Capital Index Review

In the complex world of Forex trading, finding a reliable Forex broker is pivotal. These brokers serve as the gateway to the global currency markets, offering the tools and platforms necessary for traders to execute trades. The importance of choosing the right Forex broker cannot be overstated; it influences trading conditions, transaction costs, and the overall trading experience. As such, selecting a broker that aligns with your trading strategy and goals is essential for success in the Forex market.

Capital Index, founded in 2014, stands out as a global online brokerage that specializes in CFDs, Financial Spread Betting, and Spread Trading across a variety of financial instruments, including Foreign Exchange (FX), Commodities, Indices, and Metals. This diversity in offerings positions Capital Index as a versatile choice for traders seeking to explore different markets through a single platform.

My review aims to delve deep into what makes Capital Index a potentially ideal partner for your trading journey. I will cover everything from account options to deposit and withdrawal processes, as well as commission structures. By providing a comprehensive analysis that melds expert insights with real trader experiences, our goal is to equip you with a thorough understanding of Capital Index. This will enable you to make an informed decision about whether Capital Index aligns with your trading needs.

What is Capital Index?

Capital Index is a renowned forex broker recognized for its use of MetaTrader 4 (MT4), the leading platform in forex trading. MT4’s widespread popularity is due to its comprehensive tools and features that cater to both new and experienced traders, making Capital Index an appealing choice for those seeking a reliable trading environment.

The broker provides a wide array of trading opportunities, featuring over 50 forex currency pairs, along with indices, CFDs, commodities, and precious metals. This extensive selection ensures that traders can diversify their investment portfolios according to their personal preferences and market insights. Whether you’re looking to trade traditional currency pairs or explore other financial instruments, Capital Index offers a broad spectrum of options for your personal investment and trading strategies.

Benefits of Trading with Capital Index

Trading with Capital Index has offered me a range of benefits that have significantly enhanced my trading experience. One of the standout features is the access to MetaTrader 4 (MT4), a leading trading platform known for its robust functionality, which includes advanced charting tools, automated trading capabilities, and a user-friendly interface. This has allowed me to execute trades more efficiently and analyze the markets with greater depth.

Another significant advantage is the variety of financial instruments available. With over 55 currency pairs, alongside CFDs on precious metals, commodities, and indices, I’ve been able to diversify my portfolio and engage in spread betting, which has opened up new avenues for capitalizing on market movements. This diversity ensures that traders of all preferences can find opportunities that align with their investment strategies.

Lastly, Capital Index’s commitment to transparency regarding fees is highly commendable. The fact that there are no hidden commissions and that the broker clearly outlines any potential charges, such as the withdrawal fee for instant wire transfers, provides peace of mind. This transparency has allowed me to plan my trading and financial management strategies more effectively, without worrying about unexpected costs eroding my profits.

Capital Index Regulation and Safety

Understanding the regulation and safety measures of Capital Index is crucial for traders considering this broker for their trading needs. Capital Index UK is firmly established within the regulatory framework of the United Kingdom, overseen by the Financial Conduct Authority (FCA). The FCA’s stringent regulations ensure that Capital Index adheres to the highest standards of operational integrity and client fund protection on the international market.

Additionally, Capital Index (Global) Limited operates under the jurisdiction of the Securities Commission of the Bahamas (SCB), further extending its regulatory oversight. This dual regulation emphasizes the broker’s commitment to offering secure and compliant trading conditions worldwide. The importance of trading with a regulated broker cannot be overstated, as it significantly reduces the risks associated with financial transactions and the integrity of trading operations.

One of the standout safety features at Capital Index is the protection of customer funds through the use of segregated accounts. These accounts are kept separate from the company’s own funds, ensuring that the broker cannot use client money for any other purposes. In the unlikely event of insolvency, Capital Index guarantees the return of all customers’ funds, minus any fees charged by the payment system. This information, gathered after trading with the broker, highlights the robust safety measures in place, providing traders with peace of mind and a secure trading environment.

Capital Index Pros and Cons

Pros

- User-friendly website interface

- Supports trading in micro-lots

- Suitable for beginners and professionals

Cons

- No cent accounts for beginners

- Limited options for earning passive income

Capital Index Customer Reviews

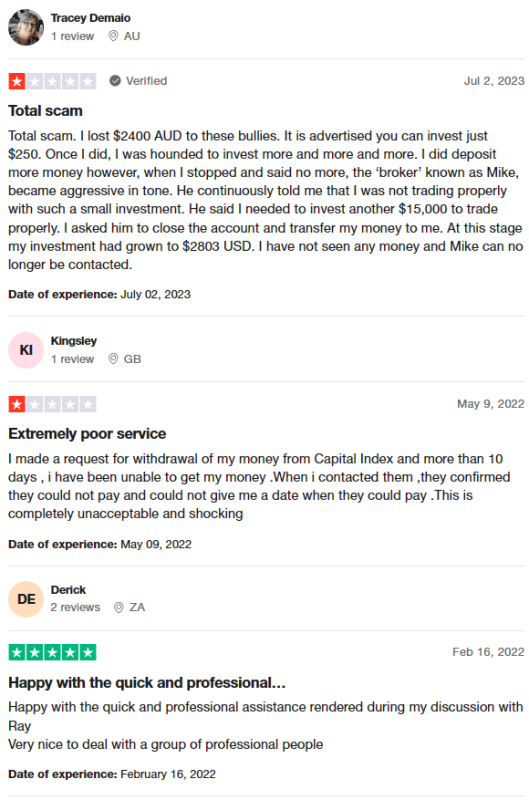

Customer reviews of Capital Index present a mixed picture. Some traders have expressed significant dissatisfaction, citing issues with aggressive marketing tactics and challenges in withdrawing funds. Reports include an instance where a customer felt pressured to invest increasingly larger amounts, leading to a negative experience when attempting to recoup their investment. Another review highlighted delays and uncertainty in the withdrawal process, marking it as both unacceptable and alarming. On the other hand, there are customers who commend the brokerage for its professional and prompt customer service, noting positive interactions with staff members. This varied feedback underscores the importance of due diligence and careful consideration when selecting a forex broker, emphasizing the need for a broker that aligns with individual trading preferences and expectations.

Capital Index Spreads, Fees, and Commissions

As I delved into the cost structure of Capital Index, I was pleased to find a straightforward approach to spreads, fees, and commissions. It’s refreshing to note that there are no hidden commissions lurking to surprise you. When it comes to funding your account, Capital Index doesn’t impose any deposit fees, which is a big plus for traders who value transparency and cost efficiency. However, there is a caveat for withdrawals; while generally fee-free, opting for an instant wire transfer service incurs a fee. This seems reasonable, given the convenience of faster access to your funds.

For those who prefer executing trades without worrying about additional costs, Capital Index mostly aligns with this preference, except for the Black Account. Here, a trading commission is applied on order execution, distinguishing it from other account types which operate on a commission-free basis. Additionally, the broker applies a swap fee for positions that are rolled over to the next trading day, a common practice across forex brokers to account for the interest differential between the two currencies in a pair.

My exploration into Capital Index’s cost structure reveals a broker committed to fairness and transparency. The absence of deposit fees and hidden commissions, alongside the specific conditions under which other fees are charged, speaks to a trading environment designed with the trader’s interests in mind.

Account Types

When exploring Capital Index for your trading needs, you’ll find a variety of account types designed to suit different levels of experience and investment capacities. Here’s a straightforward overview of what each account offers:

- Advanced Account: Tailored for novice traders, this account requires a minimum deposit of 100 units of the base currency. With spreads starting from 1.4 pips, it’s an accessible option for those new to trading, as no commission is charged for order execution.

- Pro Account: Aimed at more advanced users, the Pro Account necessitates a minimum deposit of 5,000 units of the base currency. Offering tighter spreads from 1 pip, this account also benefits from zero commission on order execution, making it attractive for traders looking to minimize costs.

- Black Account: Designed for professional traders, the Black Account requires a significant minimum deposit of at least 50,000 euros (dollars or pounds), reflecting its premium status. It boasts spreads from as low as 0.4 pips and includes a commission for order execution, catering to those with substantial trading volume and seeking the best possible spreads.

Each account type is crafted to match the specific needs and strategies of traders at different stages of their trading journey, ensuring that whether you’re just starting out or are a seasoned professional, Capital Index has an account that can accommodate your requirements.

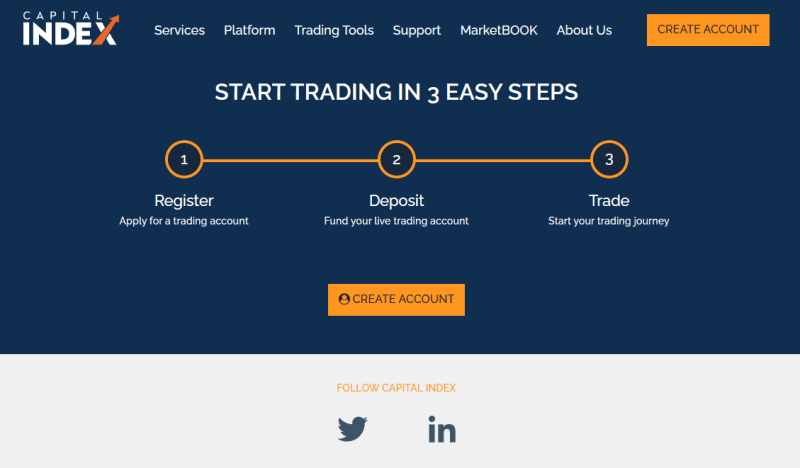

How to Open Your Account

- The user starts by navigating to the Capital Index home page and selecting the option to Create Account for setting up a live trading account.

- They fill out a questionnaire with personal information such as their name, nationality, and contact details, then proceed by clicking Next.

- The next step involves entering address details, including their country, city, and postal code.

- They are asked to provide information about their trading experience and financial education.

- A short test is administered to assess the user’s trading knowledge.

- Information regarding the user’s financial status, including their income and investment capacity, is requested.

- The user then sets up their personal trading account with the chosen specifications.

- Capital Index sends an email detailing the required documents for account verification, and account access is granted once these documents are verified.

Capital Index Trading Platforms

Based on my experience, Capital Index provides traders with access to MetaTrader 4 (MT4), one of the most popular trading platforms in the forex market. MT4 is renowned for its user-friendly interface, advanced charting tools, and robust security features, making it a preferred choice for both novice and experienced traders alike. Its comprehensive suite of resources, including numerous indicators and expert advisors, allows for a tailored trading experience that can cater to the specific strategies and needs of individual traders. This accessibility to MT4 through Capital Index enhances the trading experience by offering a reliable and efficient platform for executing trades in the forex market.

What Can You Trade on Capital Index

Based on my experience with Capital Index, traders have access to a diverse range of trading instruments that cater to various interests and strategies. The platform offers 55 currency pairs, including major, minor, and exotic pairs, providing ample opportunities for forex trading. This wide selection allows traders to engage in the global forex market with flexibility and depth.

Additionally, Capital Index enables trading in CFDs on precious metals, such as gold and silver, commodities like oil and gas, and stock indices, offering a broad spectrum of assets beyond currency pairs. These options allow traders to diversify their portfolios and hedge against market volatility or to specialize in markets where they have specific insights or interest.

Moreover, for those based in regions where it is available, spread betting offers a tax-efficient way to speculate on financial markets. This option highlights the broker’s commitment to providing a range of financial instruments that meet the varied needs and preferences of traders. Through Capital Index, investors have the tools to explore different markets, all under one roof, making it a versatile platform for trading activities.

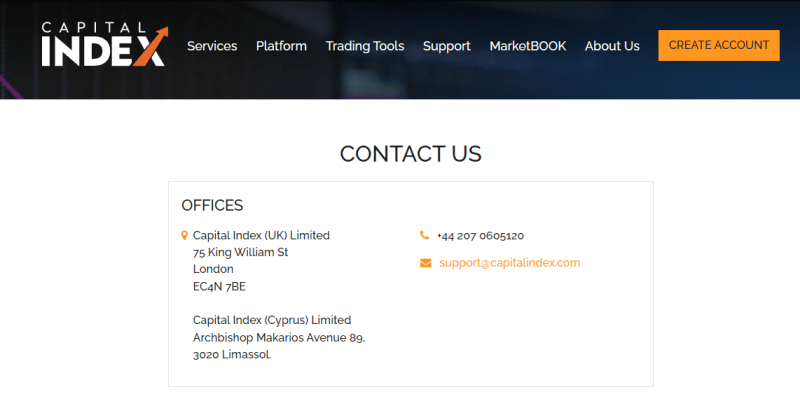

Capital Index Customer Support

Based on my experience, Capital Index offers a comprehensive and accessible customer support system. The platform provides several methods for contacting support, including phone calls, emails, a feedback form, and an online chat feature on their website. This variety ensures that traders can choose the most convenient way to get in touch with the support team according to their preferences and needs.

You can reach out to customer support both from your personal account and directly through the Capital Index website. This flexibility is particularly useful, allowing for quick and efficient resolution of queries or issues regardless of whether you’re logged into your account or browsing the site. The ability to contact support in multiple ways highlights Capital Index’s commitment to providing a supportive and responsive trading environment for its users.

Advantages and Disadvantages of Capital Index Customer Support

Withdrawal Options and Fees

To withdraw personal funds from Capital Index, I found that you need to place a request through the financial department via your personal account. Impressively, there are no limits on the number of withdrawals you can make, which adds a layer of flexibility for managing your finances. However, it’s worth noting that a withdrawal fee applies only for instant wire transfers, keeping the process largely cost-effective for other withdrawal methods.

Capital Index supports two primary methods for deposits and withdrawals: debit/credit cards and wire transfer. In my experience, transactions via debit or credit card are processed within one business day, making them a quick option for both depositing and withdrawing funds. Wire transfers, on the other hand, can take up to a week, but the platform also offers an instant wire transfer service for those needing faster access to their funds.

The broker allows transactions in three major fiat currencies: USD, EUR, and GBP, providing a good range of options for international traders. It’s important to mention that all financial transactions are contingent upon the verification of the user’s account. This verification process is a standard security measure, ensuring that all movements of funds are legitimate and secure, thereby protecting both the trader and the broker.

Capital Index Vs Other Brokers

#1. Capital Index vs AvaTrade

Capital Index and AvaTrade both cater to a wide audience, but their focus areas and strengths differ significantly. AvaTrade, established in 2006, has a vast global presence with over 300,000 registered users from more than 150 countries and offers a broad range of over 1,250 financial instruments. Its strong regulatory framework across multiple jurisdictions and its commitment to providing a full online trading experience make it a robust platform. Capital Index, on the other hand, specializes in forex, CFDs, and spread betting, offering a more focused selection of trading instruments.

Verdict: AvaTrade stands out as the better option for traders seeking a wide range of financial instruments and a broker with a significant global presence and regulatory compliance. Its extensive experience and commitment to providing a comprehensive trading environment make it more appealing for those seeking diversity in trading options.

#2. Capital Index vs RoboForex

RoboForex boasts an impressive array of over 12,000 trading options across eight asset classes, making it a heavyweight for traders seeking variety and cutting-edge technology. Its operation since 2009, under FSC regulation, showcases its stability and commitment to offering superb trading conditions. Capital Index, while offering a solid forex and CFD trading platform, does not match the sheer scale of RoboForex’s offerings or its technological flexibility.

Verdict: RoboForex is the superior choice for traders looking for a wide array of trading options, technological innovation, and personalized trading conditions. Its expansive portfolio and range of platforms cater to all trading styles, from novices to seasoned investors.

#3. Capital Index vs Exness

Exness is renowned for its exceptional monthly trading volume and diverse offering of over 120 currency pairs, including options for stocks, energy, and metals, since its start in 2008. Its unique selling point is the provision of unlimited leverage for earnings on small deposits, making it highly attractive for traders with varying account sizes. Capital Index offers a focused approach with its forex, CFDs, and spread betting options but lacks the vast currency pair selection and innovative leverage options of Exness.

Verdict: Exness emerges as the better choice due to its broader range of trading instruments, innovative unlimited leverage, and a high ranking in forex ratings. This makes it an appealing option for traders seeking flexibility in trading conditions and a wide array of markets.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH CAPITAL INDEX

Conclusion: Capital Index Review

In conclusion, Capital Index presents a solid option for traders focusing on forex, CFDs, and spread betting, with its user-friendly interface and a range of account types tailored to various levels of trading expertise. Its strength lies in offering a specialized suite of trading instruments, accompanied by accessible customer support through multiple channels, ensuring traders can receive assistance when needed.

However, potential traders should weigh the absence of 24/7 customer support and limitations in passive income opportunities against their trading needs and preferences. While Capital Index provides a reliable and regulated trading environment, the feedback on customer service and withdrawal processes suggests areas for improvement.

Also Read: RoboForex Review 2024 – Expert Trader Insights

Capital Index Review: FAQs

What trading platforms does Capital Index offer?

Capital Index offers MetaTrader 4 (MT4), a popular platform known for its user-friendly interface and advanced trading tools.

Are there any fees for withdrawing funds from Capital Index?

Withdrawal fees are only charged for instant wire transfers; other withdrawal methods do not incur a fee.

Can I trade cryptocurrencies with Capital Index?

Capital Index specializes in forex, CFDs, and spread betting on various financial instruments, but does not specifically list cryptocurrencies as part of its trading portfolio.

OPEN AN ACCOUNT NOW WITH CAPITAL INDEX AND GET YOUR BONUS