Blueberry Markets Review

Blueberry Markets is a reputable forex brokerage services known for its user-friendly trading platform and extensive range of trading options. Founded in 2016, this broker has quickly gained popularity among traders for offering a reliable and transparent trading experience. With competitive spreads and fast execution times, Blueberry Markets appeals to both beginner and experienced traders.

One of the standout features of Blueberry Markets is its commitment to customer support. Available 24/7, the support team provides assistance through live chat, email, and phone, ensuring that traders have quick access to help when needed. This broker also offers educational resources, making it easier for new traders to build their knowledge and confidence in forex trading.

Security is another key advantage for Blueberry Markets users. The FX broker is regulated by the Australian Securities and Investments Commission (ASIC), which provides a layer of protection for traders. Additionally, Blueberry Markets supports various payment methods, including credit cards, bank transfers, and e-wallets, making deposits and withdrawals straightforward and convenient.

What is Blueberry Markets?

Blueberry Markets is an online forex and CFD broker designed to offer traders a straightforward and efficient trading experience. Known for its transparency and fast trade execution, this broker has become a popular choice since its launch in 2016. With a focus on user experience, Blueberry Markets provides a platform that’s accessible to both beginner and advanced traders.

The broker is regulated by the Australian Securities and Investments Commission (ASIC), which adds a layer of security and reliability for traders. Blueberry Markets offers a wide range of assets, including forex pairs, commodities, indices, and more, giving traders ample opportunities to diversify their portfolios. Its competitive spreads and low trading fees make it appealing to those who want cost-effective trading options.

Customer support is a strong point for Blueberry Markets, with a team available 24/7 via live chat, phone, and email. The broker also provides educational resources to help traders improve their knowledge and strategies. With secure payment options and a commitment to customer satisfaction, Blueberry Markets is positioned as a reliable and user-friendly choice in the trading world.

Blueberry Markets Regulation and Safety

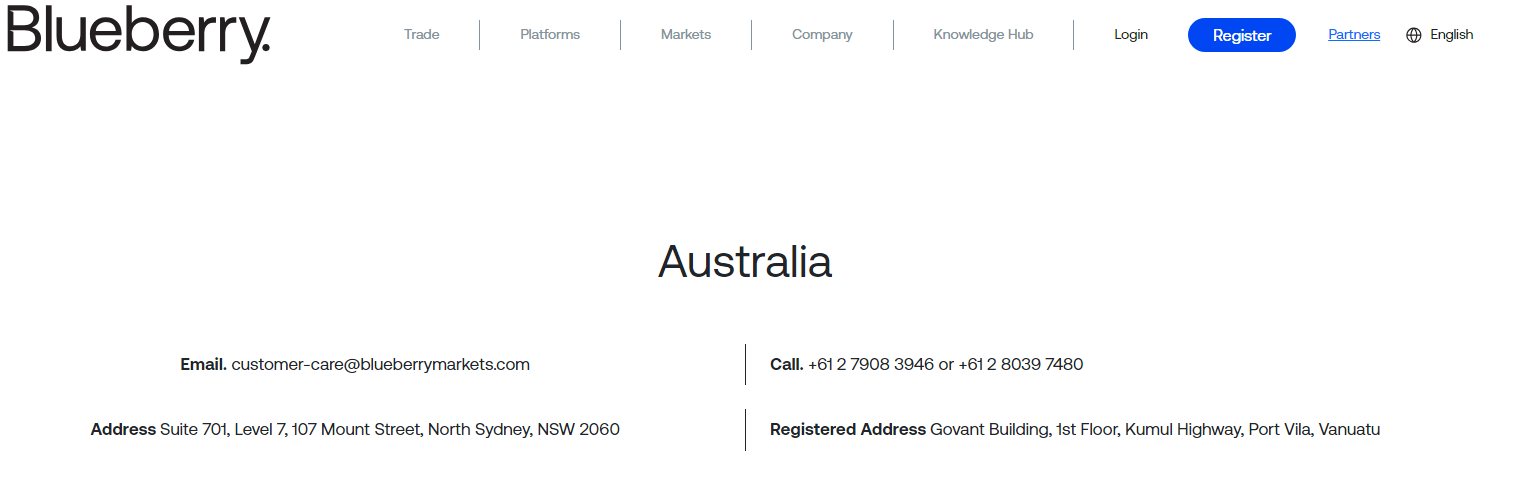

Blueberry Markets is a forex and CFD broker that operates under multiple regulatory frameworks to ensure client security and compliance in trading industry. The broker is regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). ASIC is recognized as a top-tier regulator, providing stringent oversight and enhancing the broker’s credibility. The VFSC offers additional regulatory coverage, particularly for international clients.

To safeguard client funds, Blueberry Markets maintains segregated accounts, ensuring that client money is kept separate from the company’s operational funds. This practice aligns with industry standards and provides an extra layer of protection for traders. Additionally, the broker offers negative balance protection, preventing clients from losing more than their initial investment.

Blueberry Markets Pros and Cons

Pros

- Low spreads

- Regulated broker

- MetaTrader platforms

- 24/7 support

Cons

- Limited assets

- No local offices

- Swap fees

- Basic resources

Benefits of Trading with Blueberry Markets

Blueberry Markets offers several benefits for traders seeking a dependable and straightforward trading experience. One major advantage is its competitive pricing structure, featuring low spreads and minimal trading fees, which helps make trading more cost-effective. Blueberry Markets also provides rapid trade execution, essential for those who rely on timely entries and exits to maximize their trading strategies.

The broker’s dedication to customer support and education is another notable benefit. Blueberry Markets maintains a 24/7 support team accessible through live chat, phone, and email, ensuring traders can quickly access assistance whenever needed. Additionally, the broker provides a variety of educational resources, such as webinars and tutorials, which are particularly useful for beginners looking to enhance their trading knowledge. These features position Blueberry Markets as a well-rounded choice for traders seeking affordability, support, and learning opportunities.

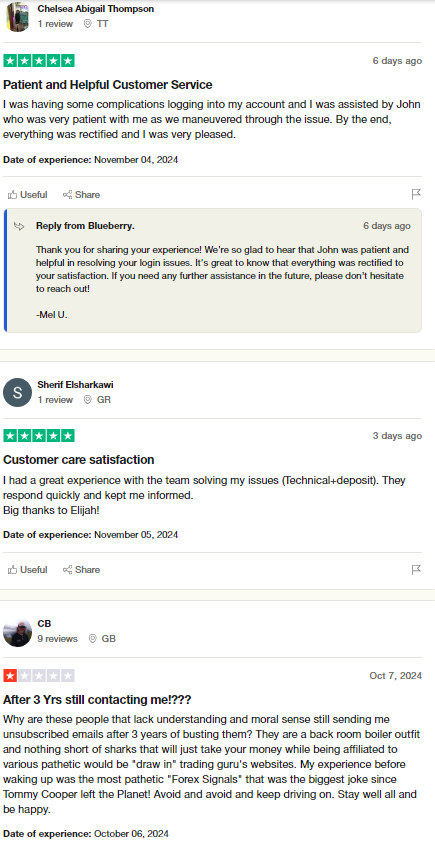

Blueberry Markets Customer Reviews

Blueberry Markets has received positive feedback from its customers, indicating high levels of satisfaction. On review platforms, the broker often holds strong ratings, with users frequently highlighting its responsive customer support, competitive trading conditions, and easy-to-navigate platform. Many traders appreciate the broker’s fast response times and the helpfulness of the support team.

Clients also praise Blueberry Markets for its smooth withdrawal process and the quality of its educational resources, which help traders make informed decisions. The consistent positive reviews reflect the broker’s commitment to delivering a seamless and supportive trading experience, which has made it a popular choice among forex traders.

Blueberry Markets Spreads, Fees, and Commissions

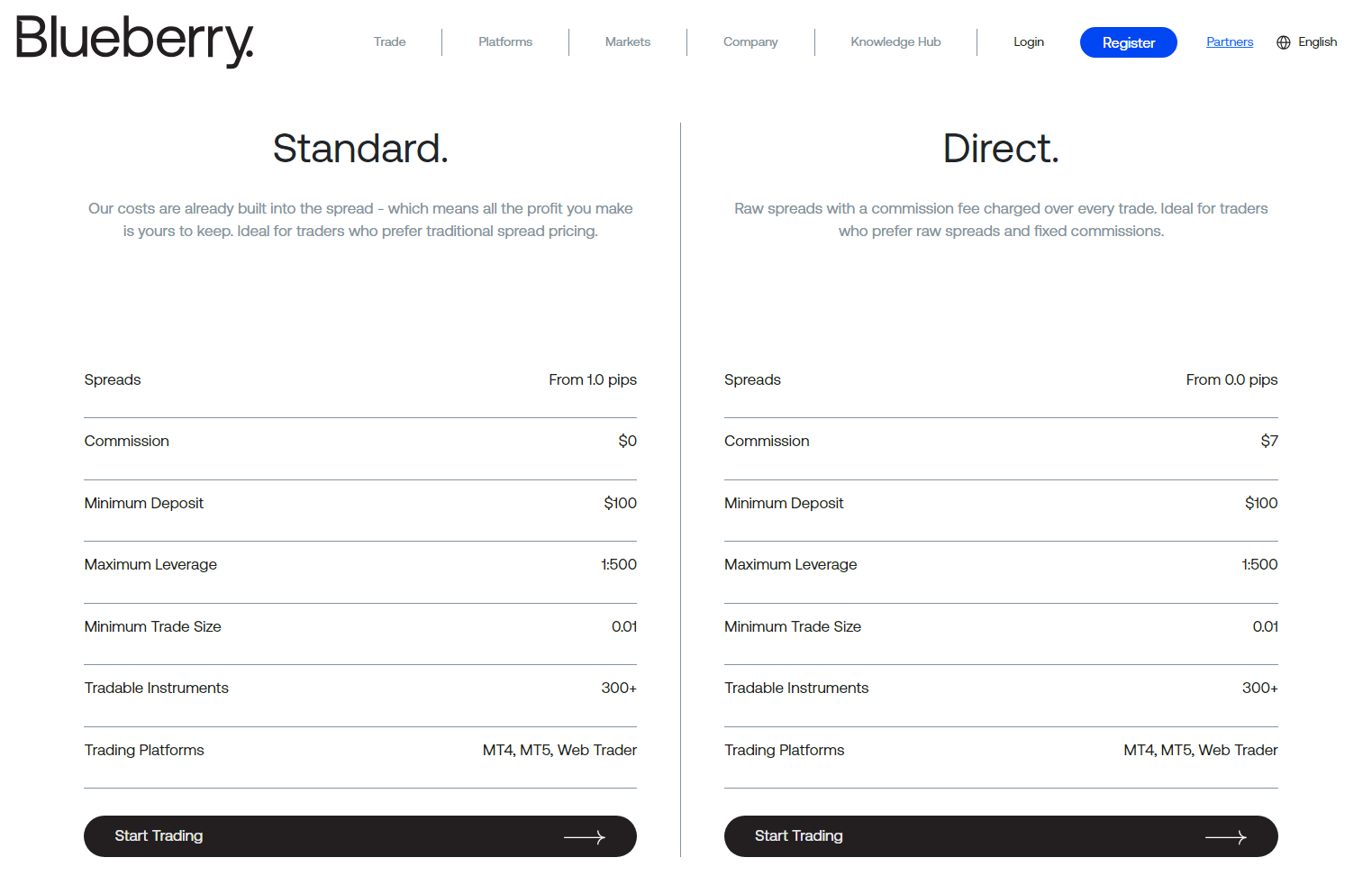

Blueberry Markets offers competitive spreads and flexible fee structures through its two main account types: the Standard Account and the Direct Account. The Standard Account is commission-free, with spreads starting from 1.0 pip, making it a suitable option for traders who prefer straightforward pricing without additional fees.

For traders seeking tighter spreads, the Direct Account provides raw spreads beginning at 0.0 pips, paired with a $7 commission per standard lot round turn. This option appeals to those comfortable with a fixed commission in exchange for lower spreads. Blueberry Markets also applies swap fees for positions held overnight, reflecting interest rate differentials, and charges a monthly fee for trading specific indices, with some flexibility depending on trading volume.

The transparent pricing structure at Blueberry Markets allows traders to choose the account type that best suits their trading style and budget, offering a balance between competitive spreads and manageable fees.

Account Types

Blueberry Markets offers two primary account types to cater to different trading preferences:

Standard Account

The Standard Account is designed for traders who prefer a straightforward pricing model without additional commissions. In this account, trading costs are incorporated into the spread, with spreads starting from 1.0 pip. This setup allows traders to focus solely on the spread without worrying about separate commission fees.

Direct Account

The Direct Account, also known as the Raw Account, is tailored for traders seeking tighter spreads and are comfortable with a commission-based structure. This account offers raw spreads starting from 0.0 pips, with a commission of $7 USD per standard lot per round turn. In direct account FX Pairs have a suffix so mind that when trading with Automated Systems. This structure is ideal for traders who prioritize lower spreads and are willing to pay a fixed commission per trade.

How to Open Your Account

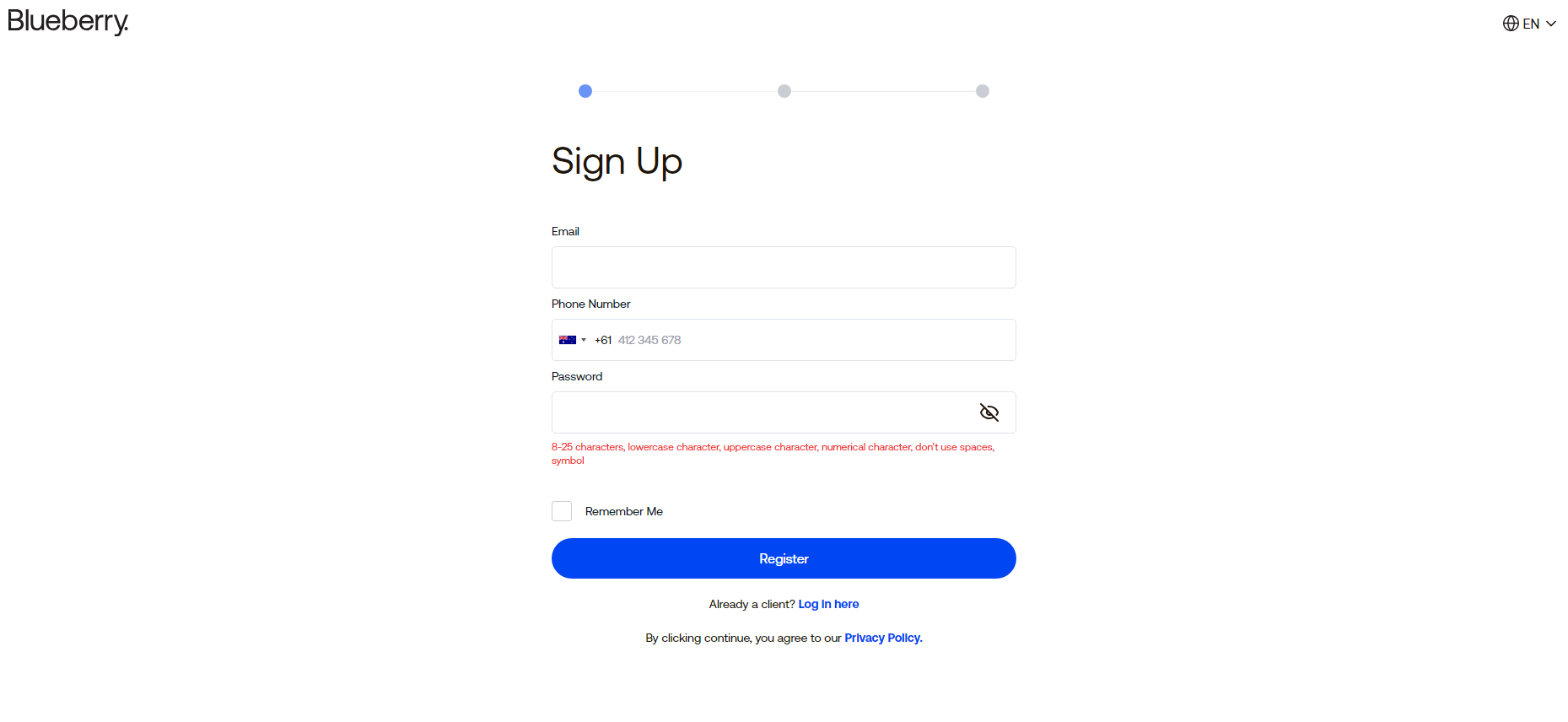

Opening a trading account with Blueberry Markets involves a series of straightforward steps designed to ensure a smooth onboarding process and to start trading.

Step 1: Registration

Prospective clients begin by visiting the Blueberry Markets website and selecting the option to create a live account. The registration form requires personal details such as name, email address, and phone number. After submitting this information, users receive login credentials for the client portal.

Step 2: Account Configuration

Within the client portal, users can customize their account settings. This includes selecting the preferred account type—Standard or Direct—choosing the base currency, and setting the desired leverage level. These configurations allow traders to tailor the account to their specific trading preferences.

Step 3: Identity Verification

To comply with regulatory standards, Blueberry Markets requires clients to verify their identity. This process involves uploading a valid government-issued photo ID, such as a passport or driver’s license, and a proof of residential address, like a utility bill or bank statement. The verification ensures the security and legitimacy of the trading environment.

Step 4: Funding the Account

Once the account is verified, clients can proceed to fund their trading account. Blueberry Markets supports various deposit methods, including bank transfers, credit/debit cards, and electronic payment systems. Clients can choose the most convenient option to deposit funds and commence trading.

By following these steps, traders can efficiently set up their accounts and begin their trading journey with Blueberry Markets.

Blueberry Markets Trading Platforms

Blueberry Markets provides traders with access to the widely acclaimed MetaTrader platforms, specifically MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their user-friendly interfaces and comprehensive trading tools, catering to both novice and experienced traders.

MetaTrader 4 (MT4) is celebrated for its robust charting capabilities, a variety of technical indicators, and support for automated trading through Expert Advisors (EAs). This platform is particularly favored by forex traders for its reliability and efficiency.

MetaTrader 5 (MT5) builds upon the features of MT4, offering additional functionalities such as more timeframes, advanced order types, and an integrated economic calendar. MT5 supports a broader range of asset classes, including forex, commodities, indices, and cryptocurrencies, making it a versatile choice for traders seeking diverse market exposure.

For those who prefer browser-based trading, Blueberry Markets offers WebTrader, which allows access to trading accounts without the need for software installation. This platform provides real-time market data, advanced charting tools, and the convenience of trading from any device with internet access.

What Can You Trade on Blueberry Markets

Blueberry Markets offers a diverse range of trading instruments, allowing traders to access various financial markets.

Forex

Traders can engage in the foreign exchange market by trading numerous currency pairs, including majors, minors, and exotics. This enables participation in the world’s largest financial market, providing opportunities to capitalize on currency fluctuations.

Commodities

The platform provides access to commodity trading, including precious metals like gold and silver, as well as energy products such as crude oil and natural gas. These instruments allow traders to diversify their portfolios and hedge against market volatility.

Indices

Blueberry Markets offers trading on major global stock indices, representing the performance of top companies in various economies. This allows traders to speculate on the overall performance of stock markets without dealing with individual stocks.

Cryptocurrencies

For those interested in digital assets, the platform supports trading of popular cryptocurrencies like Bitcoin, Ethereum, and others. This provides exposure to the rapidly evolving crypto market, enabling traders to take advantage of price movements in this sector.

By offering a wide array of trading instruments, Blueberry Markets caters to diverse trading strategies and preferences, facilitating comprehensive market engagement.

Blueberry Markets Customer Support

Blueberry Markets offers dedicated support team to assist traders effectively. Clients can reach the support team 24/7 through various channels, including live chat, email, and phone, ensuring prompt assistance for any inquiries or issues. This round-the-clock availability demonstrates the broker’s commitment to providing reliable support for its users.

In addition to direct support, Blueberry Markets provides a detailed Help Centre on their website. This resource includes guides on opening accounts, navigating the client portal, and understanding withdrawal processes, among other topics. The Help Centre serves as a valuable tool for traders seeking quick answers to common questions.

For personalized assistance, Blueberry Markets assigns an account manager to each live account holder. This dedicated point of contact helps address specific concerns and provides tailored support, enhancing the overall trading experience. The combination of multiple support channels and personalized service underscores Blueberry Markets‘ dedication to client satisfaction. For more further assistance, traders should check the very useful email bulletins to find help in the trading journey of trader’s success.

Advantages and Disadvantages of Blueberry Markets Customer Support

Withdrawal Options and Fees

Blueberry Markets provides clients with multiple withdrawal options to ensure flexibility and convenience.

Bank Transfers

Clients can withdraw funds directly to their bank accounts. Domestic bank transfers are typically processed within 3 to 7 business days and are generally free of charge. For international bank wire transfers, a fee of approximately USD $25 may apply, which is imposed by and dependent on banking intermediaries; such fees are the responsibility of the client. Processing times for international transfers may also vary depending on the receiving bank’s procedures.

Credit and Debit Cards

Withdrawals to credit or debit cards are processed as refunds to the same card used for deposits. These transactions usually take between 1 to 7 business days to reflect in the client’s account. Blueberry Markets does not charge fees for card withdrawals; however, processing times may vary based on the card issuer’s policies.

E-Wallets

For faster transactions, clients can opt for e-wallets such as Skrill and Neteller. Withdrawals to e-wallets are often processed within 24 hours, providing a quicker alternative to traditional banking methods. Blueberry Markets does not impose additional fees for e-wallet withdrawals, making this option both efficient and cost-effective.

By offering a variety of withdrawal methods with transparent processing times and minimal fees, Blueberry Markets aims to provide a seamless and user-friendly experience for its clients.

Blueberry Markets Vs Other Brokers

#1. Blueberry Markets vs AvaTrade

Blueberry Markets and AvaTrade differ primarily in their offerings and regulatory coverage. Blueberry Markets focuses on forex and provides the MetaTrader 4 and 5 platforms, with a choice between a Standard Account (commission-free with spreads from 1.0 pip) and a Direct Account (raw spreads starting from 0.0 pips with a $7 commission per lot). It is regulated by ASIC and VFSC, offering over 300 trading instruments. AvaTrade, on the other hand, has a wider range of platforms, including AvaTradeGO and AvaOptions, alongside MetaTrader 4 and 5, and supports over 1,250 instruments across forex, commodities, indices, stocks, and cryptocurrencies. AvaTrade is regulated by multiple authorities, including the Central Bank of Ireland, ASIC, and FSCA.

Verdict: AvaTrade is better suited for traders seeking broad market exposure and advanced trading options, while Blueberry Markets provides a streamlined experience focused on forex trading with competitive spreads on MetaTrader platforms.

#2. Blueberry Markets vs RoboForex

Blueberry Markets and RoboForex differ significantly in their trading offerings and regulatory reach. Blueberry Markets focuses on forex with MetaTrader 4 and 5 platforms, offering two main accounts: a Standard Account (commission-free with spreads from 1.0 pip) and a Direct Account (raw spreads starting from 0.0 pips with a $7 commission per lot). Regulated by ASIC and VFSC, it supports around 300 instruments. RoboForex, on the other hand, offers a wider selection of platforms, including MetaTrader 4 and 5, cTrader, and R Trader, with over 12,000 instruments across forex, stocks, indices, commodities, and cryptocurrencies. RoboForex is regulated by IFSC of Belize.

Verdict: RoboForex is ideal for traders seeking a vast array of instruments and platform choices, while Blueberry Markets is tailored to forex traders looking for a simpler, regulated option focused on competitive spreads and MetaTrader functionality.

#3. Blueberry Markets vs Exness

Blueberry Markets and Exness are both reputable brokers offering forex and CFD trading, yet they differ in several key aspects. Blueberry Markets, established in 2016, provides access to MetaTrader 4 and 5 platforms, focusing on forex trading with over 300 instruments. It offers two account types: a Standard Account with spreads starting from 1.0 pip and no commission, and a Direct Account with raw spreads from 0.0 pips plus a $7 commission per lot. The broker is regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). In contrast, Exness, founded in 2008, offers a broader range of platforms, including MetaTrader 4 and 5, and its proprietary Exness Trader platform. It provides access to a wide array of instruments, including forex, commodities, cryptocurrencies, and indices. Exness operates under multiple regulatory authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

Verdict: Exness offers a more extensive range of trading instruments and platforms, catering to traders seeking diverse market exposure and advanced trading tools. Blueberry Markets, while offering competitive spreads and a user-friendly experience, may appeal more to traders focused primarily on forex trading with a preference for the MetaTrader platforms.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH BLUEBERRY MARKETS

Conclusion: Blueberry Markets Review

In summary, Blueberry Markets stands out as a reliable and user-friendly forex and CFD broker, appealing to both novice and seasoned traders. With its competitive spreads, flexible account types, and transparent fee structure, it offers cost-effective options tailored to different trading styles. The broker’s support for popular trading platforms, including MetaTrader 4 and MetaTrader 5, enhances its versatility and usability across various devices.

Blueberry Markets also excels in customer service, providing 24/7 support through multiple channels, along with a dedicated account manager for personalized assistance. Regulated by ASIC and offering secure practices like segregated accounts, the broker prioritizes client safety and satisfaction. These qualities position Blueberry Markets as a trusted choice for traders seeking a reliable, accessible, and supportive trading environment.

Blueberry Markets Review: FAQs

What types of accounts does Blueberry Markets offer?

Blueberry Markets provides two main account types: the Standard Account, which is commission-free with spreads starting from 1.0 pip, and the Direct Account, which offers raw spreads from 0.0 pips with a $7 commission per standard lot.

Is Blueberry Markets regulated?

Yes, Blueberry Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC), ensuring compliance with regulatory standards for added client safety.

What trading platforms are available with Blueberry Markets?

Blueberry Markets supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are well-known for their advanced charting tools and user-friendly features. A WebTrader platform and mobile applications are also available for on-the-go trading.

OPEN AN ACCOUNT NOW WITH BLUEBERRY MARKETS AND GET YOUR BONUS