Bullionvault review

BullionVault is a widely-used trading platform that allows users to buy, sell, and store physical gold, silver, and platinum. It offers professional market prices and provides secure storage in global vaults. The platform is designed for both new and experienced investors looking to diversify into precious metals.

BullionVault stands out for its low-cost structure, featuring competitive fees for trading and storage. Users can trade metals 24/7, with access to real-time market data for transparent pricing. Additionally, all assets are fully insured, ensuring security for investors.

In terms of security, BullionVault uses advanced encryption and follows strict regulatory guidelines to protect customer investments. Regulated by the UK’s Financial Conduct Authority (FCA), it guarantees high compliance with financial standards. This makes BullionVault a reliable and cost-effective choice for precious metal investments.

What is Bullionvault?

BullionVault is an online platform for purchasing physical gold, selling, and storing gold, silver, and platinum. It offers secure storage in insured bullionvault safe across global financial centers, providing professional pricing. The platform also provides private investors and is suitable for both beginner and experienced investors looking to diversify into precious metals.

Known for its low-cost structure, BullionVault provides competitive fees for trading gold bullion and storing metals. The platform operates 24/7, giving users access to real-time market prices for full transaction transparency. This makes it a flexible option for managing investments at any time.

BullionVault is regulated by the UK’s Financial Conduct Authority (FCA), which adheres to strict financial standards. It also employs advanced encryption to safeguard user data and assets, offering a secure and reliable solution for precious metal investments.

BullionVault Regulation and Safety

BullionVault is regulated by the UK’s Financial Conduct Authority (FCA), ensuring it meets strict financial standards. This regulation provides users with transparency and trust in the platform’s operations. By adhering to these guidelines, BullionVault offers a secure and reliable environment for bullion dealers.

To ensure safety, BullionVault uses advanced encryption to protect customer data and transactions. All assets stored in its bullionvault website are fully insured, offering an additional layer of protection for investors. This ensures that users’ precious metal holdings are safeguarded against theft or loss.

BullionVault also performs daily audits to verify the accuracy and security of users’ assets. These audits enhance transparency, allowing users to track their holdings at any time. Together, these measures guarantee the safety and integrity of investments on the platform.

Bullionvault Pros and Cons

Pros:

- Low fees

- Insured storage

- 24/7 trading

- FCA regulated

Cons:

- No demo account

- Minimum investment required

- Limited asset types

- Withdrawal fees

Benefits of Trading with Bullionvault

BullionVault offers a range of advantages for bullion dealer in selling precious metals like gold, silver, and platinum. It provides access to the largest online bullion market, with low fees for buying and selling, and allows bullion trading in any amount with professional market pricing.

A key benefit is the secure storage in allocated vaults located globally, ensuring assets are fully insured and available for next-day withdrawals. Additionally, daily audits ensure transparency and accuracy in storing precious metals.

The platform operates 24/7, enabling users to trade anytime. Investors can set their own prices and trade in various currencies, offering flexibility. These features make BullionVault a secure and flexible platform for precious metal investments.

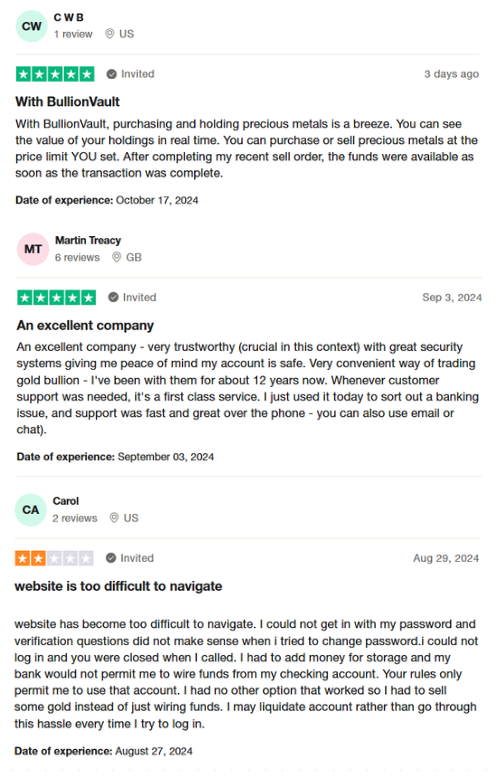

BullionVault Customer Reviews

Customer reviews for BullionVault reflect both positive and negative experiences. Many users praise the platform for its ease of use in managing precious metals, including real-time visibility of holdings and fast access to funds after sales. Long-term customers appreciate its security and trustworthiness, with some relying on it for over a decade.

Several users commend the responsive customer support, noting that assistance is easily accessible via phone, email, or chat. The platform’s secure storage and transparent processes add to its credibility, providing peace of mind to investors.

However, some users report difficulties navigating the website, with one reviewer mentioning issues related to login and verification, as well as challenges wiring funds. These usability concerns suggest that while BullionVault excels in support and security, improvements to the site’s interface are needed.

BullionVault Spreads, Fees, and Commissions

BullionVault provides competitive spreads on precious metals such as gold and silver, closely matching professional bullion market prices. The spread reflects the difference between buy and sell prices, offering bullionvault clients the cost-effective rates for gold, silver, and platinum transactions. This ensures efficient trading with minimal price gaps.

Regarding fees, BullionVault charges a commission that decreases with larger trade volumes, starting at 0.5% and dropping to 0.05% for higher amounts. There is also a daily storage fee for holding metals, with the cost depending on the type and quantity of metal stored.

The platform’s storage fees are low, starting from 0.12% per year for gold, covering insurance and secure storage. With its low spreads, scaled commissions, and affordable storage, BullionVault is a cost-efficient choice for precious metal investors.

Account Types

Standard Account

The BullionVault Standard Account is designed for individual investors who want to buy, sell, and store precious metals like gold, silver, and platinum. It provides full access to the platform’s trading features, including real-time market prices and 24/7 trading. This account offers competitive spreads and fees, along with secure, insured storage in vaults across multiple global locations.

Joint Account

A Joint Account with BullionVault allows two or more individuals to share ownership of the account and its assets. It offers the same features as the Standard Account, including access to professional market prices, competitive trading fees, and insured vault storage. This account type is ideal for family members or business partners looking to invest together.

Company Account

The Company Account is tailored for businesses that want to trade and hold precious metals through BullionVault. It includes all the features of the Standard Account, such as 24/7 trading, secure storage, and access to market prices, but with the ability to manage the account under a company’s name. This account type is best suited for corporate entities looking to diversify their investments into precious metals.

Self-Invested Personal Pension (SIPP) Account

BullionVault offers a SIPP Account for UK-based customers who want to include precious metals in their retirement portfolios. This account allows individuals to hold gold as part of their SIPP, benefiting from tax advantages under UK pension rules. It provides the same secure, insured storage and low trading fees as other accounts, with the added benefit of retirement savings integration.

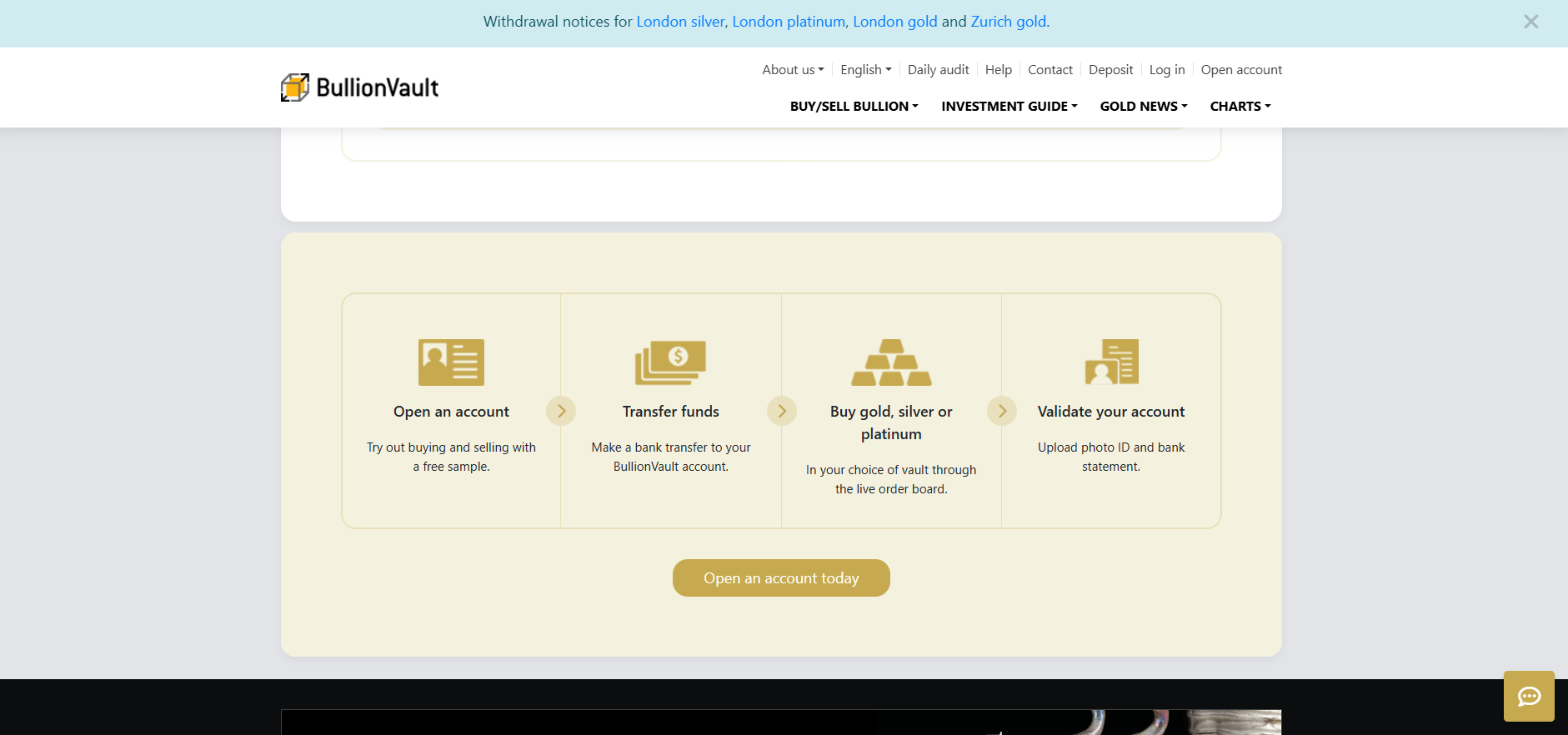

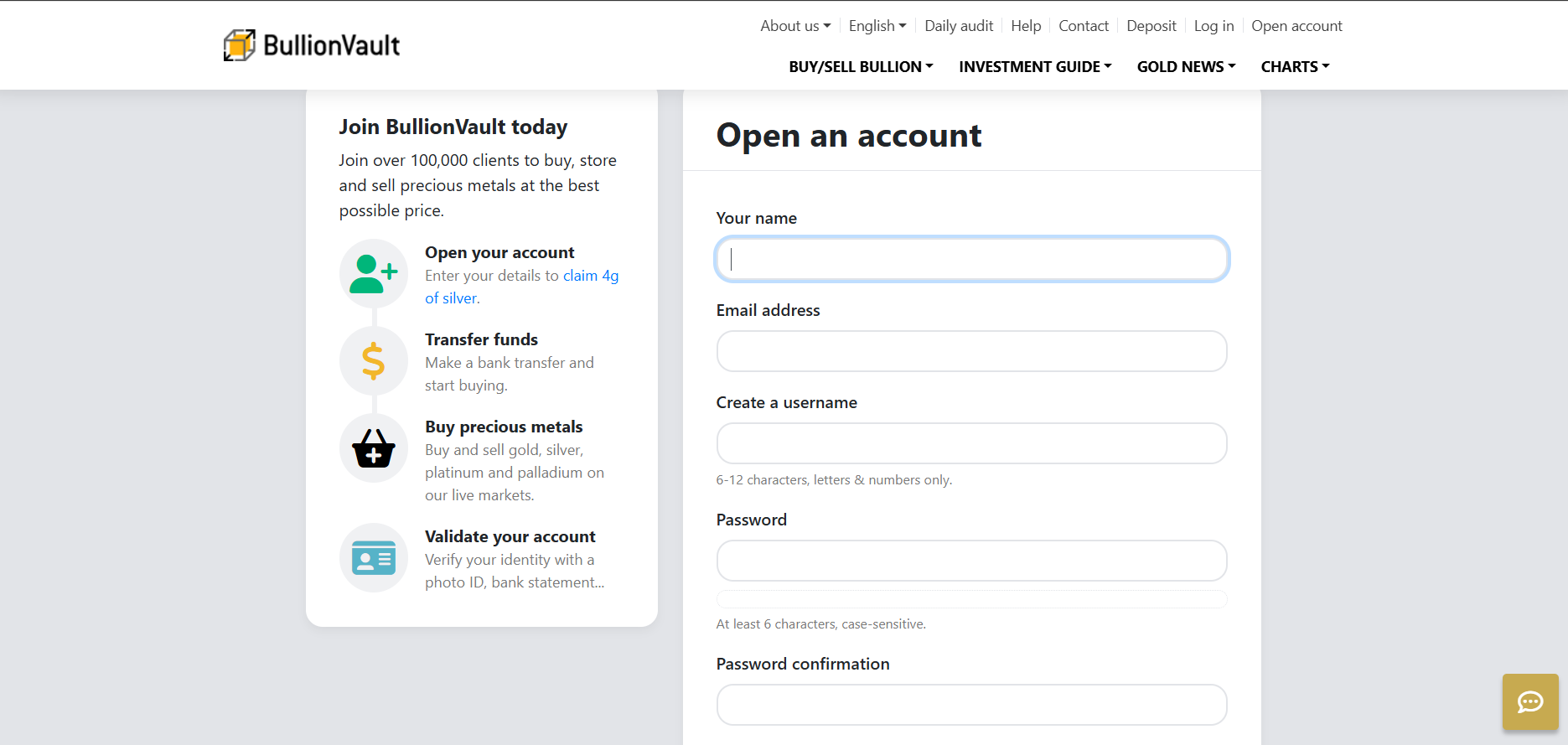

How to Open Your Account

To open a BullionVault account, start by visiting the BullionVault website and clicking on the “Open Account” option. You will need to provide your email address, create a username, and set a password. Once the form is submitted, you will receive a confirmation email to verify your account.

After account verification through email, log into the platform and link your bank account to facilitate bank transfers such as deposits and withdrawals. BullionVault will guide you through entering your bank details and ensuring that your account is ready for transactions. Once linked, you can deposit funds and start buying and selling metals.

You can then begin exploring the platform by navigating to the trading section to view live prices for gold, silver, and platinum. You can execute trades as soon as your funds are available. The process is designed to be straightforward, ensuring you can quickly start managing your investments on BullionVault.

BullionVault Trading Platforms

BullionVault provides a simple trading platform accessible through both its website and mobile app. Users can view live prices for gold, silver, and platinum and execute trades in real-time. The platform supports market orders and allows users to set price limits for their trades.

In the trading section, users can view price charts, open orders, and past trades, ensuring a smooth trading experience. The intuitive design helps users easily execute trades and manage portfolios, even if they are new to the platform. Additionally, investors can track price movements and access detailed trading data.

For on-the-go access, BullionVault’s mobile app offers the same functionality as the desktop platform. Users can manage trades, monitor prices, and handle their accounts from anywhere, ensuring they stay connected to the market at all times.

What Can You Trade on Bullionvault

On BullionVault, users can trade physical precious metals such as gold, silver, platinum, and palladium. Investors can buy and sell these metals at professional market prices through the platform’s live trading interface. The metals are held in secure, allocated vaults located in cities like London, Zurich, and New York.

To get started, users can select the type of metal they wish to trade, choose the amount, and then execute the trade based on real-time pricing. The platform allows users to purchase as little as one gram of gold or silver, making it accessible to a range of investors. BullionVault provides flexibility by enabling trades in multiple currencies, including USD, GBP, EUR, and JPY.

Once purchased, the metals are stored securely in one of BullionVault’s global vaults, with storage and insurance fees applied. Users can monitor their holdings in real-time and are free to sell whenever they choose. This process offers investors a transparent and secure way to manage their precious metal portfolios.

Bullionvault Customer Support

BullionVault provides multi-channel customer support, ensuring users can get help when needed. Customers can reach the support team through phone, email, and live chat, all of which are available during regular business hours. This ensures that users have multiple options for resolving any issues or getting answers to their queries.

For immediate assistance, users can use the live chat feature directly on the website, which provides real-time help with trading, account management, or technical difficulties. Email support is also available for more detailed inquiries, with response times typically being quick. BullionVault’s support team is knowledgeable and responsive, helping to resolve most issues efficiently.

Additionally, the platform offers a comprehensive FAQ section on its website, covering a wide range of common questions about trading, storage, and account management. This allows users to find solutions to basic problems without needing to contact customer service directly. Overall, BullionVault’s support system ensures a smooth user experience for both new and experienced investors.

Advantages and Disadvantages of Investous Customer Support

Withdrawal Options and Fees

BullionVault offers several withdrawal options for users to access their funds. Customers can withdraw money directly to their registered bank account, and this process typically takes 1-2 business days. Withdrawals are only allowed to the bank account previously linked during account verification to ensure security.

The platform charges a small withdrawal fee, depending on the user’s location and the currency being withdrawn. For example, withdrawals in USD, GBP, and EUR are often free, while international transfers may incur additional charges. It’s essential to check the fee schedule on BullionVault’s website for specific amounts.

To initiate a withdrawal, users need to log into their BullionVault account, go to the “Withdrawal” section, and follow the steps to select the bank account and currency. Once confirmed, the platform processes the transaction, and the funds are transferred accordingly. BullionVault ensures a secure and transparent withdrawal process, providing users peace of mind when accessing their money.

BullionVault Vs Other Brokers

#1. Bullionvault vs Avatrade

BullionVault and AvaTrade serve different types of investors with their unique offerings. BullionVault focuses on precious metals trading, allowing users to buy, sell, and store physical gold, silver, and platinum. It’s ideal for long-term investors who want to diversify into tangible assets and benefit from secure, insured vault storage across global locations. In contrast, AvaTrade specializes in forex and CFD trading, offering a wide range of instruments, including currencies, stocks, commodities, and cryptocurrencies. AvaTrade provides more advanced tools, such as MetaTrader 4 and 5, as well as social and automated trading options, catering to short-term and active traders. AvaTrade also supports a broader range of asset classes compared to BullionVault’s metal-focused services.

Verdict: When it comes to platforms and trading flexibility, BullionVault is optimized for investors who want to buy and hold metals over time, with secure storage being a key feature. AvaTrade, however, is built for traders seeking to engage in frequent, leveraged trades across multiple financial markets. Each platform appeals to different investor profiles based on their trading needs and asset preferences.

#2. Bullionvault vs RoboForex

BullionVault and RoboForex are geared toward different investor types. BullionVault specializes in precious metals trading, allowing users to buy, sell, and store gold, silver, and platinum in secure vaults. It caters to long-term investors focused on physical assets and secure, insured storage. RoboForex, on the other hand, is aimed at active traders, offering a variety of instruments including forex, stocks, commodities, and cryptocurrencies. With platforms like MetaTrader 4 and 5 and high leverage options, RoboForex is designed for short-term, frequent trading. Its range of assets makes it ideal for traders seeking flexibility across multiple markets.

Verdict: While BullionVault emphasizes simplicity and security for metal-focused investing, RoboForex offers a broader, more complex trading environment for those looking for frequent trades across asset classes. Each platform appeals to different investment strategies based on investor goals.

#3. Bullionvault vs Exness

BullionVault and Exness are tailored to different types of traders. BullionVault is focused on precious metals like gold, silver, and platinum, providing secure, insured storage in global vaults. It’s ideal for long-term investors looking for physical ownership of metals. Exness, in contrast, targets forex and CFD traders with access to currencies, stocks, and cryptocurrencies. Exness offers advanced trading platforms like MetaTrader 4 and 5, along with leverage, catering to short-term and frequent trading strategies.

Verdict: Functionally, BullionVault prioritizes simplicity and security for long-term metal investments, while Exness is designed for high-frequency trading across multiple asset classes. Each platform serves different investment strategies, depending on whether traders seek stable, tangible assets or fast-paced market opportunities.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: BullionVault Review

BullionVault is a reliable platform for investors interested in trading and storing precious metals like gold, silver, and platinum. It offers secure, insured vaults in major global locations, making it ideal for long-term investors seeking physical assets. With competitive fees and real-time market pricing, BullionVault caters to both novice and experienced investors.

The platform features low trading commissions and clear storage fees, starting at 0.12% per year for gold. Its simple interface, combined with real-time pricing and daily audits, ensures a secure and transparent trading experience. This makes BullionVault a strong option for investors focused on tangible, long-term metal investments.

While BullionVault is primarily designed for metals investors, it lacks the tools for high-frequency or multi-asset trading. Investors looking for more diversified assets or advanced trading platforms may need to explore other options. Overall, BullionVault stands out as a top choice for secure, cost-effective precious metal trading and storage.

BullionVault Review: FAQs

Is BullionVault regulated?

Yes, BullionVault is regulated by the UK’s Financial Conduct Authority (FCA), ensuring compliance with strict financial standards. This regulation provides transparency and security for users trading and storing precious metals.

What precious metals can I trade on BullionVault?

On BullionVault, you can trade gold, silver, platinum, and palladium. The platform offers live market prices and secure, insured vault storage in locations such as London, Zurich, and New York.

Does BullionVault offer a demo account?

No, BullionVault does not provide a traditional demo account. However, new users receive a small silver bonus (approximately 4 grams) to practice trading and explore the platform before investing real money.

OPEN AN ACCOUNT NOW WITH BULLIONVAULT AND GET YOUR BONUS