryptocurrencies, and more, catering to traders with diverse preferences.

What trading platforms are available with CFI?

CFI supports industry-leading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, offering advanced tools for trading across multiple devices.

Are there any minimum deposit requirements with CFI?

No, CFI does not have a minimum deposit requirement, making it accessible to both beginner and professional traders.

Does CFI offer customer support?

Yes, CFI provides 24/7 customer support through live chat, email, and phone to assist traders with any inquiries or technical issues.

OPEN AN ACCOUNT NOW WITH CFI AND GET YOUR BONUS