Position in Rating | Overall Rating | Trading Terminals |

202nd  | 2.4 Overall Rating |  |

CapitalXtend Review

When venturing into forex trading, choosing the right broker is crucial. The right broker ensures that your trades are executed efficiently, your funds are secure, and you have access to essential trading tools and support. A reliable broker can significantly influence your trading success by providing a stable platform, competitive spreads, and excellent customer service.

CapitalXtend is a standout broker in the forex market. With over 15 years of industry experience, they offer a range of trading instruments, including currencies, CFDs on metals, energies, shares, indices, and cryptocurrencies. Their platforms, MetaTrader 4 and MetaTrader 5, are highly regarded for their advanced features, fast execution, and user-friendly interfaces.

In this detailed review, I aim to provide an exhaustive evaluation of CapitalXtend, emphasizing its unique selling propositions and potential drawbacks. My objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. My balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering CapitalXtend as your preferred brokerage service provider.

What is CapitalXtend?

CapitalXtend is a global forex broker that has been serving traders since 2005. They offer a wide range of trading instruments, including forex, CFDs on metals, energies, shares, indices, and cryptocurrencies. Their platforms, MetaTrader 4 and MetaTrader 5, are highly regarded for their advanced features, fast execution, and user-friendly interfaces.

One of the standout features of CapitalXtend is their commitment to customer support and security. They provide 24/7 customer service and negative-balance protection, ensuring traders have assistance and do not lose more money than they have in their accounts. With impressive leverage options up to 1:5000 and a variety of account types, CapitalXtend caters to both new and experienced traders, making them a reliable choice for anyone looking to succeed in the forex market.

CapitalXtend Regulation and Safety

CapitalXtend is regulated by several authorities, ensuring a secure trading environment. They are registered with the Financial Services Commission of Mauritius, holding an Investment Dealer License. This regulation underscores their commitment to providing safe and dependable financial services. Additionally, they are registered in Saint Vincent and the Grenadines and the Republic of Kazakhstan, which further solidifies their global regulatory compliance.

Knowing about a broker’s regulation and safety measures is crucial. CapitalXtend’s membership in The Financial Commission provides an extra layer of protection, offering up to €20,000 compensation in case of disputes. This independent regulator ensures that traders’ interests are safeguarded. Their compliance with multiple regulatory bodies demonstrates their dedication to transparency and security, making them a trustworthy option for traders seeking a reliable trading platform.

CapitalXtend Pros and Cons

Pros

- Wide range of trading instruments

- High leverage options up to 1:5000

- Multiple account types to suit different traders

- No commission on most accounts

- Fast execution speeds

- Regulated by FSC Mauritius

Cons

- Limited regulation in some jurisdictions

- Verification required for withdrawals

- No proprietary mobile app

- Higher spreads on Standard account

Benefits of Trading with CapitalXtend

Trading with CapitalXtend brings several key benefits that have greatly enhanced my trading experience. One major advantage is the wide range of trading instruments available, including forex, CFDs on metals, energies, shares, indices, and cryptocurrencies. This variety allows me to diversify my portfolio and tap into different market opportunities. Additionally, the high leverage options of up to 1:5000 have significantly boosted my trading potential, enabling me to maximize profits even with smaller investments.

Another standout feature is the use of MetaTrader 4 and MetaTrader 5 platforms, which provide a user-friendly and reliable trading environment. These platforms offer advanced tools for technical analysis and fast execution speeds, making my trading more efficient and informed. Furthermore, the 24/7 customer support ensures that I have access to assistance whenever needed, which is crucial for addressing any issues promptly. With regulation by the Financial Services Commission of Mauritius, I feel secure knowing that CapitalXtend adheres to strict financial standards, making it a trustworthy choice for traders.

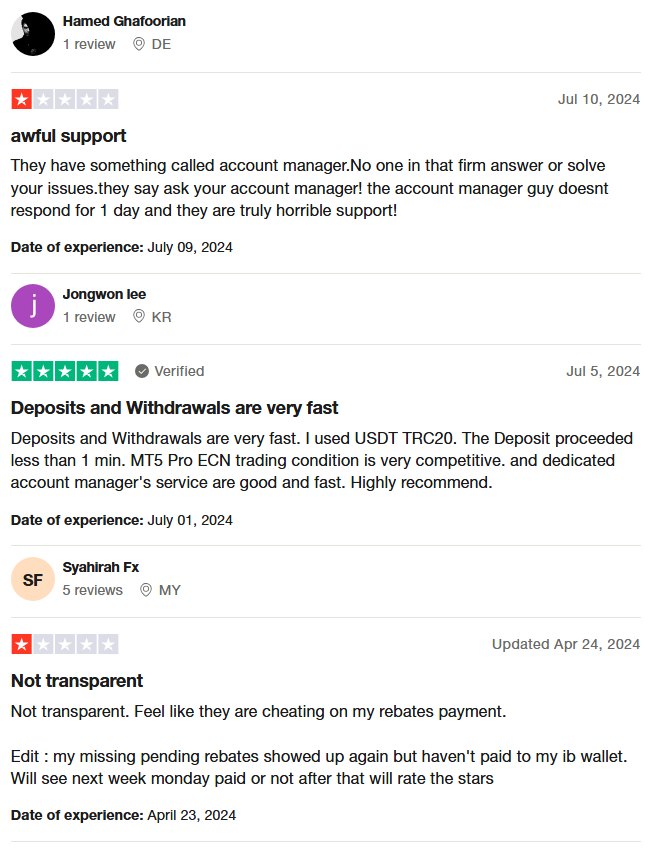

CapitalXtend Customer Reviews

Customer reviews of CapitalXtend present a mixed picture. Some users have praised the broker for its fast deposit and withdrawal processes, particularly using USDT TRC20, noting that transactions are processed in under a minute. They also appreciate the competitive trading conditions on the MT5 Pro ECN platform and the prompt service from dedicated account managers. However, other reviews highlight issues with poor customer support, where inquiries are often deflected to account managers who do not respond promptly. Additionally, there are concerns about transparency and delayed rebate payments, with some users feeling that the company might be untrustworthy in handling their funds. Despite these mixed reviews, the broker’s fast transaction speeds and competitive trading conditions have received positive feedback.

CapitalXtend Spreads, Fees, and Commissions

Trading with CapitalXtend, I noticed their spreads, fees, and commissions are quite competitive and transparent. The Standard Account offers commission-free trading with spreads starting at 3 pips, although the typical spreads average around 2.5 pips. For tighter spreads, the ECN and Pro-ECN accounts provide spreads starting from 1.6 pips and 0.2 pips, respectively, with the Pro-ECN account charging a $3 commission per side. This setup is beneficial for traders who prioritize low-cost trading environments.

Regarding fees, CapitalXtend processes deposits and withdrawals quickly and mostly free of charge. However, some withdrawal methods, such as Paylivre and cryptocurrency transactions, incur small fees. Additionally, there are swap charges for positions held overnight, which is standard practice among brokers but important to consider for long-term trades

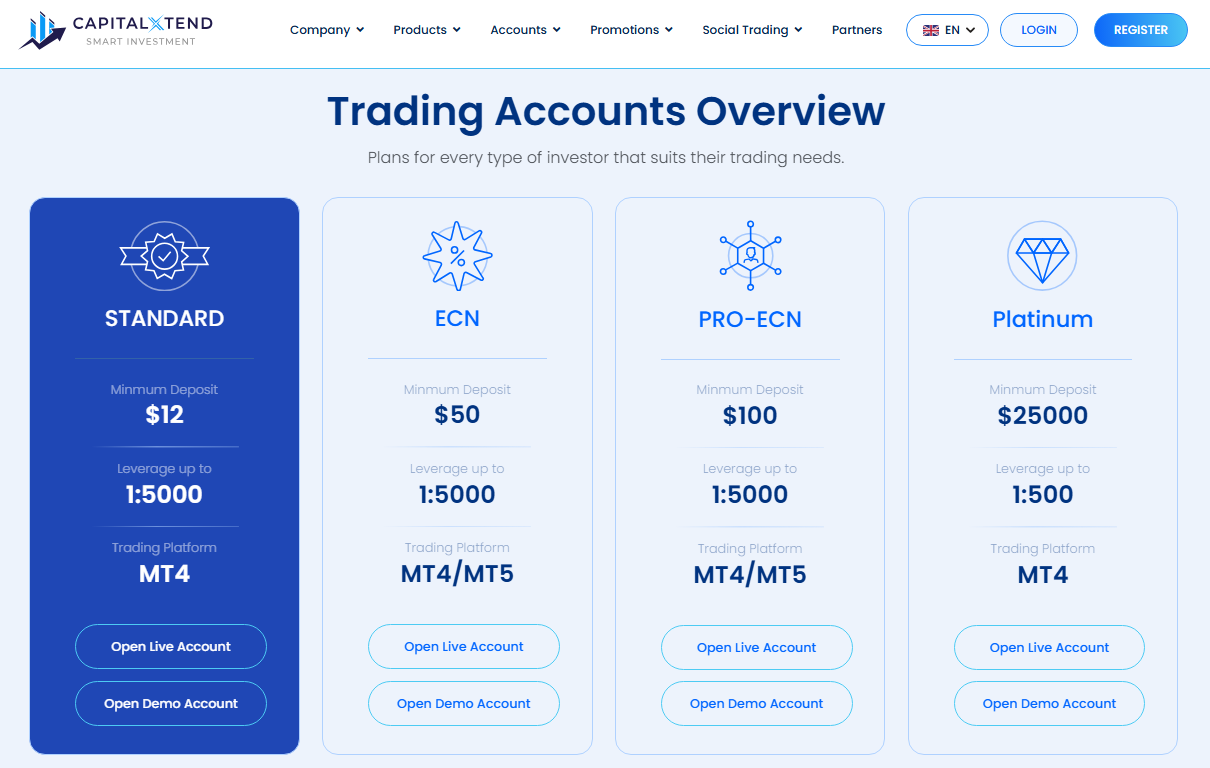

Account Types

When trading with CapitalXtend, I found that they offer a variety of account types to suit different trading needs. Here’s a breakdown of the available accounts:

Standard Account

- Minimum Deposit: $12

- Leverage: Up to 1:5000

- Trading Platforms: MT4

- Commission: None

- Spread: From 2.0

- Trading Instruments: FX, Spot Metals, Spot Commodities, CFD Indices, US shares, EU shares, Cryptocurrencies

- Swap-Free: Available

- Pricing: 5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD

ECN Account

- Minimum Deposit: $50

- Leverage: Up to 1:5000

- Trading Platforms: MT4/MT5

- Commission: None

- Spread: From 1.2

- Trading Instruments: FX, Spot Metals, Spot Commodities, CFD Indices, Cryptocurrencies

- Swap-Free: Available

- Pricing: 5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD

Pro-ECN Account

- Minimum Deposit: $100

- Leverage: Up to 1:5000

- Trading Platforms: MT4/MT5

- Commission: $3 fixed per side

- Spread: From 0.0

- Trading Instruments: FX, Spot Metals, Spot Commodities, CFD Indices, Cryptocurrencies (MT5)

- Swap-Free: Available

- Pricing: 5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD

Platinum Account

- Minimum Deposit: $25,000

- Leverage: Up to 1:500

- Trading Platforms: MT4

- Commission: $3 fixed per side

- Spread: From 0.0

- Trading Instruments: FX, Spot Metals, Spot Commodities, CFD Indices

- Swap-Free: Available

- Pricing: 5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD

How to Open Your Account

- Go to the CapitalXtend official website.

- Click the “register” button to start the sign-up process.

- Fill in your personal details including first name, last name, and nationality.

- Provide a valid phone number and an active email address.

- Create a strong, memorable password for your account.

- Complete the captcha to confirm you are not a robot.

- Read and agree to the customer agreement to understand the terms of service.

- Verify your email address by clicking on the confirmation link sent to your inbox.

CapitalXtend Trading Platforms

Trading with CapitalXtend provides access to two of the most popular trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MetaTrader 4 is renowned for its user-friendly interface and robust analytical tools, making it ideal for both beginners and experienced traders. It offers features like interactive charts, technical indicators, and automated trading through Expert Advisors. The platform’s security and multi-device functionality ensure that trades can be managed efficiently from anywhere.

On the other hand, MetaTrader 5 offers enhanced features for more advanced trading. It includes additional order types, an integrated economic calendar, and the ability to hedge positions. MT5 supports more chart types and timeframes than its predecessor, making it suitable for detailed market analysis. Both platforms are available on multiple devices, ensuring that I can trade conveniently whether I’m at my desktop or on the go.

What Can You Trade on CapitalXtend

When trading with CapitalXtend, I found that they offer a wide range of trading instruments, providing ample opportunities to diversify and capitalize on market movements. CapitalXtend offers access to over 60 forex pairs, including major, minor, and exotic pairs. This variety allows me to trade different currencies depending on market conditions and personal preference. Additionally, the platform includes commodities like gold, silver, and crude oil, which are essential for traders looking to hedge or speculate on commodity prices.

Moreover, CapitalXtend also provides a comprehensive selection of CFDs on shares from leading European and US companies, such as Adidas, L’Oreal, and Ford. This broadens the trading scope beyond just forex and commodities, allowing for exposure to the stock market as well. The inclusion of cryptocurrencies like Bitcoin, Ethereum, and Litecoin adds another layer of flexibility, catering to the growing interest in digital assets. These extensive trading options ensure that I can tailor my trading strategy to a wide array of market conditions and asset classes.

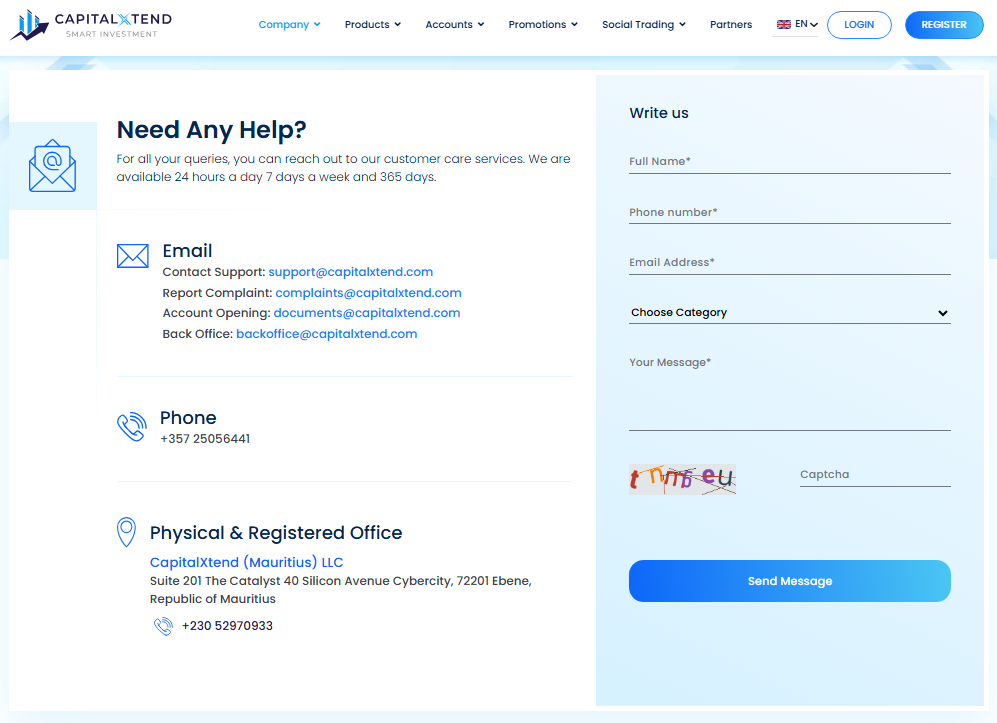

CapitalXtend Customer Support

When trading with CapitalXtend, I found their customer support to be highly responsive and accessible. They offer 24/7 customer support, ensuring that assistance is available at any time. I appreciated the multiple contact options, including email, phone, and live chat, which made it easy to get help quickly when needed. Their support team is available via email at [email protected] and by phone at +357 25056441, providing multiple channels to resolve any issues or queries.

Moreover, the live chat feature on their website is particularly useful for immediate responses. The support team is knowledgeable and able to handle a range of inquiries, from account setup to technical issues. I found their customer service to be reliable and efficient, making my trading experience smoother.

Advantages and Disadvantages of CapitalXtend Customer Support

Withdrawal Options and Fees

When withdrawing funds from CapitalXtend, I found the process to be quite straightforward with multiple options available. The broker supports withdrawals through Visa, Mastercard, bank transfers, and several electronic payment methods including cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Most methods are commission-free, except for certain services like Paylivre which has a 1.8% fee and Perfect Money with a 0.5% charge. This variety ensures that I can choose the most convenient and cost-effective option for my needs.

However, it’s important to note that withdrawals typically take up to 24 hours to process, which is in line with industry standards. Additionally, account verification is required before making a withdrawal, which involves submitting proof of identity and residency. This step, while necessary for security, can add a slight delay to the initial withdrawal process.

CapitalXtend Vs Other Brokers

#1. CapitalXtend vs AvaTrade

CapitalXtend and AvaTrade both offer extensive trading options but cater to different trader needs. CapitalXtend provides a variety of trading instruments with a focus on high leverage up to 1:5000 and multiple account types. AvaTrade, on the other hand, is renowned for its robust regulatory framework, operating in numerous jurisdictions with over 300,000 registered customers. AvaTrade offers more than 1,250 financial instruments and focuses on providing a comprehensive trading experience with excellent educational resources.

Verdict: AvaTrade is better for those seeking strong regulatory oversight and a wide array of trading instruments with a reliable trading environment. CapitalXtend, however, might appeal more to traders looking for high leverage and diverse account options.

#2. CapitalXtend vs RoboForex

CapitalXtend and RoboForex offer competitive trading conditions but differ in their platforms and additional features. CapitalXtend is known for its high leverage and multiple account types, while RoboForex offers a wide range of over 12,000 trading options across eight asset classes. RoboForex stands out with its advanced trading platforms, including MetaTrader, cTrader, and RTrader, and unique offerings like ContestFX, which includes trading contests on demo accounts.

Verdict: RoboForex is superior for traders seeking advanced trading platforms and diverse asset classes, combined with innovative features like trading contests. CapitalXtend is preferable for those prioritizing high leverage and various account options.

#3. CapitalXtend vs Exness

CapitalXtend and Exness both provide substantial trading opportunities but differ in their services and market reach. CapitalXtend offers high leverage up to 1:5000 and multiple account types, suitable for different trader needs. Exness, however, provides over 120 currency pairings, including cryptocurrencies, and features such as infinite leverage for small deposits and instant fund withdrawals. Exness also offers a cozy trading environment and reliable brokerage services.

Verdict: Exness is better for traders who value a wide range of trading instruments, instant fund withdrawals, and the option of infinite leverage for small deposits. CapitalXtend is more attractive for those looking for high leverage and a variety of account options.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH CAPITALXTEND

Conclusion: CapitalXtend Review

In conclusion, trading with CapitalXtend offers several advantages, such as high leverage options up to 1:5000 and a variety of account types to cater to different trading needs. The platform supports a wide range of trading instruments, including forex, commodities, shares, and cryptocurrencies. The availability of the popular MetaTrader 4 and MetaTrader 5 platforms ensures a robust trading experience, complemented by 24/7 customer support for timely assistance.

However, there are some drawbacks to consider. The broker’s regulatory status is not as robust as some of its competitors, which might raise concerns for traders seeking stringent regulatory oversight. Additionally, customer feedback highlights occasional issues with customer support and transparency in certain areas. While CapitalXtend provides a versatile trading environment, potential users should weigh these pros and cons carefully before deciding to trade with them.

Also Read: AdroFX Review 2024 – Expert Trader Insights

CapitalXtend Review: FAQs

What types of accounts does CapitalXtend offer?

CapitalXtend offers four main account types: Standard, ECN, Pro-ECN, and Platinum, each with different features to cater to various trader needs, including varying minimum deposits and leverage options.

Is CapitalXtend regulated?

CapitalXtend is regulated by the Financial Services Commission of Mauritius and is a member of The Financial Commission, although it lacks regulation from top-tier financial authorities, which might concern some traders.

What trading platforms are available with CapitalXtend?

CapitalXtend supports the MetaTrader 4 and MetaTrader 5 platforms, known for their robust features and user-friendly interfaces, providing traders with advanced tools for analysis and automated trading.

OPEN AN ACCOUNT NOW WITH CAPITALXTEND AND GET YOUR BONUS