CAPEX.com Review

As a top online trading platform offering a variety of financial instruments and cutting-edge technologies, CAPEX.com has made a name for itself. It is crucial to examine and study the platform as 2023 approaches in order to comprehend its functionality, features, and general user experience.

Access to numerous financial markets, including equities, indices, commodities, cryptocurrencies, and more, is provided via CAPEX.com, an all-in-one trading platform. The platform offers both new and seasoned traders a user-friendly interface and a variety of cutting-edge features to help them improve their trading methods.

In this capex.com review, we examine CAPEX.com in detail, providing an unbiased assessment of its features, services, advantages, disadvantages, comparison to other well-known brokers, and more. We will comprehend the safety measures and security procedures put in place by CAPEX.com to guarantee the safety of its customers.

What is CAPEX.com?

CAPEX.com is an online trading platform that provides access to a wide range of financial instruments and markets. It allows traders to engage in buying and selling various assets, including stocks, indices, commodities, cryptocurrencies, and more.

The platform aims to cater to both novice and experienced traders, offering a user-friendly interface, advanced trading tools, educational resources, and market analysis features.

CAPEX.com is designed to facilitate efficient and seamless trading experiences. Traders can access the platform through desktop computers, tablets, and mobile devices, enabling them to trade on-the-go and stay connected to the markets at all times.

The platform offers real-time market data, charting tools, risk management features, and customizable indicators to assist users in making informed trading decisions.

As a regulated platform, CAPEX.com adheres to stringent financial regulations to ensure the security and protection of users’ funds and personal information. It employs encryption protocols, firewall systems, and other security measures to maintain the integrity of transactions and safeguard sensitive data.

Furthermore, CAPEX.com emphasizes customer support and provides various channels for users to seek assistance. Traders can engage with the platform’s customer support team through live chat, email, or phone support, receiving prompt and knowledgeable responses to their queries or concerns.

Advantages and Disadvantages of Trading with CAPEX.com?

Trading with CAPEX.com presents a variety of advantages and disadvantages that traders should consider when selecting a forex broker. These factors contribute to the overall trading experience, and understanding them can help traders align their choice with their trading goals and preferences.

Benefits of Trading with CAPEX.com

Indeed, before diving into the benefits of trading with CAPEX.com, it’s important to understand that the choice of a broker can significantly impact your trading journey.

The right broker not only provides a platform for executing trades but also offers the tools, resources, and services to facilitate successful trading outcomes.

As a well-established and respected broker, CAPEX.com brings numerous advantages to the table that can enhance your trading experience. Here, we delve into the key benefits of choosing CAPEX.com as your trading partner.

Diverse Range of Trading Assets

CAPEX.com provides access to a wide variety of trading instruments, including currencies, commodities, stocks, bonds, indices, ETFs, and cryptocurrencies.

This allows traders to diversify their portfolios and explore different market opportunities.

Comprehensive Educational Resources

CAPEX.com offers an extensive educational base, including the CAPEX Academy, market reviews, podcasts, articles, and more.

These resources empower traders to enhance their knowledge and skills, improving their understanding of the markets and trading strategies.

Regulated and Trustworthy

CAPEX.com is regulated by reputable authorities such as CySEC (Cyprus Securities and Exchange Commission) and FSRA.

This regulatory oversight ensures that the broker operates in compliance with established financial standards, providing a level of trust and security for traders.

Advanced Trading Tools and Features

CAPEX.com offers a range of advanced trading tools and features to support traders. These include real-time market data, charting capabilities, risk management tools, customizable indicators, economic calendars, and trading signals.

These tools enable traders to make informed trading decisions and implement effective strategies.

User-Friendly Trading Platform

CAPEX.com provides a user-friendly interface, making it easy for traders to navigate the platform and execute trades efficiently.

The platform is accessible on various devices, including desktops, tablets, and mobile phones, allowing traders to trade on-the-go.

Customer Support

CAPEX.com prioritizes customer satisfaction and provides reliable customer support services. Traders can reach out to the support team through live chat, email, or phone support, receiving prompt assistance and guidance when needed.

Regulatory Compliance and Security

CAPEX.com places a strong emphasis on the security and protection of users’ funds and personal information. The platform employs encryption protocols, firewall systems, and other security measures to ensure the safety of transactions and sensitive data.

CAPEX.com Pros and Cons

When choosing a forex broker, understanding the pros and cons can provide a balanced perspective to aid decision-making.

Here are some key advantages and disadvantages associated with CAPEX.com:

Pros

- Wide Range of Trading Instruments

- Segregated Client Funds

- Analysis and News from Trading Central

- Fixed and Variable Spread Accounts

- Proprietary Web and Mobile Platforms

Cons

- Restricted Client Base

- No Social Trading

- Lack of Comprehensive Education Package

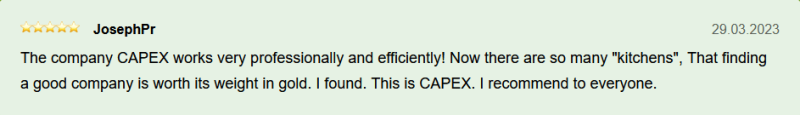

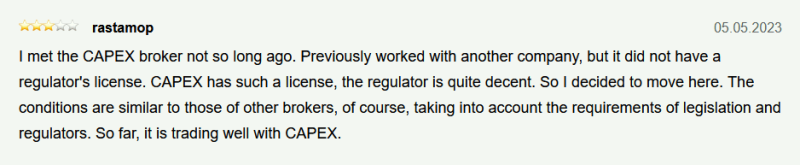

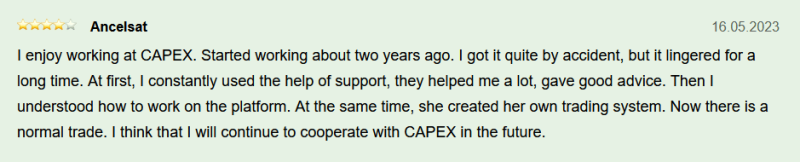

CAPEX.com Customer Reviews

Customers have expressed positive sentiments about CAPEX.com in their reviews. One customer highlights the convenience of the web-based user interface, which allows them to trade on the go.

Another reviewer mentions that they were initially unfamiliar with online trading but were convinced by CAPEX.com that it is a worthwhile investment.

They even mention making a profit. Customer support is highly praised for being friendly and responsive, with quick availability to address any queries.

Keep in mind that reviews can be subjective and are often based on personal experiences, so it’s wise to look for patterns and consistent feedback among multiple reviews. Remember, while user reviews can be helpful, they should not be the only factor considered when choosing a forex broker.

CAPEX.com Spreads, Fees, and Commissions

Choosing a broker with competitive spreads, fees, and commissions is a key factor in maximizing your trading profits. It’s not just about the trading platform’s capabilities or the variety of markets available to trade.

Costs associated with each trade can quickly add up and impact your bottom line, especially for active traders. In this section, we’ll examine the fee structure at CAPEX.com and how it may affect your trading experience.

The spread refers to the difference between the bid and asks prices, typically measured in pips, which represent the smallest price increments. CAPEX.com offers predominantly floating spreads, with some fixed spreads available.

The overall spread offering is competitive, with major currency pairs like GBPUSD and EURUSD having spreads as low as 0.01 pips. For indices, typical spreads are 1.2 on FTSE100 and 0.65 on S&P 500.

In terms of commissions, CAPEX.com offers completely commission-free trading. This, combined with the competitive spread offering, presents a favorable pricing model for traders.

Considering these factors, CAPEX.com demonstrates a competitive fee structure, with low spreads and commission-free trading, enhancing the overall trading experience for its users.

Account Types

CAPEX.com offers a range of live account choices for traders. These include the Essential Account, Original Account, and Signature Account.

Additionally, an Islamic Account version is available for all these account types. Traders can also access a demo account upon registration to practice and familiarize themselves with the platform. Here’s an overview:

Essential Account

The Essential Account is designed for beginner traders or those who prefer a straightforward trading experience. It provides access to a wide range of financial instruments, including currencies, commodities, stocks, indices, and cryptocurrencies.

The Essential Account offers competitive spreads and a user-friendly trading platform to execute trades efficiently. It is an ideal choice for traders starting their trading journey.

Original Account

The Original Account is suitable for intermediate traders looking for more advanced features and trading tools. In addition to the instruments available in the Essential Account, the Original Account offers enhanced trading conditions.

Traders can access more comprehensive market analysis, trading signals, and additional features to support their trading strategies. The Original Account is designed to meet the needs of traders with some trading experience.

Signature Account

The Signature Account is tailored for experienced and professional traders seeking advanced trading capabilities. It provides access to all the instruments and features available in the Essential and Original Accounts, along with premium features and benefits.

Traders with the Signature Account have access to personalized support, priority customer service, exclusive research, and other premium resources. The Signature Account is designed to cater to the specific requirements of seasoned traders.

Islamic Account

CAPEX.com also offers an Islamic Account version for all the above account types. The Islamic Account follows the principles of Islamic finance, adhering to Shariah law, which prohibits earning or paying interest.

The Islamic Account eliminates swap fees or any other interest-based charges, making it suitable for traders who adhere to Islamic principles.

Traders can choose the account type that aligns with their trading experience, preferences, and goals. It’s recommended to review the features and benefits of each account type to determine the best fit for individual trading needs.

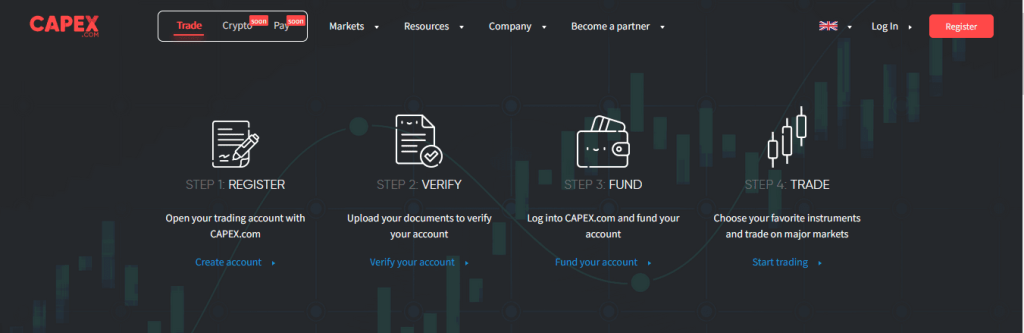

How To Open Your Account?

Opening an account with CAPEX.com is a straightforward process. Here’s a step-by-step guide. Be sure to check CAPEX.com’ official website for any changes to this process.

Visit the CAPEX.com website: Start by going to the CAPEX.com official website.

Sign Up: Click on the “Register” or “Open Live Account” button, usually located at the top right of the website.

Complete the Registration Form: You’ll be asked to fill out a form with personal details, including your name, email address, phone number, and country of residence.

Choose an Account Type: Select the account type that best fits your trading needs and deposit requirements – Essential Account, Original Account, Signature Account, Islamic Account.

Verify Your Identity: To comply with financial regulations, CAPEX.com will require proof of identity and proof of residence.

This can usually be completed by uploading a scanned copy of a valid passport or ID for proof of identity, and a utility bill or bank statement for proof of residence.

Fund Your Account: Once your account is verified, you can deposit funds. CAPEX.com offers several funding options, including bank transfer, credit/debit card, and various online wallets. Select the method that suits you best and follow the instructions to complete the deposit.

Start Trading: After your deposit has been processed, you can start trading. Download the trading platform, log in with your account details, and begin your trading journey.

What Can You Trade on CAPEX.com?

CAPEX.com provides a diverse range of financial instruments for trading, allowing traders to access multiple markets from a single platform. While specific offerings may evolve over time, here are some of the common instruments you can trade on CAPEX.com:

Forex: Trade a wide variety of major, minor, and exotic currency pairs, including EUR/USD, GBP/USD, USD/JPY, and more.

Commodities: Access popular commodities such as gold, silver, crude oil, natural gas, and agricultural products like wheat, corn, and soybeans.

Indices: Trade major global stock market indices, including the S&P 500, NASDAQ, Dow Jones, FTSE 100, DAX, and more.

Shares: Some brokers may offer the ability to trade shares (stocks) of publicly traded companies. Please check with CAPEX.com to see if this is available.

Cryptocurrencies: Depending on the broker and current market conditions, you may have the opportunity to trade popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and others.

It’s important to note that the availability of specific instruments may vary depending on your location and the account type you choose. Additionally, market conditions and new product offerings may introduce additional tradable instruments.

CAPEX.com Customer Support

CAPEX.com prides itself on providing reliable and efficient customer support to assist traders with their inquiries and concerns. The broker offers multiple channels for customer support, ensuring that assistance is readily available when needed.

Here’s an overview of CAPEX.com’ customer support:

Live Chat: CAPEX.com provides a live chat feature on its website, allowing traders to engage in real-time conversations with customer support representatives.

This can be an efficient way to get quick responses to queries and receive immediate assistance.

Email Support: Traders can reach out to CAPEX.com’ customer support team via email. This allows for more detailed or complex inquiries and provides a written record of communication.

Phone Support: CAPEX.com offers phone support, allowing traders to speak directly with customer support representatives. This can be particularly useful for urgent matters or situations that require immediate attention.

It’s worth noting that the availability of customer support channels, response times, and language options may vary based on factors such as the trader’s location and the specific service package they have chosen.

Advantages and Disadvantages of CAPEX.com Customer Support

When considering the customer support provided by CAPEX.com, it’s important to assess both the advantages and disadvantages to gain a comprehensive understanding. Here are some potential advantages and disadvantages of CAPEX.com’ customer support:

Security for Investors

CAPEX.com prioritizes the security of investor funds and operates under regulatory oversight to ensure a safe trading environment.

Here are some key aspects of security for investors provided by CAPEX.com:

It is important to note that the advantages of robust security measures typically outweigh the potential disadvantages. Investors should prioritize the safety of their funds and personal information when selecting a broker, understanding that security measures are in place to protect their interests in the long run.

Withdrawal Options and Fees

CAPEX.com offered various withdrawal options for traders to access their funds. However, it’s important to note that specific withdrawal options and associated fees may have changed since then.

Here are some general considerations regarding withdrawal options and fees:

Bank Card: You can withdraw funds directly to your bank card, making it a convenient and straightforward option.

Wire Transfer: CAPEX.com supports wire transfers, which allow you to electronically transfer funds from your trading account to your bank account. Please note that wire transfers may involve fees and longer processing times compared to other methods.

Neteller: Neteller is an e-wallet service widely accepted by CAPEX.com. It provides a fast and secure way to transfer money online, allowing you to withdraw funds easily.

Skrill: CAPEX.com also supports Skrill, another popular e-wallet service that enables online money transfers. You can use Skrill for both deposits and withdrawals.

It’s important to note that the availability of these withdrawal options may depend on your location and the specific terms and conditions of CAPEX.com.

Regarding withdrawal fees, CAPEX.com offers zero withdrawal fees. However, please keep in mind that additional fees or charges may be applied by your bank or the payment service provider you choose (such as Neteller or Skrill) for processing the withdrawal.

CAPEX.com Vs Other Brokers

When comparing CAPEX.com to other brokers, it’s essential to consider various factors that can impact the trading experience.

Here, we’ll explore the comparisons between CAPEX.com and AvaTrade, RoboForex, and Alpari to help you make an informed decision.

#1. CAPEX.com Vs AvaTrade

CAPEX.com and AvaTrade are both well-established online trading platforms offering a range of financial instruments, including forex, stocks, commodities, and more. While both platforms provide a user-friendly interface and access to various trading tools, there are a few key differences to consider.

CAPEX.com is known for its comprehensive educational resources and market analysis, providing traders with valuable insights to enhance their trading strategies. The platform offers a wide range of trading instruments and competitive spreads.

On the other hand, AvaTrade has a strong reputation in the industry and offers a wide selection of trading platforms, including their proprietary platform called AvaTradeGO, as well as MetaTrader 4 and MetaTrader 5.

The platform provides access to numerous markets and offers a variety of educational materials and tools. AvaTrade supports several payment methods, including bank cards, wire transfers, and e-wallets like PayPal and Neteller.

In terms of choosing the best platform, it ultimately depends on your specific trading needs and preferences. If you value comprehensive educational resources and prefer a zero withdrawal fee policy, CAPEX.com could be a suitable choice.

On the other hand, if you prioritize a wider selection of trading platforms and are comfortable with potential withdrawal fees, AvaTrade may be a good fit.

#2. CAPEX.com vs. RoboForex

CAPEX.com offers a user-friendly platform with a wide range of financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies. The platform provides traders with comprehensive educational resources and market analysis, making it suitable for both beginners and experienced traders.

CAPEX.com supports various payment methods such as bank cards, wire transfers, Neteller, and Skrill for deposits and withdrawals. Moreover, CAPEX.com has a zero withdrawal fee policy, which can be advantageous for traders.

On the other hand, RoboForex is known for its diverse account types and trading platforms. It offers both the popular MetaTrader 4 and MetaTrader 5 platforms, as well as its proprietary platform called R Trader. RoboForex provides traders with access to a wide range of financial instruments, including forex, stocks, indices, commodities, and cryptocurrencies.

The platform also offers different account types tailored to different trading strategies and experience levels. RoboForex supports various payment methods, including bank cards, wire transfers, and e-wallets like Skrill and Neteller. However, it’s worth noting that RoboForex may have withdrawal fees depending on the chosen payment method.

When determining which platform is best for you, it’s essential to consider factors such as available trading instruments, trading platforms, educational resources, account types, and payment options. Additionally, you may want to evaluate customer support, trading conditions, and any applicable fees or charges.

#3. CAPEX.com vs. Alpari

CAPEX.com stands out for its comprehensive educational resources, market analysis, and zero withdrawal fees. If you prioritize access to educational materials and analysis tools, along with a transparent withdrawal fee policy, CAPEX.com may be a good fit.

On the other hand, Alpari has a global presence, extensive industry experience, and offers a diverse range of financial instruments. If you value a wide selection of account types, the availability of MetaTrader platforms, and prefer a well-established platform, Alpari may be a suitable choice.

To make an informed decision, consider evaluating your trading needs, such as preferred instruments, trading platforms, educational resources, account types, and payment options. Additionally, you may want to consider factors like customer support, trading conditions, and any applicable fees or charges.

Conclusion: CAPEX.com Review

CAPEX.com is a highly recommended option for both beginner and advanced traders. With its regulated status as a Cyprus-based Forex trading broker, it provides a secure and trustworthy trading environment. The platform offers a wide range of over 2000 trading instruments across various asset classes and supports advanced trading platforms such as MetaTrader 5 and WebTrader.

CAPEX.com stands out with its tight spreads and commission-free trading, making it cost-effective for traders. Additionally, the platform is well-equipped with advanced trading tools and features, ensuring that traders have the necessary resources for successful trading. CAPEX.com’s commitment to education and trader support is evident through its recognition as the Best Forex Educational Broker and Best Trading Tools in 2020.

With a strong emphasis on regulatory compliance and continuous enhancements tailored to investor needs, CAPEX.com is committed to delivering an exceptional trading experience. The platform offers a variety of trading accounts and supports a wide range of financial instruments, including forex, stocks, commodities, and indices.

Moreover, CAPEX.com integrates Trading Central, a renowned financial analysis provider, to provide traders with valuable insights and research tools. By prioritizing the needs of traders and maintaining strict regulatory standards, CAPEX.com establishes itself as a trusted and reliable choice among forex brokers.

Whether you are starting your financial trading journey or looking for advanced trading solutions, CAPEX.com offers a compelling platform that combines advanced software, relevant information, and a user-friendly interface.

CAPEX.com Review FAQs

What financial instruments can I trade on CAPEX.com?

CAPEX.com offers a wide range of financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies.

Does CAPEX.com charge withdrawal fees?

No, CAPEX.com has a zero withdrawal fee policy, making it convenient for traders to access their funds without incurring additional charges.

What trading platforms does CAPEX.com support?

CAPEX.com supports popular trading platforms such as MetaTrader 5 (MT5) and WebTrader, providing traders with a choice of robust and feature-rich platforms to execute their trades effectively.