There is constant discussion of bear and bull markets. These discussions have taken on even more importance since the COVID-19 pandemic, COVID-19 lockdowns, monkeypox infections, and economic stimulus packages being issued on a regular basis by governments to keep their economies alive and growing.

Also Read: What Is a Bull Call Spread?

Contents

- Stock Market Terms: Bear and Bull Markets?

- What is a bull market?

- What is a bear market?

- Investing in Bear Markets

- Key Takeaways

- FAQs

Stock Market Terms: Bear and Bull Markets?

It is believed that the terms come from the way the two animals fight.

Origin of Term: Bull Market

Bulls attack another animal using their horns. They charge their enemies with their heads down and then thrust their heads up to gore their enemies with their horns. So, when there is growth in the markets, they resemble a bull charging and thrusting its head upwards.

Origin of Term: Bear Market

Bears, on the other hand, use their paws to defend themselves. They swipe downward with their paws. The downward motion of their paws represents the downward movement of the markets when the economy is not doing well and economic performance is in falling.

What is a bull market?

Bull markets exist when there is economic growth, stock prices rise, consumer sentiment is optimistic, consumer spending is high, and market traders have a lot of confidence in the economy. Other aspects of a bearish market include high employment, rising interest rates, strong demand for goods and services, and development and expansion of most sectors of the economy. Bull markets can last for years.

Investing in Bull Markets

Bullish traders anticipate that the future results of their trades will be positive. Most traders prefer bull markets because stock prices rise, and they are more likely to get a good return on their investments. Also, there is a lot of money in the market, expansion of the economy, profits are high, and in general the economic health of the nation is good.

It is generally believed that it is harder to lose money in a bull market. Besides having higher returns, rising stock prices, and more opportunities to invest in profitable securities, it is much easier to diversify one's portfolio.

Buy and Hold

This is the strategy used by long-term investors. They find a stock that is performing well and is expected to perform well over time. They purchase the stock and hold it. With this form of investing, all the work is put in before the stock is purchased. After acquisition, the investor monitors the market and sells the stock if the reasons for holding it are no longer valid.

Value Investing

In this strategy, favored by Warren Buffett, investors find undervalued stocks that they expect to perform well in the future. They buy them and hold them. In this case, investors believe that the past performance of the stock is not indicative of its true value. Like buy and hold, after the stock is purchased, they just hold it.

Technical Trading

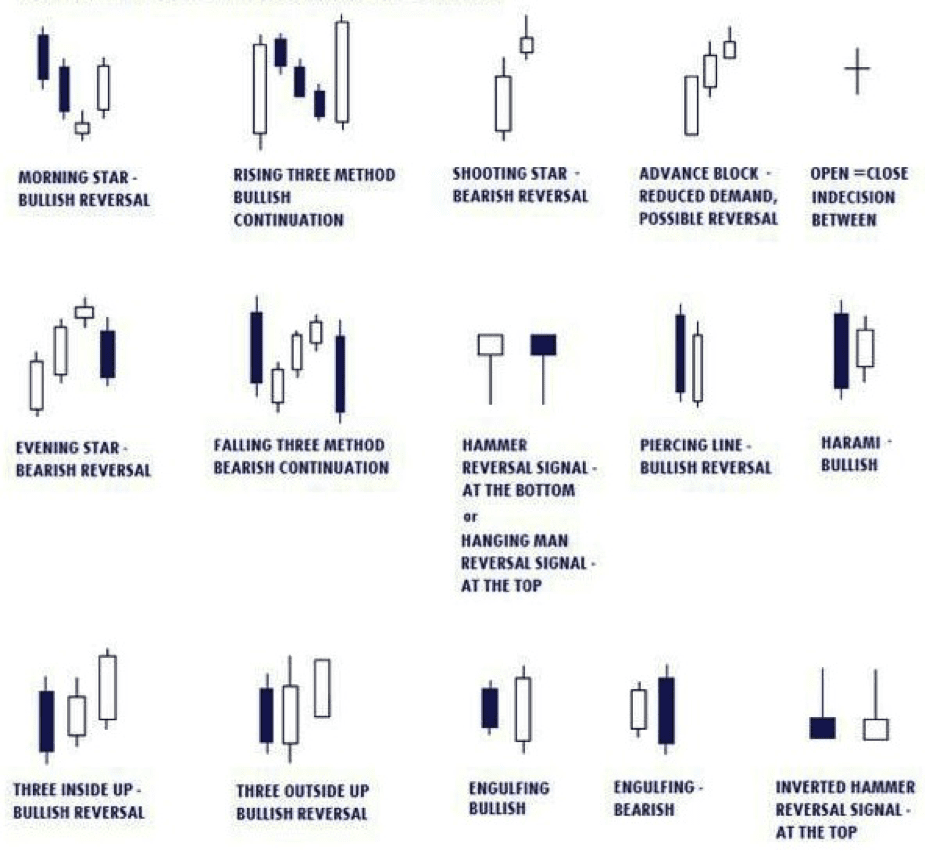

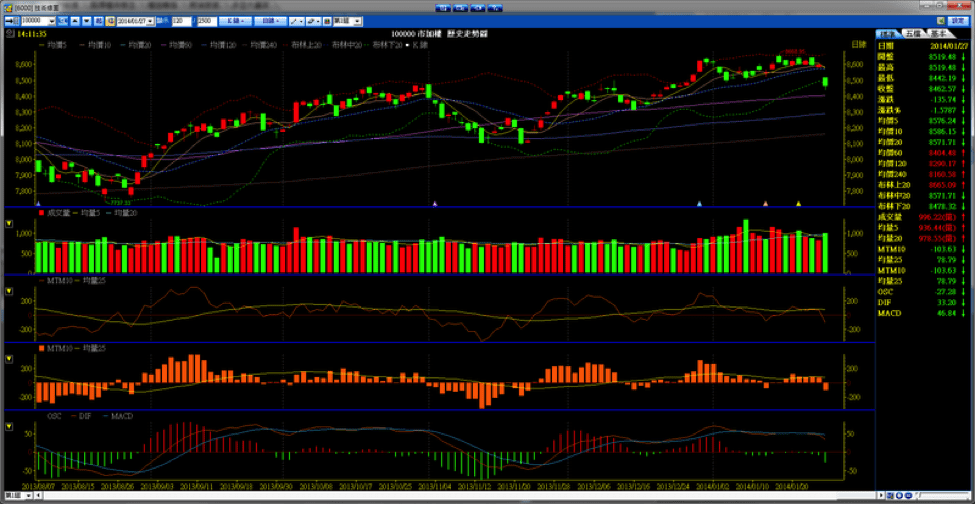

Technical trading uses technical analysis to predict the performance of a security or index. The technical indicators assess the past performance of the asset and use that to interpret its current performance and predict its later performance.

They use technical indicators to decide if they should buy, sell, or hold an asset. Generally, they use a combination of technical indicators to make their trading decisions. If the signals from the different technical indicators are the same, then they feel more confident that they are interpreting the market correctly and making good trading decisions.

Momentum Trading

Momentum trading involves following an established market trend. These traders get into the market after it gains momentum and then try to exit it before the trend reverses itself. They are literally chasing promising trades and potential profit.

Although this investing strategy may seem to be the least risky, the problem is that the traders pay more to get into the trend and earn less profit before they exit the trend when compared to traders who got into the market before the trend became strong and obvious. Also, it takes a lot of time, energy, and effort to find, monitor, and act on trends. In addition, they may agonize over when to sell the asset.

Derivative Trading

The stock market has a wealth of money making opportunities, with more being created every year. Increasingly, new traders are moving into derivative trading. Derivative investing can be very lucrative and requires less capital than buying a stock.

Derivatives are trading contracts based on the value of a stock or other stock market securities. The security it is based on is called the underlying security. Essentially, traders try to predict the underlying asset's price movements and then pay to enter a contract that will pay them a profit if they are correct. If they are incorrect, they can sell their contract (most of the time) or they will only lose the money spent to purchase the contract.

Derivatives include options, forwards, futures, and swaps contracts. There are also contracts for difference. Skilled traders often hedge their bets, so that even if they are wrong, they will still make money, or, at the very least, not lose any money.

What is a bear market?

A bear market occurs when the economy starts shrinking, assets drop in valuation, and traders lose confidence in the economy. These characteristics are associated with lower demand for goods and services, lower gross domestic product, and reduced consumer spending.

These markets are generally perceived as a bad thing. Monetary policies are implemented to pull the nation out of them. To do this, governments inject money into the economy and try to stimulate spending and borrowing by consumers and businesses.

Investing in Bear Markets

Investing in a bear market requires more care because there are many more ways to lose money than in a bull market. Remember, no one knows when a market will stop contracting.

Rebel Stocks in a Bear Market

During this kind of market, not all securities listed on a stock exchange will be falling. Some securities may actually rise. Their movement against the overall economic trend does not negate the trend.

Assets that move against the general trend may not be directly influenced by the factors that affect the financial markets. In addition, there may be other factors that account for the anomalous price performance of the deviant security.

Some securities that may not follow general market trends are utilities owned by the government, securities that represent goods and services that people need regardless of the state of the economy (e.g., toothpaste, toilet paper, soap, food), and securities that are not affected by the economy in distress (e.g., securities listed on other stock exchanges in other parts of the world).

Buy and Hold

The buy and hold strategy works well here. In fact, investors can purchase the desired assets at much lower prices during a bear market and watch them appreciate when it rebounds (at the end of the bear market). The same care taken to select stocks during a bull market must be made during a bear market.

This market makes it more challenging because the stock prices are falling, investors are selling off their holdings, and buy and hold investors must ignore all that and focus on the true value of the stock and its probable performance over time.

Value Investing

When the price of an undervalued stock falls, it looks very attractive to an investor who knows its true valuation is not reflected by the market. Value investors who buy at these times can get their stocks and other securities at a steep discount and make even higher returns when the market becomes bullish.

Just like the buy and hold investors, these people must look past the current market price, market behavior, and popular thinking, and invest in the undervalued assets.

Technical Trading

Technical traders can use technical analysis to predict the performance of a security over time. If the technical indicators signal that the price of the security will continue to fall, then the trader can short the security.

When shorting the asset, the trader is betting that the asset's market price will drop to a specific market valuation. If that happens, then the trader makes a profit. Traders who use stop limits can limit their potential losses if the asset moves against their expectations.

Derivative Trading

In a bear market, many traders invest in options contracts. They will enter contracts in which they bet against another party that an underlying asset's valuation will fall in the future. If they are correct on or before the expiration of date of the contract, they will profit from their market bet.

They can also go long on an underlying asset and bet that its stock will increase. If they enter the market at the right time, just before it becomes bullish, then the trader can earn a good return from the asset's upward moving valuation when the market becomes bullish.

Key Takeaways

While investing in bull and bear markets is similar, there are some very important differences between them. They both represent opportunities to earn a profit from predicting the price performance of a security. Moreover, all listed securities will not behave in the same way during both kinds of market.

Ultimately, market traders must study the assets of interest, decide on a trading strategy, select the securities or basket of securities that they want to trade, and review the results of their trades. Trading securities exposes the trader to potential gains and losses. Successful traders have more gains than losses and review their wins and losses so that they learn lessons from them.

FAQs

Do prices only move in one direction during bear and bull markets?

No, both kinds of markets can have dips and pullbacks that temporarily cause the market prices to move against the general trend.

For instance, bear markets, in general, have rising prices, but there are instances when the prices will temporarily fall or move sideways. This does not change the classification of the market, because the classification is based on overall market performance, not short-term reversals in prices.

What is the definition of a bear market?

This market occurs when a financial market's valuation declines by 20% or more from the last peak in the bull market and continues to decline. The minimum decline is 20%. If the decline is 19.5 %, it is not a bear market.

What is the definition of a bull market?

The valuation of the market increases by 20% or more from the bear market's trough to the bull market's peak. The difference between peak and trough must be 20% or higher, anything less, and it is not a bull market.