Position in Rating | Overall Rating | Trading Terminals |

230th  | 2.1 Overall Rating |  |

Bulbrokers Review

Bulbrokers is the perfect starting point for anyone beginning their trading or forex journey.A critical first step in your trading account or forex journey is choosing the appropriate broker. Access to a wide range of financial instruments, clear costs, and trustworthy customer services are all provided by a trustworthy broker to a trader.

Having been in the financial markets for more than 16 years, Bulbrokers is a reputable brokerage firm. The company provides access to a broad range of tradable assets, including currencies, options, futures, shares, indices, bonds, and funds, and it serves over 30,000 clients globally, including important markets in Bulgaria and Greece.

This review of Bulbrokers covers the platform’s pros and cons. It looks at important details like the types of accounts, how to deposit and withdraw money, commission fees, and other key features. The review combines expert analysis with real user feedback, making it easier for traders to decide if Bulbrokers is the right choice for their needs.

What is Bulbrokers?

The forex markets can be difficult to navigate, but with Bulbrokers, traders have found a partner that truly understands the needs of investors. Known for its professionalism and credibility, Bulbrokers offers a wide range of tradable assets, including indexes, bonds, shares, futures, options, and currencies. The platform is designed to be flexible, catering to both individual investors and legal entities, making it a suitable choice for traders of all skill levels.

What sets Bulbrokers apart is their commitment to flexibility and tailored solutions. Whether it’s low commission rates, seamless cash transfer options, or access to global markets, their services have consistently aligned with my financial goals. Their platform’s user-friendly design and broad asset selection make it easier to make informed investment decisions.

With a strong presence from Bulgaria to Greece and a global clientele, Bulbrokers has built a legacy of reliability and trustworthiness. Their focus on providing professional services and customized solutions has been instrumental in helping me and countless others succeed in the markets. If you’re looking for a brokerage firm to support your financial journey, Bulbrokers is a name worth exploring.

Bulbrokers Regulation and Safety

Bulbrokers’ connections with well-known financial institutions help to preserve its credibility. It has memberships in the Investor Compensation Fund, the Central Depository, and the Bulgarian Stock Exchange. These affiliations strengthen its dedication to openness and investor protection, as does its compliance with the Markets in Financial Instruments Directive (MiFID).

This strong regulatory structure demonstrates Bulbrokers’ commitment to upholding a safe and reliable trading environment. Because the platform is governed by reputable authorities and adheres to international standards, investors can trade with confidence.

Bulbrokers Pros and Cons

Pros

- Regulated & Safe

- Negative Balance Protection

- Low Spreads

- No Inactivity fee

- No Deposit Fee

Cons

- Strict Account Requirements

- High Forex Fees

- Withdrawal Fee

Benefits of Trading with Bulbrokers

One of the first things that caught my attention when I made the decision to begin trading with Bulbrokers was their strict standards and safety protocols. Because Bulbrokers is subject to Tier-1 regulation, I can feel secure knowing that my money is secure. They also provide negative balance protection, so I don’t have to be concerned about losing more money than I put in. When selecting a broker, this degree of security is essential.

The variety of assets I can trade with Bulbrokers is another advantage I’ve discovered. Bulbrokers gives me access to all markets, whether I want to trade stocks, bonds, indices, FX, or CFDs. Without being restricted to a single asset class, this enables me to broaden my trading approach and investigate various investing opportunities.

Regardless of your level of trading experience, Bulbrokers’ platforms are simple to use. I value the ability to trade on MetaTrader 4, which is a dependable and well-liked option among traders, in my experience. For individuals that want more sophisticated capabilities, they also provide Trader Workstation. For me, trading is simple and accessible because of its robust features and ease of use.

The platforms offered by Bulbrokers are user-friendly, regardless of your level of experience. Since MetaTrader 4 is a dependable and well-liked option among traders, I value the ability to trade on it. In addition, they provide Trader Workstation for individuals who want more sophisticated capabilities. I can trade easily and conveniently because of its robust features and ease of usage.

Finally, with more than 8 years of experience, Bulbrokers has a solid track record. With over 30,000 customers across the globe, including in areas like Greece and Bulgaria, it has established a solid reputation as a trustworthy and dependable broker. Bulbrokers is a good option for any trader because of its excellent platforms, reasonable costs, and strong reputation.

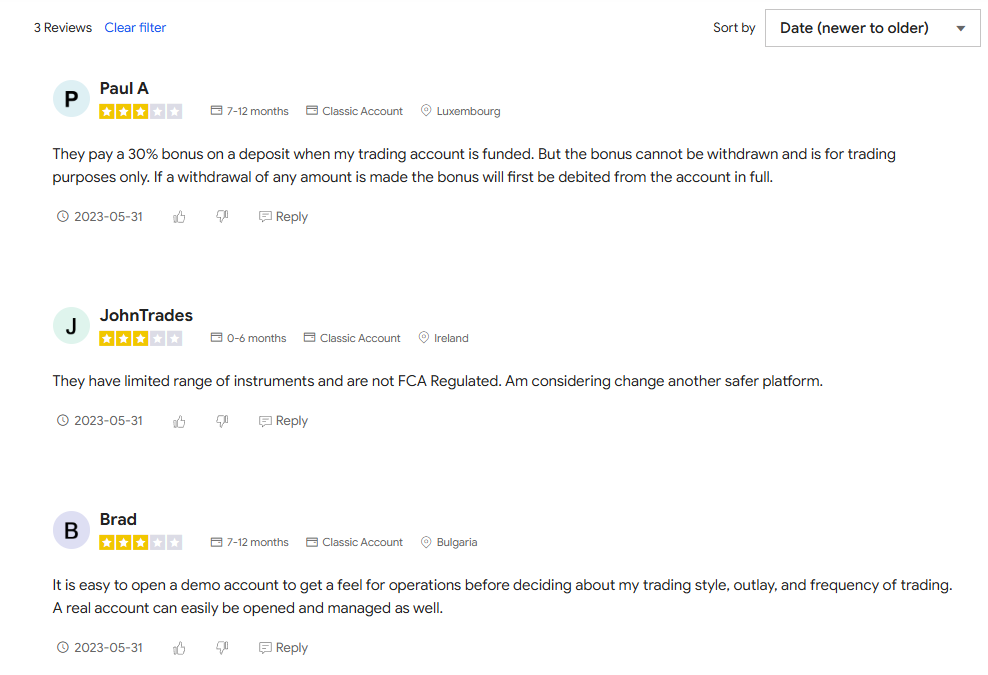

Bulbrokers Customer Reviews

The reviews of Bulbrokers offer a mix of positive and negative feedback. While the platform is appreciated for its easy account setup and the 30% bonus on deposits, some users are concerned about the bonus’s limitations, as it cannot be withdrawn and is debited if any withdrawal is made. Additionally, there are complaints about the limited range of trading instruments and the lack of FCA regulation, leading some users to consider alternative, more regulated platforms. Overall, Bulbrokers provides a user-friendly experience but has room for improvement in terms of regulatory security and available assets.

Bulbrokers Spreads, Fees, and Commissions

With no commission costs for Forex trading, Bulbrokers provides traders with a transparent and competitive pricing structure. With spreads as low as 0.0 pips on the ECN Premium Account, the broker offers very alluring spreads. Spreads are locked at 2 pips for traders utilizing other account types, like the Classic Account, whilst the Standard Account offers spreads as low as 0.8 pips. Traders can increase overall profitability and reduce trading expenses by using these competitive spreads.

One of the advantages of trading with Bulbrokers is the lack of deposit fees, which helps reduce upfront costs for traders. However, it’s important to note that Bulbrokers charges withdrawal fees, depending on the method used. Traders should carefully review these withdrawal fees to ensure they fit within their trading strategy and budget. Fortunately, there are no inactivity fees, making Bulbrokers a good choice for traders who prefer to trade infrequently.

Overall, Bulbrokers provides a strong and competitive fee structure, making it an attractive option for traders looking for low spreads and no deposit fees. While withdrawal fees do apply, understanding these costs can help you plan your trading activities more effectively. With transparent pricing and low minimum deposit requirements, Bulbrokers makes it easier for traders to manage costs and maximize potential profits.

Account Types

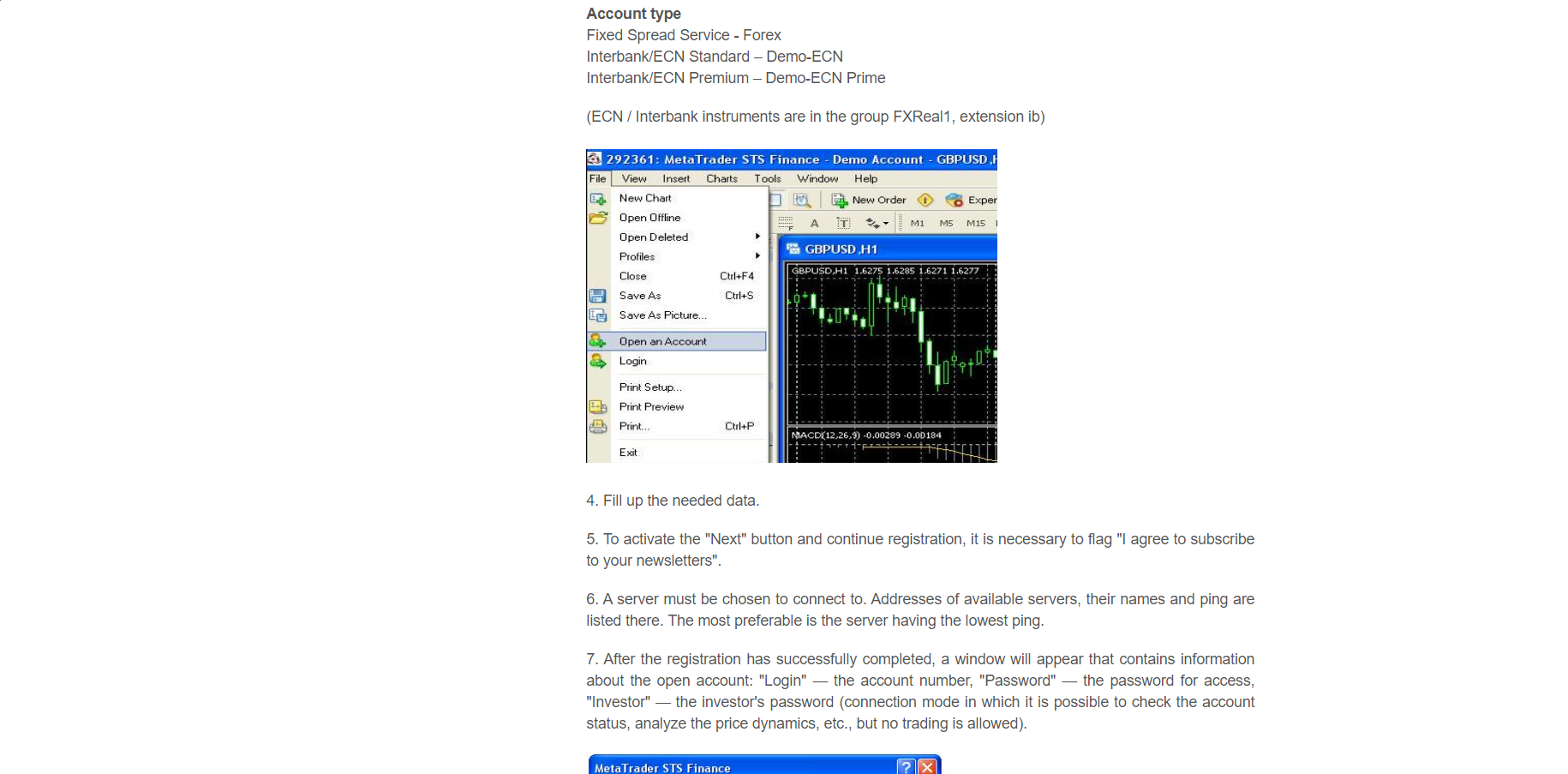

Demo Accounts

- Fixed Spread Service – Forex

- Simulated trading with fixed spreads

- Suitable for learning or testing strategies in Forex trading

- Interbank/ECN Standard – Demo-ECN

- Simulated ECN trading with interbank rates

- Ideal for standard-level traders practicing strategies

- Interbank/ECN Premium – Demo-ECN Prime

- Advanced demo trading with premium ECN features

- Suitable for refining skills with access to tighter spreads and superior liquidity

Live Account

- Real Account

- Actual trading with real money

- Access to live market conditions and features based on account type

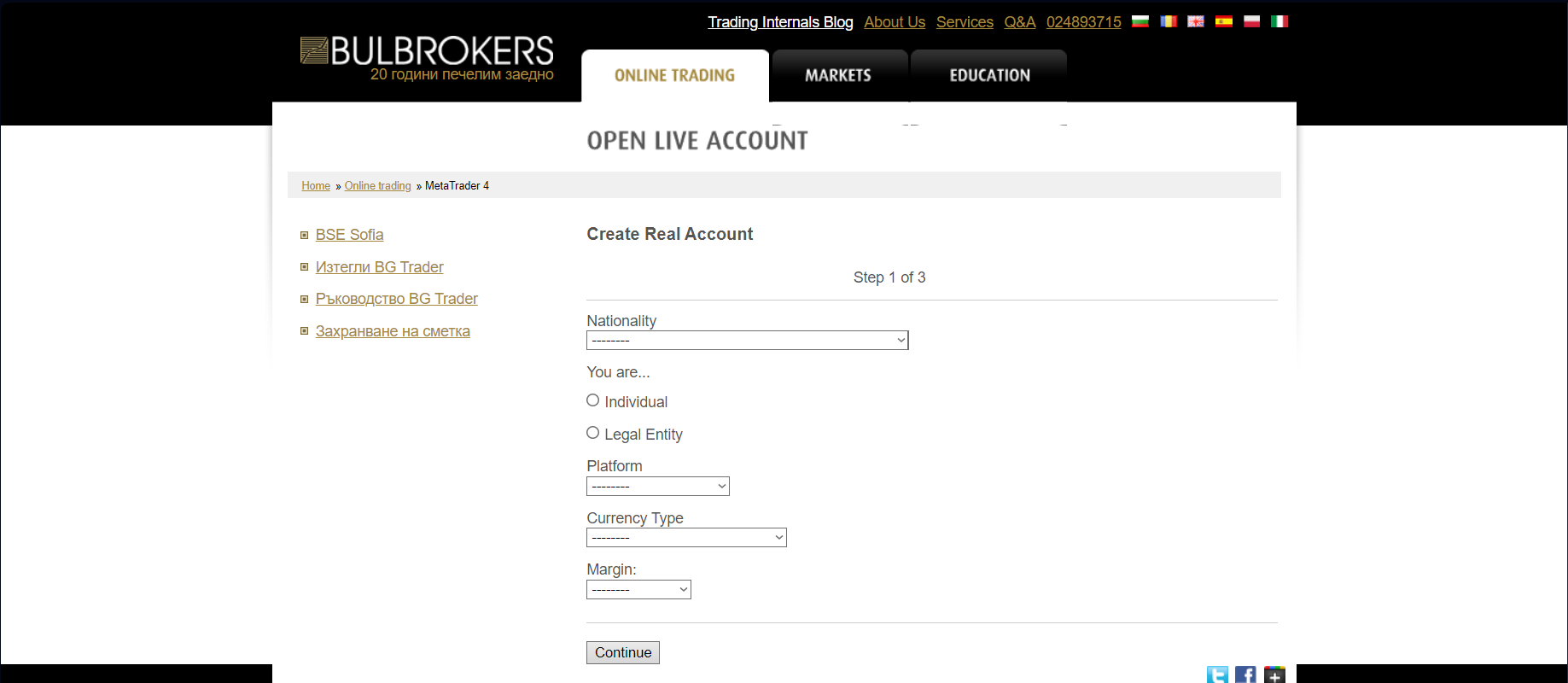

How to Open Your Account

Opening an account on our platform is quick and straightforward. Follow these steps to complete your registration and get started today.

- Select Your Nationality

- Choose Account Type: Register as an individual or a legal entity.

- Pick Your Trading Platform: For example, MetaTrader 4.

- Set Currency and Margin Preferences

- Fill in Basic Personal Details

- Add Payment Information (optional)

- Complete Registration: Click the button to finalize your account setup.

Bulbrokers Trading Platforms

BulkBrokers is a trading platform that allows me to buy and sell financial instruments like stocks, commodities, and currencies. It’s specifically designed for high-volume traders and institutional investors who need to make large trades quickly and efficiently.

With BulkBrokers, I can execute bulk trades—large orders of stocks or other assets—without worrying about slippage or delayed execution. The platform offers advanced features like real-time market data, automated trading systems, and risk management tools to help me make informed decisions. These tools are perfect for those who need quick access to multiple markets and want to track their investments with precision.

For anyone involved in active trading, BulkBrokers provides a user-friendly experience while ensuring I can manage both high-speed transactions and complex orders effectively. Whether you’re an individual trader or part of a larger institution, BulkBrokers helps me navigate the world of trading with ease and confidence.

What Can You Trade on Bulbrokers

Exploring the diverse trading opportunities offered by Bulbrokers has been an enriching experience. This platform stands out with its wide range of markets and instruments, including Forex, stocks, indices, futures, options, CFDs, and bonds. As a trader who values variety and flexibility, I found Bulbrokers to be a solid choice for diversifying my portfolio. The availability of multiple tools and resources makes it easier to make informed trading decisions across various asset classes.

One of the first areas I explored was Forex trading, which features over 25 currency pairs, including both major and exotic options. With leverage reaching up to 1:200, the platform offers significant potential for amplifying trades. However, I approached leverage cautiously, understanding the inherent risks. For those interested in Forex, Bulbrokers provides a robust environment with competitive features that support both beginner and experienced traders.

When it comes to stocks and indices, the ability to trade Bulgarian and international stocks was a major advantage. The platform’s competitive fees, such as 0.015 USD per share for U.S. stocks, are ideal for frequent traders like me. Whether you’re targeting individual stocks or indices that track broader market trends, the options available here make it easy to maintain a well-diversified portfolio.

I’ve investigated a variety of financial instruments, each with its own advantages, including bonds, futures, options, and CFDs. Futures help you control risks when prices fluctuate suddenly by allowing you to lock in a price now for a future transaction. Options provide you with the flexibility to time your trades by granting you the right to purchase or sell at a fixed price. Bonds offer longer-term, more secure returns, but CFDs were ideal for making money off of short-term market fluctuations. This platform is perfect for managing risks and seizing opportunities since it blends high-risk and low-risk options, giving traders the freedom to modify their plans in response to market conditions.

Bulbrokers Customer Support

Effective customer support is a crucial factor for traders, and Bulbrokers offers assistance through multiple channels to address client inquiries. Help is available via email at forex@bulbrokers.com and through telephone at (+359) 2 4893 715. Support hours are between 09:00 and 17:00 ET, providing a window for users to get answers to their trading-related questions or account concerns.

While the availability of both email and telephone support ensures direct communication with knowledgeable representatives, it is worth noting that Bulbrokers does not currently offer a live chat service. This could be a limitation for traders who prefer instant, real-time responses, especially outside of the designated support hours.

Advantages and Disadvantages of Bulbrokers Customer Support

Withdrawal Options and Fees

Withdrawal in Bulbrokers is easy and convenient. You can request a bank transfer or stop by any of our offices (with the exception of Romania). Simply fill out the Withdrawal Request form, sign it, and fax it to +359 2 4893 788 or send a scanned copy to accounts@bulbrokers.com if your bank account information is already on file. You must first complete an Update Information Form if you haven’t yet submitted your bank account information. Once both forms are filled out and signed, you can fax or email them.

The credit or debit card (Visa or MasterCard) that you used to make the deposit will receive the money back when you request a withdrawal. The withdrawal to your card will be handled first if you paid with another manner. Recognize the costs related to withdrawals. There are no costs for cash withdrawals up to BGN 1,000, however there is a 0.2% fee if the amount is more than that. Withdrawals made through PayPal or Skrill incur additional fees: 3.4% + 0.35 EUR for PayPal and 1.9% plus 0.25 EUR for Skrill. When preparing your withdrawal, be careful to account for these fees.

Bulbrokers Vs Other Brokers

#1. Bulbrokers vs XM

Bulbrokers and XM cater to different trader needs, but XM stands out with its versatile platform options (MT4, MT5, XM App) compared to Bulbrokers’ Trader Workstation and BG Trader. XM offers a lower minimum deposit of $5, broader payment options like Apple Pay and Google Pay, and supports more instruments, while Bulbrokers has slightly tighter spreads starting at 0.1 pips but requires a $100 deposit and lacks mobile trading.

Verdict: XM’s flexibility, lower entry cost, and modern trading features make it the better choice for traders of all levels.

#2. Bulbrokers vs RoboForex

Bulbrokers offers a focused trading experience with limited instruments and platforms like Trader Workstation and BG Trader, while RoboForex provides a diverse selection of over 12,000 financial instruments, including CFDs on stocks, indices, metals, and futures. RoboForex also features competitive spreads starting at 0 pips, higher leverage of up to 1:2000, and unique tools like the CopyFx investment program for passive income, which Bulbrokers does not offer.

Verdict: With its broader instrument range, advanced trading tools, and competitive conditions, RoboForex is a superior choice for traders seeking flexibility and innovation.

#3. Bulbrokers vs Exness

Juno Markets and Exness are both reputable brokers, but they cater to different types of traders. Juno Markets specializes in Forex, CFDs, and commodities, offering platforms like MT4 and its proprietary Juno Auto Trader, with leverage up to 1:500, while Exness offers a wider range of financial instruments, including cryptocurrencies and CFDs on stocks and commodities, with leverage up to 1:unlimited. Juno Markets requires a minimum deposit of $25, whereas Exness has a low deposit starting at just $10 for many account types. Exness also stands out with its multiple licenses and strong security features, such as 24/7 support and fast withdrawals.

Verdict: Exness is ideal for traders looking for higher leverage, more asset options, and top security. With low deposit requirements and diverse account options, Exness offers a versatile and secure trading experience.

Also Read: Exness Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH BULBROKERS

Conclusion: Bulbrokers Review

This trading platform provides both advantages and challenges for users to consider. It offers easy account setup, including demo accounts for beginners to practice before starting real trading. With over 16 years of experience in the financial industry, the platform emphasizes trust and reliability. It also caters to private and institutional investors by providing a range of investment services. However, factors like limited trading options and the need for stronger regulatory oversight might be concerns for traders looking for broader options and enhanced security.

For those prioritizing trusted market expertise, the platform’s connections with established financial organizations and compliance with European trading standards (MiFID) are appealing. However, to ensure the best fit for their needs, users should weigh the platform’s features against their goals, particularly if they value diverse trading instruments or higher levels of regulation. This balanced approach helps traders make smarter, more secure decisions.

Bulbrokers Review: FAQs

What platforms does Bulbrokers offer?

Bulbrokers offers Trader Workstation and BG Trader platforms.

What is the minimum deposit?

The minimum deposit is $100.

Does Bulbrokers support mobile trading?

No, Bulbrokers does not offer mobile trading.

OPEN AN ACCOUNT NOW WITH BULBROKERS AND GET YOUR BONUS