Trading the Bullish Tri-Star Pattern can be a profitable venture for traders who understand its nuances. This candlestick pattern is a rare but powerful signal in technical analysis, indicating a possible trend reversal from bearish to bullish. By learning how to spot and trade this pattern, traders can enhance their ability to make informed trading decisions across various markets, including the forex, stock, and commodity markets.

What is the Bullish Tri-Star Pattern?

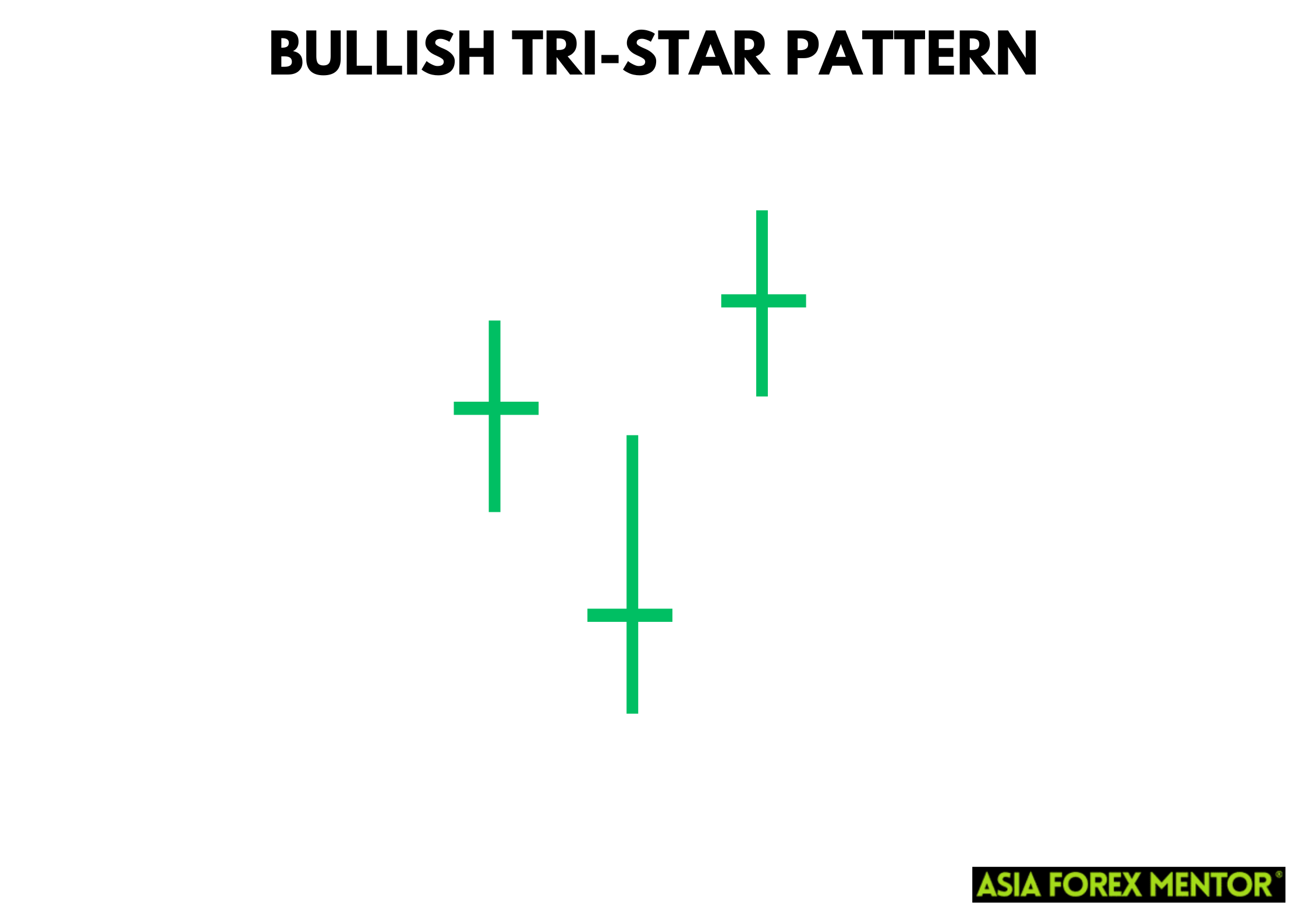

The Bullish Tri-Star Pattern is a bullish reversal pattern that forms after a downtrend, indicating a potential upward price reversal. This pattern is composed of three consecutive doji candlesticks, each representing market indecision.

- First Doji: Appears after a downswing, signaling the start of market indecision.

- Second Doji: Gaps below the first, continuing the indecision.

- Third Doji: Gaps above the second, indicating a shift in market sentiment.

This three-line candlestick pattern signifies that buying pressure is starting to outweigh selling pressure, suggesting a potential bullish reversal.

Detailed Breakdown

- First Doji: This doji forms after a pronounced downtrend, indicating that the sellers are losing momentum. It marks the beginning of a potential reversal but doesn't confirm it on its own.

- Second Doji: The second doji gaps down, creating a doji star. This gap shows that there is still uncertainty in the market. The distance between the first and second doji adds to the pattern's significance.

- Third Doji: The third doji gaps up from the second, forming the final part of the pattern. This gap signifies that buyers are starting to enter the market, showing a potential end to the bearish trend and a shift towards bullish sentiment.

The presence of these three consecutive dojis indicates a strong market indecision followed by a potential trend reversal, making the Bullish Tri-Star Pattern a crucial indicator for traders looking to capitalize on trend reversals. This pattern is often used in conjunction with other technical indicators to confirm the potential reversal and make more informed trading decisions.

Also Read: The 28 Forex Patterns Complete Guide

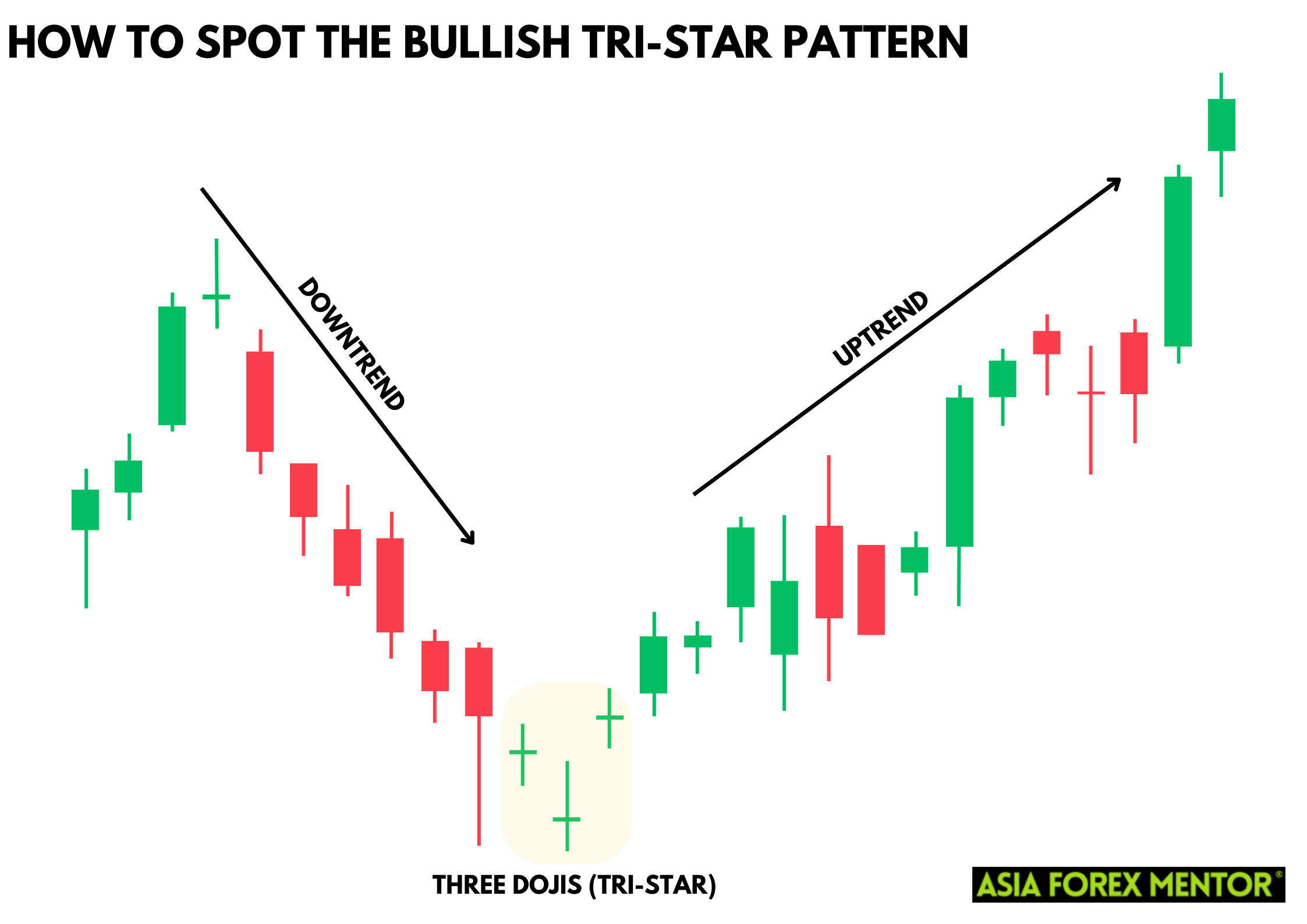

How to Spot the Bullish Tri-Star Pattern

Identifying the Bullish Tri-Star Pattern involves recognizing three consecutive doji candlesticks within a downtrend. Here's a step-by-step approach:

- Current Trend: Ensure the pattern appears in a downtrend. This context is crucial as the Bullish Tri-Star Pattern is a reversal signal, indicating a shift from a bearish trend to a bullish one.

- Three Consecutive Doji Candlesticks: Look for three consecutive doji candles, which represent market indecision. These doji candlesticks should appear consecutively, each one indicating that neither buyers nor sellers are in control.

- Gaps: Check for gaps between the doji candlesticks. Specifically, the second doji should gap below the first, and the third doji should gap above the second. These gaps, known as doji gaps, highlight the significant indecision and potential for reversal.

- Doji Characteristics: Each doji should have small or non-existent real bodies with long shadows. This indicates that the opening and closing prices are very close to each other, reflecting market indecision. The long shadows suggest volatility, with prices moving significantly during the period but settling near the opening price.

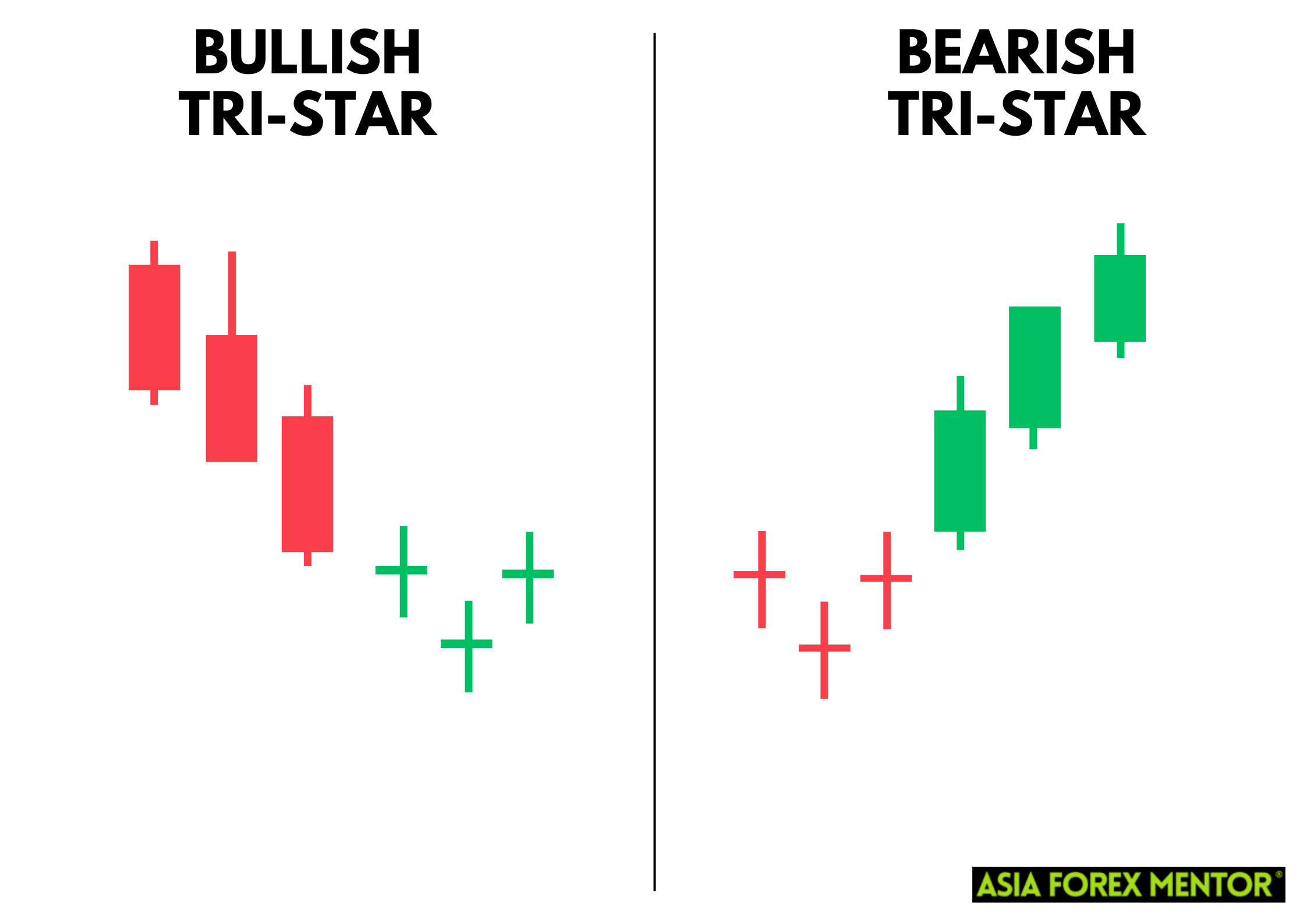

Bullish vs. Bearish Tri-Star Pattern

Bullish Tri-Star Pattern

The Bullish Tri-Star Pattern is a rare but powerful reversal signal that appears after a downtrend, indicating a potential shift from bearish to bullish sentiment. This pattern consists of three consecutive doji candlesticks, each representing market indecision. The first doji appears after a downtrend, the second doji gaps below the first, and the third doji gaps above the second. This formation signifies that the selling pressure is decreasing and buying interest is increasing, suggesting a possible upward price reversal.

To effectively trade the Bullish Tri-Star Pattern, traders should wait for the third doji to close and confirm the pattern before entering a long position. Additional confirmation from other technical indicators, such as moving averages, RSI, MACD, and volume, can increase the reliability of this pattern.

Bearish Tri-Star Pattern

In contrast, the Bearish Tri-Star Pattern signals a potential reversal from a bullish to a bearish trend. This pattern also consists of three consecutive doji candlesticks but appears at the top of an uptrend. The first doji follows an uptrend, the second doji gaps up from the first, and the third doji gaps down from the second. This formation indicates that the buying pressure is weakening, and selling interest is starting to dominate, suggesting a potential downward price reversal.

Trading the Bearish Tri-Star Pattern involves entering a short position after the third doji closes, confirming the pattern. Like the bullish version, additional confirmation from other technical analysis tools can improve the pattern's reliability. Traders often use trend lines, support and resistance levels, and other indicators to validate the signal and make informed decisions.

Key Differences

- Market Trend: The Bullish Tri-Star Pattern appears at the end of a downtrend, signaling a potential upward reversal, while the Bearish Tri-Star Pattern appears at the end of an uptrend, indicating a potential downward reversal.

- Doji Gaps: In the bullish pattern, the second doji gaps down, and the third doji gaps up. In the bearish pattern, the second doji gaps up, and the third doji gaps down.

- Sentiment Shift: The bullish pattern indicates a shift from bearish to bullish sentiment, whereas the bearish pattern signifies a shift from bullish to bearish sentiment.

Both patterns are valuable tools for traders looking to identify potential trend reversals. However, due to their rarity and the potential for false signals, they should be used in conjunction with other technical indicators and within the context of broader market conditions to maximize their effectiveness.

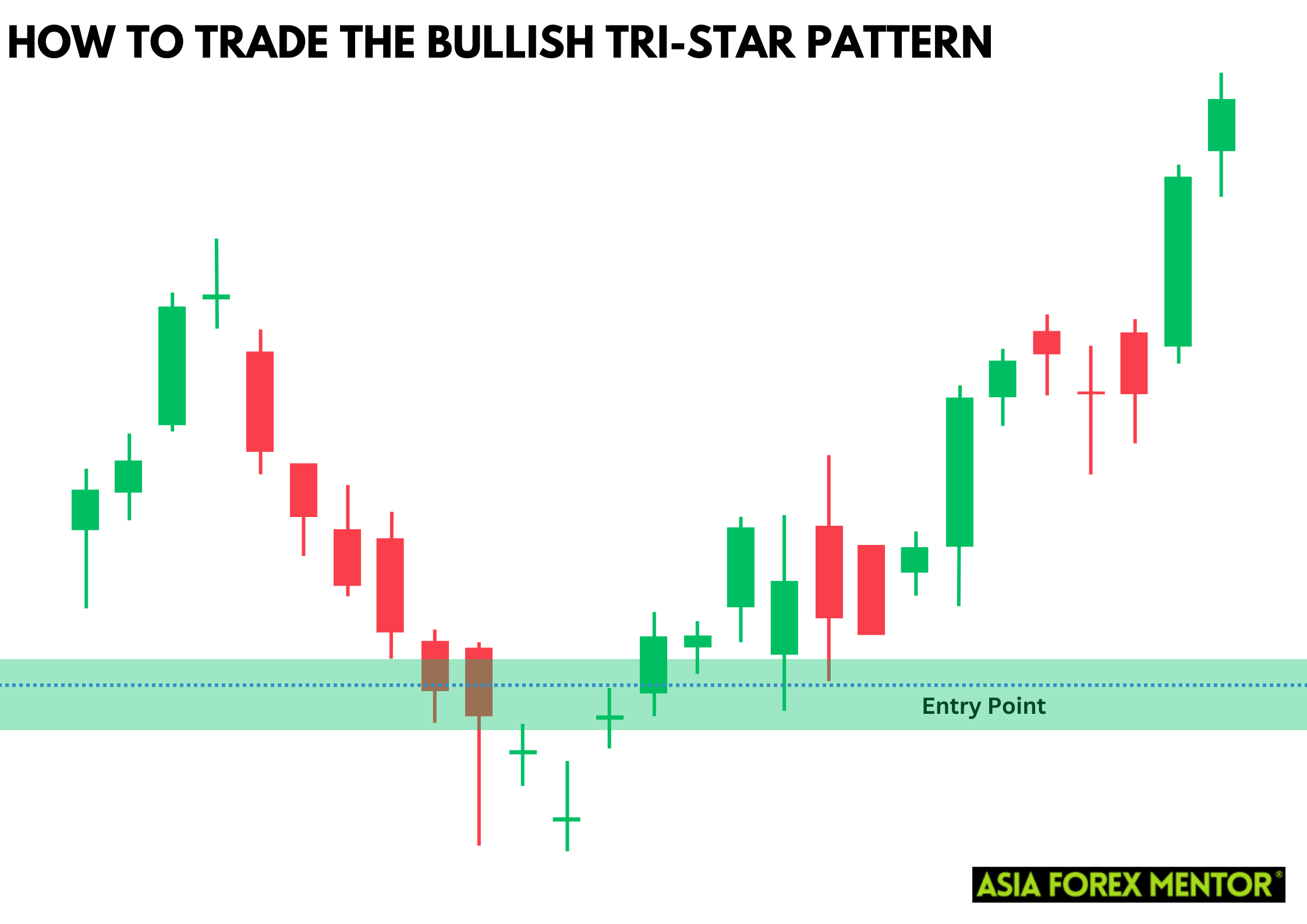

How to Trade the Bullish Tri-Star Pattern

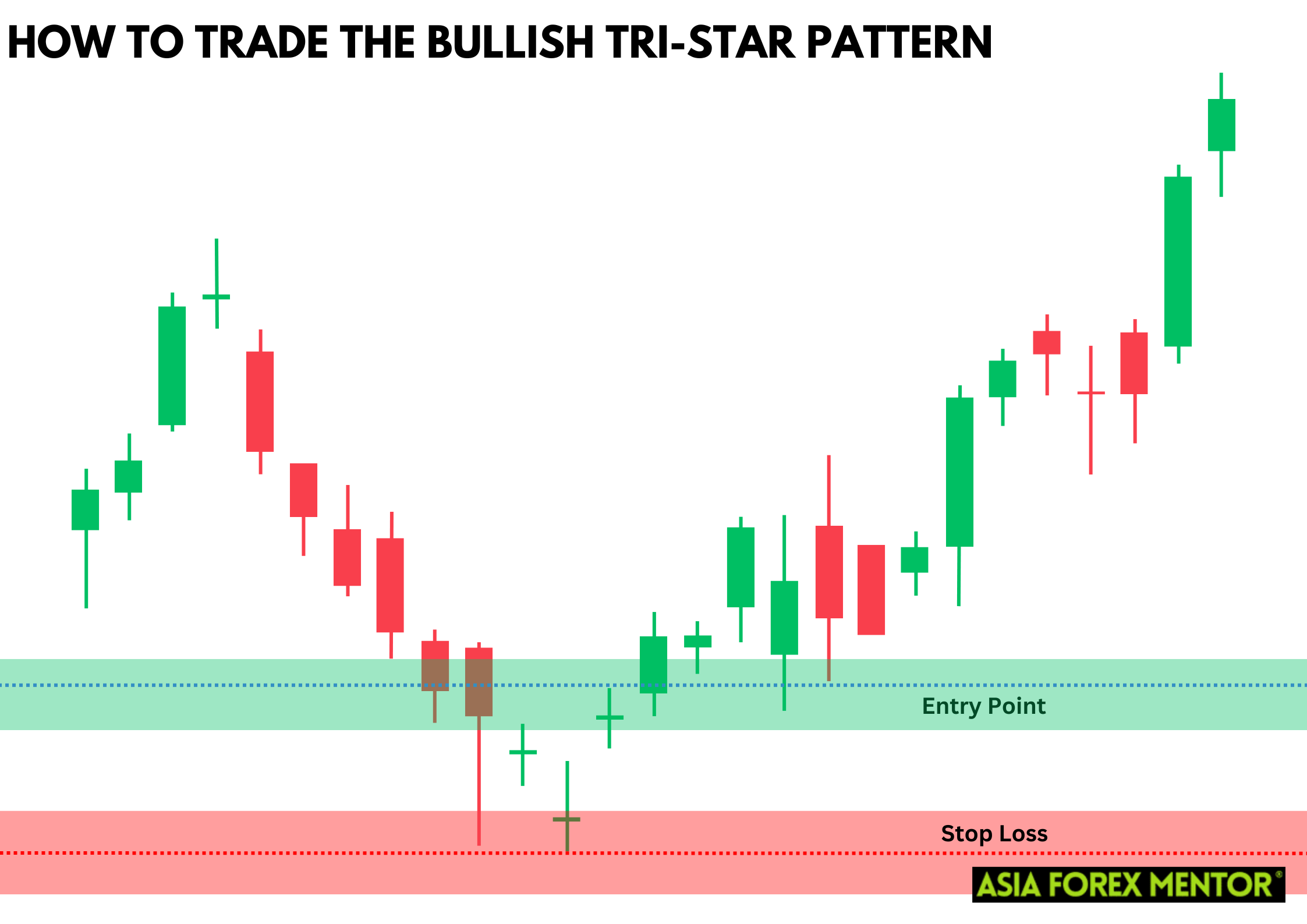

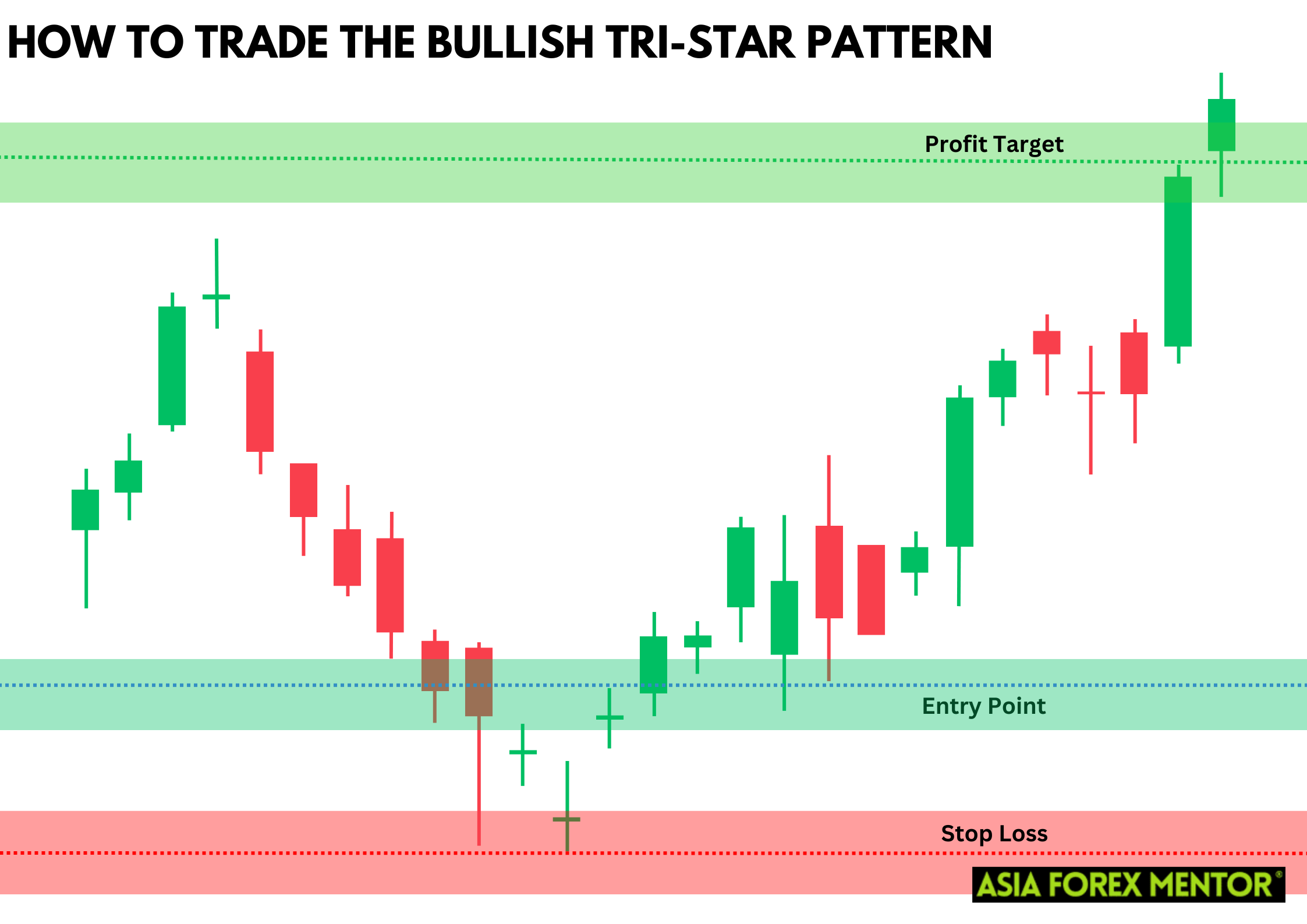

Entry Point

The ideal entry point for trading the Bullish Tri-Star Pattern occurs after the third doji closes, confirming the pattern. Traders can enter a long position when the price breaks above the high of the third doji. This break signifies that buying pressure is increasing and the market sentiment is shifting towards bullishness.

Once the third doji closes, confirming the pattern, wait for the price to break above the high of the third doji before entering a long position. This confirmation reduces the risk of entering on a false signal.

Stop Loss

To manage risk and protect against false signals, set a stop-loss order below the lowest point of the three doji candlesticks. This level acts as a safety net, ensuring that if the price moves against the trade, losses are minimized.

Place the stop-loss order just below the lowest point of the three doji candlesticks. This level is critical because if the price falls below this point, it indicates that the bullish reversal has failed, and the downtrend may continue.

Profit Target

Aim for a risk-reward ratio of at least 1:2 when setting a profit target. This means that the potential reward should be at least twice the amount risked. Set the profit target at a level where previous resistance exists or based on other technical indicators suggesting a strong bullish move. This approach helps in maximizing gains while maintaining a disciplined trading strategy.

Determine your profit target based on key resistance levels or other technical indicators. For example, if the price has previously encountered resistance at a specific level, this could be a logical target for taking profits. Additionally, using indicators such as moving averages or Fibonacci retracement levels can help in identifying potential profit targets.

Pros and Cons of the Bullish Tri-Star Pattern

Pros

- Indicates a significant shift from bearish to bullish sentiment

- Provides clear guidelines for entry, stop-loss, and profit targets

- Effective in various markets, including forex, stocks, and commodities

Cons

- The pattern is rare, reducing the frequency of trading opportunities

- Like all technical patterns, it can produce false signals, especially in volatile markets

Indicators to Use to Confirm the Pattern

To enhance the reliability of the Bullish Tri-Star Pattern, traders should use other technical indicators for confirmation:

Moving Averages

A bullish crossover in moving averages, such as the 50-day moving average crossing above the 200-day moving average, can confirm the Bullish Tri-Star Pattern. This crossover indicates that the short-term price trend is gaining strength relative to the long-term trend, reinforcing the likelihood of a reversal.

Relative Strength Index (RSI)

When the RSI rises from the oversold region (below 30) towards higher values, it signals increasing buying pressure. This movement supports the Bullish Tri-Star Pattern by indicating that the bearish momentum is waning and bullish sentiment is strengthening.

MACD

A bullish crossover on the MACD (Moving Average Convergence Divergence) line, where the MACD line crosses above the signal line, provides additional confirmation. This crossover suggests a shift in momentum from bearish to bullish, aligning with the reversal indicated by the Bullish Tri-Star Pattern.

Volume

High trading volume during the formation of the Bullish Tri-Star Pattern suggests a stronger potential reversal. Increased volume indicates significant market interest and participation, lending credibility to the pattern and the likelihood of a sustained bullish reversal.

Common Mistakes When Trading the Bullish Tri-Star Pattern

Ignoring Market Context

One common mistake traders make is ignoring the broader market context. The Bullish Tri-Star Pattern is most effective when it appears in a well-established downtrend. Failing to consider the overall market trend can lead to false signals and unsuccessful trades.

Overlooking Volume Confirmation

Volume is a critical factor in confirming the strength of the Bullish Tri-Star Pattern. Traders often overlook the importance of high trading volume during the pattern's formation, which can validate the potential reversal. Low volume may suggest a weak or unreliable signal.

Neglecting Stop-Loss Strategies

Proper risk management is essential, and neglecting to set a stop-loss order below the lowest point of the three doji candlesticks can result in significant losses. A disciplined stop-loss strategy helps protect against unexpected market movements.

Misinterpreting Doji Candles

Accurately identifying doji candles is crucial. Traders sometimes mistake other candlestick types for dojis, leading to incorrect pattern identification. Ensuring that the doji candles have small or non-existent real bodies with long shadows is vital for correct interpretation.

Relying Solely on the Pattern

Relying exclusively on the Bullish Tri-Star Pattern without using additional technical indicators for confirmation can be risky. Combining the pattern with indicators such as moving averages, RSI, MACD, and volume helps validate the signal and increase the likelihood of a successful trade.

Conclusion

The Bullish Tri-Star Pattern is a potent tool in technical analysis for identifying potential trend reversals. By understanding how to spot and trade this pattern, and using additional technical indicators for confirmation, traders can make more informed and potentially profitable trading decisions. However, due to its rarity, it's essential to remain patient and wait for clear signals before executing trades.

Also Read: How to Trade the Bullish Belt Hold Pattern

FAQs

How reliable is the Bullish Tri-Star Pattern?

While the pattern is considered a strong reversal signal, it is rare and should be confirmed with other technical indicators to improve reliability.

Can the Bullish Tri-Star Pattern be used in all markets?

Yes, the pattern is applicable across various markets, including forex, stocks, and commodities. However, market-specific factors should always be considered.

What are the key risks associated with trading this pattern?

The main risks include false signals and market conditions not reversing as expected. Using proper risk management strategies, such as stop-loss orders and position sizing, is crucial.