Blue Guardian Review

Proprietary trading firms, or “prop firms,” are companies where traders trade financial instruments with the firm’s capital. They aim to generate profits for the company and offer a unique avenue for talented traders to grow.

Blue Guardian is one such firm that offers funded accounts to help traders maximize their potential. This platform is dedicated to nurturing trading talents and providing them with the tools they need for a successful career.

You’ll find insights from my experience and customer reviews in this review. We will cover the pros and cons of trading with Blue Guardian, their trading platforms, and other key features. This information aims to help you decide if Blue Guardian is the right fit for your trading needs.

What is Blue Guardian?

Blue Guardian specializes in forex trading and offers traders a structured two-step evaluation process. This process is designed to assess a trader’s skill and discipline, ultimately leading to a funded trading account if the trader is successful.

Phase 1 is the initial stage, where traders are tested over 40 days. During this time, traders must meet specific objectives to prove their skills. Success in Phase 1 allows them to proceed to the next stage.

Phase 2 is the conclusive 80-day trading period. This is the final step for traders to become funded by Blue Guardian. After verifying the trading results, traders enter the funded phase.

Once a trader becomes a funded “Guardian Trader,” they get to keep 85% of their profits. Consistent and responsible trading may qualify them for an increased account balance through Blue Guardian’s scaling plan. This setup allows traders to grow their careers and earn substantial profits.

Advantages and Disadvantages of Trading with Blue Guardian

Benefits of Trading with Blue Guardian

After trading with Blue Guardian, one of the standout benefits is the generous 85% profit split for funded traders. This high percentage gives traders a significant share of their earnings, making the platform highly rewarding for those who trade successfully.

Blue Guardian also offers flexibility in trading timeframes. This is especially beneficial for traders with varying schedules but still want to participate in the forex market.

Another benefit of trading with them is the variety of their account types. They have a wide selection of programs and funding that cater to different types of traders. Such feature enhances the overall trading experience of the traders.

Aside from the account types, you also get to access the broad variety of the firm’s trading instruments. Such variety allows traders to diversify their trading portfolios and not just limit themselves to one or two assets.

Blue Guardian Pros and Cons

Pros:

- Customizable account types

- Diverse trading instruments

- Effective risk management tool

- Copy trading is allowed

- Using trading bots is also allowed

- Multiple assets available

Cons:

- Calls are not supported by customer support

- Bi-weekly withdrawal limit

Difficulties Met by the Traders Who Participated in the Brokers Challenge

10% Maximum Drawdown

A maximum drawdown limit of 10% poses a strict boundary on how much traders can lose before facing potential account termination. In volatile markets, even a single bad trade can bring you dangerously close to this threshold. For traders who rely on riskier, high-reward strategies, this constraint can be especially restrictive.

How to Overcome the Difficulty

To navigate this challenge, focus on strong risk management tactics. Utilize stop-loss orders to automatically halt trades that are plunging into losses. Keep a close eye on your performance metrics to ensure you’re not nearing the drawdown limit. By doing so, you can adapt your trading strategy in real-time to stay within the limit.

Leverage Up to 1:100

Leverage is a double-edged sword. On one hand, it offers the potential for higher profits, but on the other, it exponentially increases the risk of significant losses. The maximum leverage of 1:100 the firm provides may tempt traders to take oversized positions relative to their account size.

How to Overcome the Difficulty

Exercising discipline is crucial when dealing with high leverage. Begin with a conservative leverage ratio to better understand its implications on your trades. As you gain more experience and better understand the market conditions, you may consider gradually increasing your leverage, but always within limits you’re comfortable with.

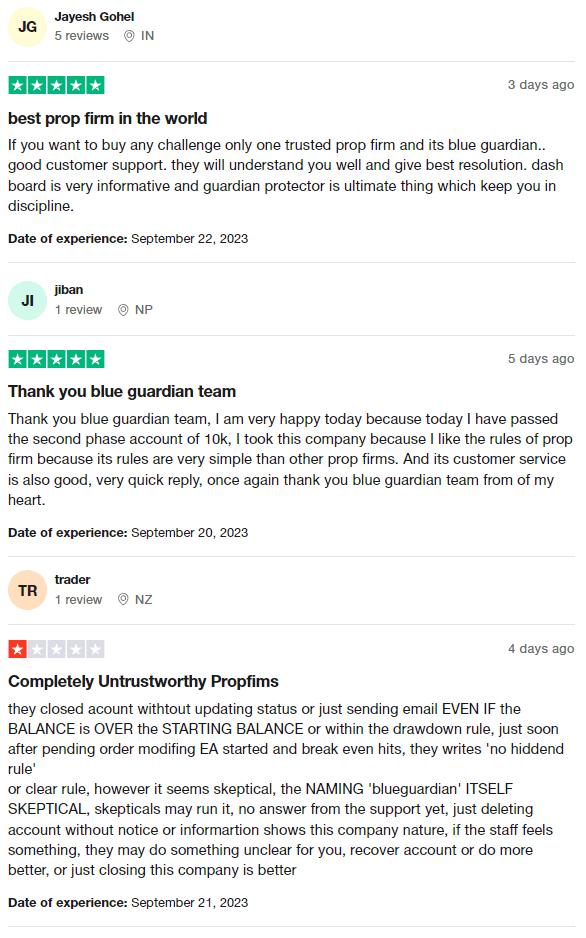

Blue Guardian Customer Reviews

Based on available customer reviews, Blue Guardian currently holds a 4.8-star rating on Trustpilot. Customers generally praise the firm for its strong customer support and simple rules compared to other prop firms.

The platform’s dashboard and risk management tool, Guardian Protector, are highlighted as beneficial features that help traders maintain discipline.

However, there are also concerns about account closures without clear communication, raising questions about the company’s transparency and customer service in some instances.

Blue Guardian Fees and Commissions

Blue Guardian has a straightforward fee structure that I consider to be quite favorable for traders. You start by paying an initial fee based on your chosen account balance. What’s great is that this fee is refunded if you successfully complete their trading challenge. As for the profit, the firm takes a 15% cut, leaving you with a generous 85%.

Something that sets Blue Guardian apart is their $3.50 universal fee. While this fee isn’t unique to Blue Guardian, the firm is transparent about it, unlike some other prop firms that aren’t as forthcoming. There are no hidden fees here. The spreads and trading fees are set by their associated broker, Eightcap.

Importantly, if you trade as a partner of Blue Guardian, you get the benefit of tighter spreads and lower fees compared to trading directly with the broker.

Account Types

After testing the various account types offered by Blue Guardian, here’s what you need to know:

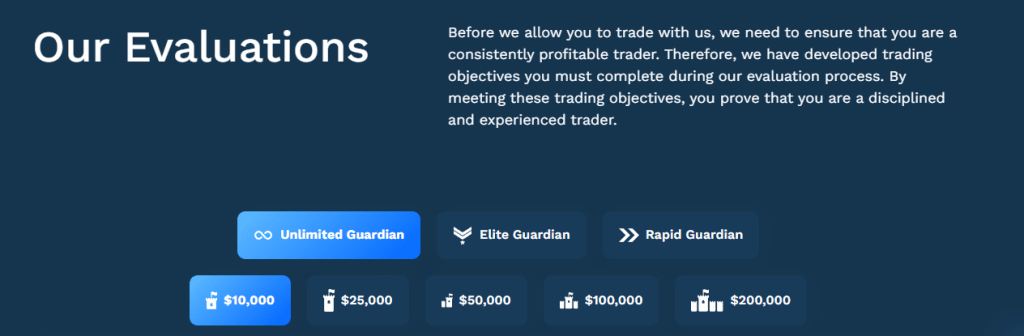

Unlimited Guardian

This is a 3-phase funding program offering between $10,000 to $200,000 in funding. There’s no time limit and zero minimum trading days. The profit target is set at 8% for Phase 1 and 4% for Phase 2. You get to keep 85% of the profits. The maximum daily loss is capped at 4%. Fees range from $87 to $947, depending on the funding.

Elite Guardian

Similar to the Unlimited Guardian, this is also a 3-phase program with the same funding range and profit targets. What sets it apart is the requirement of a minimum of 5 trading days. The profit split remains at 85%, and the maximum daily loss is 4%. The fee for this account type varies between $120 and $1,020 based on the amount of funding.

Rapid Guardian

This is a quicker, 2-phase funding program. You can get between $10,000 to $200,000 in funding with no time limit. Unlike the other accounts, the profit target for phase 1 is higher at 10%. The profit split is still 85%, and the maximum daily loss allowed is 4%. The fees for this account range from $97 to $947, depending on the funding.

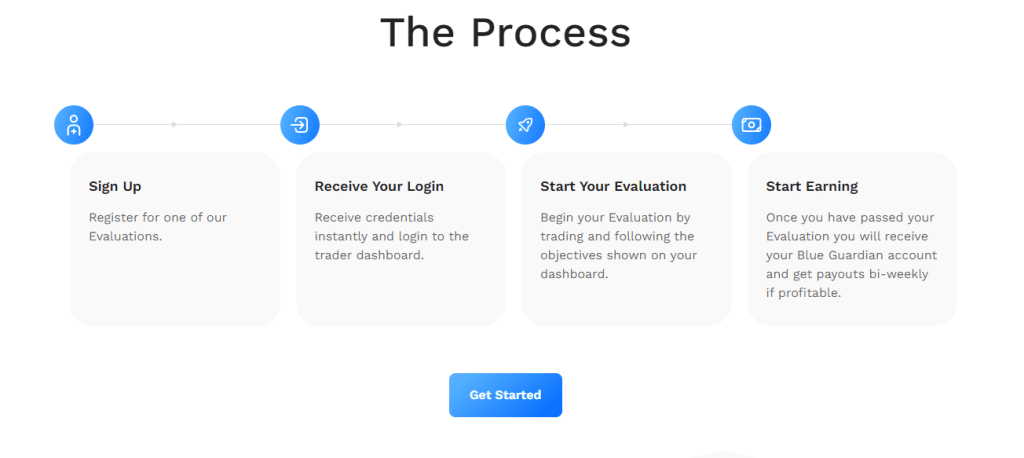

How to Open Your Account

- Visit the Blue Guardian website and click the “Get Started” button.

- Review the available balance options and trading conditions to select one that fits your needs.

- Choose the Challenge Type, Account Balance, and Platform, then fill in the required details.

- Use the coupon code ASIAFOREXMENTOR for a discount.

- Click “Confirm and Proceed to Payment” to move on to the payment section.

- Choose your preferred payment method, either Credit Card (Stripe) or cryptocurrencies like Bitcoin.

- Click “Place Order” to finalize your payment choice.

- Enter the necessary payment details and click “Pay for Order.“

- Once payment is received by the prop firm, you’ll gain access to your user account.

Blue Guardian Customer Support

Based on my experience, solid customer support is crucial for traders, especially when they encounter issues they can’t resolve alone. No matter how user-friendly a website is or how detailed the FAQs are, questions are bound to arise. This is where Blue Guardian excels. They offer 24/7 technical support, accessible via main communication channels like email, live chat, and tickets. Having these options gives traders like me the confidence that help is just a message away anytime we need it.

Advantages and Disadvantages of Blue Guardian Customer Support

Contact Table

Security for Investors

Withdrawal Options and Fees

At Blue Guardian, traders utilize demo accounts throughout the challenge period, hence no profits are made. The funding phase is when things really start to happen. The stakes and possible profit are real since traders are given actual accounts and their trades are visible on the interbank market.

After you have been trading for fifteen days, you are eligible to begin requesting withdrawals. The amount you can withdraw is not limited in any way. This increases flexibility by enabling traders to allocate their profits however they see suitable.

The platform provides e-wallets, bank cards, and cryptocurrency-wallets as withdrawal methods. Usually, your withdrawal request is handled in a few hours. However, keep in mind that you may only request another withdrawal 14 days after the first one.

You may monitor your withdrawals by visiting the user account area. There is a list of all your withdrawal requests along with their current status. This maintains the withdrawal procedure open and simple to follow.

What Makes Blue Guardian Different from Other Prop Firms

One of the standout features of Blue Guardian is its transparent approach to trading. Unlike many other prop firms that have hidden fees, Blue Guardian makes sure all charges are upfront. This level of transparency is refreshing and beneficial for traders who don’t like surprise costs.

Another key differentiator is the scaling plan. If you’re profitable over a span of months, you may qualify for an increased account balance. Not all prop firms offer this kind of growth opportunity. It encourages traders to stay disciplined and focused on long-term success.

The firm’s structured two-step evaluation process is also noteworthy. It’s not just about assessing trading skills; it’s about nurturing them. By having traders meet specific trading objectives, the firm ensures that only disciplined and experienced individuals become funded traders.

Additionally, the platform offers a wide range of trading instruments. This allows traders to diversify their portfolios, an option not always available in other proprietary trading firms. This flexibility in asset selection can be a game-changer for many traders.

Lastly, the profit split at Blue Guardian is quite generous, with traders keeping 85% of their profits. Coupled with a bi-weekly payout system, this makes for a lucrative trading experience that is hard to match.

How Can Asia Forex Mentor Help You Pass Blue Guardian’s Evaluation?

Here at Asia Forex Mentor, I have dedicated myself to helping traders succeed in the forex market. What started as casual lessons among friends has grown into a community of learners benefiting from my years of experience. I’ve even had the honor of training trading companies and financial institutions, further honing my teaching techniques.

Now, all of that expertise is bundled into a comprehensive package called the AFM Proprietary One Core Program. This program aims to equip you with a foolproof trading system, in-depth market analysis skills, and prudent account management techniques. It’s designed to give you a complete grasp of the trading world.

The One Core Program is detailed yet accessible, featuring 26 main lessons with over 60 subtopics. Each lesson comes with high-quality videos and is enriched by handpicked examples and explanations from my own experience. It’s a beginner-friendly, low-risk avenue for anyone serious about forex trading.

So, how can this program help you pass Blue Guardian’s evaluation? Blue Guardian demands discipline, skill, and a deep understanding of market behavior—qualities that the One Core Program instills in its students. By applying what you learn from us, you’ll be better equipped to meet and exceed the evaluation criteria set by Blue Guardian. With our program, your path to becoming a funded trader becomes clearer and much more attainable.

Our Journey at Asia Forex Mentor

I’ve witnessed remarkable transformations, having trained a diverse range of traders, from beginners to bank professionals. Many have gone from complete novices to successful full-time traders or fund managers. The One Core Program encapsulates these invaluable lessons, offering a well-rounded perspective on trading that extends beyond basic strategies.

Within the program, I delve into the intricacies of bar-by-bar backtesting, trading psychology, and the importance of keeping a trading diary. I also share the ‘set-and-forget’ strategy, simplifying trading and allowing for a hands-off approach. The course content includes an exclusive auto stop-loss tool and a deep dive into the free trade concept. I’ve taken the time to distinguish between large and small stop loss levels, explaining their different impacts.

If you’re eager to embark on this transformative journey, the One Core Program comes with a seven-day free trial. The full course is priced at a one-time fee of $997. However, if you’re already convinced of the program’s value and wish to bypass the trial, a direct purchase option is available for $940. This approach accelerates your path to mastering forex trading.

Conclusion: Blue Guardian Review

Overall, Blue Guardian is a legit prop firm with several advantages that I have noted. They have a transparent fee structure and a wide range of different account types that every trader would definitely benefit. They also have a customer support team that is available 24/7, although lacking calls as one of contact channels can be a downside for some potential traders.

Additionally, the prop firm’s partnership with Eightcap might provide security. It’s also crucial to remember that Blue Guardian does not offer license or regulation information for the business. For traders who are looking for a prop firm that prioritizes security, this could be a major turn-off.

Also Read: SurgeTrader Review 2023

Blue Guardian Review FAQs

Is Blue Guardian trustworthy?

Yes, it has a 4.8-star rating on Trustpilot and is partnered with a regulated broker.

What are the fees like?

Transparent and competitive, with a standard initial fee and a 15% profit split.

Is customer support available 24/7?

Yes, via email, live chat, and tickets, but no call center is available.