What Is A Buy Limit?

A buy limit refers to an order to buy an asset below or at a particular price limit, allowing forex traders to control the amount they pay. The investors can pay less or that price using the limit order to buy the stock. Although the stock price can be specific, the order value remains versatile. In any case, the stock market cannot execute the buy limit unless the buying price is below or at that buy limit price.

If the asset value does not hit the limit price, the order cannot get processed, and the investor can miss out on the trading window. In other words, using the buy limit order allows the investors to purchase the assets at a better or set buy limit order price, but they do not have the assurance that the stock market will file the stock order.

Whenever the investor opts for a decline in the asset price, the buy limit approach is the most reasonable approach to implement. If the buyer does not mind paying a higher or the current price limit, the stock market order to purchase stop limit can be higher if the asset value increases.

Also Read: Short Selling

Contents

Buy Limit Benefits

The buy limit helps to make sure that the buyer does not spend more than they expect. It provides the traders and investors with the options to enter a position at a precise price limit. For instance, a buy limit can be $2.40, and the stock market can be trading it at $2.45. Hence, the order will proceed automatically when the price drops to $2.40. In general, the stock order will not proceed unless the price drops below or to $2.40.

Another benefit of using the buy limit would be the price improvement ability whenever the asset gaps from the next day and the previous day. The order will not happen during the same trading day when the trader places a buy limit at $2.40 as long as the demand remains in a position to benefit from the gap.

If the stock price starts at $2.20 on the next day, the investor will receive the shares at this value since that would be the first price available below $2.40. Yet, whenever the investors pay a lower price, they may rethink the dropped price and consider it worth purchasing the shares.

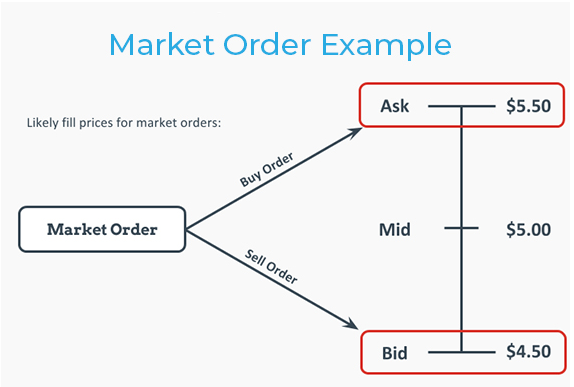

The buy limit order is not like the market order where the investor buys at the current price offer no matter the value. Instead, the buy limit appears on the broker’s book at a particular price limit. The buy order limit indicates that the investors would be willing to purchase a specific value of shares on the stock market at a certain limit price. The trade occurs whenever the assets drop toward the buy limit, provided the seller is still willing to sell the assets at that buy order price.

Generally, the buy limit order appears on the stock trading book to showcase that the investor would like to buy the assets at that price. Thus, the stock order will be below the current market price. In a case where the assets’ price shifts below that buy limit and the seller accepts the order, the trader will purchase the assets at that bid. Therefore, they can avoid paying the spread costs.

This strategy can be practical for day traders seeking to make quick and small profits. For large traders taking more significant positions in the stock market, incremental price limits at several price options can apply to attain the best possible price for the entire order. The buy order limit can also be helpful in a volatile stock market.

For instance, an investor can be opting to purchase the stock but is aware that the stock moves widely daily. They can opt for the market buy order that goes for the first available price limit. Alternatively, they can opt for the buy limit approach.

For example, if an asset closed at $10 on the previous day, the trader can set a $10 buy limit. Hence, he will get assured that they are not willing to pay more for the asset. Thus, when the stock opens the following day at $11, the order will not occur, but it would have saved the investor from paying more than they would like to spend on that order.

Buy Order Disadvantages

It would be best to mention that the buy limit does not assure that the trade will happen. Execution will occur if the assets trade below the limit value and a sell order within the buy limit order. In any case, the asset trading value at that buy limit order is not enough.

For that reason, the trader can have 100 shares to purchase at a specific price, but there can be numerous shares ahead willing to buy at the same price. Thus, the assets’ price will need to clear the buy limit ultimately to allow the buy limit to work. The time of placing the order at that price will determine the chances of completing the transactions. The earlier the order, the higher the chances of completing the transaction.

The buy limit can result in missed opportunities. Remember that the asset price must trade at the buy limit or lower, but the trader cannot transact if it does not exchange. Controlling your assets price is crucial, but it can also block you from some opportunities. Whenever the asset quickly rises, it cannot pull back to the buy order limit before rising higher.

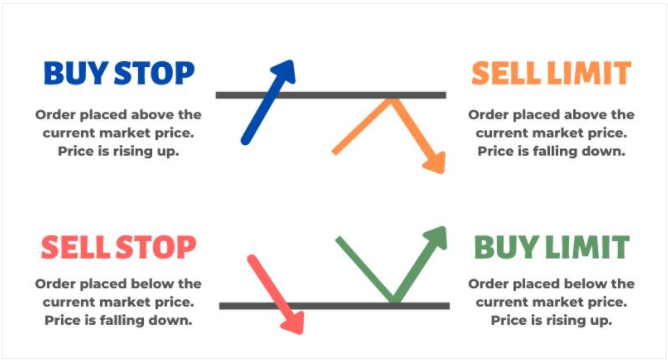

Yet, if investors want to enter the market at any price, they can opt for the market order. The buy stop-limit option would be best for investors who do not mind paying more for the asset but would like to control the transaction value.

Also, some brokers can charge a higher commission for the buy limit than for other options like the market order. However, this option is outdated, and most brokers charge no fee or a flat fee for all orders or based on shares that the investor trades, not the order type.

Buy Limit Example

Apple stock can be trading at a $125.26 offer and $125.25 bid when investors add it to their portfolio. This trade offers several order types for investors to pursue. They can opt for the market order and purchase the stock at $125.26. Alternatively, they can opt for the buy limit at any asset price of below or at $125.25.

The trader might be optimistic that the price will slightly fall in the next coming weeks. Thus, they place a buy limit of about $121. If the stock trades drop to $121, the trader will buy the shares at $121. This statement implies that the investor will make the $125.25/26 price that they first saw.

Nevertheless, the price may not drop to the buy limit. Instead, it can move higher over the following weeks. This case will imply that the investor will miss participating in the stock if it never hits their buy limit.

Also Read: Forex Market Hours

Frequently Asked Questions

1. How do I Place a Buy Limit Price?

It would be best to determine the limit price for the assets you would like to buy before placing the buy limit order. The stock order will only occur at your buy limit price or even lower. Also, you ought to set an expiry date for the buy limit order. You can mark your order as GTC (good ‘til canceled) to complete the order when you want. The buy limit order will remain open until you decide to close it. All in all, the brokerage will give a time limit to keep your buy limit on GTC, usually within 90 days.

2. What is a Buy Stop-Limit?

A buy stop-limit order can combine the limit and stop order features. You ought to select two price points to place a buy stop-limit order. The first price point would be the stop, which marks the start of the stock trade for that target price. The second point would be the limit price, which marks the outside limit for the trade target price. Also, you ought to set a timeframe through which you can execute the trade. After you attain the stop price, the stop-limit order can convert to a limit order.