Candlestick patterns are a crucial part of technical analysis, providing traders with visual cues about market sentiment and potential price reversals. Among the myriad of these patterns, the bullish harami stands out as a potent indicator of a possible shift in market momentum.

In this article, we delve into the nature, recognition, and interpretation of the bullish harami candlestick pattern. Furthermore, we’ll explore its variations, implications for forex trading, and the importance of its use alongside other technical indicators for a comprehensive trading strategy. The knowledge gained here is aimed at enabling both novice and experienced traders to understand and use the bullish harami pattern as an effective part of their trading toolkit.

What is a Bullish Harami Pattern?

The bullish harami pattern is a significant pattern in the realm of forex trading and technical analysis. It’s a two-candlestick pattern that signifies a potential trend reversal from a previous bearish trend to a new bullish trend. Traders closely monitor this pattern as it can provide a buy signal, suggesting a good time to open a long position.

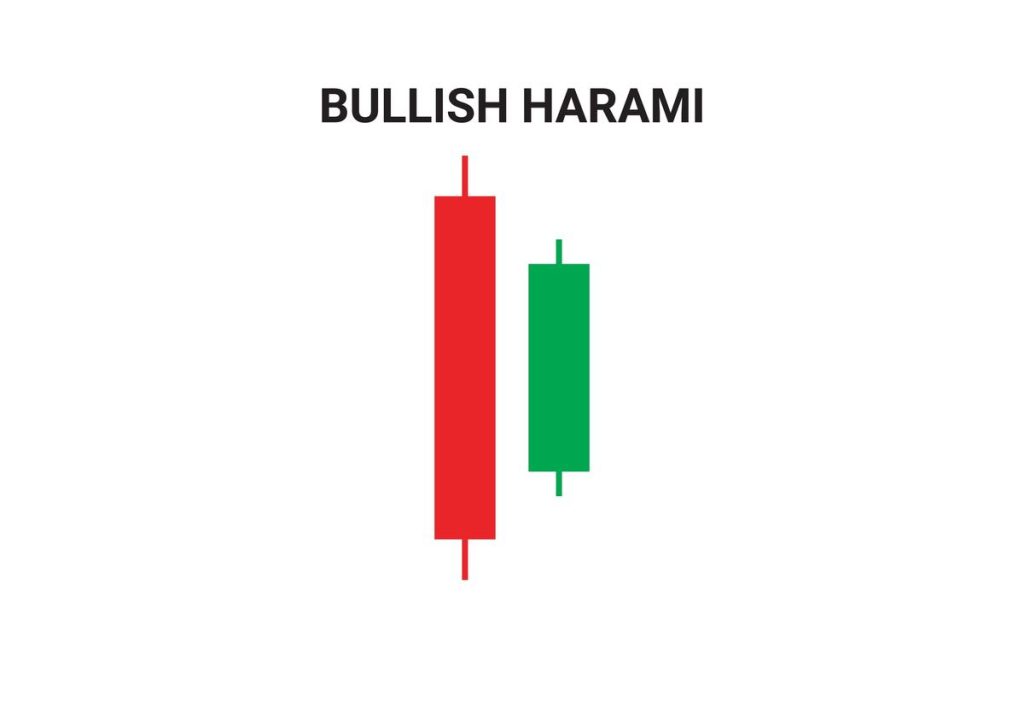

The name “harami” comes from an old Japanese word for “pregnant“. The metaphor is visually descriptive: the first candle in the pattern is a large bearish candle, followed by a smaller bullish candle. The small bullish candle is “encased” within the body of the prior candle, akin to a baby in a mother’s womb. The formation of this pattern is where the bullish harami candle pattern gets its intriguing name.

Components of a Bullish Harami Pattern

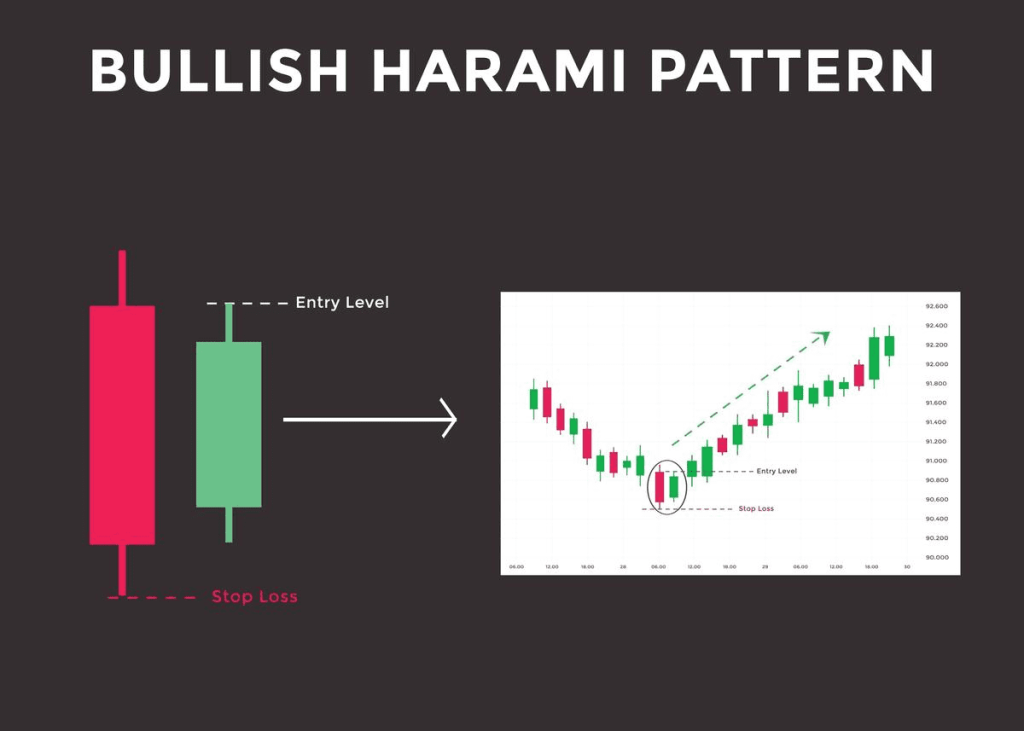

A bullish harami consists of two main components. The first candlestick is a long bearish candle that occurs at the end of a downtrend. This candle represents strong negative market sentiment and is often a continuation of the previous trend.

The second candle, however, paints a different picture. This is a smaller bullish candle, which opens higher than the previous day’s close and closes lower than the previous day’s open. The second bullish candle is completely engulfed within the body of the first candle.

In a typical bullish harami setup, the first candle has a large real body representing a strong down-move or sell-off. The second candle is a small candlestick, signifying reduced selling pressure. It could be a white candle, a small green candle, or a doji candle (a candle with nearly the same opening and closing prices, indicating indecision in the market).

Recognizing a Bullish Harami Candlestick Pattern on a Stock Chart

Identifying a bullish harami on a stock chart is straightforward. You’re looking for a long bearish candlestick followed by a smaller bullish candle, completely contained within the body of the first candle. Remember, this two-candlestick pattern appears after a downtrend.

Seeing this pattern occur frequently is not uncommon in the financial markets. However, you should always corroborate its appearance with other technical indicators before making a trading decision.

Understanding the Market Sentiment Behind the Bullish Harami Pattern

When a bullish harami appears at the end of a downtrend, it hints at a shift in market sentiment. The long bearish candle of the first day shows that sellers are in control, pushing the stock price lower. However, the appearance of a small bullish candle on the following day suggests that selling pressure is weakening, and buyers are starting to step in.

The bullish harami pattern, therefore, signals that the bears’ dominance is waning and a bullish reversal could be on the cards. It indicates a potential change in the price trend from bearish to bullish, reflecting a change in trader sentiment.

Trading the Bullish Harami Pattern

When you identify a bullish harami pattern on your trading chart, it’s essential to understand that it’s not an immediate call to action. A bullish harami is a bullish signal, but it’s only a preliminary indication of a potential reversal.

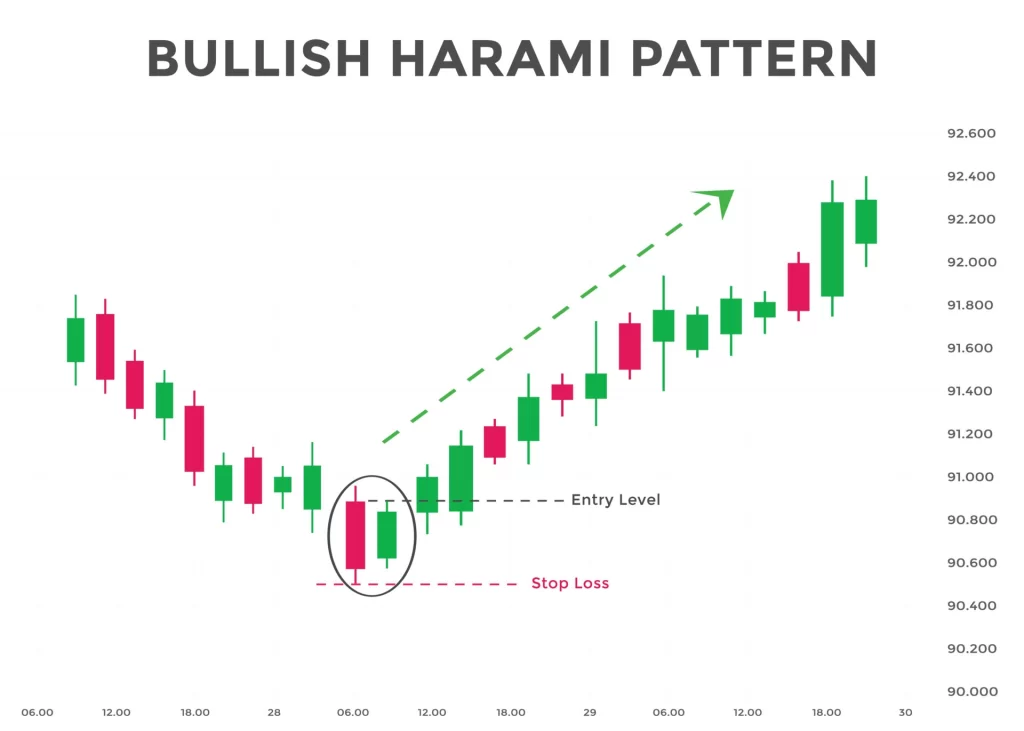

To trade a bullish harami, you should look for confirmation from the price chart and other indicators. One common method is to wait until the price breaks above the high of the harami’s second candle. When the stock price moves above this level, it may be a good time to initiate a long position.

Another trading strategy could be to look for a bullish harami near a significant support level. The combination of a bullish harami pattern and a strong support level can enhance the reliability of the potential bullish reversal.

You might also consider using other technical indicators for further confirmation. These could include trend lines, moving averages, oscillators, or volume indicators.

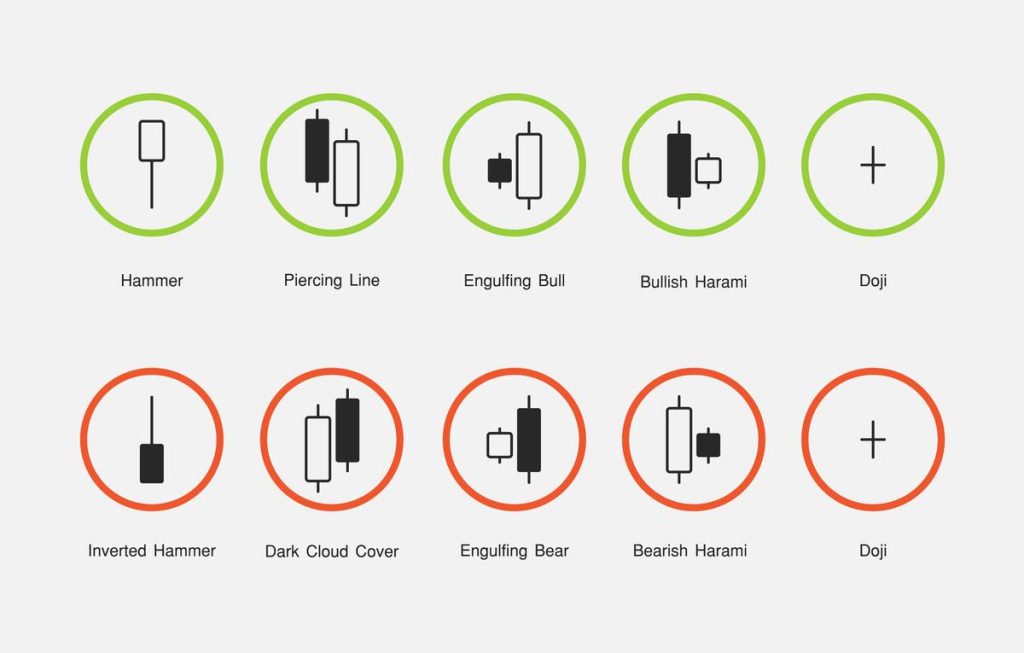

Understanding the Bearish Harami Pattern

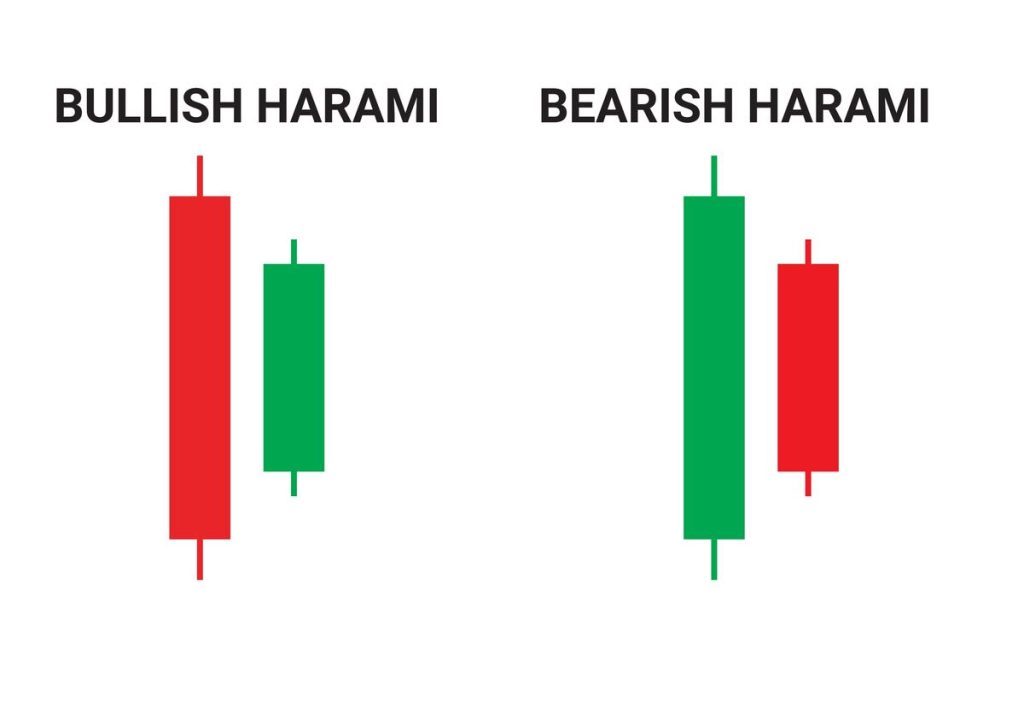

While this article focuses on the bullish harami candlestick pattern, it’s worth mentioning its counterpart, the bearish harami pattern. This pattern is the exact opposite of the bullish harami. Instead of indicating a bullish reversal after a downtrend, a bearish harami indicates a bearish reversal after an uptrend.

The bearish harami consists of a large bullish candle followed by a small bearish candle, with the second candle being within the real body of the prior candle. The appearance of this pattern hints at a weakening of the bullish sentiment and the possibility of a downward trend. Just like with the bullish harami, traders should always use other technical indicators for confirmation before deciding to trade based on this pattern.

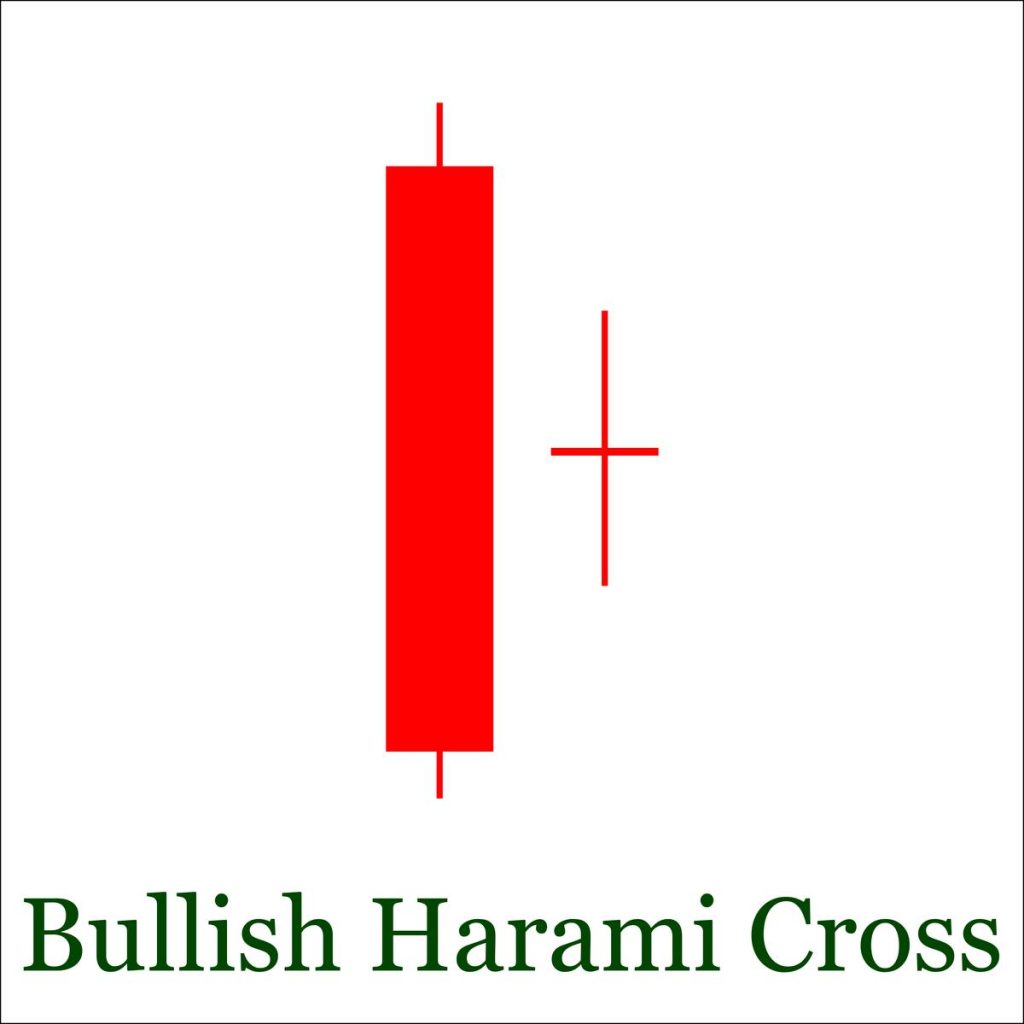

Variations of the Bullish Harami Pattern: The Bullish Harami Cross

A variation of the bullish harami pattern is the bullish harami cross. This pattern occurs when the second candle is a doji instead of a regular bullish candle. The presence of the doji indicates indecision in the market, which can make the potential trend reversal even more significant.

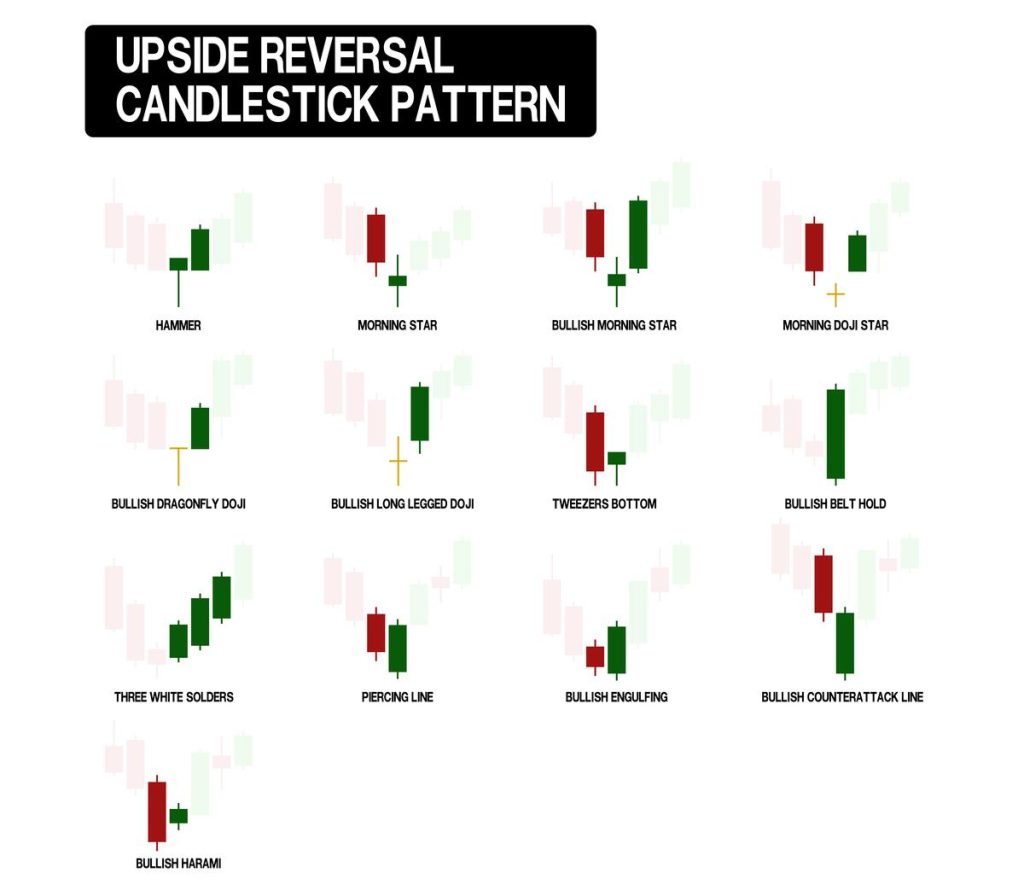

The Importance of Candlestick Patterns

While we’ve concentrated on the bullish harami candlestick pattern, it’s just one of many candlestick patterns used in forex trading and technical analysis. These patterns are the language of the market. They provide a visual representation of market sentiment and offer clues about potential price reversals and continuation patterns.

In essence, candlestick chart patterns are a way of understanding the ongoing battle between buyers and sellers. Some patterns suggest that buyers are in control (bullish patterns), while others suggest sellers are in control (bearish patterns). There are also neutral patterns, indicating a balanced market with no clear winner.

Using candlestick patterns for trading decisions is not new. The first documented use of candlestick patterns can be traced back to 18th century Japan when rice merchants used them to trade rice contracts. Today, these patterns are applied to all financial markets, including forex, stocks, commodities, and indices.

Other Notable Candlestick Patterns

While the bullish harami is a valuable pattern to understand, there are other candlestick patterns also worth learning. These include the bullish engulfing pattern, bearish harami, bearish engulfing, piercing line, and hammer, to name just a few.

Like the bullish harami, each of these patterns provides unique insights into market dynamics and potential future price action. However, similar to the bullish harami, these patterns should not be used in isolation. Instead, they should form part of a broader trading strategy that incorporates other indicators and risk management techniques.

Using Bullish Harami with Other Technical Indicators

The bullish harami pattern can be used more effectively when combined with other technical indicators. These additional tools can help confirm the pattern and increase the probability of a successful trade. For example, a moving average can help identify the overall trend, while the Relative Strength Index (RSI) can provide information about market overbought or oversold conditions.

Another crucial concept is support and resistance levels. These are price levels at which the price trend has historically reversed. A bullish harami pattern that appears near a support level might carry more weight than one that appears at random.

False Signals and Risk Management

Although the bullish harami pattern is a powerful tool in technical analysis, it’s important to remember that no pattern is 100% reliable. False signals can and do occur. Therefore, risk management is an essential part of any trading strategy.

One practical risk management technique is to set a stop loss. A stop loss is a predetermined price at which you will close your trade if the market moves against you. It helps limit potential losses.

Similarly, a profit target is a price at which you plan to close your trade when the market moves in your favor. It helps ensure that you exit your trade at a profitable point before the market can reverse and erase your gains.

Conclusion

The bullish harami candlestick pattern is a versatile and insightful tool that can enrich any trader’s technical analysis toolkit. Its ability to signal potential bullish reversals makes it a favored pattern among forex traders. However, it should not be used in isolation. Instead, it should be part of a comprehensive trading strategy that includes other technical indicators, sound risk management, and a deep understanding of the financial markets.

By understanding the bullish harami and other candlestick patterns, traders can gain a deeper understanding of market sentiment, which can aid in making informed trading decisions. However, like all trading strategies, using candlestick patterns requires practice, patience, and an ongoing commitment to learning and improving.

Also Read: How To Read Candlesticks Like A Pro

FAQs

Why is it important to wait for confirmation after identifying a bullish harami pattern?

While the bullish harami pattern indicates a potential bullish reversal, it’s not a definitive buy signal. False signals can occur, and the pattern itself might not lead to a reversal if the broader market conditions aren’t supportive. Hence, waiting for confirmation, such as a price break above the high of the harami’s second candle, or corroboration from other technical indicators, helps verify the reversal and increase the probability of a successful trade.

How can I distinguish between a bullish harami and a bullish harami cross?

The difference between a bullish harami and a bullish harami cross lies in the second candle of the pattern. In a bullish harami, the second candle is a small bullish candle that is completely contained within the first, large bearish candle. On the other hand, in a bullish harami cross, the second candle is a doji—a candlestick with nearly the same opening and closing prices—instead of a regular bullish candle. The doji symbolizes market indecision, which can make the potential trend reversal more significant.

Can I use the bullish harami pattern in all market conditions?

The bullish harami pattern can occur in any market; however, it’s most significant when it appears after a clear downtrend. The pattern signals a potential reversal from bearish to bullish market conditions. If it forms during an uptrend or within a range-bound market, its predictive power may be less reliable. Always consider the overall market trend when interpreting this pattern. Also, remember to use other technical indicators to confirm the potential reversal signaled by a bullish harami.