Capital Street FX Review

As the world of finance continues to evolve at breakneck speed, finding a trustworthy and innovative financial services provider is essential. For both new and experienced investors, identifying the right company to partner with can be a daunting task. In this review, we will be delving into the world of Capital Street FX, a pioneer in the field of financial products and services, to provide you with an in-depth understanding of the company and its offerings.

Capital Street FX is at the forefront of innovation in the financial services industry. The company continually invests in research and development to introduce cutting-edge solutions and products. Its advanced trading platform is designed to provide investors with a seamless trading experience, offering a wide range of analytical tools and market data to help clients make informed decisions.

In addition, Capital Street FX has embraced the world of digital finance, incorporating cryptocurrencies into its portfolio of financial instruments. This forward-thinking approach demonstrates the company’s commitment to staying ahead of industry trends and catering to the evolving needs of its clients.

What is Capital Street FX?

Established in 2002, Capital Street Intermarkets Limited is a reputable financial services provider headquartered in Mauritius. The company is authorized and regulated by the Financial Services Commission (FSC) Mauritius, with license No. C112010690 as a Full Services Investment Dealer (excluding underwriting). This accreditation ensures that the company adheres to strict regulatory guidelines and maintains a high level of integrity and professionalism.

Capital Street FX prides itself on offering an extensive list of financial services to its customers. These services range from Capital Market Execution to Private Banking services, providing investors with a one-stop solution to all their financial needs. With nearly two decades of experience, the company has consistently evolved and introduced innovations in the field of financial products and services, catering to a diverse client base.

Capital Street FX has established itself as a leading financial services provider in the market. With a strong regulatory foundation, a diverse range of services, and a commitment to innovation, the company is well-positioned to serve the needs of investors across the globe. If you’re searching for a reliable and forward-thinking partner to help you navigate the complexities of the financial markets, Capital Street FX is an excellent choice.

Advantages and Disadvantages of Trading with Capital Street FX

Benefits of Trading with Capital Street FX

Choosing the right financial services provider is crucial for investors seeking success in the world of trading. Capital Street FX, with its comprehensive suite of services and commitment to innovation, presents numerous benefits for traders. In this article, we will highlight the key advantages of trading with Capital Street FX, making it an attractive option for investors.

We found that ActTrader is a flexible platform, supporting both investors interested in easy trades and those wishing to carry out extensive technical analysis. But before switching to live trading, we suggest using a demo account for those who are accustomed to MetaTrader 4 and MetaTrader 5. This will let you get used to ActTrader’s distinct interface and features.

ActTrader boasts a range of impressive features that cater to various trading styles and strategies. Some of our top picks include:

Level II quotes

These provide traders with a more detailed view of market depth, including information on bid and ask prices, order sizes, and market participants, enabling better-informed trading decisions.

Financial news

ActTrader offers real-time financial news updates, allowing traders to stay informed about market developments and make timely adjustments to their strategies.

One-click trading

This feature streamlines the trading process by enabling quick order execution with a single click, reducing delays and enhancing trading efficiency.

Algorithmic trading

ActTrader encourages the use of trading algorithms, which let investors automate their plans and take advantage of market opportunities without continual human intervention.

Multiple order types

The platform includes a range of order types, including market, limit, stop, and trailing stop orders, offering traders the freedom to use various risk management strategies.

30 technical indicators

ActTrader comes equipped with a comprehensive suite of technical indicators, enabling traders to perform detailed chart analyses and identify potential market trends and entry or exit points.

Range of charts and timeframes

The platform provides multiple chart types (e.g., candlestick, bar, and line charts) and timeframes, allowing traders to analyze market movements from various perspectives and adapt their strategies accordingly.

Keep in mind that these benefits are based on general observations, and it is essential to conduct thorough research and due diligence before making any decisions about financial services providers.

Capital Street FX Pros and Cons

Pros

- Wide Range of Trading Instruments

- A variety of trading platforms

- User-Friendly Interface

- Tight Spreads and Competitive Fees

- Advanced Trading Tools and Features

- Regulated and Secure

Cons

- Limited Account Types

- No Support for US Clients

- Inactivity Cost

- Limited Cryptocurrency Offerings

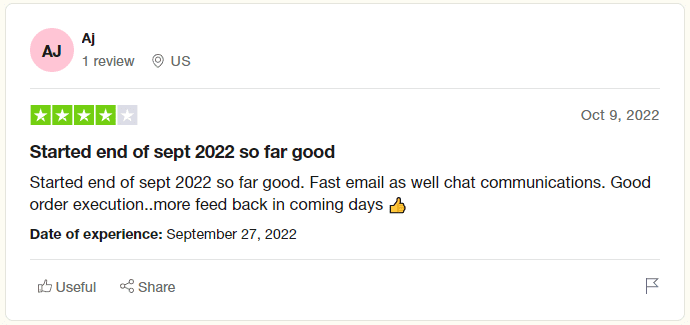

Capital Street FX Customer Reviews

Understanding the experiences of fellow traders can be invaluable when choosing an online trading platform. In this section, we will explore customer reviews of Capital Street FX to provide you with insights into the real-world experiences of traders using the platform. From user-friendliness and advanced trading tools to customer support and fee structures, we’ll cover the key aspects that matter most to traders.

Customer reviews of Capital Street FX are mixed, reflecting a range of experiences with the broker. Some customers express satisfaction with the platform’s wide selection of trading instruments and appreciate the availability of customer support in multiple languages. They highlight the ease of use of the proprietary trading platform, ActTrader, and the extensive educational resources provided.

However, there are also negative reviews from customers who express concerns about the broker’s offshore regulation and relatively higher spreads compared to other brokers. Some customers mention difficulties with the withdrawal process, particularly in terms of fees associated with different withdrawal methods.

Overall, it is important for potential clients to carefully consider both positive and negative reviews, along with their own trading preferences and priorities, when evaluating whether Capital Street FX is the right choice for their individual needs. Conducting thorough research and due diligence is recommended before making a decision.

Capital Street FX Spreads, Fees, and Commissions

Understanding the associated spreads, fees, and commissions when choosing an online trading platform is essential to maximize your trading profits. To give you a clear understanding of what to anticipate as a trader on this well-known platform, we will look at the various charges related to trading on Capital Street FX in this part.

Capital Street FX’s pricing structure could be more transparent and straightforward, as the variety of trading accounts can make it difficult for clients to determine the best value.

Fees largely depend on the account type chosen. Generally, the VIP and Zero accounts have no spreads, with a few exceptions. The Zero, Cent, Classic, and Professional account types feature a minimum spread of 0.1 pips on EUR/USD, GBP/USD, and USD/JPY CFDs. In contrast, the ECN VIP account offers spreads starting from 0.0 pips.

Our analysis revealed that the Basic account typically has EUR/USD spreads of 1.5 pips, the Cent account 1.6 pips, and the Classic account 1.4 pips. The Professional account exhibits average spreads of 1.0 pips, while the ECN account showcases raw spreads of approximately 0.1 pips.

These spreads for non-ECN accounts are somewhat higher than we would prefer, particularly for the Professional account, which requires a substantial minimum deposit.

On the bright side, Capital Street FX does not charge commissions on forex, commodities, stocks, and cryptos for most account types, with the exception of the Zero (with bonus) and VIP accounts. These accounts feature a reasonable commission of 0.1% per side.

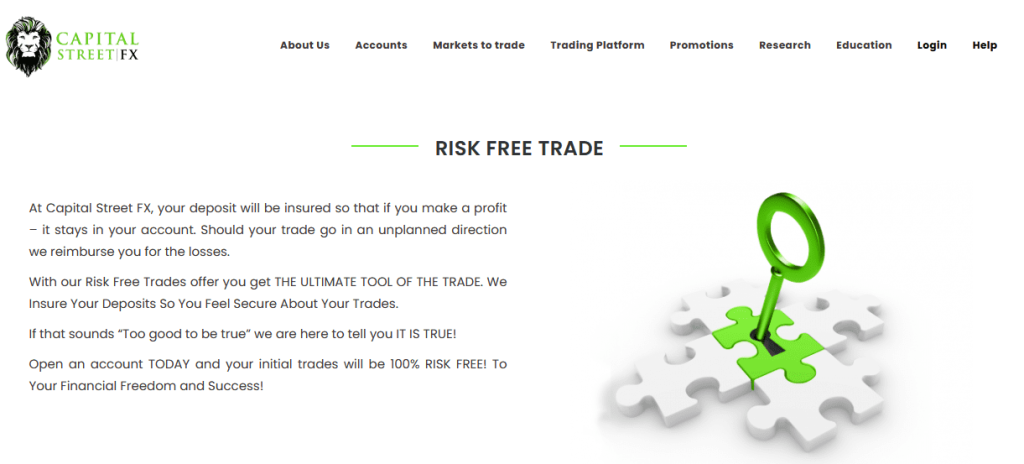

Account Types

Capital Street FX offers a range of account types to accommodate the varying needs and preferences of its diverse clientele, meaning clients of different abilities with various strategies can find a pricing model that works for them.

Notably, Capital Street FX operates as a non-dealing desk (NDD) broker. All account types, except for the VIP account, utilize Straight Through Processing (STP), while the VIP account offers Electronic Communication Network (ECN) execution. Consequently, the VIP account boasts exceptionally fast execution speeds, although the average execution speed for other accounts remains swift at just 0.1 seconds.

The Cent and Basic accounts are the most user-friendly options – we recommend beginners start with one of these since they provide access to all instruments without any commission charges.

In this section, we will explore the different account options available on Capital Street FX, allowing you to determine the best fit for your unique trading requirements.

Basic:

- Access to all instruments

- £100 minimum deposit

- Average spread on EUR/USD: 1.5 pips

- No commission on forex, commodities, stocks, and cryptos

Cent:

- Access to all instruments

- £50 minimum deposit

- The average spread on EUR/USD: 1.6 pips

- No commission on forex, commodities, stocks, and cryptos

Classic:

- Access to all instruments

- £200 minimum deposit

- The average spread on EUR/USD: 1.4 pips

- No commission on forex, commodities, stocks, and cryptos

Professional:

- Access to all instruments

- £1,000 minimum deposit

- The average spread on EUR/USD: 1.0 pips

- No commission on forex, commodities, stocks, and cryptos

Zero (With 900% Bonus Only):

- Access to all instruments

- £5,000 minimum deposit

- The average spread on EUR/USD: zero pips

- 0.01% per side on forex, commodities, stocks, and cryptos

VIP:

- Access to all instruments

- £10,000 minimum deposit

- The average spread on EUR/USD: zero pips

- 0.01% per side commission on forex, commodities, stocks, and cryptos

How To Open Your Account?

In order to get you up and running as soon as possible, opening an account with Capital Street FX is a short and straightforward process. To help you easily start trading on this well-liked platform, we will walk you through the processes in this portion of opening your account.

How to Register for a Capital Street FX Account:

Signing up for a Capital Street FX account is a straightforward process requiring only basic information. To begin:

Step 1:

Visit the Capital Street FX website Navigate to the Capital Street FX website using your preferred web browser.

Step 2:

Locate the ‘Accounts’ tab At the top of the website’s homepage, you will find the ‘Accounts’ tab. Click on it to reveal a dropdown menu.

Step 3:

Select ‘Open an Account’ From the dropdown menu, click on the ‘Open an Account’ option to initiate the account registration process.

Step 4:

Complete the registration form Fill out the registration form with your personal details, including your name, email address, and phone number. Make sure to provide accurate information.

Step 5:

Provide your address and contact information Enter your full address, including street, city, state or province, and postal code. Also, input your contact details, such as your phone number and email address.

Step 6:

Create your login credentials Choose a username and a strong password for your Capital Street FX account. Remember to store this information securely, as you will need it to access your account in the future.

Step 7:

Log in to your Capital Street FX account Use your newly created login credentials to access your Capital Street FX account.

Step 8:

Verify your profile To complete the account verification process, upload the required documents. This may include proof of identity (e.g., a passport or driver’s license) and proof of residence (e.g., a utility bill or bank statement).

Step 9:

Deposit funds Select your preferred funding method and deposit the required minimum amount for the account type you have chosen. Make sure to review any fees or charges associated with your chosen funding method.

Step 10:

Start trading Once your account is verified and funded, you can begin trading on the Capital Street FX platform. Explore the available trading instruments, and make sure to familiarize yourself with the platform’s features and tools before placing your first trade.

What Can You Trade on Capital Street FX?

Capital Street FX provides traders with a wide variety of trading instruments, giving them several options to diversify their portfolios and profit from market fluctuations. This section will help you comprehend the complete range of trading options accessible to you by examining the various asset classes that can be traded on Capital Street FX.

On Capital Street FX, traders have access to a diverse range of financial instruments for trading. These include:

CFDs (Contract for Difference):

Traders can engage in CFD trading, which allows them to speculate on the price movements of various underlying assets without owning the actual asset. CFDs provide opportunities to trade on leverage and benefit from both rising and falling markets.

Forex (Foreign Exchange):

Capital Street FX offers a wide range of forex currency pairs for trading. Traders can participate in the largest financial market globally, taking advantage of the fluctuations in exchange rates between different currency pairs.

Stocks:

Investors can trade stocks of major companies listed on various global exchanges. This includes shares of renowned companies across different sectors, allowing traders to potentially profit from price movements in individual stocks.

Indices:

Capital Street FX enables traders to trade on a variety of global stock indices, such as the S&P 500, FTSE 100, NASDAQ, and more. Indices represent a basket of stocks from specific markets, providing traders with exposure to broader market trends.

Commodities:

Traders can speculate on the prices of commodities such as gold, silver, crude oil, natural gas, and agricultural products. Commodities offer a way to diversify portfolios and potentially benefit from supply and demand dynamics in global markets.

Cryptocurrencies:

Capital Street FX allows traders to participate in the cryptocurrency market, offering trading opportunities on popular digital currencies such as Bitcoin, Ethereum, Ripple, Litecoin, and more. Cryptocurrencies have gained significant popularity and can provide unique trading opportunities.

Bonds:

The platform also offers trading opportunities in bonds, allowing investors to engage in fixed-income securities issued by governments, municipalities, and corporations. Bonds can provide income generation and diversification benefits to investment portfolios.

ETFs (Exchange-Traded Funds):

Traders can access a range of ETFs, which are investment funds traded on stock exchanges. ETFs provide exposure to various asset classes, sectors, and themes, allowing traders to diversify their investment strategies.

Capital Street FX Customer Support

Any online trading platform must offer dependable and attentive customer service in order to guarantee that users may voice their concerns and receive timely responses to their inquiries. In this section, we’ll talk about Capital Street FX’s customer service options, stressing the several assistance channels and their dedication to giving customers a seamless trading experience.

Capital Street FX’s customer support is quite impressive, offering online assistance in over 20 major languages. We discovered that their technical support team is accessible 24/7 via email, and they also provide an extensive FAQ section for addressing common inquiries.

Clients can choose from a range of customer support options, including:

- Live chat: For immediate assistance, Capital Street FX provides a live chat option to connect with their support team in real time.

- Online contact form: You can fill out an online form with your queries or concerns, and a support representative will get back to you promptly.

- Phone: Clients can reach Capital Street FX’s customer support by calling +1 (949) 391 1002.

- Email: For email support, you can contact the team at support@capitalstreetfx.com.

- Skype & WhatsApp: In some regions, Capital Street FX offers support via Skype and WhatsApp, allowing for quick and convenient communication.

- Voice Support: Capital Street FX provides voice support in more than 10 languages, seven days a week, ensuring that clients from various linguistic backgrounds can receive assistance in their preferred language.

Advantages and Disadvantages of Capital Street FX Customer Support

Effective customer support plays a pivotal role in the overall trading experience on an online platform. In this section, we will discuss the advantages and disadvantages of Capital Street FX’s customer support, helping you gain a better understanding of what to expect when seeking assistance from the platform’s support team.

Security for Investors

Security is a top priority for any online trading platform, as it directly impacts the safety of investors’ funds and personal information. Capital Street FX understands the importance of security, which is why it uses advanced security measures to protect its clients’ funds and personal information.

While Capital Street FX operates as an offshore-regulated broker, we found that the company has taken significant steps to ensure the protection of client funds and data.

Withdrawal Options and Fees

Efficient withdrawal options and transparent fee structures are crucial components of a seamless trading experience. In this section, we will explore the various withdrawal methods available on Capital Street FX, along with any associated fees, to help you understand how to access your funds quickly and conveniently.

Our team discovers that Capital Street FX provides prompt withdrawals for the majority of methods, except for Visa or Mastercard payment cards, which take 3-5 business days, and wire transfers, which require 3-7 business days to process.

Nevertheless, we found out that all withdrawal methods come with associated fees, unlike many leading brokers who offer free deposits and withdrawals. This presents a considerable disadvantage for those contemplating trading with Capital Street FX.

The withdrawal methods, along with their corresponding fees, include:

- Advcash – $4 per side

- Perfect Money – 2.5% per side

- Visa/Mastercard – 5.5% per side

- Wire transfer – £50-£70 per transfer

- Eligible cryptocurrencies – 2% gateway charges plus blockchain fees

It’s important to note that deposit funds can only be withdrawn using the same method as the initial deposit. Any balance funds, such as profits, must be sent to your bank account via wire transfer.

To Withdraw Funds:

- Log in to the Members’ Area on the Capital Street FX website.

- Navigate to the Withdraw Funds tab.

- Choose the appropriate payment method from the available options.

- Follow the on-screen instructions to complete the withdrawal process.

Capital Street FX Vs Other Brokers

#1. Capital Street FX Vs AvaTrade

Both Capital Street FX and AvaTrade offer a wide range of trading instruments, including forex, stocks, and cryptocurrencies. While Capital Street FX provides a proprietary trading platform (ActTrader), AvaTrade offers multiple platforms, including MetaTrader 4, MetaTrader 5, and their own proprietary platform, AvaTradeGO.

AvaTrade is regulated by multiple top-tier authorities, including the FCA, ASIC, and CySEC, whereas Capital Street FX is regulated offshore by the FSC in Mauritius. This gives AvaTrade a significant edge in terms of trustworthiness and security.

In terms of trading conditions, AvaTrade generally offers lower spreads compared to Capital Street FX. Moreover, AvaTrade provides a more extensive educational offering, making it an excellent choice for beginners.

Verdict: AvaTrade is the better choice due to its superior regulation, lower spreads, and diverse trading platform options.

#2. Capital Street FX Vs RoboForex

Both brokers offer a wide range of trading instruments, but RoboForex provides a more comprehensive selection of platforms, including MetaTrader 4, MetaTrader 5, and cTrader. Capital Street FX, on the other hand, only offers ActTrader.

RoboForex is regulated by the IFSC in Belize, which is still considered an offshore regulator but has slightly higher standards compared to the FSC in Mauritius, where Capital Street FX is regulated.

In terms of trading conditions, RoboForex generally has more competitive spreads and offers more account types to choose from, catering to a broader range of trading strategies.

Verdict: RoboForex comes out on top due to its wider platform selection, more competitive spreads, and relatively better regulation.

#3. Capital Street FX Vs FX Choice

Both Capital Street FX and FX Choice are reputable brokers offering a wide range of trading instruments. Capital Street FX is regulated by the FSC in Mauritius, while FX Choice is regulated by the IFSC in Belize. While both regulators provide oversight, FX Choice may be perceived as having stricter regulations.

Capital Street FX provides its proprietary platform, ActTrader, while FX Choice offers popular platforms like MetaTrader 4 and MetaTrader 5. Trading conditions such as spreads, commissions, leverage, and minimum deposit requirements may vary between the two brokers.

Considering the overall comparison, both brokers have their strengths. However, FX Choice may have an advantage in terms of regulatory credibility as it is regulated by the IFSC. Additionally, the availability of popular MetaTrader platforms and potentially competitive trading conditions could make FX Choice a preferred choice for some traders.

Verdict: FX Choice may be the better choice due to its regulation, popular trading platforms, and potentially more favorable trading conditions. However, individual preferences and priorities should be taken into account when making a decision.

Conclusion: Capital Street FX Review

In conclusion, Capital Street FX is an offshore-regulated broker that offers a variety of financial instruments, including forex, stocks, bonds, and cryptocurrencies. With a proprietary trading platform, ActTrader, the broker caters to both beginners and experienced traders. While the platform offers several useful features, such as Level II quotes and algorithmic trading, it may not appeal to those who prefer popular platforms like MetaTrader 4 or MetaTrader 5.

Capital Street FX provides multiple account types to cater to a wide range of trading strategies and experience levels. However, the broker’s offshore regulation and relatively higher spreads might be a concern for some traders. On the positive side, the company offers strong customer support, accessible in multiple languages, and has implemented security measures to protect client funds and data.

Overall, Capital Street FX might be suitable for traders who value a proprietary platform and a diverse range of trading instruments. However, those seeking top-tier regulation and more competitive trading conditions should consider exploring other options.

Capital Street FX Review FAQs

At Capital Street FX, we ensure that our platform is evaluated under strict criteria to give traders a reliable and unbiased recommendation. Our goal is to provide traders with a transparent and reliable trading platform that caters to their diverse needs. By answering the most common questions about our platform, we hope to provide a transparent picture that can help you make an informed trading decision.

Is Capital Street FX Legitimate or a Scam?

Established in 2008, Capital Street FX boasts a robust global client base. Despite its offshore regulation, the company’s physical presence in multiple jurisdictions worldwide offers a certain level of reassurance. However, due to the absence of FCA authorization, we are unable to assign a higher trust score to the broker.

How Do Trading Signals Function at Capital Street FX?

Trading signals provided by this broker specify a timeframe for a position on a particular asset, along with recommended selling prices and suggested take profit and stop loss positions. Our comprehensive Capital Street FX review details the necessary steps to begin using the signals service.

Is There a Choice of Trading Platforms at Capital Street FX?

Regrettably, investors at Capital Street FX have only one option for a trading platform, as only ActTrader is integrated with the broker. MetaTrader 4 and MetaTrader 5 are not available, which is a significant drawback for some traders who may prefer these more popular platforms.