Position in Rating | Overall Rating | Trading Terminals |

180th  | 2.9 Overall Rating |

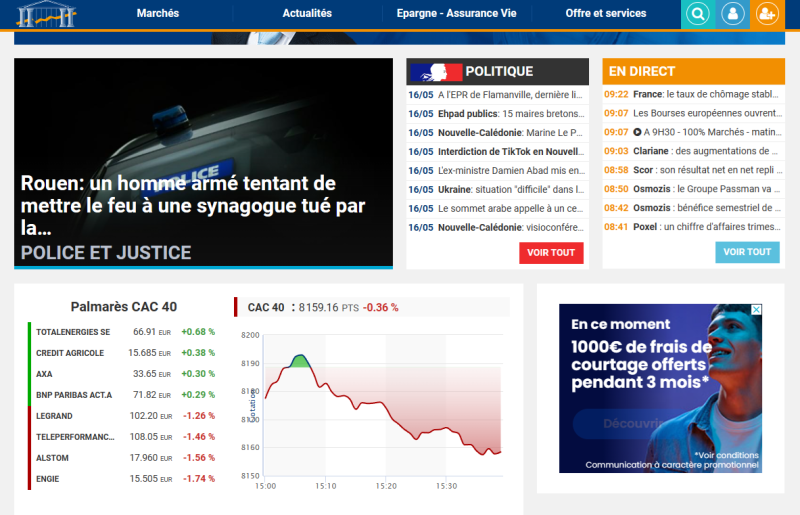

Bourse Direct Review

In the world of investment, Forex brokers play a crucial role by providing traders with access to the foreign exchange market. These brokers serve as intermediaries between individual traders and the broader currency markets. Selecting the right Forex broker is paramount because it directly impacts the efficiency, cost, and security of your trading activities. A trustworthy and competent broker can enhance your trading experience by offering better technology, lower fees, and reliable customer support.

As we delve into the specifics of Bourse Direct, a prominent French stockbroker, it’s important to highlight what sets them apart. Founded in 1996 as a subsidiary of VIEL & Cie, Bourse Direct has a long-standing history in the European financial sector. This background gives them a significant edge in understanding market dynamics and client needs. In our comprehensive review, we will uncover the distinct features of Bourse Direct, including their account options, commission structures, and the ease of transactions.

By offering a blend of expert analysis and real user feedback, this review aims to equip you with all the necessary details to determine if Bourse Direct is the ideal broker for your trading needs. Whether you’re a novice or an experienced trader, understanding the offerings and potential limitations of a broker like Bourse Direct is essential for making an informed decision. Stay tuned for a detailed exploration of their services, designed to help you navigate your investment choices effectively.

What is Bourse Direct?

Bourse Direct is a leading French stockbroker renowned for its comprehensive online brokerage services. Established in 1996, it operates as a subsidiary of VIEL & Cie, a significant player in European financial investments. This heritage underscores its robust position in the financial market, focusing on long-term investment strategies in a variety of financial assets.

In 1999, Bourse Direct took a significant step by listing on the Euronext Paris, enhancing its visibility and credibility in the financial community. This move also highlighted the broker’s commitment to transparency and regulatory compliance in its operations.

Regulation is a cornerstone of Bourse Direct’s operations, with oversight provided by both the ACPR (Autorité de Contrôle Prudentiel et de Résolution) and the AMF (Autorité des marchés financiers). These authorities ensure that Bourse Direct adheres to stringent financial standards and practices, offering clients a secure environment for trading and investing.

Benefits of Trading with Bourse Direct

Trading with Bourse Direct has shown me several clear advantages. First and foremost, the platform’s regulatory compliance is impressive. As a trader, knowing that Bourse Direct is regulated by both the ACPR and the AMF provides a strong sense of security and trust. This compliance ensures that my investments are handled with high standards of accountability and transparency.

Another significant benefit I’ve experienced is the absence of deposit and withdrawal fees. This makes it more economical to manage funds, as I can move money in and out without worrying about extra costs. Additionally, the negative balance protection feature prevents me from losing more than what I have in my account, which is particularly important in volatile trading conditions.

The platform also offers a range of educational resources that are accessible for free. These resources have been invaluable in helping me refine my trading strategies and broaden my understanding of the markets. The real-time newsfeeds keep me updated on global financial news, which is crucial for making informed trading decisions.

Bourse Direct Regulation and Safety

Bourse Direct operates under stringent regulatory frameworks that ensure its safety and transparency, making it a trustworthy choice for traders. As a part of VIEL & Cie, Bourse Direct adheres to the Sapin II Law, which is designed to combat corruption and promote transparency within financial markets. The broker also holds the single European maximum transparency certificate, confirming its commitment to clear and open financial dealings. This level of regulatory compliance is crucial for traders who seek a reliable and secure environment for their investments.

The broker’s activities are fully accredited by the CECEI (Comité des établissements de crédit et des entreprises d’investissement), which oversees credit institutions and investment companies in France. Furthermore, Bourse Direct is regulated by both the ACPR (Autorité de Contrôle Prudentiel et de Résolution) and the AMF (Autorité des marchés financiers), ensuring adherence to the highest standards of financial conduct. The broker is also registered with ORIAS, which maintains a registry of insurance, banking, and finance intermediaries. This layered regulatory oversight guarantees that Bourse Direct operates with integrity and accountability.

An additional safety feature offered by Bourse Direct is negative balance protection, which prevents clients from losing more money than they have deposited in their accounts. This is particularly important in volatile trading environments where sudden market movements can otherwise lead to significant losses. Furthermore, the broker ensures transparency in the execution of trades, which helps clients to verify that they are receiving fair and accurate pricing. This information, gathered from direct trading experiences with the broker, highlights why understanding the regulation and safety measures of your chosen broker is essential.

Bourse Direct Pros and Cons

Pros

- Comprehensive real-time newsfeeds and global news available at no extra cost, which are crucial for combining technical and fundamental analyses.

- No minimum deposit required, offering flexibility for traders of all levels.

- Developed a robust online education platform, ranging from simple tips to detailed webinars, with most resources available for free.

- Offers a secure trading environment, adhering to stringent regulations under the Sapin II Law and holding a European transparency certificate.

- Operates under comprehensive regulatory oversight by the CECEI, ACPR, and AMF, ensuring high standards of financial conduct and safety.

- Features negative balance protection, safeguarding clients from losing more than their account balance.

- Transparency in trade execution, ensuring clients receive fair and accurate pricing.

Cons

- Higher spreads on Standard accounts can increase trading costs.

- The absence of an English version of the website may limit accessibility for non-French speakers.

- Lack of bonus offers for Forex traders could be a drawback for those looking for extra trading incentives.

- Educational materials are only available in French, which could be a barrier for those not proficient in the language.

- Withdrawals are restricted to EUR, which might be inconvenient for those preferring transactions in other currencies.

Bourse Direct Customer Reviews

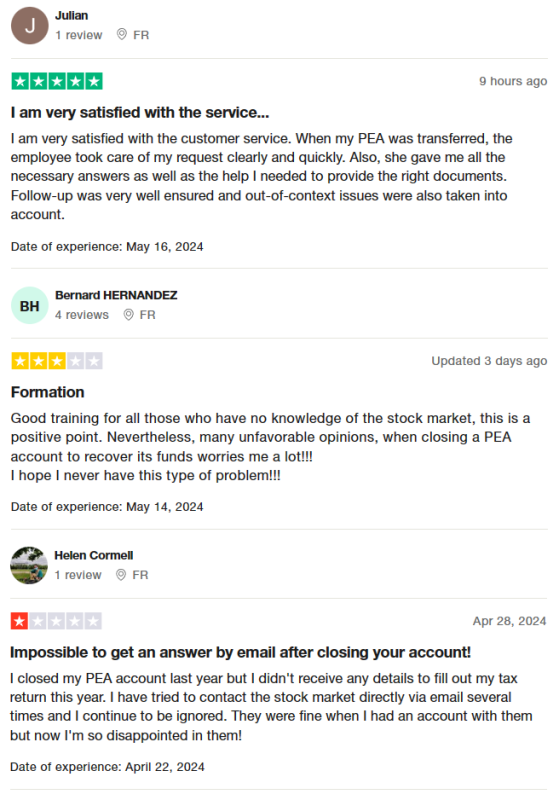

Customer reviews of Bourse Direct show a mixed experience among users. Some customers express satisfaction with the customer service, particularly appreciating the clarity and speed in handling requests such as PEA transfers, and noting effective follow-up even for issues outside the main context. On the other hand, there are significant concerns about the process of closing accounts and retrieving funds, with some users reporting difficulties in getting responses from the service team once their accounts are closed. Additionally, the transition to a new trading platform has not been well-received by all users, particularly those who prefer other systems like TradingView, which was not integrated with Bourse Direct’s new platform.

Bourse Direct Spreads, Fees, and Commissions

When trading with Bourse Direct, I find their fee structure straightforward and cost-effective. They do not impose any deposit fees, which simplifies the process of funding my account. For trading currency pairs, the only fees I encounter are the spreads, which are competitive within the industry. For trading other instruments such as stocks or commodities, Bourse Direct charges a minimal fixed fee starting at €0.99 per transaction, depending on the asset.

Interestingly, Bourse Direct does not charge maintenance fees for using their trading platforms or accessing analytics, which is a significant advantage for traders like me who rely on these tools for daily trading decisions. Additionally, they do not charge any withdrawal fees, making it cost-effective to access my funds. However, it’s important to note that swap fees apply for positions held overnight, which is standard practice in the forex market.

Account Types

Bourse Direct offers two main types of accounts tailored to meet different trading needs and preferences:

Standard Account

- Platform Availability: This account can be accessed through MT4 and TradeBox FX, both renowned for their robust trading features.

- Leverage: Up to 1:200, providing significant potential for magnifying gains, though it also increases risk.

- Spreads: Starts at 2.4 pips, which is suitable for casual and semi-experienced traders.

- Minimum Deposit: There are no minimum deposit requirements, making it accessible for traders of all levels who may want to start with smaller amounts.

Premium Account

- Account Type: Aimed at professional traders, this account features more competitive conditions based on trading activity and initial funding.

- Spreads: Floating spreads that vary according to daily trading volumes and the initial deposit, potentially offering lower costs for high-volume traders.

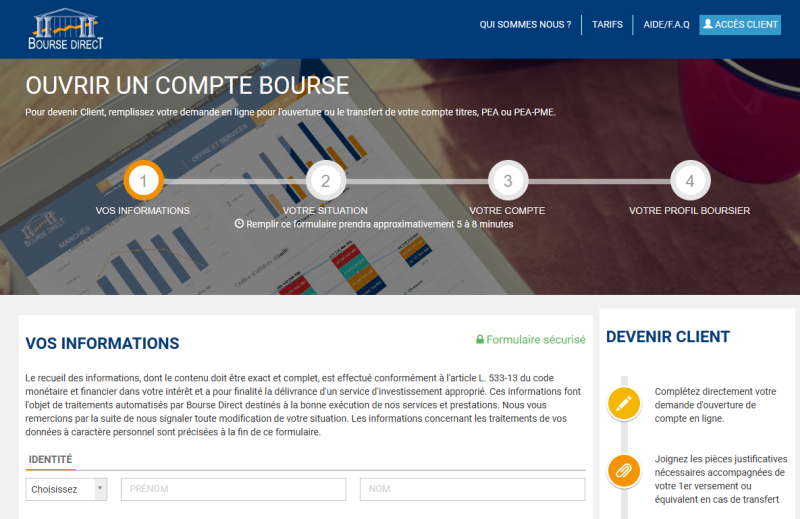

How to Open Your Account

- Click the “Ourvir un compte” button on the main page of the broker’s official website.

- Fill in your personal information in the designated fields.

- Agree to the user agreement and the processing of your personal data by checking the appropriate boxes.

- Submit your application to receive your login credentials, which will also be sent to your email.

- Choose the type of account you wish to open from the available options.

- Select one of the trading platforms offered by Bourse Direct.

- Upload the required documents to verify your identity and address.

- Wait for Bourse Direct to complete the verification process. Once verified, you can start funding your account and begin trading.

Bourse Direct Trading Platforms

Bourse Direct offers traders access to two primary trading platforms: MetaTrader 4 (MT4) and TradeBox FX. Based on my experience, these platforms provide a comprehensive and user-friendly interface suitable for traders of all skill levels.

MetaTrader 4 (MT4) is renowned for its advanced charting capabilities, a wide range of technical indicators, and automated trading options through Expert Advisors (EAs). As an MT4 user, I appreciate its reliability and the ability to customize my trading strategies with ease. The platform’s robust security features ensure that my trading activities and personal information are well-protected.

TradeBox FX is another excellent platform offered by Bourse Direct, tailored for traders looking for an intuitive and powerful trading experience. From my usage, I found TradeBox FX to be highly responsive, with seamless order execution and real-time data updates. The platform also supports various analytical tools that help in making informed trading decisions. Whether you’re a novice or a seasoned trader, TradeBox FX provides a solid foundation for effective trading.

What Can You Trade on Bourse Direct

Based on my experience with Bourse Direct, I’ve found that they offer a diverse range of trading instruments, making it a versatile platform for different types of traders. You can trade currency pairs, which is ideal for those interested in forex markets. Additionally, there are options for trading stocks, providing access to major stock exchanges.

Bourse Direct also offers warrants, trackers, and UCITS (Undertakings for Collective Investment in Transferable Securities), catering to those looking for investment funds and derivative products. For more advanced traders, they provide the ability to trade options and OTC (Over-the-Counter) products, offering flexibility in trading strategies.

Furthermore, the platform has recently expanded to include cryptocurrencies, appealing to those interested in digital currency markets. This addition underscores Bourse Direct’s commitment to adapting to current trends and expanding its financial instruments to meet trader demands.

Bourse Direct Customer Support

Bourse Direct offers efficient and accessible customer support through multiple communication channels. Based on my experience, the technical support team can be reached via phone numbers provided on their website, which ensures direct and prompt assistance for urgent issues. This immediate access is crucial when dealing with time-sensitive trading problems.

Additionally, support is available via email, allowing clients to send detailed queries or concerns that can be addressed in a structured manner. This method is particularly useful for non-urgent issues that require comprehensive explanations or documentation. The response times are generally reliable, making email support a convenient option for thorough assistance.

For more immediate help, users can utilize the live chat feature on the website or within their user account. This service offers quick resolutions to common problems and questions, providing a seamless way to get assistance without significant delays. The live chat is particularly handy for real-time troubleshooting and quick answers.

Advantages and Disadvantages of Bourse Direct Customer Support

Withdrawal Options and Fees

As a user of Bourse Direct, I appreciate the 24/7 availability of withdrawals, which allows me to access my funds at any time. I can transfer money directly to my bank card or bank account using my bank details, ensuring convenience and security.

EUR is the only transaction currency, meaning there’s no need to worry about conversion fees. This simplifies the withdrawal process. Additionally, I can get my withdrawal fees refunded if I meet the requirements for one of the bonus programs, though this does not apply to Forex transactions.

To ensure security, verification of my personal and payment data is required before making withdrawals. This step helps protect my funds and personal information, providing peace of mind.

Bourse Direct Vs Other Brokers

#1. Bourse Direct vs AvaTrade

AvaTrade is a prominent online Forex and CFD broker established in 2006, boasting over 300,000 registered customers from more than 150 countries. They offer more than 1,250 financial instruments and execute roughly two million monthly transactions. AvaTrade is heavily regulated, with offices in Australia, Ireland, the British Virgin Islands, and Japan, though it does not serve US traders. In comparison, Bourse Direct offers a more localized experience with a focus on French markets. It supports trading in stocks, ETFs, options, and futures but does not provide the same global reach or variety of financial instruments as AvaTrade.

Verdict: AvaTrade is better for those seeking a broad range of financial instruments and global market access. Bourse Direct is ideal for traders focused on the French market.

#2. Bourse Direct vs RoboForex

RoboForex has been operating since 2009 and is known for its superb trading conditions and cutting-edge technologies. With more than 12,000 trading options across eight asset classes, RoboForex provides services suitable for traders of all experience levels. It offers various trading platforms, including MetaTrader, cTrader, and RTrader, and holds frequent trading contests. On the other hand, Bourse Direct focuses primarily on the French market and offers fewer trading options compared to RoboForex. It specializes in stocks, ETFs, options, and futures, catering to traders interested in these instruments.

Verdict: RoboForex is superior for traders seeking diverse trading options and advanced platforms. Bourse Direct is better for those concentrating on the French market.

#3. Bourse Direct vs Exness

Exness, established in 2008, is a reputable broker offering CFDs for stocks, energy, metals, and over 120 currency pairings, including cryptocurrencies. Exness provides beneficial working conditions such as low commissions, immediate order execution, and fund withdrawal. They also offer infinite leverage for small deposits and various account types. Bourse Direct provides a more limited scope, focusing on the French market with instruments like stocks, ETFs, options, and futures. It does not offer the same range of CFDs or leverage options as Exness.

Verdict: Exness is better for traders looking for a wide range of CFDs and flexible leverage options. Bourse Direct is preferable for those focused on trading within the French market.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH BOURSE DIRECT

Conclusion: Bourse Direct Review

In conclusion, Bourse Direct stands out as a reliable and well-regulated French broker, ideal for traders focused on the French market. With its strict adherence to regulatory standards and a secure trading environment, it offers a solid choice for those prioritizing safety and compliance.

However, potential clients should be aware of its limitations. The broker primarily operates in EUR and provides resources mostly in French, which could pose challenges for international traders and those who do not speak the language. Additionally, the range of financial instruments and trading options is more limited compared to global brokers.

While Bourse Direct offers robust trading solutions and excellent regulatory compliance, it may not suit everyone. Traders seeking more diversity in financial instruments or needing services in other languages might find better options elsewhere.

Also Read: LegacyFX Review 2024 – Expert Trader Insights

Bourse Direct Review: FAQs

What types of trading accounts does Bourse Direct offer?

Bourse Direct offers several types of trading accounts to cater to different trader needs, including Standard and Premium accounts. These accounts vary in terms of spreads and access to different trading platforms like MT4 and TradeBox FX, allowing traders to choose the one that best fits their trading style and financial goals.

Can I trade cryptocurrencies with Bourse Direct?

Yes, Bourse Direct has recently expanded its offerings to include cryptocurrencies. This allows traders to engage in the dynamic and rapidly growing market of digital currencies, alongside traditional financial instruments like stocks and currency pairs.

What are the educational resources available at Bourse Direct?

Bourse Direct provides a wealth of educational resources, which include detailed webinars, trading tips, and comprehensive guides. These resources are mostly free and are designed to help both novice and experienced traders improve their trading knowledge and skills.

OPEN AN ACCOUNT NOW WITH BOURSE DIRECT AND GET YOUR BONUS